- Many startups, in their pursuit of customers, set too low prices for their products and fail to account for all real expenses. Afterwards, they horrifyingly discover that they are operating at a loss ☹️.

- Therefore, accurate accounting of all expenses is the foundation for creating a profitable business. The thing is, platforms for calculating unit economics are becoming particularly relevant now.

- It’s no wonder Y Combinator in the current batch invested in a startup creating such a platform. So, you can take it as a source of inspiration for creating your own counterpart:

Project essence

Bilanc is a platform that allows controlling unit economics for each client of the company.

I would like to remind you that in classic terms, “unit economics” refers to the calculation of revenue and expenses per unit of the product or service sold.

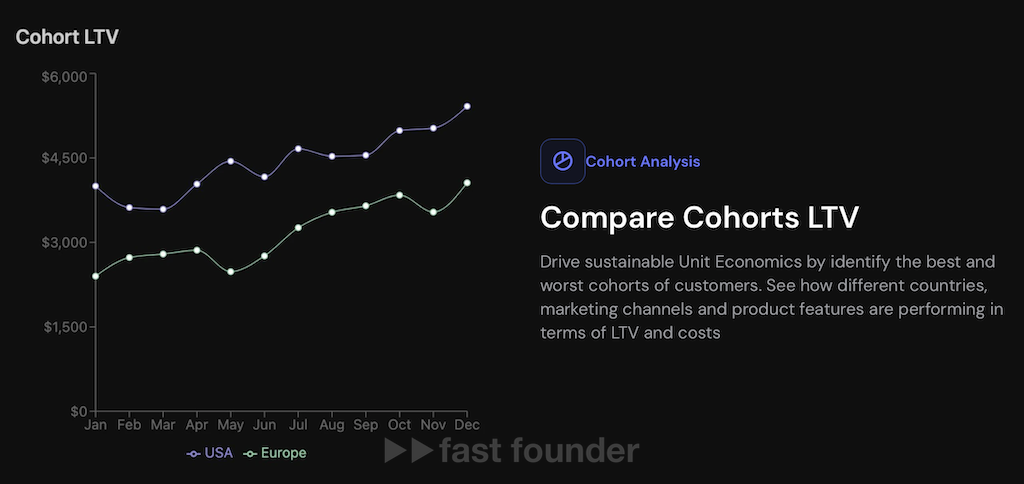

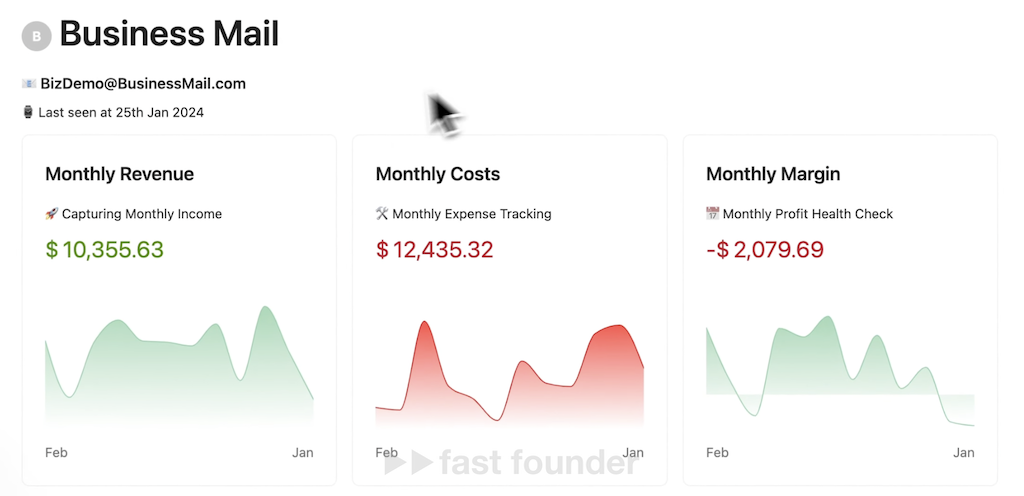

However, Bilanc interprets this concept more broadly. Their platform helps calculate the profit that the company has received from a specific client—taking into account the revenue received from them and the expenses incurred by the company not only for providing them with services but also for related services. This profit can be calculated for a specific period or for the entire lifetime of the client (LTV, LifeTime Value).

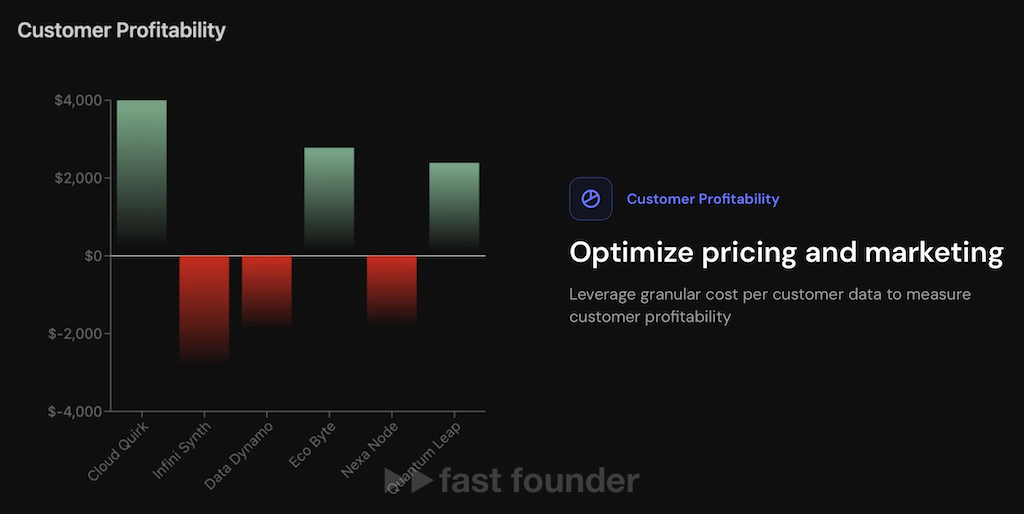

The target audience of the platform is B2B service providers who can delve more deeply into each of their clients to optimize their prices and/or business processes.

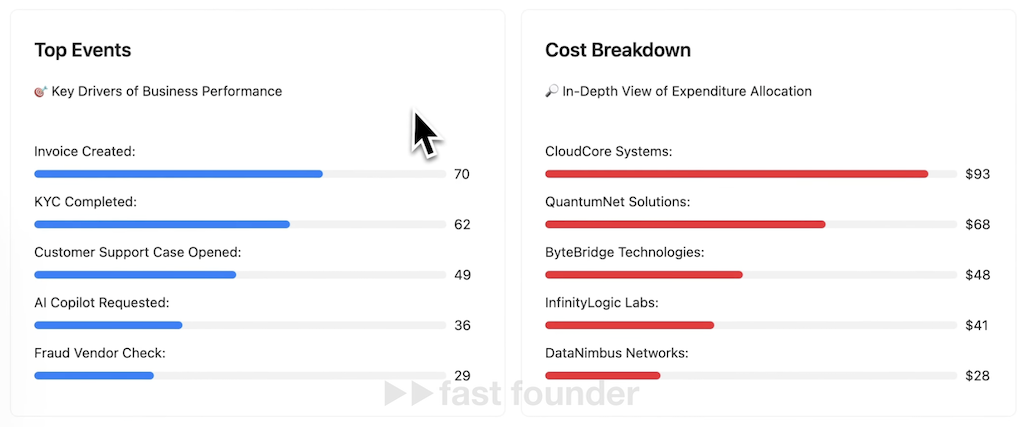

Unit economics can be analyzed for each client or for entire customer groups. For example, profitability of customers from different regions can be compared to subsequently set different tariffs for different geographies. Or compare the LTV of customers coming from different advertising channels—to exclude some channels and, conversely, to invest more money into others.

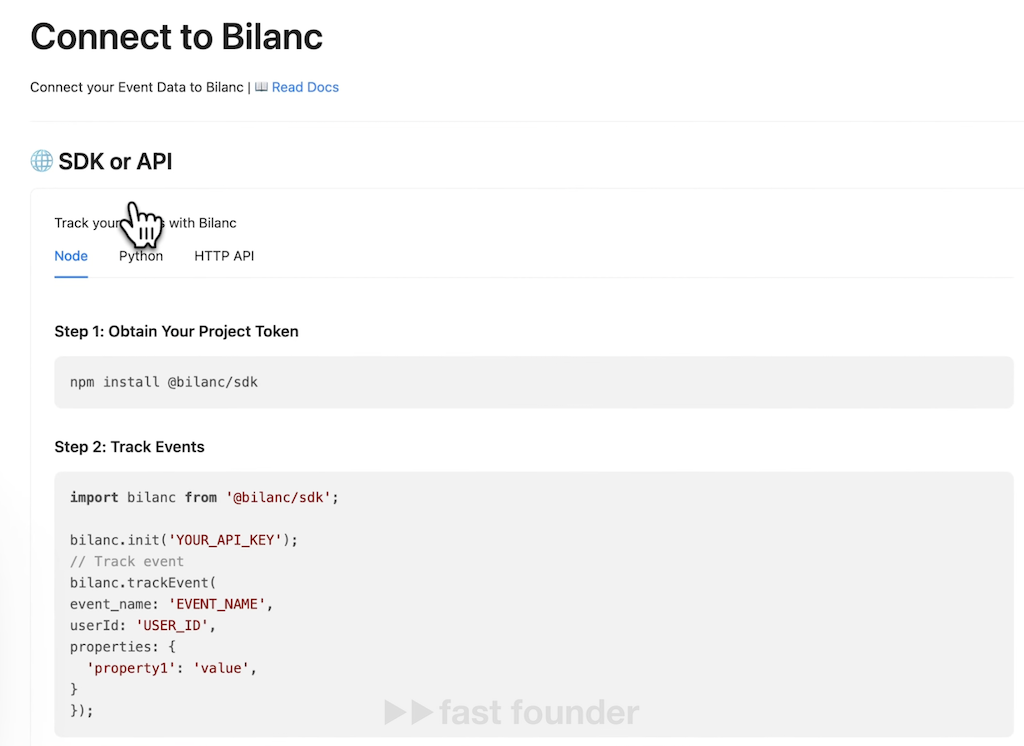

The platform can collect revenue from customers from connected accounting systems. However, for precise calculation of expenses in the necessary parts of the product and corporate systems, API calls to Bilanc are required. Each such call saves information on the platform about what action a particular client has taken.

This action may involve a product feature that costs the company money—for example, using a third-party AI engine, storing a certain amount of data on the server, or something else.

Moreover, such actions may not be directly related to product usage—for example, a call or email to the company’s technical support. But this is the time of support staff—which means, it’s also an expense that the company incurs for servicing the client. Therefore, the corresponding API call with the event “such-and-such client called the support service” should also be inserted into the corporate system used by the support service, such as Zendesk or Intercom.

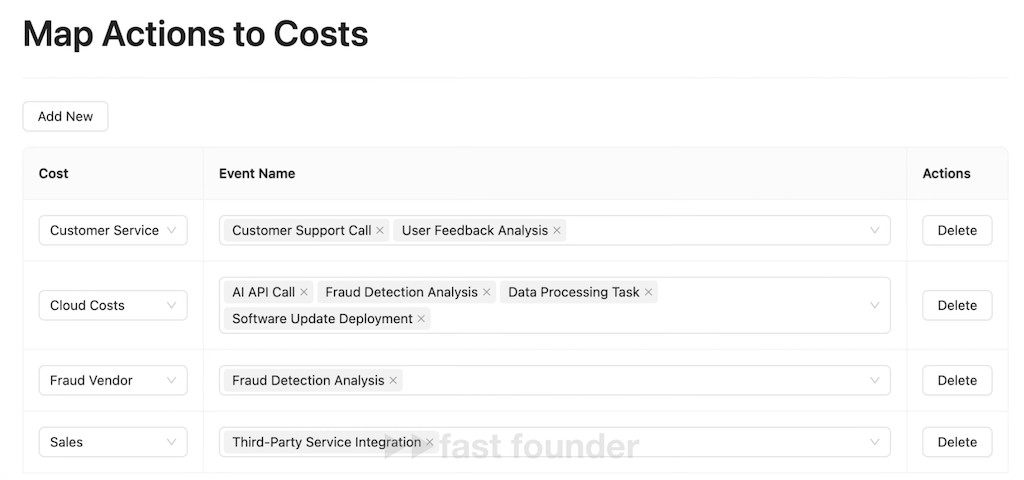

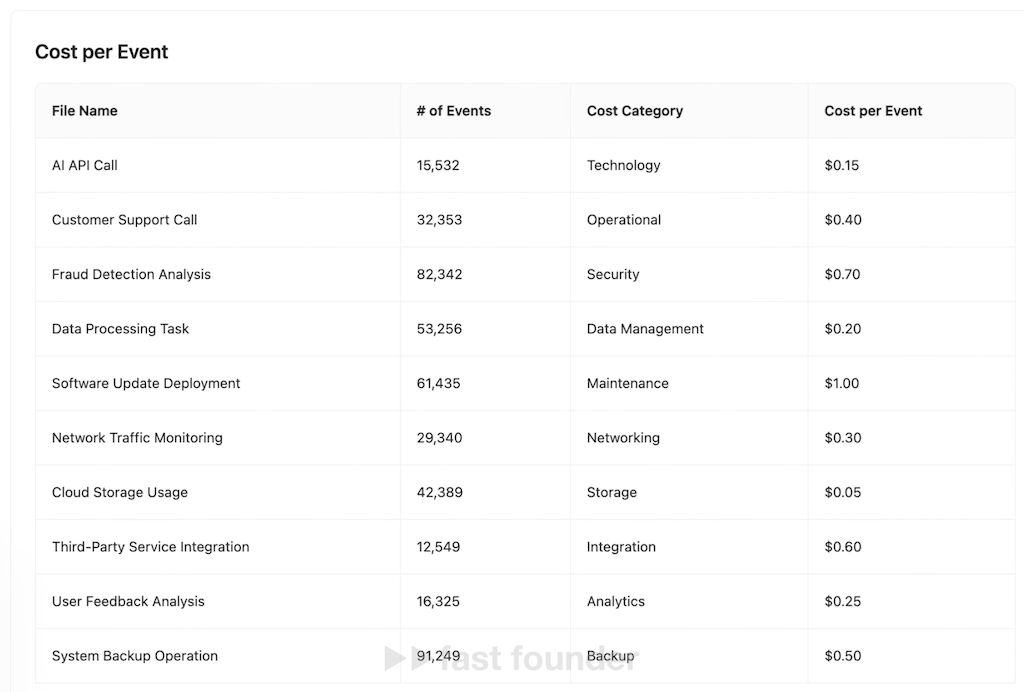

Separately, a table with a list of all possible events transmitted to the Bilanc API is created on the platform—and each event is assigned a certain cost. This price can be fixed in advance or calculated depending on the parameters of the event— for example, how many tokens were transferred to and received from the AI engine, or how many gigabytes of data the client’s data was simultaneously stored on the product server.

Then everything is clear. The platform takes events passed to it via API, matches them with the cost table—and obtains a list of all events accounted for in the cost structure along with their cost.

Now the platform can take customer revenue data received from the accounting system and combine it with data on the total cost of events associated with this client—after which it can show the revenue-to-expense ratio per client for any period in the form of a table or graph.

As part of a more detailed analysis, it is possible to see which specific events in servicing a particular client turned out to be the most costly. Perhaps the issue lies not with the client—but with the need to better optimize these actions if they lead to such expenses.

Bilanc is currently going through Y Combinator, from which it received the first $500,000 in investments. The startup launched the first version of its platform just a few days ago.

What’s interesting

It’s clear that today’s Bilanc is at a very early stage, so many details of unit economics calculation have not yet been taken into account.

Among them, including a tool for more accurate accounting of the time employees spend on solving specific client tasks. After all, there are types of businesses where the lion’s share of expenses is spent on manual labor of employees—such as accounting firms. And for many other businesses, employee time spent on customer service is accounted for in a lump sum without detailed breakdown by clients and types of work performed.

This means that Bilanc will either have to create such a tool itself or integrate with third-party tools that allow this.

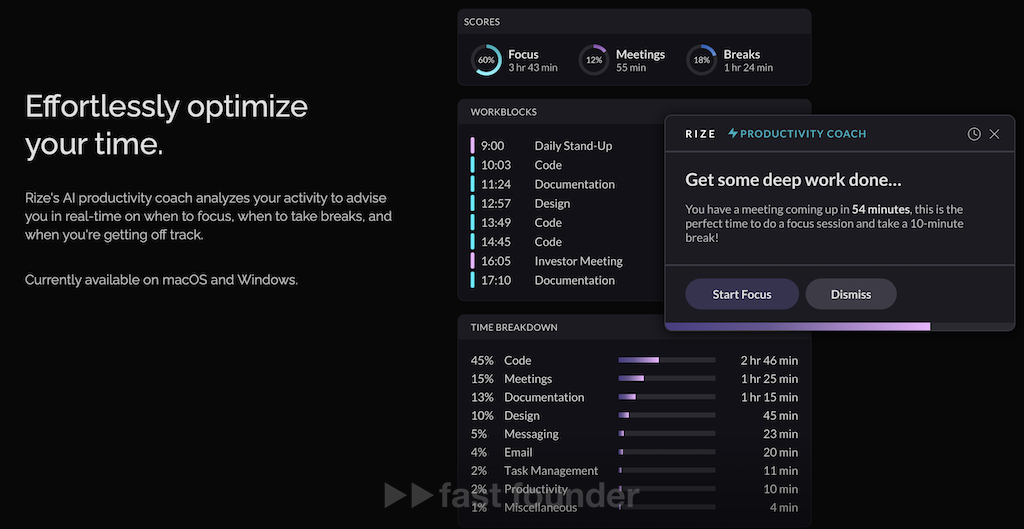

In this regard, one can recall the Rize platform, which I wrote about a couple of weeks ago. This platform allows not only to account for manual labor time of employees at the computer, breaking it down by different types of work and projects—but also to optimize it, periodically suggesting breaks or blocking push notifications during intensive work.

The problem that today’s Bilanc wants to solve is an old one. This is a disease that usually afflicts all starting businesses, trying by any means to get the first customers—for which they set too low prices for their products or services, and often subconsciously do not take into account a number of hidden expenses.

As a result, after some time, they realize with horror that they are operating at a loss. And it’s good if this realization comes in time, when everything can still be corrected.

But if this problem is old, then why can such a platform be relevant and in demand right now?

The first reason is the worsening overall economic situation.

As a result, all companies have become much more careful about accounting for their expenses. In particular, this has greatly affected startups, for which it is no longer enough to show revenue growth at any cost—it is also necessary to show investors a healthy unit economics. And in order to do this, it is necessary to be able to calculate it quickly, cheaply, and constantly in some way—which is exactly what the Bilanc platform helps to do 😉

The second reason is less obvious—it is related to the fact that most of today’s products are becoming AI products.

However, in order to add AI capabilities to their products, most companies use calls to third-party AI engines—via APIs like OpenAI, Google’s Gemini, Hugging Face’s Mistral, or any other AI engine through any other platform. And for each such call, companies pay depending on the volume of data transmitted and received with each call.

Thus, each such call turns into expenses that need to be accounted for so that the unit economics of the product does not go into the red. And it’s very easy to go into the red—for example, by giving your customers unlimited access to the AI assistant built into the product, for each response of which the product developer will have to pay 😉

Of course, this is the dumbest option. Real scenarios of using third-party engines within one’s product may be much more complex. But this also means that it will be more difficult to calculate unit economics and to ensure that the product is not operating at a loss. And here, without automated expense tracking tools, it will be impossible.

At the same time, of course, you can create a separate tool for accounting for expenses on calls to AI engines—which is also starting to be done now. But if clients are going into the unit economics issue in the specific case of using AI engines, they can easily be persuaded to implement a full-fledged platform for calculating unit economics right away, which can provide much more useful and profitable insights.

Thus, the overall Bilanc platform has a chance to start successfully penetrating clients on the wave of one specific case, which has become relevant right now.

Where to go

In general, due to the worsening economic situation, the topic of platforms for financial accounting for companies is once again becoming popular.

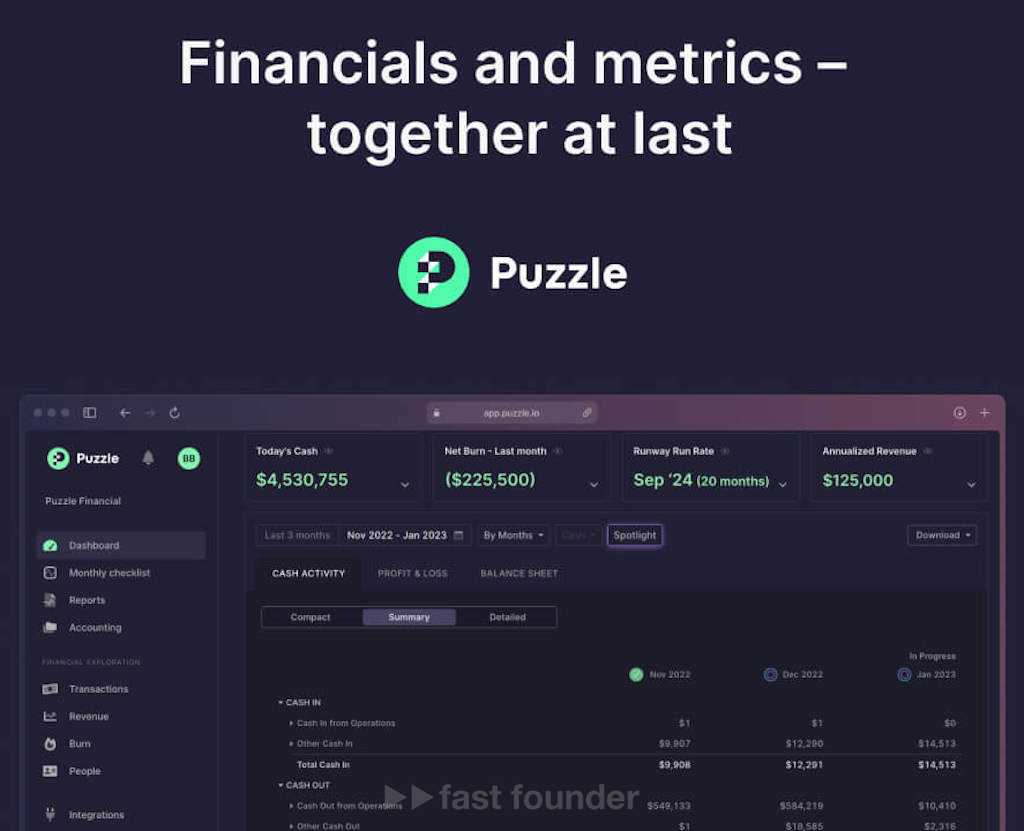

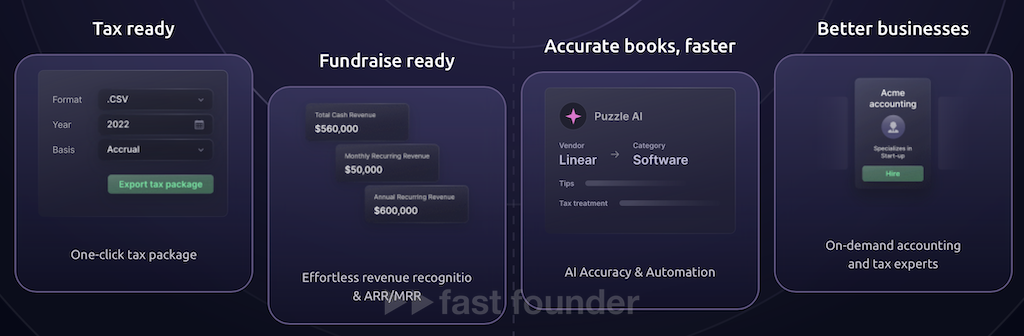

A year ago, for example, I wrote about the Puzzle startup, which created a “modern financial accounting platform.”

At the same time, their target audience was startup founders who needed to understand the financial indicators and metrics of their startup well.

Moreover, not only for creating correct accounting reports and calculating taxes but also for building financially efficient businesses and raising investments, which are now only given to financially efficient businesses.

Since my review of Puzzle, they have raised another round of investments of $30 million, after which the total amount of investments in the startup exceeded $45 million.

Well, to understand the finances of the project correctly, you can’t do without unit economics. So, the topic of creating platforms for the correct calculation of unit economics fits perfectly into the trend of changing priorities for startup founders and company managers—where financial accounting begins to take precedence in the list of priorities.

Therefore, you don’t even have to make up anything around here, but immediately identify the direction of possible movement as creating platforms for calculating unit economics for B2B product developers.

The starting point for inspiration could be today’s Bilanc, whose still quite raw concept needs to be turned into a full-fledged product—taking into account various details, nuances, and scenarios of possible use.

About the Company

Bilanc

Website: bilanc.co

Last round: $500K, 12/01/2023

Total investments: $500K, rounds: 1