- A cool business model is “subtract and share” 😉 You enter a large market where there are several big players and a bunch of small ones—and you provide small players with tools to attract at least some customers away from the big ones.

- Since the market is large, even “at least some” means big money! Some of it will be earned by the small players. And the other part will come to you as the creator of these tools. However, there is one important detail here.

- You need to come up with a “hook” that big players cannot use but can attract the small ones. This startup managed to pull off such a trick in the food delivery market. But the same principle can be applied to other markets too:

Project Essence

Owner.com promises that with their platform, “restaurants will find it easier to grow online”.

The startup’s target audience includes non-chain restaurants and cafes, which are usually small family businesses. Owner.com sees its mission as protecting small restaurant owners from ubiquitous online food delivery services.

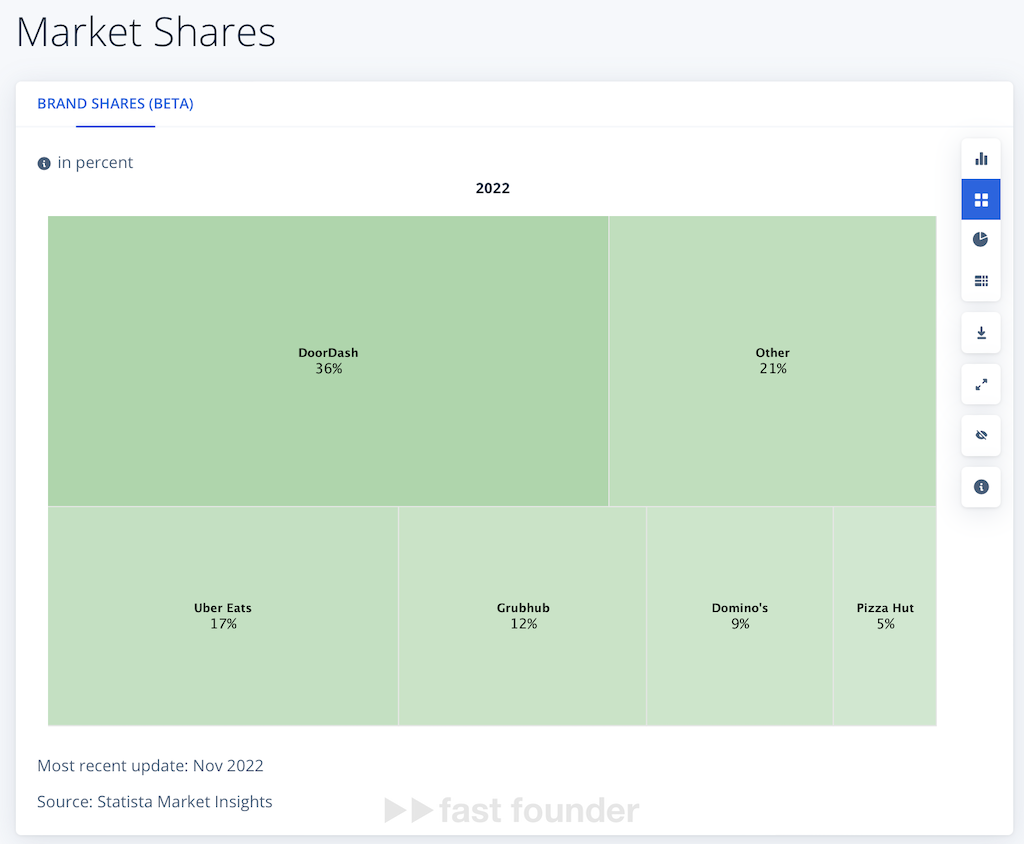

This image shows the distribution of shares in the American restaurant food delivery market, where just three aggregators—DoorDash, Uber Eats, and Grubhub—occupy 65%.

“Imagine being able to use the same technologies to attract customers as big chains like Domino’s or Starbucks,” the startup tells its potential clients.

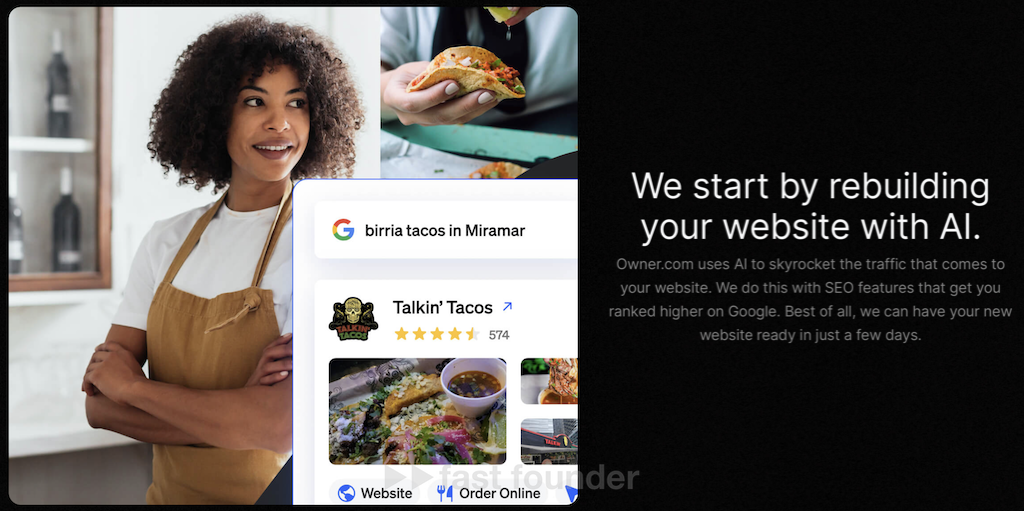

The startup’s work begins with revamping restaurant websites, putting them on their platform. As it’s currently fashionable to say, they develop restaurant websites “using AI”. But in this case, it’s not even crucial because the result is a fully functional and attractive website—which small restaurants usually lack the money, resources, or imagination for.

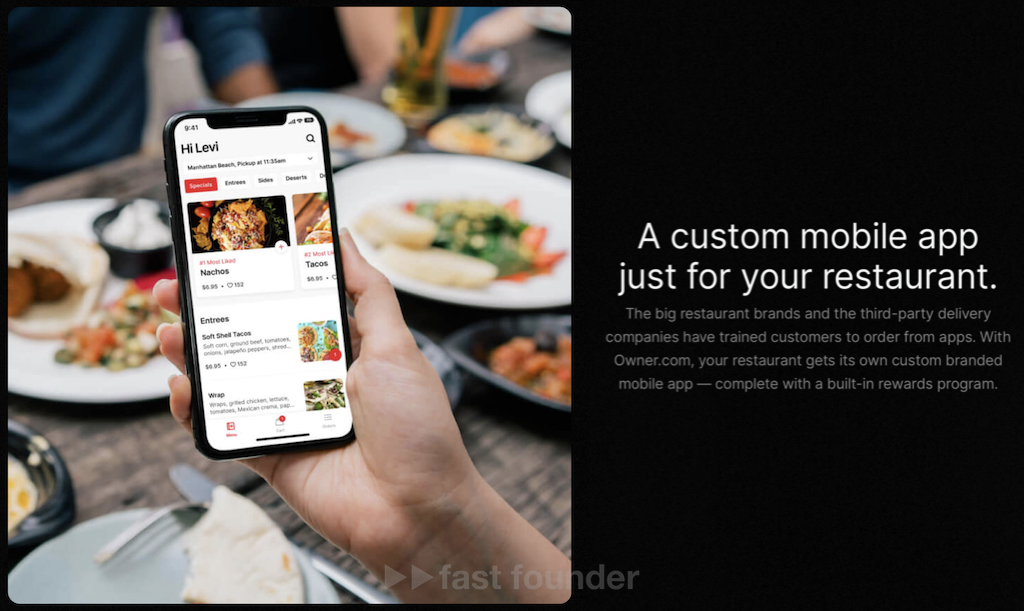

At the same time, the restaurant also gets a mobile app.

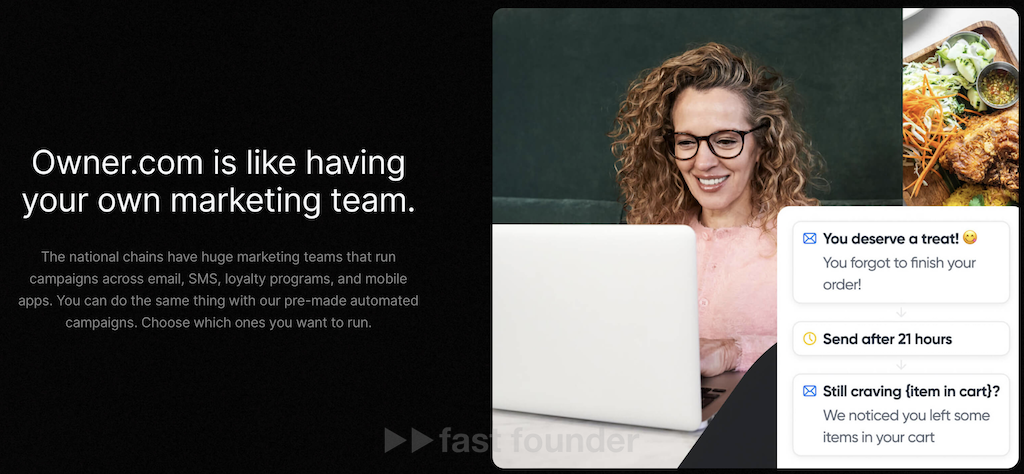

But the most important thing, as the startup claims, is that “using our platform is like having your own marketing team”.

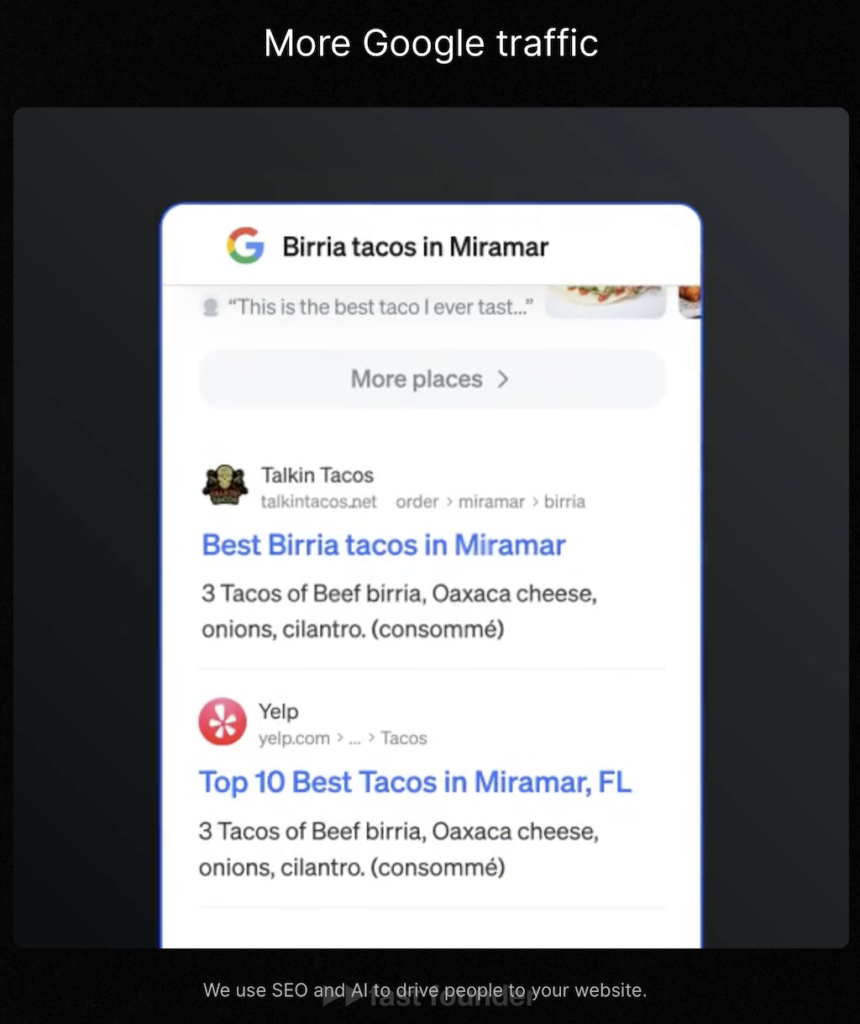

The platform automatically creates and updates numerous pages for each restaurant, helping it get more traffic from Google searches—which brings in more orders.

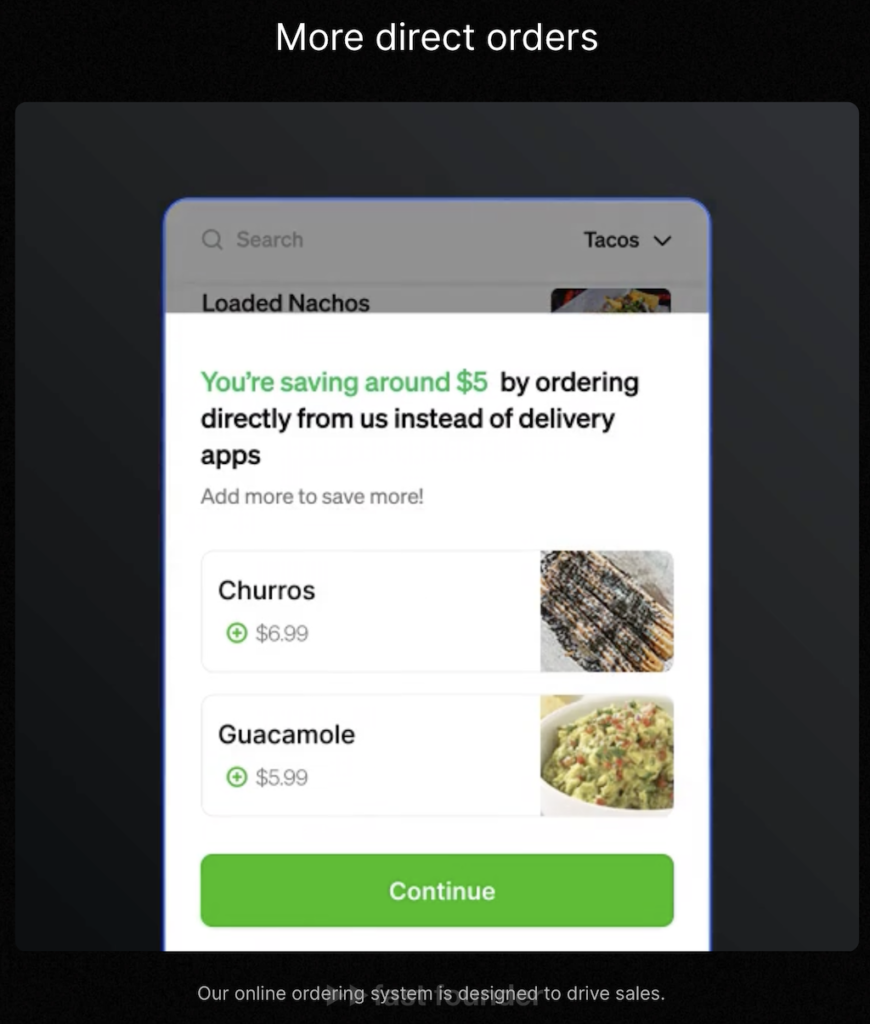

At the same time, visitors land on landing pages of the restaurant’s website, where they are persuaded in every possible way to order directly from the restaurant, rather than going through the aggregator’s mobile app. The dumbest but working method is “Get a $5 discount if you place an order directly, not through the aggregator”.

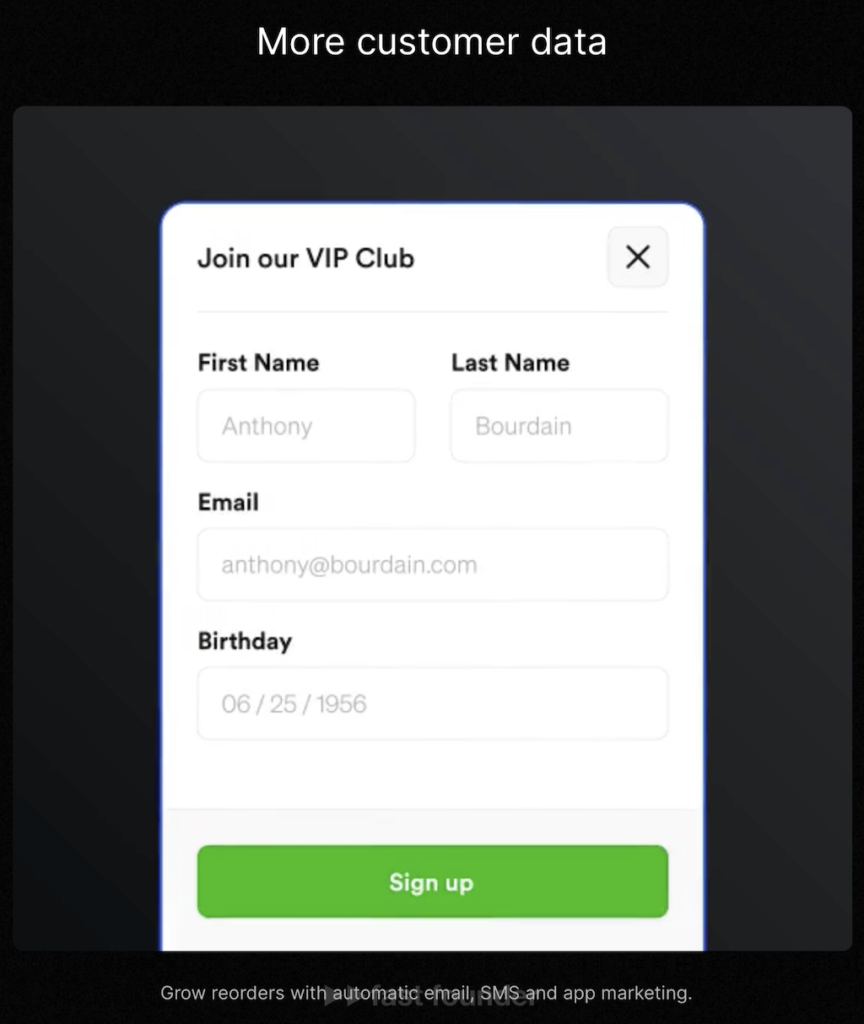

If a person decides to place an order directly, the platform takes their contact details—to put them into its loyalty program, and then sends them reminders and special offers, encouraging them to repeat orders, using the bonuses received for previous orders. Naturally, all the tools for this are already built into the platform.

The Owner.com platform was launched in 2020. During this time, 2,000 restaurants have connected to the platform, serving 3 million customers through the platform, totaling $400 million.

The startup’s revenue grew threefold in 2022-2023, and over the next two years, they plan to increase it fivefold.

Currently, Owner.com has raised an additional $33 million in investments, increasing the total investment in the project to $62.2 million.

What’s Interesting

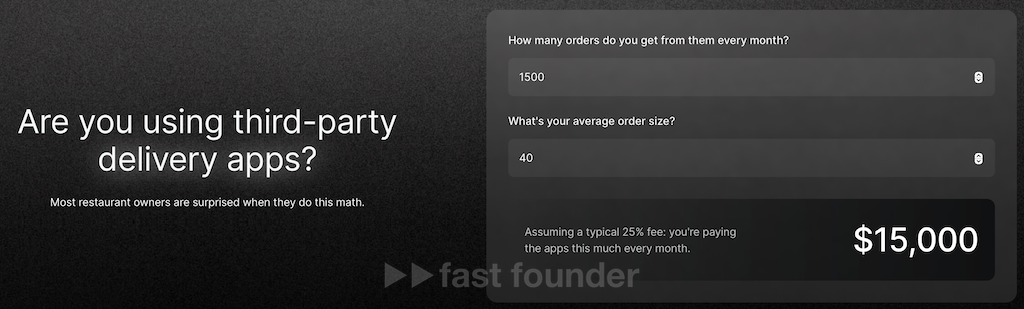

But why do restaurants need protection from aggregators? Because aggregators typically charge 25-35% of the food’s cost for their services! This often leads to restaurants barely breaking even or even operating at a loss on online orders ☹️

Large restaurant chains can afford this, considering it as marketing expenses to attract new customers. But small restaurants cannot.

Moreover, the owners of small restaurants awaken simple greed 😉 If a restaurant fulfills 1,500 online orders with an average value of $40 each, at a 25% commission, they give the aggregator $15,000 a month. And this comes not from some marketing budget but from their own pocket.

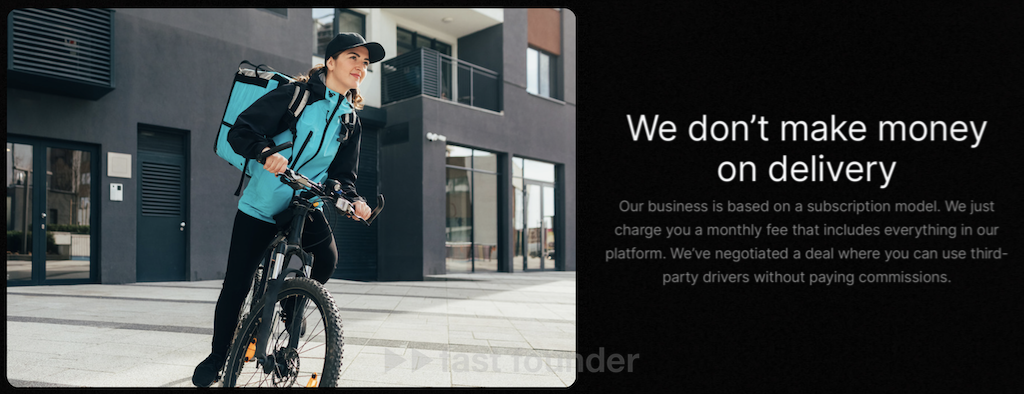

However, Owner.com “doesn’t make money on delivery”! They don’t take commissions from restaurants based on the food’s delivery price. Restaurants pay them fixed fees for subscribing to the platform.

True, each restaurant has its own price, depending on the restaurant’s location, number of outlets, customers, and several other factors. To find out this price, you need to contact the startup directly.

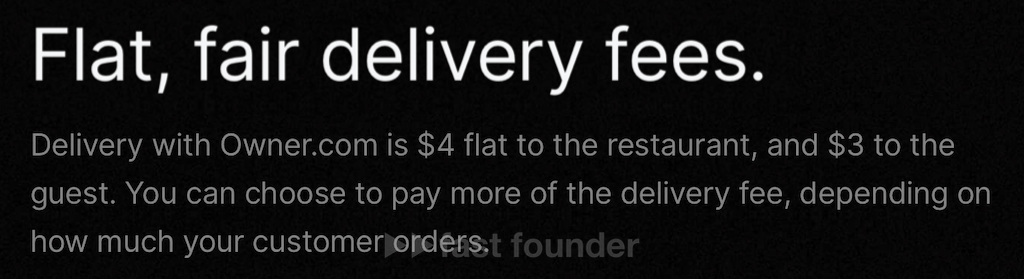

You might get the impression that everything is perfect, and delivery is included in the subscription price. But that’s not quite the case. Each delivery costs the restaurant $4, and the buyer pays an additional $3. However, the delivery price is not tied to the food’s cost.

Almost not tied 😉 Because if the order is large and needs to be delivered urgently, the restaurant can choose the option with a higher price for premium express delivery.

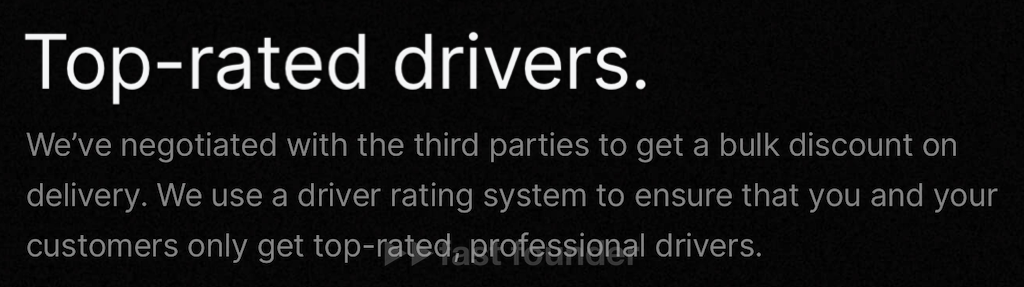

Moreover, Owner.com doesn’t have its own couriers but uses external delivery services. They ensure an acceptable delivery cost, which fits within their declared fixed price, through:

Agreements with delivery services that give Owner.com discounts based on the volume of deliveries. As you can understand, no small restaurant with its order volume can get such delivery prices. Having a platform integrated with external delivery services, which allows automatically finding the cheapest delivery options at the specific moment of sending a specific order. For example, because a courier is already moving along a nearby route or because a particular delivery service currently has a temporary shortage of orders. Why does Owner.com’s model have the right to exist against the backdrop of the real dominance of aggregators in the food delivery market?

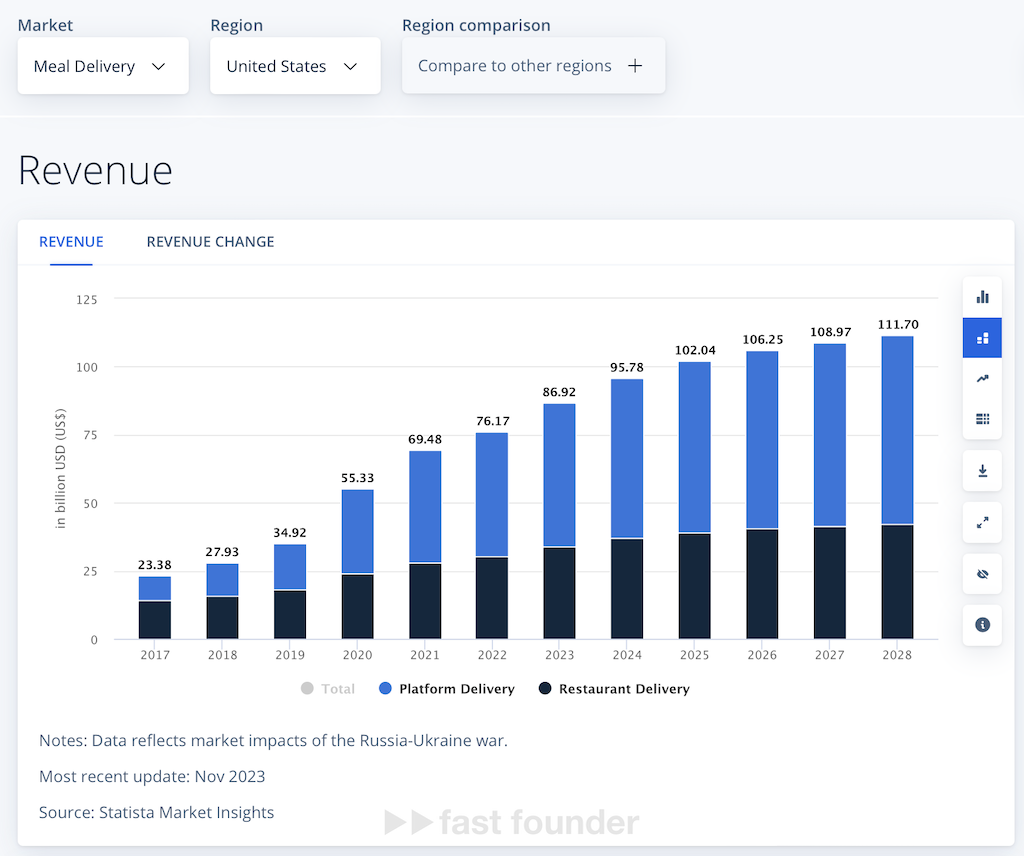

The ready-to-eat food delivery market is huge. In the US, in 2023, it amounted to $86.92 billion, and by 2028, it will grow to $111.7 billion. Moreover, this growth mainly occurs due to the growth of delivery through aggregators, while the monetary share of orders through restaurants grows almost imperceptibly.

Accordingly, for Owner.com to make decent money, they don’t need to “create a market” or “generate customers out of nowhere” 😉 It’s enough for them to attract at least a small part of the orders from aggregators to restaurants directly—which is a much more understandable task. But, given the overall market size, this will constitute significant absolute amounts of money—which they will somehow share with the restaurants.

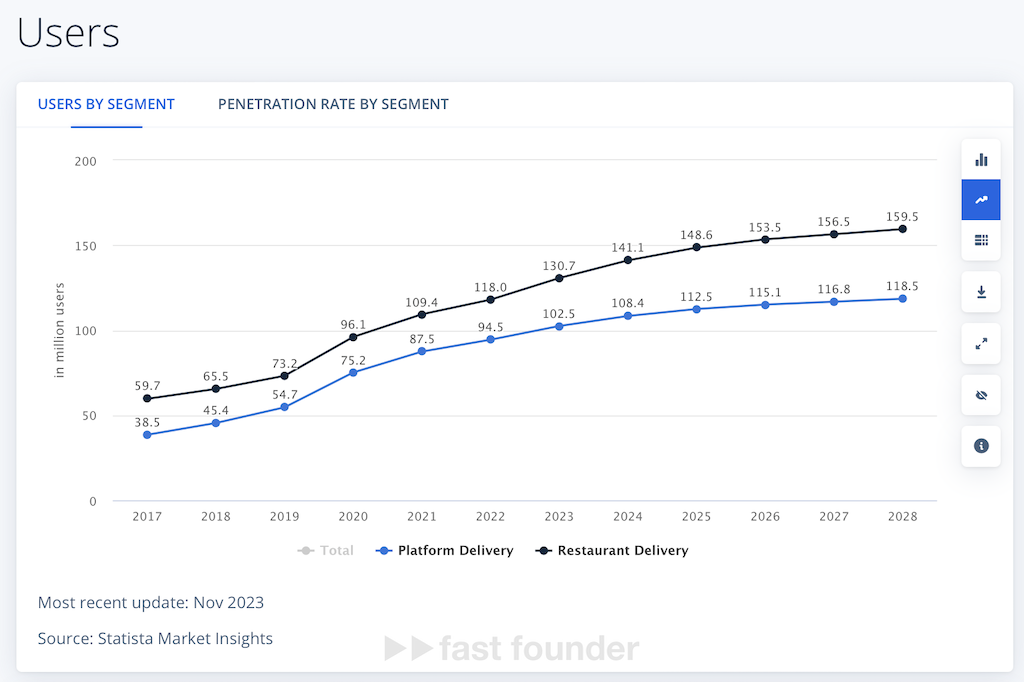

Even more interesting is that the number of Americans who have at least once ordered food online directly from a restaurant has always been higher since 2017 than those who have ordered through aggregators! In 2023, it was 130.7 million people against 102.5 million.

But why do restaurants end up with less money?

Because restaurants don’t know how to make customers place larger orders and keep them for a long time! Since 2017, the average revenue per customer at restaurants has remained at a constant level of $240-260. While for aggregators, from 2017 to 2023, it more than doubled—from the same $240 to $520.

And this is again a very understandable task. It’s necessary to give restaurants effective tools that allow them to increase order sizes at the moment and also encourage their return with repeat orders directly to the restaurants, not to the aggregators.

Moreover, all these tools are known! They are used by both the aggregators themselves and large restaurant chains like Domino’s and Pizza Hut, which have noticeable shares of the online ordering market. It remains only to provide small restaurants with a platform that would gather all these tools, and these tools would work on autopilot, requiring no special mental effort from restaurant owners 😉

Owner.com is dealing with solving these understandable tasks of attracting orders from aggregators to restaurants using known tools. At the same time, they use the model of fixed delivery prices as bait for attracting restaurant clients. By the way, this model, among other things, also encourages restaurants to put maximum effort into increasing order sizes because they will pocket the resulting difference entirely.

Where to Run

One option is to enter the online food ordering market with a model like Owner.com’s. It’s worth noting that there are other services with models similar to Owner.com’s.

Among them, we can mention the startup Slice, which specializes in helping independent pizzerias. Despite the “narrowness” of the market, this startup has raised $125 million in investments because pizza is the most popular food for online ordering.

However, the most interesting thing is to look for places to apply the same concept in other markets. The essence of the concept can be formulated as “subtract and share” 😉

We come to a big market where there are several big players and a bunch of small ones—and we give the small players well-known tools with which they will attract at least some customers away from the big ones.

Since the market is large, even “at least some” means big money! Some of it will be earned by the small players. And the other part will go to us as the creators of these tools.

An important detail is to come up with a business model that big players cannot use but will serve as a “hook” to attract the small ones. In the case of Owner.com, it’s fixed delivery prices, which aggregators cannot adopt as it would significantly reduce their revenue.

So, the billion-dollar question. What is this big market? What are these well-known tools? How to put them into the hands of small players? And what can be that “hook” that large players cannot use?

About the Company

Owner.com

Website: owner.com

Latest Round: $33M, 01/31/2024

Total Investments: $62.2M, Rounds: 6