Startups seek real money from investors in exchange for equity… only to then use that money to pay for essential services to get started. But why do they need a middleman like an investor — if they can directly pay companies providing such services with their equity shares. This startup believes that this old idea can suddenly take off now. And here’s why it really might happen.

THE ESSENCE OF THE PROJECT

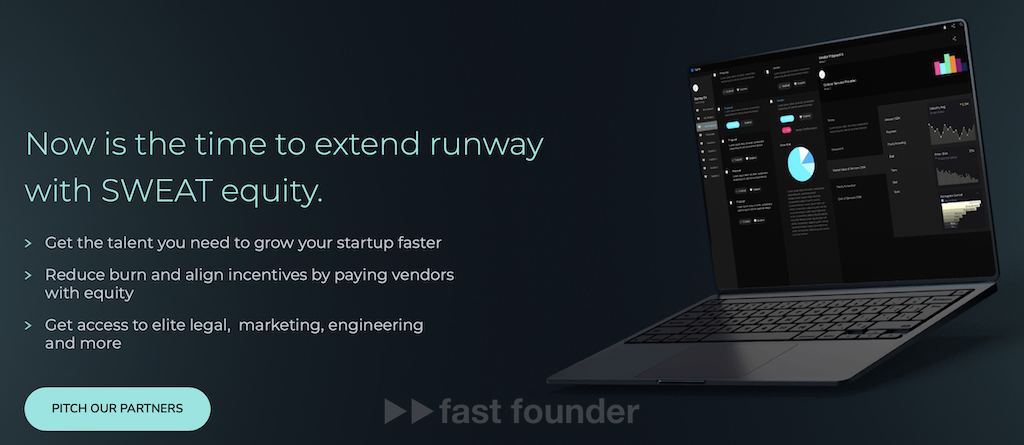

Lynx is a marketplace where startups can find companies willing to provide them with professional services not for real money, but in exchange for a share in the startup. Examples of such services provided by the startup include legal services, marketing and PR, development, and even the provision of part-time financial directors.

The term “sweat equity” used on the site literally means “equity earned by sweat,” i.e., hard work.

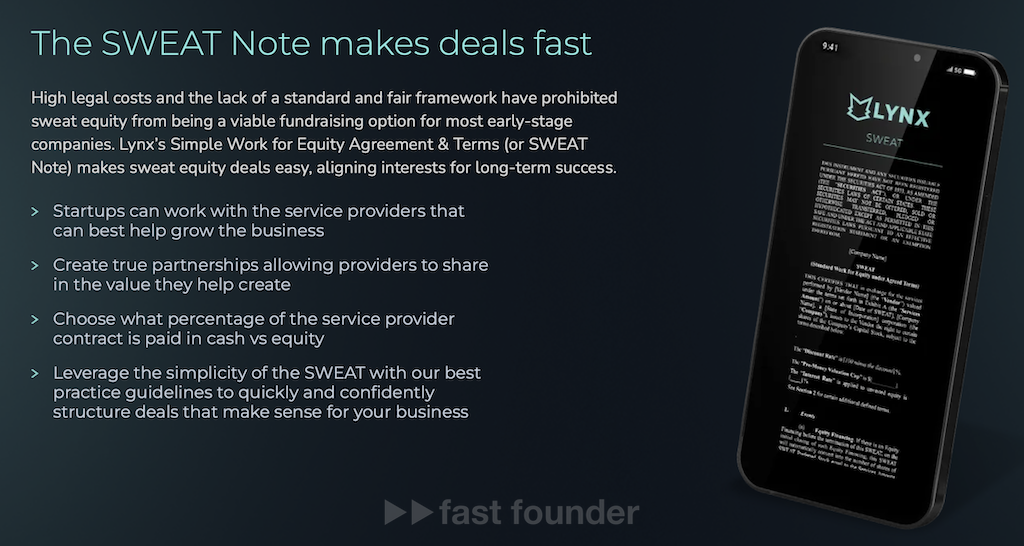

To formalize the service provision in exchange for equity, the startup developed a special form of legal document, which it called “SWEAT Note” (SWEAT-agreement).

The structure of this agreement is similar to SAFE Note (Simple Agreement for Future Equity), developed by Y Combinator — whereby investors lend money to the startup at an undefined valuation. This debt is converted into a specific share only in the next round of traditional investing, when a certain amount of money is invested in exchange for a certain share, i.e., the entire startup’s value finally becomes clear.

At the same time, the initial debt is converted into a share with a certain discount in favor of the creditor — meaning they get a larger share for the same money than the investor of the next round. Such agreements may also provide for a maximum valuation at which the debt will be converted into a share, even if the startup’s valuation in the next round turned out to be higher than it — so that the investor still gets a significant share at the time of debt-to-equity conversion.

The general principle of SWEAT Note is the same — only instead of the amount of live money lent by the investor, it stipulates the set and overall cost of services provided by the company.

On the marketplace of the platform, companies ready to offer their services in exchange for equity are listed—among which a startup can search for the necessary ones, choose suitable ones, communicate with them, and come to a principal agreement with some of them.

After that, Lynx specialists will help prepare the SWEAT-agreement, and if necessary, even create a separate company within which this agreement will be executed.

A startup can approach Lynx specialists, even bringing a company not from the marketplace—but whose services they would like to use. In this case, the startup specialists will also help with the arrangement of an agreement between them.

Lynx has the opportunity to earn on the payment of services provided for the preparation and execution of the agreement and for monitoring the agreement’s fulfillment, with the payment size possibly depending on the agreement amount. I think Lynx can also take payment (fully or partially) not in real money, but in a future share of the startup, becoming yet another participant in the SWEAT-agreement.

For the startup, exchanging a future share for services is good as it allows them to survive longer in search of a repeatable and scalable business model, without spending real money—which they may not have.

An additional plus is that the service-providing company will work not for money, but for a future share—which will be worth something only in case of the startup’s success. And this may make them provide services to the startup faster, with higher quality, and with the application of more attention and brains 😉

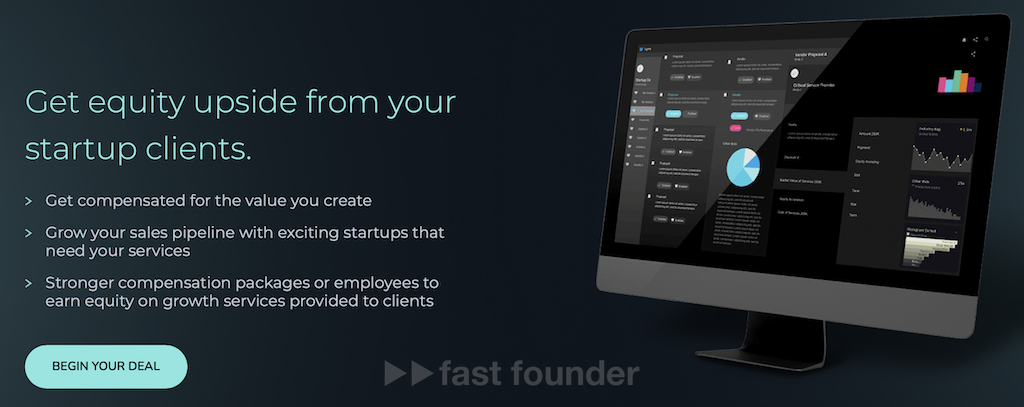

For service-providing companies, exchanging services for a share is good as they can earn much more money on the received share in the future than if they had received payment at the rate immediately. However, only if they can afford to perform part of the work essentially for free—for the theoretical profit in the future.

Lynx is also working on attracting investors to their marketplace—who might find another channel for acquiring startups not on the radars of other investors interesting. Because these startups do not run to investors in search of money, but have found companies willing to provide them with necessary services for now for free.

Lynx was founded last year, and now it has raised the first investment of “only” 650 thousand dollars. Although such a small investment size might be explained by the fact that there’s not much need for big money in such a model 😉

What interesting

The business model of Lynx may seem disadvantageous for a startup aspiring for success at first glance. The startup would have to give away equity for something it could pay for now, although the value of that equity may significantly exceed the cost of the services received over time.

This is true, but only if the startup has the funds to pay for these services. If not, it needs to find an investor who will provide the capital… to then pay for the necessary services with it.

Yet, the startup will still give away equity to the investor for this capital, sooner or later (per SAFE agreement)—it doesn’t matter. Roughly speaking, in this case, the investor becomes an unnecessary intermediary. Why take money for equity from him to pay for services, when you can exchange services for equity directly?

The absence of intermediaries usually reduces costs and simplifies all processes. Additionally, a professional investor, with extensive negotiation experience and many other investment opportunities, will likely negotiate much more favorable terms for themselves than a service company 😉

Therefore, for founders without money, exchanging equity directly for services may be simpler and more beneficial than exchanging equity for an investor’s money, only to pay for services with it later.

This model isn’t new; many have tried working on it before, but it never became mainstream. Startups mostly preferred working with investors, and service companies preferred real money.

As a result, typically startups that couldn’t attract investments, and service companies that lacked clients, agreed to such arrangements, working for almost anything. Understandably, these desperate alliances “on the fly” seldom yielded successful outcomes, deterring others from entering similar alliances.

So, what has changed now? Why might this model suddenly become more workable and popular? It’s because the recent pandemic dramatically disrupted the established order in the labor market.

Companies initially had to send their staff to work remotely. They later realized that a remote staff member essentially doesn’t differ from a freelancer, which led to the reduction of permanent salaried employees and the hiring of freelancers and temporary workers instead. This gave rise to platforms for “cloud” employees, through which a company hires a specified number of employees with the required qualifications to complete certain tasks within a specified period.

A similar change is starting to happen in the minds of startup founders. They used to take real money from investors primarily to hire staff who would complete the bulk of the work. But if startups begin outsourcing a larger portion of the work, they’ll need money not for salaries, but to pay for the services of external companies performing these tasks. And if they can pay for these services not with real money, but with equity, why not?

Thus, right now, the model of exchanging equity for services might unexpectedly revive and become popular even among those startups that aim to be successful—amid the general trend of growing popularity of outsourcing and freelancing.

Where to run

Where to run Essentially, in the description of the model, the word “startup” can be replaced with “new business” – and its essence will not change from this.

A “startup” is usually understood as a new company that wants to revolutionize the market, and a “new business” is a new company that just wants to make money. “Startups” aim to earn much more – but die much more often. “New businesses” do not want to die – therefore they agree to much smaller sizes of future earnings 😉

“Startups” and “new businesses” are united by two things. Firstly, their value grows over time – if they do not die, of course. Secondly, most of their founders lack the money to start – and they go for it to investors, banks, or friends, acquaintances, and relatives.

Well, why then don’t “new businesses” use the same financing scheme for the start with an exchange of shares for professional services, which they will need anyway?

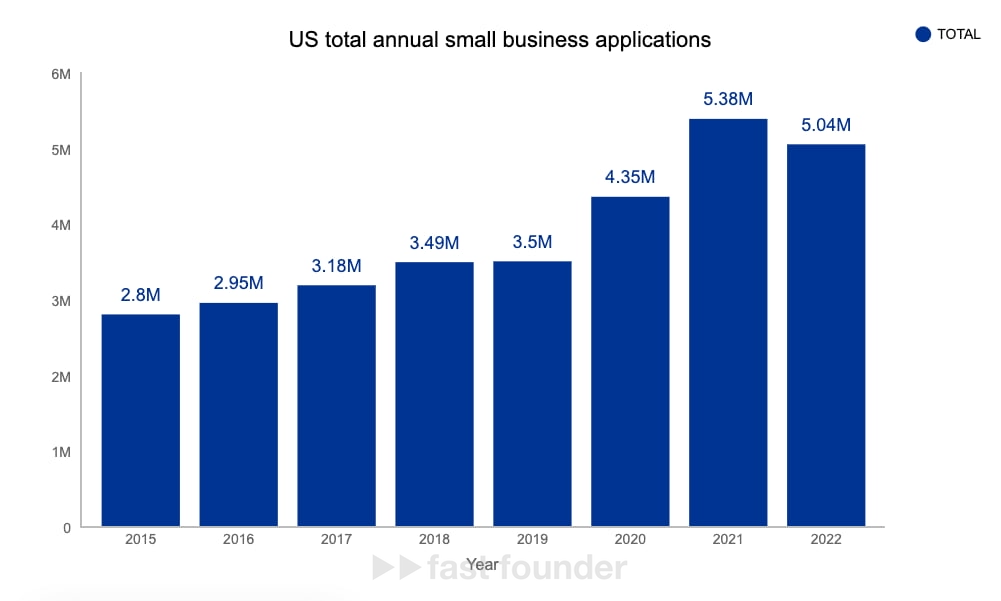

But then it will fundamentally expand the potential audience of platforms similar to Lynx. After all, only in the USA about 5 million applications for opening new companies are submitted every year. And most of their founders do not have money, but they do have a need for services necessary for a successful start.

So, a possible direction of movement is the creation of marketplaces where new businesses (and startups) can exchange shares in them for the services they need directly without intermediaries in the form of investors and bankers.

Such marketplaces may suddenly take off as a result of the current changes, which have caused the rise in popularity of outsourcing and freelancing in general.

Yes, it’s just a hypothesis that still needs to be tested.

But if it works out – it will work out on a large scale. As at one time the idea of Airbnb with a marketplace for short-term apartment rentals suddenly took off – which few believed in at the very beginning.

About Company

Lynx Website: lynx.ventures

Latest Round: $650K, 01.09.2023

Total Investments: $650K, Rounds: 1