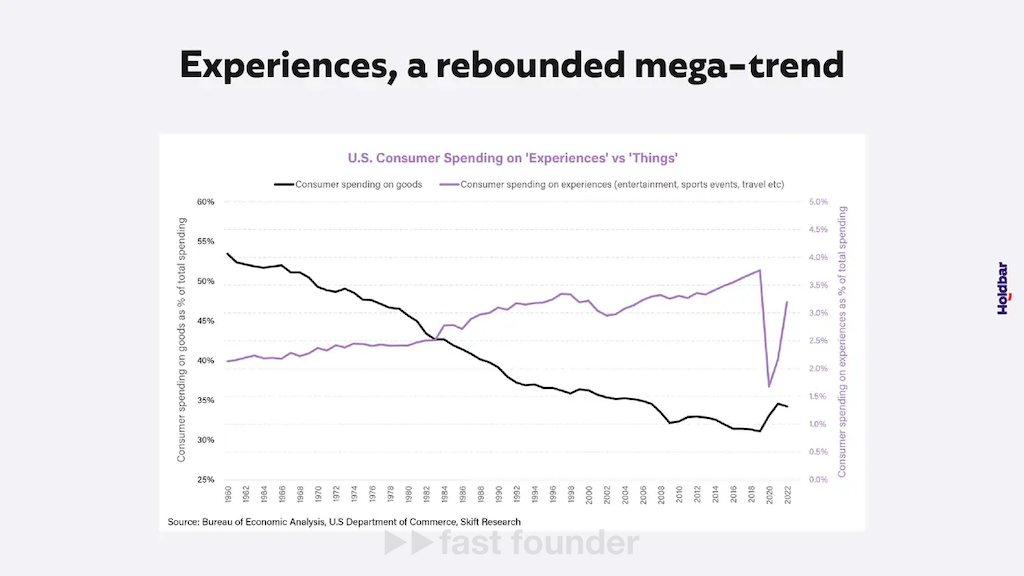

- There’s a megatrend that few are noticing yet — the service sales market has already become larger than the market for physical goods sales. However, the service sales market is still poorly digitized. But this means that it will now start to digitize rapidly and quickly.

- To take off on the wings of this megatrend, one needs to create digital platforms for service providers. But which ones? Here’s a startup that has created an excellent product for the niche of legal services. But the catch is not even in legal services!

- The catch is that you can take the concept of this product — and develop it into a more universal tool, which will now be in demand on the huge service market. And most importantly — the idea is very simple:

Project Essence

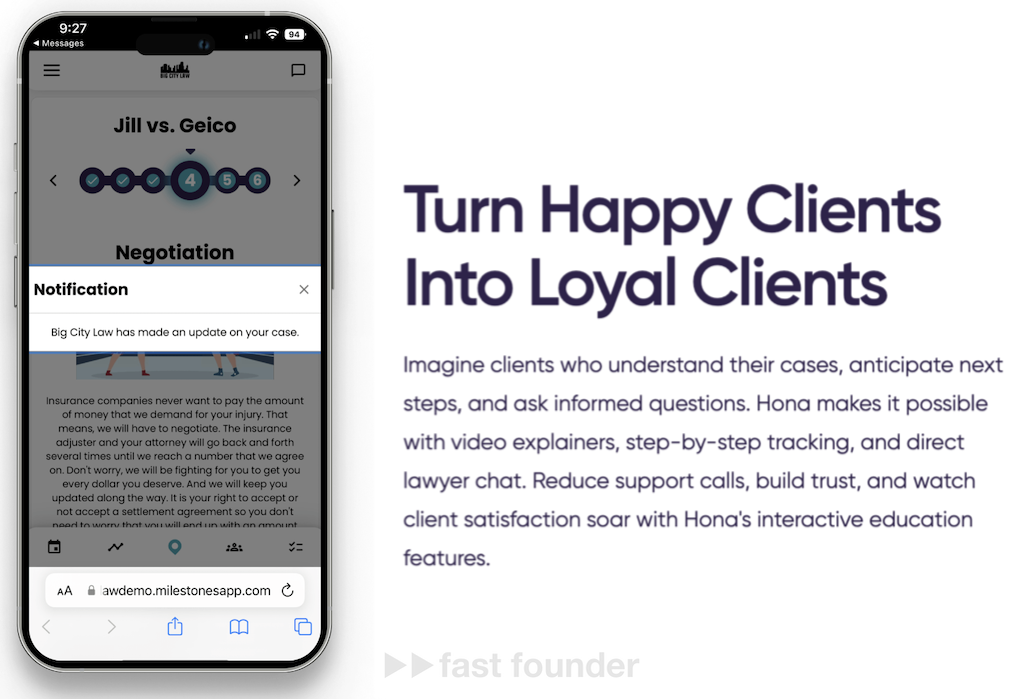

Hona has created a service that allows legal firms to establish “proactive” communication with their clients.

Typically, clients’ interactions with legal firms and other service-providing companies are “reactive.” This means that clients have to call or message the company to inquire about the status of their order—where their order stands in the completion process, when to expect the next step, and if there’s anything additional the client needs to do.

If a company connects with Hona, everything starts to happen differently.

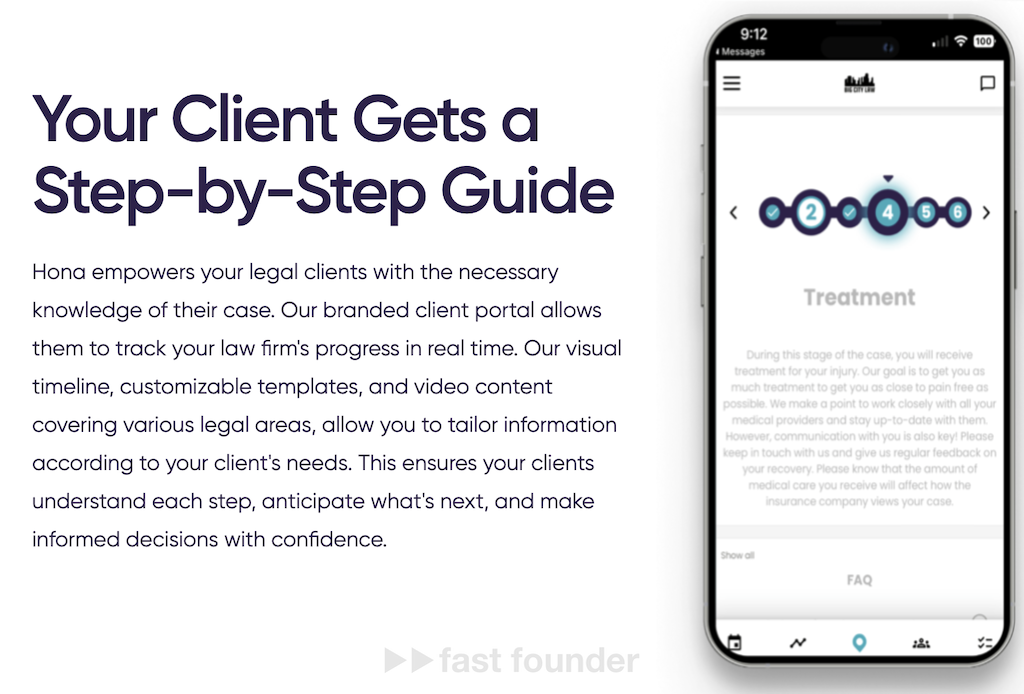

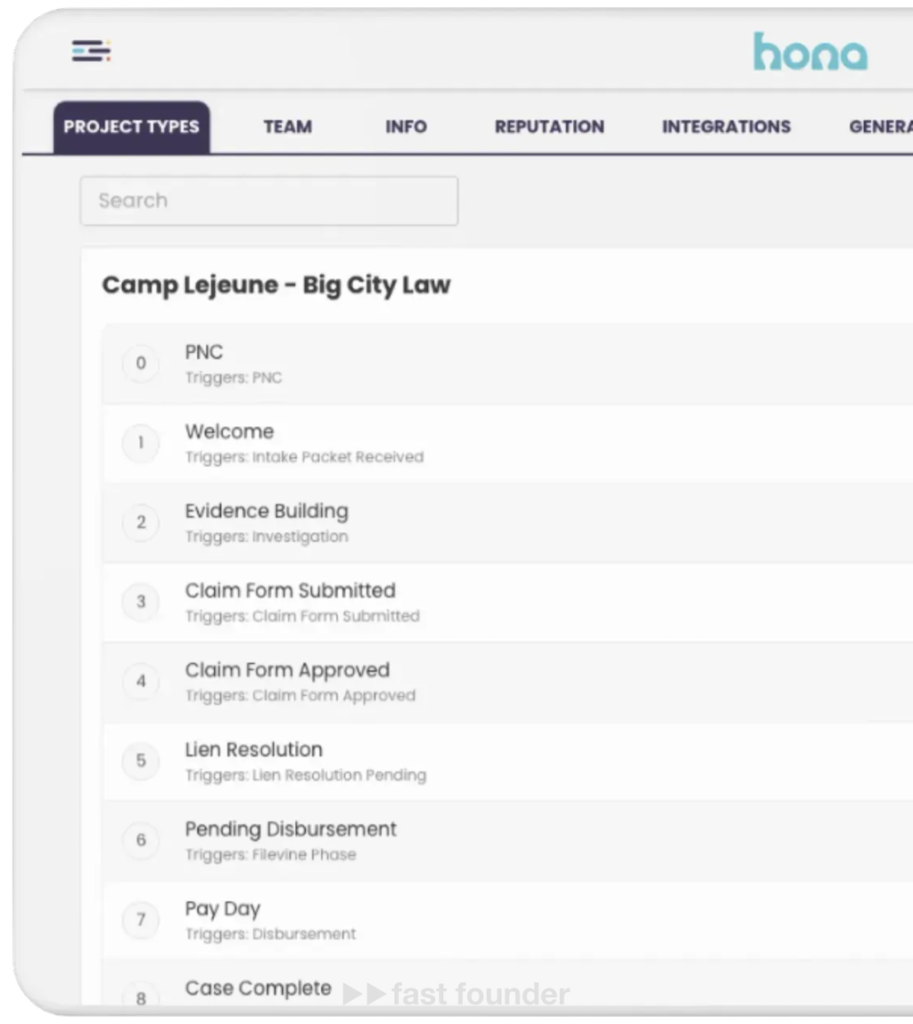

Firstly, upon handing over their case to the legal company, the client immediately sees in their personal account the sequence of all steps their case will undergo—with an explanation of each step and an estimate of how long it will take to complete.

Secondly, when the company completes another step in the client’s case, a trigger set by the company for this event is activated—such as sending an SMS or email to the client informing them that a particular step has been completed.

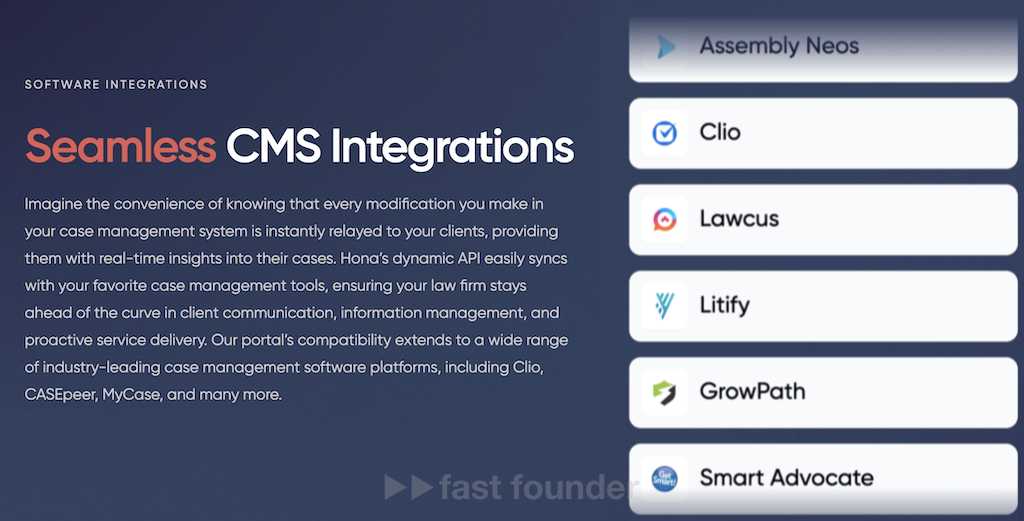

Tracking completed steps happens automatically—thanks to Hona’s ready-made integration modules with popular project management platforms for legal firms and even with the versatile Salesforce.

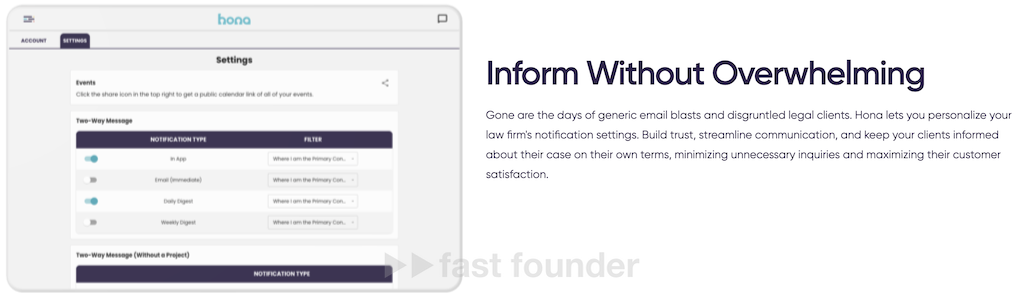

Additionally, the company can define itself which events trigger messages to clients, as cases may periodically go through internal stages like handovers between performers. Since the startup’s slogan is “Inform but Don’t Overload,” this allows companies to avoid overwhelming their clients with unnecessary information 😉

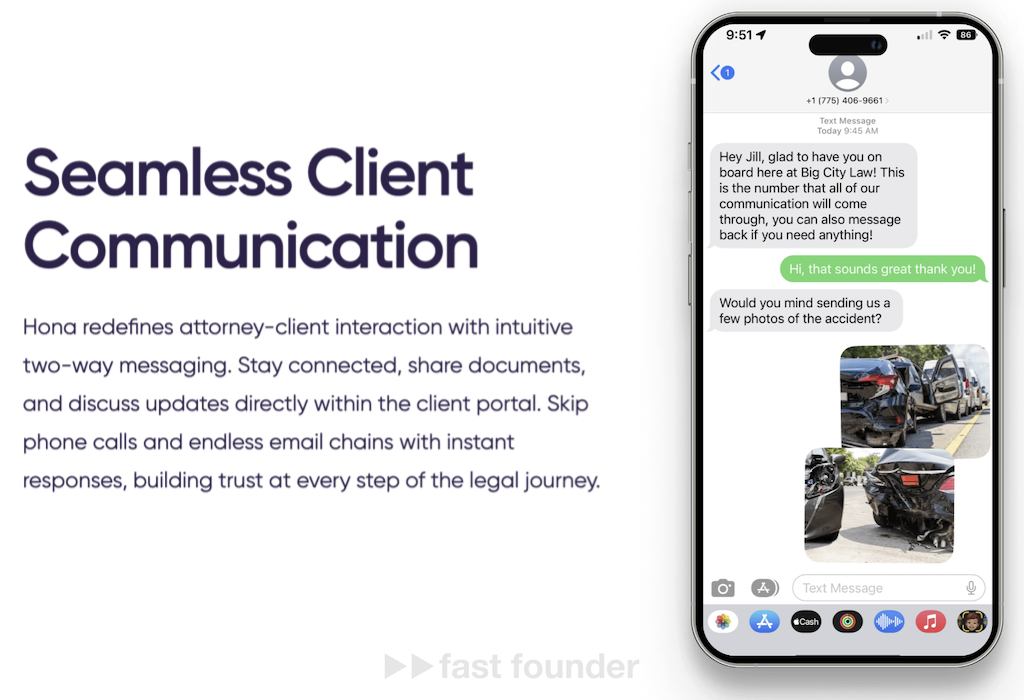

Thirdly, communications with the client through Hona are not limited to simple updates—they can be two-way. After completing another stage of work on the case, the platform can notify the client and simultaneously request documents necessary for the next stage. The client can send these documents in a reply message or upload them to their personal account, where the entire history of their communications with the company is stored.

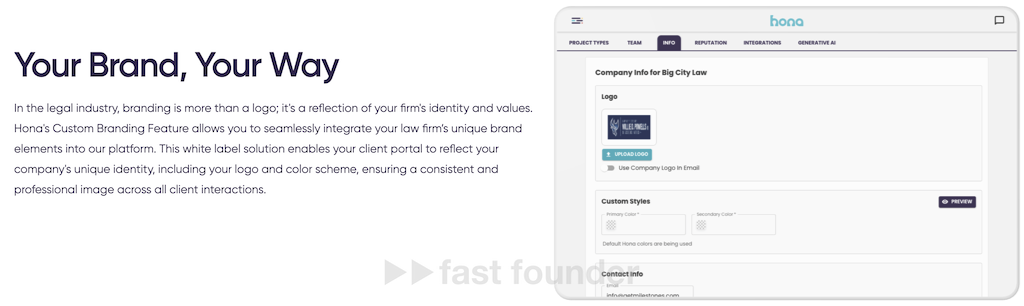

The company can brand the platform as it sees fit, so the client gets the full impression that the company itself has developed such a wonderful tool for their convenience.

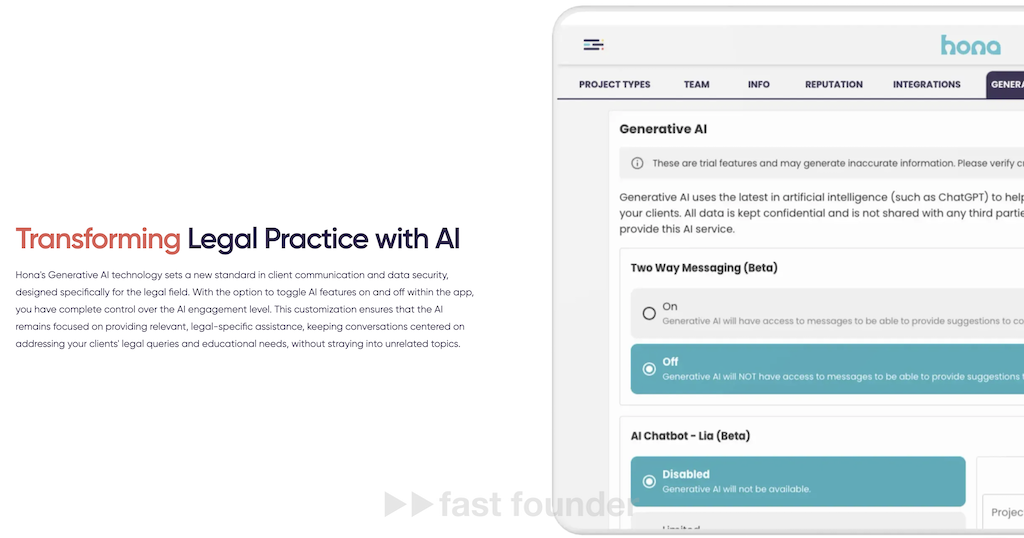

Currently, the startup has launched an AI assistant in beta mode on its platform, which autonomously answers client questions related to their case—providing more detailed explanations of its status, what has happened, what will happen, and how it translates into plain language 😉

Remember, the Hona platform is specifically tailored for legal companies—for which there are ready-made sets of templates for defining the stages of completing various cases and integration modules with popular project management platforms for legal companies.

The first time I noticed this startup was last summer when it graduated from Y Combinator and attracted $2.1 million in investments in addition to the accelerator’s standard check. And now, less than a year later, Hona has raised new investments totaling $12.22 million.

What’s Interesting

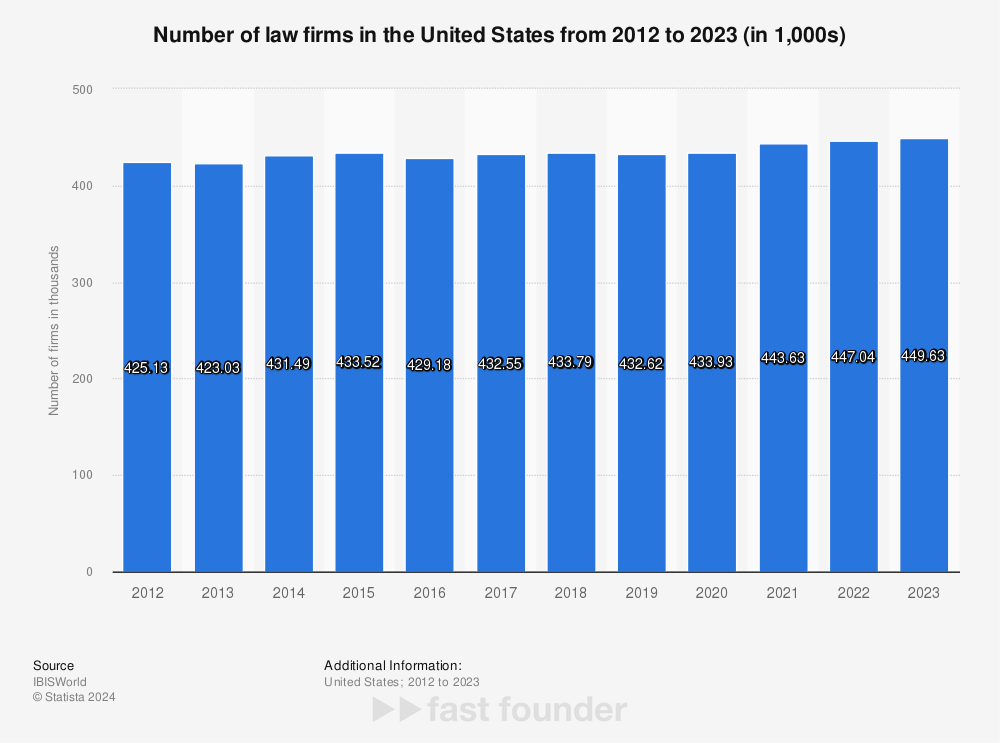

The fact that Hona has focused on the legal services market may seem like a serious limitation. However, this is a vast market that still has plenty of untapped potential 😉

Firstly, in the United States alone, there are around 45,000 legal firms, each of which could potentially become a platform client.

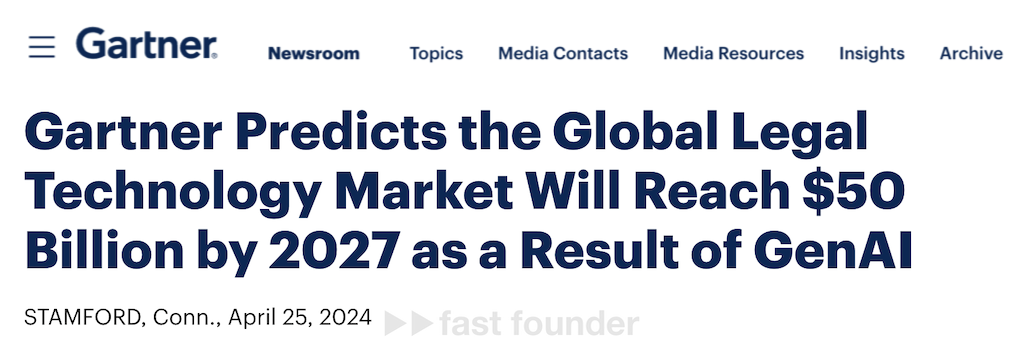

Secondly, the size of the global market for technological platforms in the legal sphere already stands at $25 billion. By 2027, thanks to the development of AI technologies, it will grow to $50 billion. That’s why Hona is actively experimenting with AI application in its platform—to catch the wave.

However, in my opinion, there’s an even more powerful trend hidden here—it’s the digitization of the service market. More and more services are being advertised and sold online—even if they are provided offline. And digital platforms are increasingly being used to manage the provision of these services—allowing for more effective control of these processes.

As a result, service marketplaces are becoming popular because people want the convenience of finding service providers and comparing their terms in one place, just like when buying physical goods.

One example of a company diving into this trend is the European startup Scnd with its marketplace builder platform for services, which I wrote about last fall. It raised €4 million in investments in its very first round.

However, for now, service marketplaces essentially serve as directories of business cards, where you can find service providers. Because all further communication with the found providers still happens manually—from clarifying prices, terms, and conditions to monitoring the service provision process.

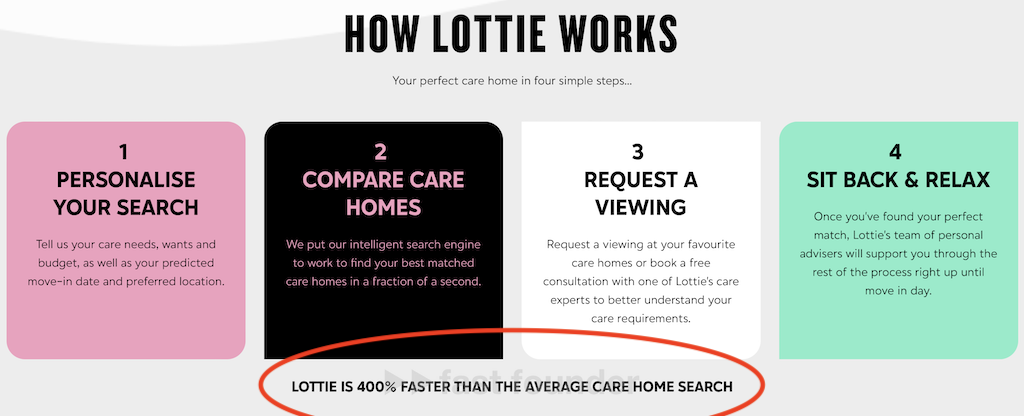

This brings to mind the example of the British startup Lottie, which I wrote about last fall.

Initially, they had just a marketplace for nursing homes, which was also essentially a “business card catalog.” Because after finding suitable nursing homes, users of the marketplace had to manually contact them to clarify availability and possible move-in dates—requiring an average of 6 contacts.

However, after receiving investments twice the size of all previous ones combined, Lottie purchased CRM Found, specifically designed for managing nursing homes. Lottie integrated its marketplace with this CRM, and as a result, users of the marketplace started finding nursing home profiles with information on possible move-in dates right away—which reduced the search time for a suitable nursing home by 5 times.

A surprising bonus was that Lottie could earn more! Previously, they only charged nursing homes for “clicks,” i.e., for contacts made by clients with nursing homes found on the marketplace—because the further path of the client was unclear to them. Now they receive information from the integrated CRM about real bookings made through the marketplace—and therefore charge nursing homes a percentage of the fees for the accommodation of clients brought by the marketplace.

Thus, modern service marketplaces are essentially integrated business card catalogs with CRM providers. Because from this CRM, the marketplace can pull information about the current workload of service providers, services actually provided to clients coming from the marketplace, service provision timelines, and other useful information—which the marketplace can use for rating, sorting search results, and even transitioning to a pay-for-performance model. Additionally, in the user’s personal account on the marketplace, they will be able to track the progress of their service through integration with the provider’s CRM.

This seriously brings underdeveloped service marketplaces closer to the normal state of marketplaces that users are already accustomed to with examples from marketplaces for selling physical goods.

Where to Go

Actually, today’s mega-trend is that the market for service sales has already become larger than the market for physical goods sales. However, the service market is still poorly digitized. And that means it will now start to digitize rapidly to meet the demands of the times. This will apply to both its own digitization and the emergence of modern-type service marketplaces.

The problem is that future and existing service marketplaces will struggle to develop integration modules with various CRMs and platforms used by service providers in their work. They will also need to implement their own digital platforms in this lagging sphere of market digitization.

Moreover, service providers are unlikely to want to get tied to the tools of a specific marketplace, which would constrain them too much. They will want a more flexible and independent solution that allows them to integrate with any marketplace and also use the same scheme for integrating with their own website and other channels for selling their services.

This brings us to the idea of creating a kind of “middleware” — a platform that, on one hand, can integrate with internal CRMs of service providers, and on the other hand, interact directly with customers or integrate with third-party services like marketplaces.

The task of this “middleware” is to make the service delivery process predictable and transparent, and also to ensure two-way communication between the customer and the service provider. And for service providers who are not yet digitized, such middleware can even sell its own or third-party CRMs 😉

But isn’t this exactly what today’s Hona does! Therefore, the “local” idea of this startup that clients of law firms need to be made “happy” first (by providing them with transparency and predictability in getting results), and then “loyal” — can be expanded to the idea of creating a middleware platform to ensure transparency and predictability in the service market as a whole.

Thus, the possible direction of movement is the development of the Hona concept towards creating a more universal platform with the ability to integrate with marketplaces and other marketing and sales channels.

As I mentioned, the service market is currently undergoing rapid digitization. And this makes such a direction of movement very, very relevant — allowing such a platform to rise on the wave of changes currently taking place in the market.

About the Company

Hona

Website: hona.com

Latest Round: $11.22M, 29.04.2024

Total Investments: $13.3M+, Rounds: 3