- Free money should work, otherwise inflation will devour it. But the problem is that even more money is consumed by other people’s investment advice and one’s own intuition ☹️.

- And here comes an interesting idea. Why not discard all this subjectivity and start following a simple rule—invest only in those companies from which you actually buy something!

- Even more interestingly—expand this idea to companies whose stocks are not even traded on the stock exchange. And then you can do something of your own here, drawing inspiration from these examples:

Project Essence

Grifin offers people to “turn expenses into investments.

Unfortunately, expenses don’t actually turn into investments ☹️ The point is that the service helps a person invest in the companies whose products or services they purchase.

Roughly speaking, every time they make a purchase from a company whose stocks are traded on the stock exchange, they automatically spend an additional $1 to buy stocks in that company.

The startup even went so far as to obtain a trademark for this method called “Adaptive Investing.”

For this mechanism to work, a person must download the Grifin app and link it to their bank card, which the service will use to track purchases from public companies and from which money will be debited to purchase their stocks.

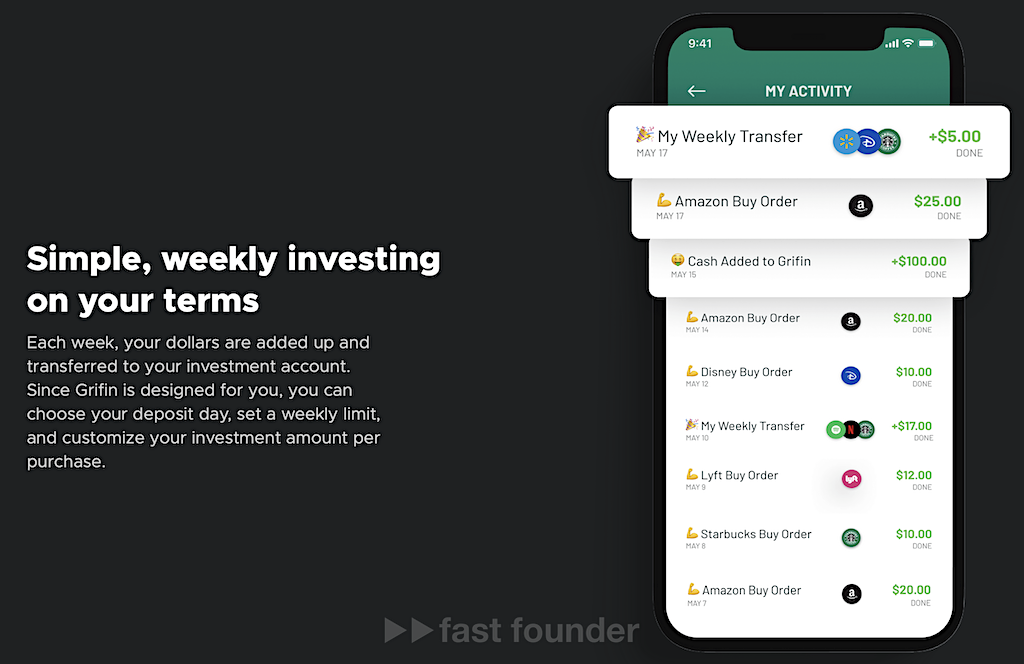

Actual stock purchases are made weekly—only after the user has reviewed and approved the list of accumulated purchase orders for the week.

The app allows users to customize the process of creating stock purchase orders. Users can change the default purchase amount, ranging from $1 to $99. They can “ban” specific companies, meaning they can prevent automatic creation of purchase orders for their stocks. Additionally, they can pause the entire stock purchase process—then purchase orders will not be automatically created until they re-enable this feature.

The startup’s app was officially launched on February 22, although Grifin had been working on it for a couple of years and had already raised $11 million in investments for it.

What’s interesting

The startup claims on its website that their methodology allows you to “invest in a state of constant motion,” meaning that you continue to live as you did while investments adjust to your lifestyle. However, either several important points are not disclosed on the website, or they are not yet implemented in the application.

The first point is “portfolio rebalancing.”

Rebalancing is when an investor regularly reviews their investment portfolio to sell some of the existing stocks and buy more of others. This is done to maintain the proportion of money invested in different companies in line with the investor’s current level of confidence in them. If confidence in a company decreases, they sell some of its stocks; if confidence increases, they buy more.

Ideally, Grifin should also periodically rebalance the portfolio. Within their methodology, this may mean that the service should regularly suggest to the user to sell some stocks of those companies whose products or services they have recently bought less frequently or stopped buying altogether.

The second point is the dependence of the amount spent on purchasing stocks on the price of the purchased goods or services.

For example, if I buy coffee at Starbucks for $10 every weekday morning and order pizza from Domino’s for the whole family for $100 once a week, then by default, I will buy Starbucks stocks for $5 weekly and Domino’s stocks for only $1. Although my wallet votes more significantly for Domino’s than for Starbucks.

In essence, what Grifin wants to achieve with its methodology is for each person to have their own “index fund.” An index fund buys and sells stocks of companies not at the discretion of fund managers but according to predefined rules based on measurable data—the regularly calculated “index” of the significance of various stocks.

The most famous index is the S&P 500. Funds that follow this index must always have in their portfolio stocks of 500 public companies with the highest market capitalization, and the proportion of these stocks in the fund’s portfolio must correspond to the proportion of the companies’ values, achieved through regular portfolio rebalancing.

In Grifin’s case, a person’s purchasing habits should become this index. In theory, a Grifin user’s portfolio should consist of stocks of companies whose products or services they purchase at any given time. Moreover, probably in the proportion of how much money they spend on them rather than how often they buy them.

In principle, nothing prevents Grifin from creating its own global index, combining the individual portfolios of all its users. Then this index will reflect not the behavior of stock market speculators, as in the case of the S&P 500, but the consumer habits of the population. This is entirely justified since usually, companies whose products and services people buy are the ones that survive and grow.

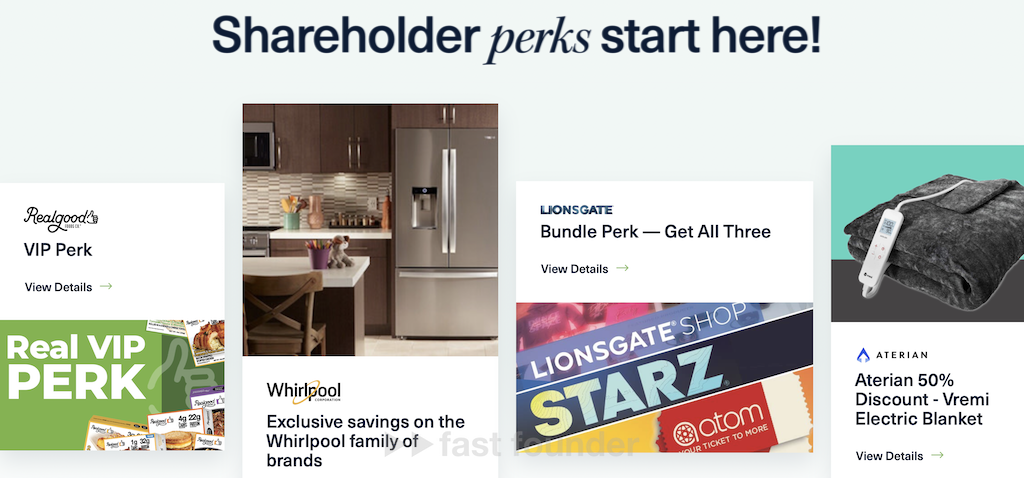

Grifin is trying to establish a connection “from buyers to shareholders” so that active buyers become shareholders of the companies they purchase from. However, it’s interesting to note that startups are emerging that are establishing a connection in the opposite direction— “from shareholders to buyers,” so that company shareholders also become active purchasers of its products.

Stakeholder Labs, a startup is developing a product called Roundtable, which allows public companies to incentivize their private investors to buy their products and services by offering them discounts and rewards. The product has not yet been released, but the startup has raised $4.2 million for its development.

A similar mechanism is being implemented by Tiicker. It has raised $10.35 million in investments.

Where to Run

I’ve thought about Grifin’s methodology and realized that most of the time I spend money at local cafes, restaurants, and stores that aren’t even public companies. But I trust them, just like their other customers—and wouldn’t mind earning on that trust 😉.

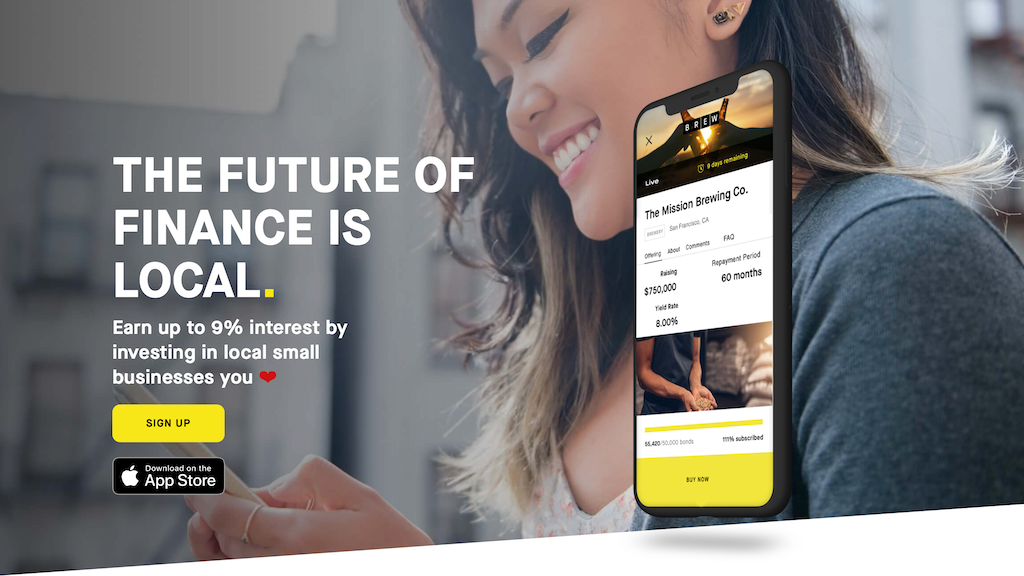

Then I remembered the startup SMBX. They created a platform where local businesses can attract loans for development from their customers who like what and how they sell and are willing to vote for them with their dollar—earning up to 9% annual interest. This startup raised $15.2 million in investments.

After that, I thought that the same mechanism as Grifin could be applied here as well—automatically allocating investments from customers to local businesses that have posted loan requests on the platform. If we continue this idea further, using the same mechanism, we can invest in bloggers I follow or in small app developers whose apps I use.

The key point is to remove any “subjectivity,” leaving only the “index” principle. If I use it and/or pay for it, then it’s worthy of investment or lending, proportionate to my activity. If not, then no.

So, a possible direction to move in is creating platforms that allow buyers and users to lend or invest in businesses depending on their level of consumer activity.

Of course, there will be many details and pitfalls involved—but the idea itself seems cool and, from a general standpoint, no less precarious than relying on one’s own intuition or others’ “authoritative” opinions 😉

About the Company

Grifin

Website: grifin.com

Latest Round: $9.5M, 01.06.2021

Total Investments: $11M, Rounds: 3