- The potential audience for personal financial planning services is 99% of the Earth’s population! The task is simply to formulate the main offer in a way that breaks through the wall of indifference, composed of “too complicated,” “no time,” and “someday later.”

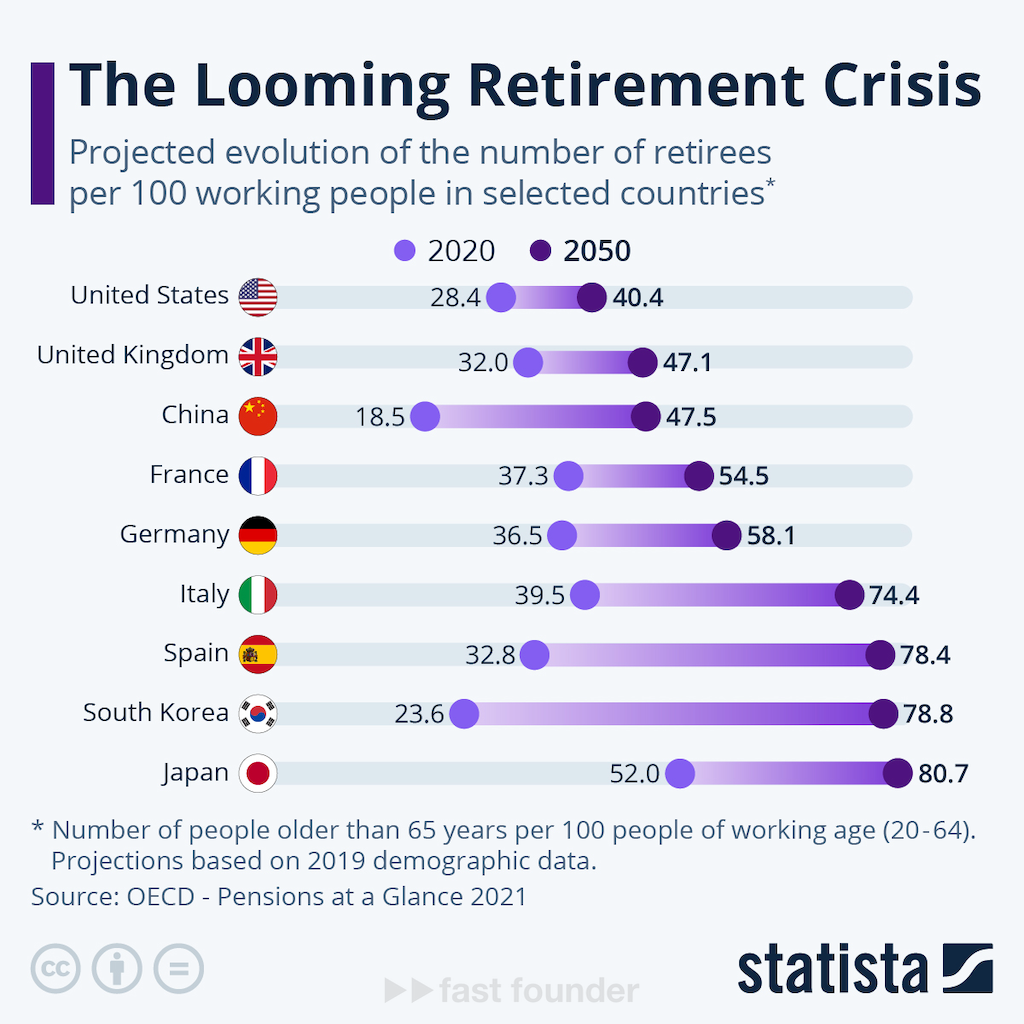

- Previously, no one had succeeded in this. But now a key change is happening that could alter this situation. This change is the increase in life expectancy. While this is undoubtedly good, pension systems in any country were not designed for it ☹️

- Therefore, “saving money for retirement” is shifting from a benevolent wish to a harsh necessity. What can be utilized right now is exemplified by this startup:

Project Essence

NewRetirement urges people to “take control of their financial well-being” by engaging in financial planning for their lives.

The very name of the NewRetirement project implies that this planning has a goal – to accumulate enough money to live comfortably in old age after retiring.

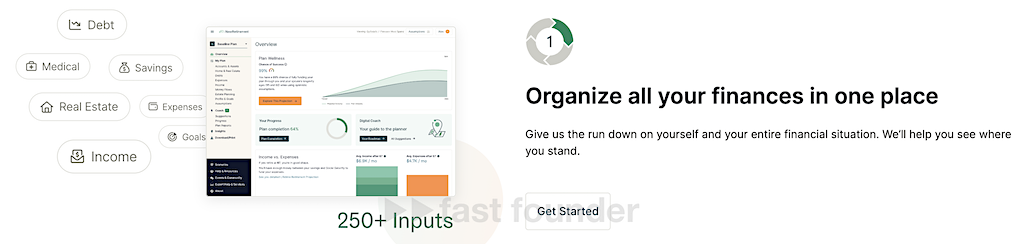

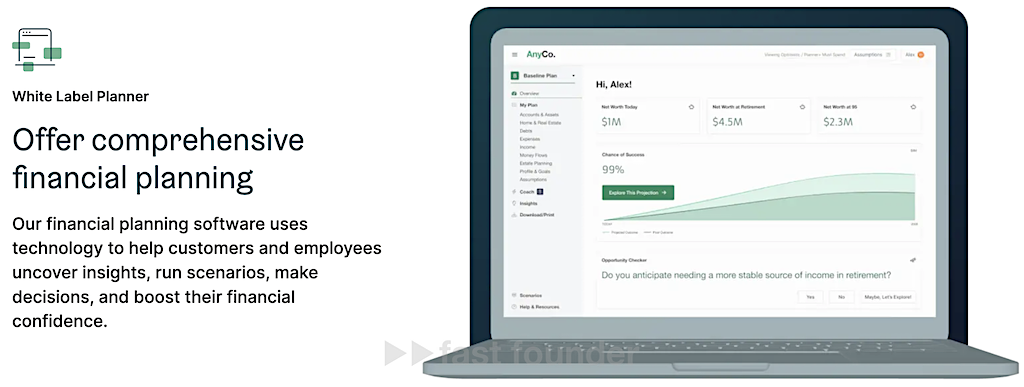

Unlike many other financial planning apps that focus either on allocating the current family budget or on investments, NewRetirement looks at a more holistic picture – one that also takes into account the cost of medical care, expenses covered by the state insurance system, taxes, inflation, and all other factors that can affect current and future expenses and incomes.

First, all sources of information about current incomes, expenses, and assets must be connected to the platform – bank accounts, information about existing real estate, debt obligations, medical expenses, and other sources of information.

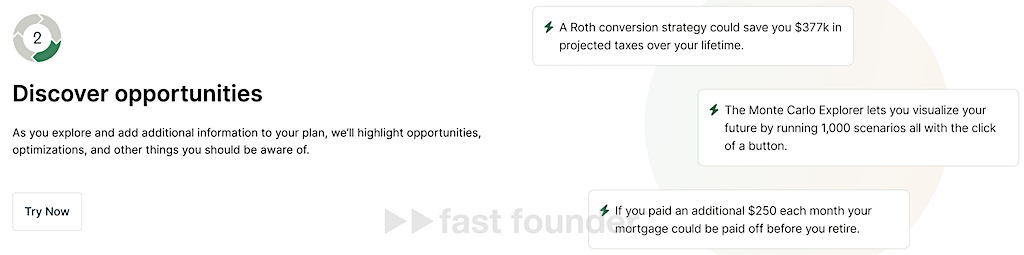

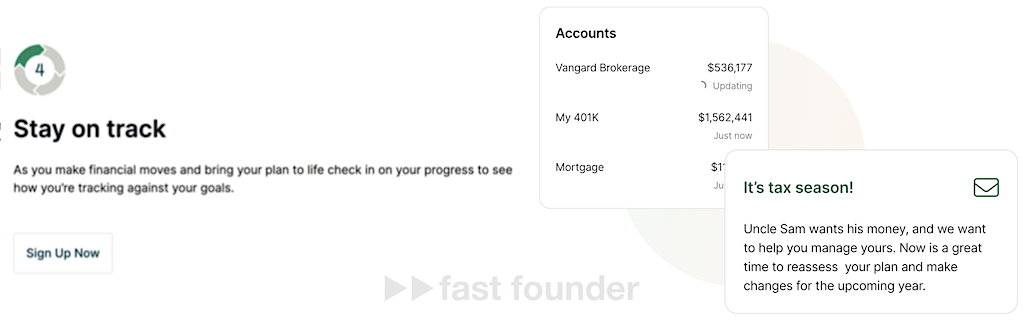

After that, you can continue to live as you did before 😉 However, the platform will monitor your financial situation and periodically advise on what can be changed to optimize future financial flows – redistribute existing assets within the pension plan, start paying slightly more on the mortgage to pay it off faster and pay less overall, and so on.

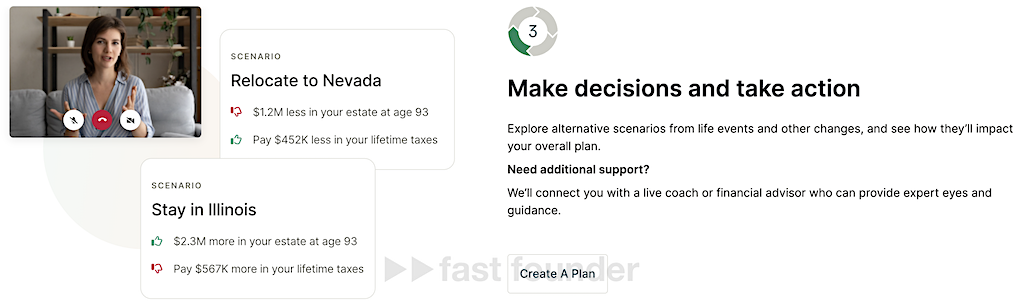

The most interesting part of the platform is its ability to run various scenarios at the touch of a button based on the “what-if” principle. If I sell my apartment and move to another state – how will it affect my assets and taxes compared to staying where I lived, for example.

By the way, the tips regularly provided by the platform are also based on scenarios. The platform periodically runs many different scenarios on the stock market, real estate, and other financial markets in the background – and suggests actions that are worth taking right now to stay afloat in any scenario or come out ahead in a favorable scenario.

In addition, the platform constantly shows the user where exactly they are on the path to achieving their desired level of financial well-being. And whether they need to urgently take action to get back on track.

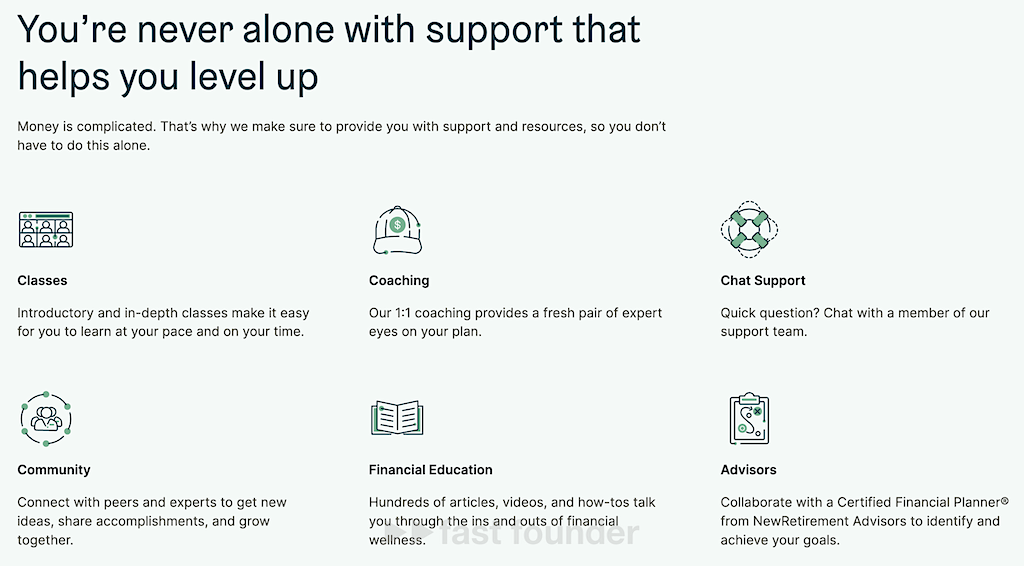

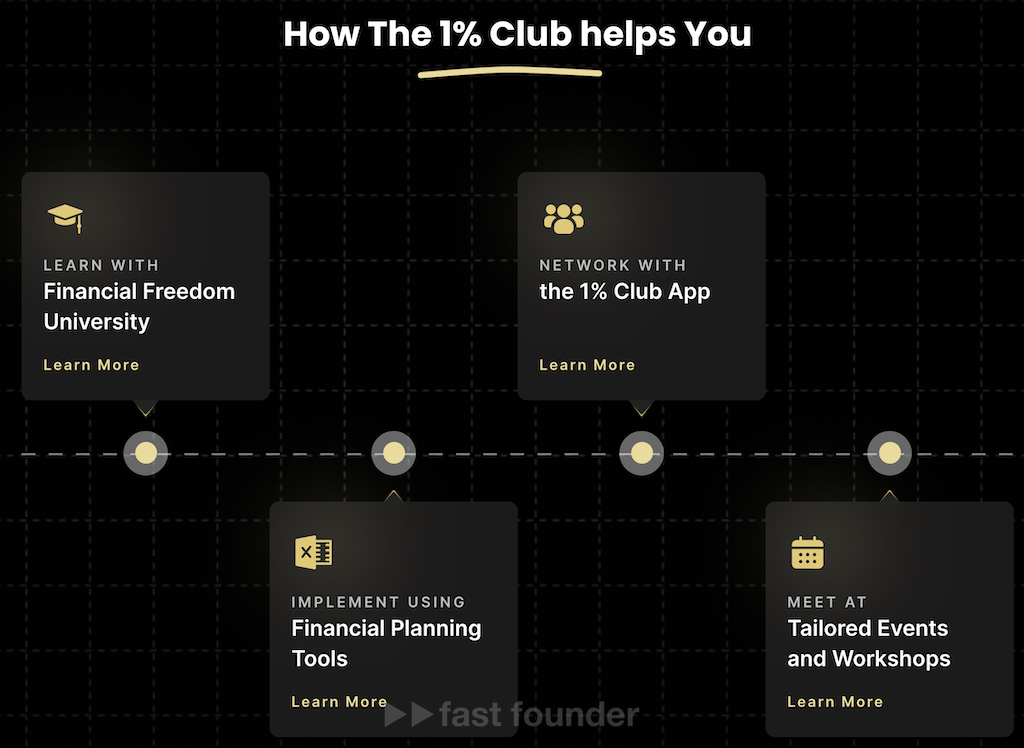

NewRetirement is not just a financial planning program. It’s an entire infrastructure where the user doesn’t remain alone with their financial problems.

There is a financial literacy training program, regular financial webinars, coaches with whom you can work individually to develop an individual financial plan, a support chat where you can ask any question at any time, a community where you can use the “crowd help,” and the opportunity to get consultations from a certified financial consultant.

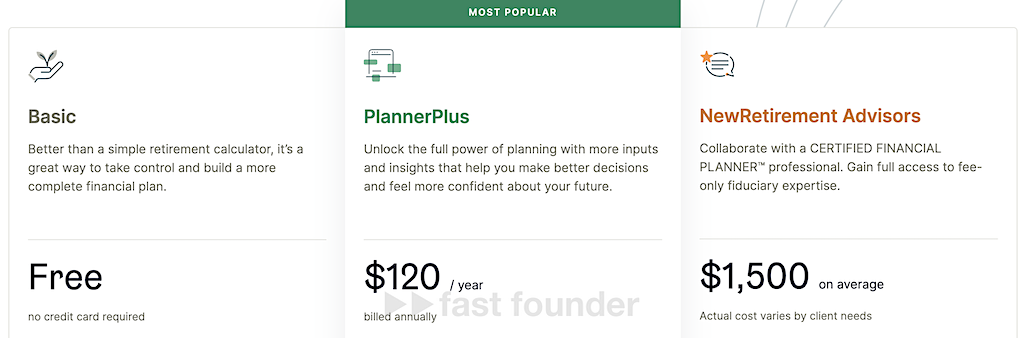

In “calculator” mode, the app can be used for free. The full functionality of the service is available on a paid subscription for $120 per year. Advice from a certified financial consultant will cost an average of $1,500 per year depending on the complexity of the task given to the consultant.

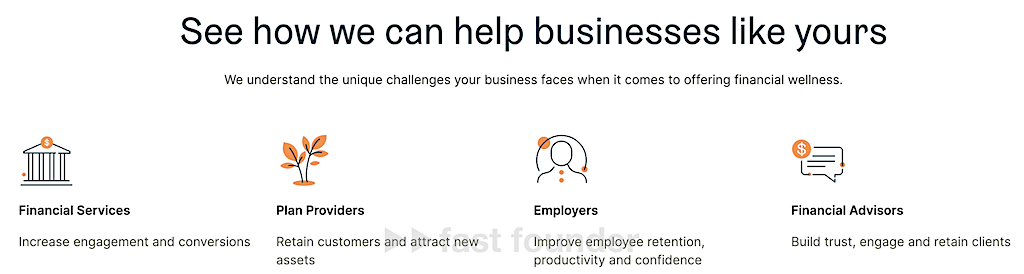

The startup is making separate efforts to implement the B2B2C model – reaching out to businesses that can provide the service to their audience. These could be employer companies offering access to the service to their employees, financial consultants giving access to the service to their clients, or financial institutions (e.g., banks) that include the service in their package of services for their clients.

These companies have the opportunity to brand the service with their own logos – so that clients or employees get the impression that this service was developed by the company itself.

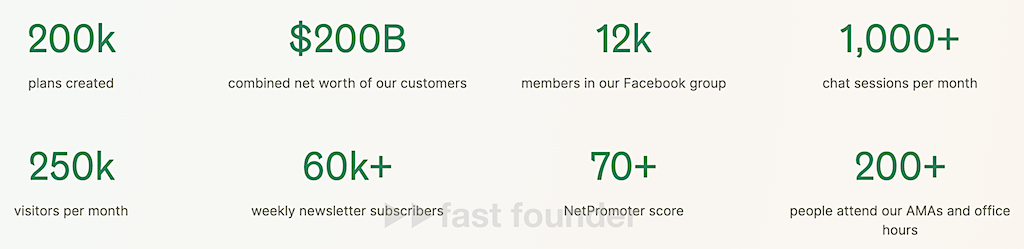

Currently, the service has about 70,000 active users, of which 20,000 are individual users, and the rest are clients or employees of partner companies of the startup. The startup receives 70% of its revenue from companies.

NewRetirement has raised $20.8 million in investments, bringing the total investment in the project to $32.6 million.

What’s Interesting

Today’s startup, while providing tools for “ordinary” financial planning, has focused on the problem of financial well-being after retirement, which is even implied in its name.

Why such a focus on pensions? Because pensions are about to undergo a major upheaval!

The problem is that life expectancy has begun to sharply increase, and the pension systems of all countries were not designed for this. Their budgets were based on payments, figuratively speaking, for 5-10 years, which was the average lifespan people had between retirement and death – but this period is noticeably increasing.

For example, in 2020, in the USA, there were 28.4 people of retirement age per 100 residents – but by 2050, there will be 40.4. In Spain, it was 32.8 – but it will be 78.4. In China, it was 18.5 – but it will be 47.5. And similar trends will occur in all countries worldwide.

So, the startup’s slogan that it’s time to “take control of your financial well-being [in retirement] in your own hands” is not just a well-wishing; it’s a harsh necessity ☹️

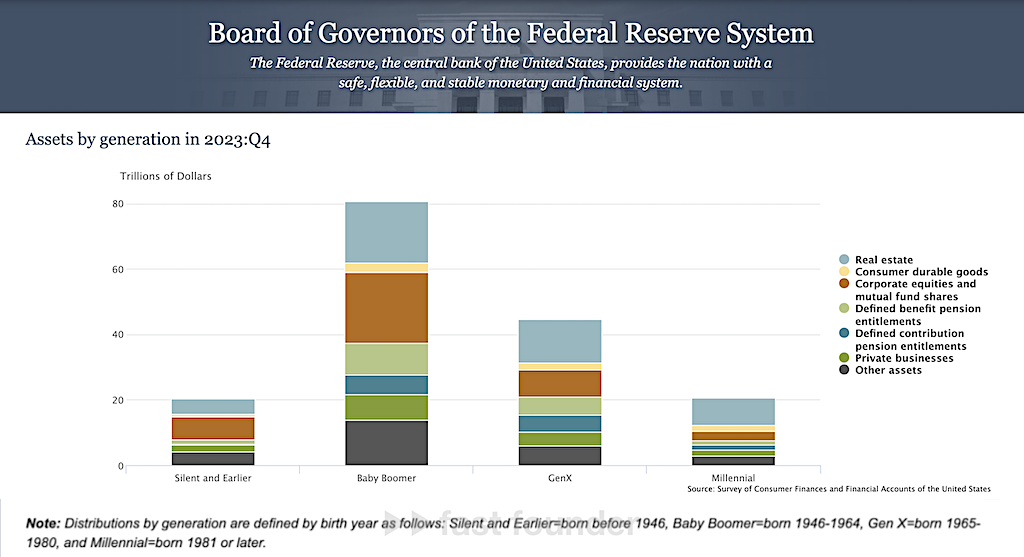

Moreover, 80% of all assets of the population, taking the example of the USA, are concentrated in the hands of people born between 1946 and 1964 – who are on the brink of retirement life issues that need addressing right now.

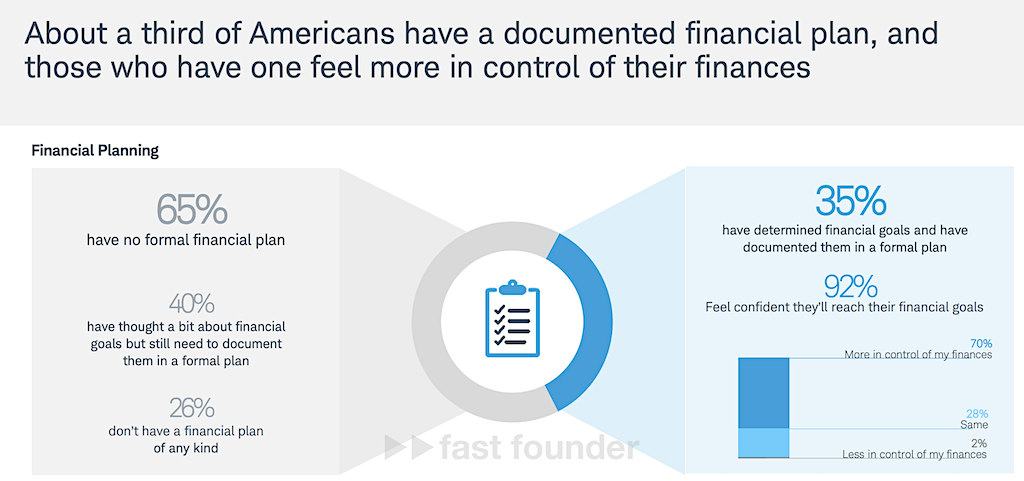

However, 65% of Americans do not have formal financial plans. Nevertheless, 40% have “thought a little” about the need for such a plan – but haven’t taken practical steps in that direction.

By the way, it’s a very good sign that they have “thought a little.” It means these people don’t need much persuasion – just a little push 😉

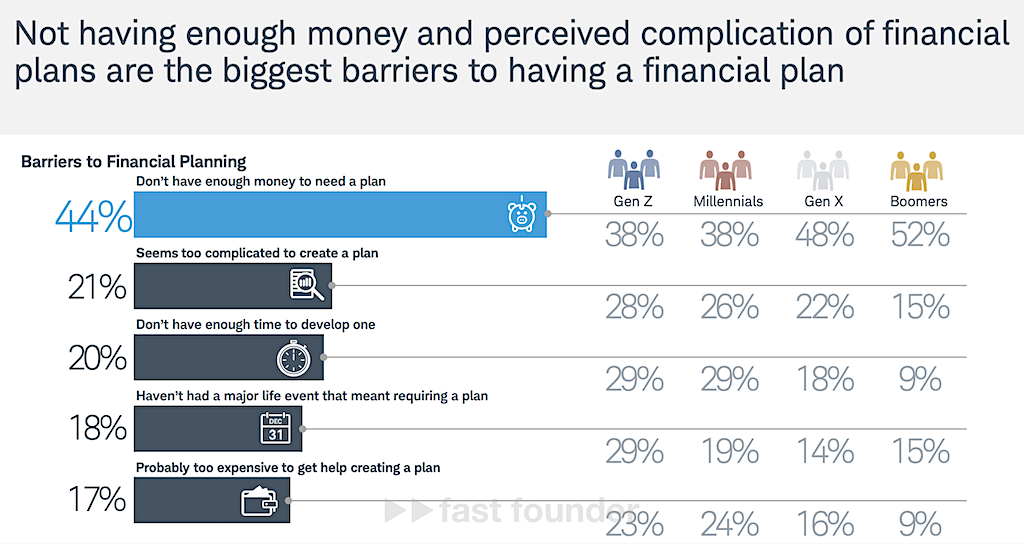

The most common reason for not having a financial plan is “not enough money to make a plan.” Although, logic suggests that a financial plan is critically necessary precisely for those who lack money 😉 Because those who have enough money will somehow manage without it.

Other common excuses are “it’s too complicated,” “there’s no time for it,” “turning to financial consultants to make a plan is too expensive.” And the most interesting one is, “nothing in my life has happened yet to make me start making a financial plan.” However, when it does happen, it may be too late ☹️

Startups in the field of financial planning are becoming popular now. Moreover, most of them sooner or later switch to the B2B2C model, ceasing to chase after each user individually.

LearnLux, which I wrote about in the fall of 2022, raised another $7.1 million in investments in February of this year, thus increasing the total investment amount to $24.2 million.

Origin, which I wrote about in the fall of 2021, raised $72 million.

Where to Run

Some services that help people achieve financial well-being position themselves as “clubs for the chosen few” who are capable of achieving this. Like the Indian startup The 1% Club, which raised $1.2 million, about which I wrote in November last year. It claims that only 1% of people are financially independent now — and invites others to join this 1%.

But the real money can be made by making financial planning a habit for the remaining 99%! And that’s where the focus should be when positioning and promoting your service in this field.

But how to achieve this? Perhaps the secret lies in moving from general words about financial planning or well-being to setting a specific goal. And it should be a long-term goal that will keep people attached to your service for a long time.

One such goal could be to save money for life after retirement, as this problem is relevant precisely for the remaining 99% of people. Today’s NewRetirement has already formulated this goal in its name — however, in the text of the website, this goal again got diluted into a bunch of general words. Although, firstly, the simpler, the better. And secondly, to convey a message to the user, you need to repeat it 100 times 😉

However, the idea of the need for financial planning and especially of ensuring one’s own life in retirement in the face of an impending pension crisis is an important and critical problem that needs to be solved by 99% of the world’s population.

Thus, a possible direction of movement is the creation of a financial planning service that will finally be wrapped in such an attractive package with such a simple and understandable offer that it will reach a potential audience of billions of people.

One possible option is exactly saving for future retirement, which today’s NewRetirement has started moving towards.

The problem is critical. Now it has become even more relevant. The size of the potential audience is enormous. All that remains is to start putting forward and testing hypotheses on how this potential can be realized.

What offer in this field can break through the wall of indifference, made up of “too complicated,” “no time,” and “someday later”? What simple tools are needed to support this offer? Through which channels, besides advertising, can such a service be effectively promoted?

About the Company

NewRetirement

Website: newretirement.com

Latest round: $20.8M, 27.03.2024

Total investments: $32.6M, rounds: 5