- The service market is a mess 😉 There are no McDonald’s here, where you can quickly buy a product of standard quality. What you’ll encounter when ordering another service in a new or even in an old place is unknown.

- The only thing that is known is that it will turn out longer and more expensive than planned ☹️ At the same time, any service sector is a large market with a bunch of small players. Entering here to create yet another small player doesn’t make sense.

- But you can play big without even spending big money — but with the expectation of a big win! If you go the way outlined by these startups:

Project Essence

Pipedreams calls itself a “technological service provider.” They specialize in what is called HVAC (Heating, Ventilation, and Air Conditioning)—that is, the installation, maintenance, and repair of heating, ventilation, and air conditioning systems.

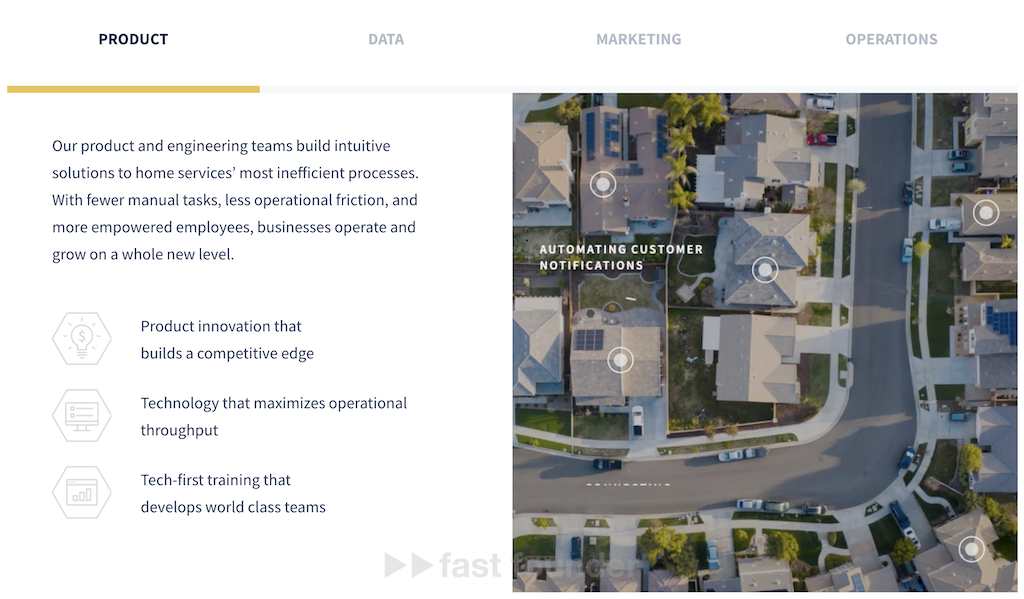

However, their business model consists of buying companies that are already engaged in this—and transferring their activities to their technological platform.

The platform’s goal is to optimize the business processes that are currently organized “on the knee” in such companies using Excel and phone calls.

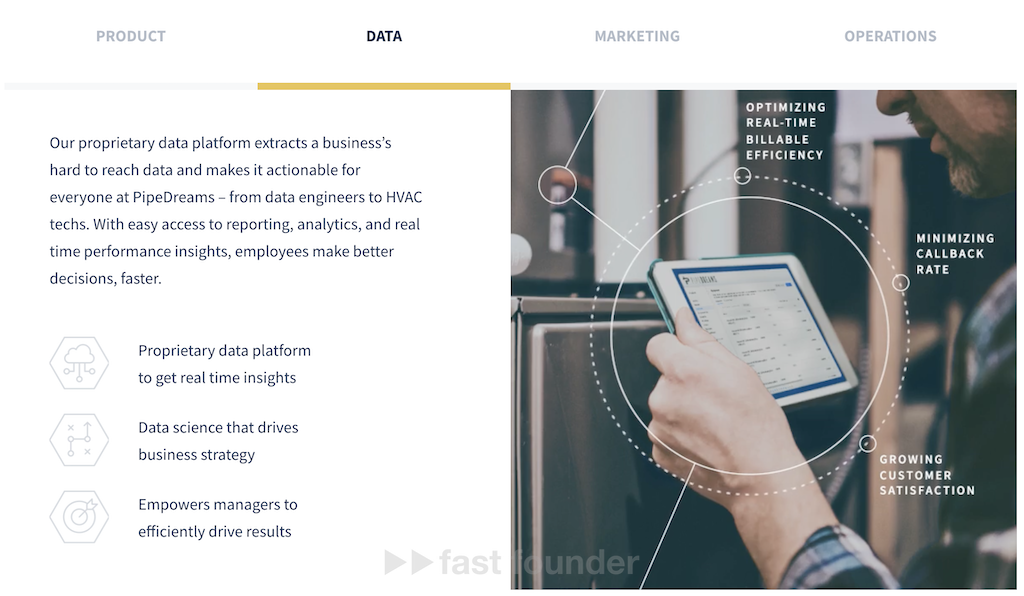

The platform’s operation is based on collecting and analyzing data—what and when usually breaks down, and what problems usually hide behind which external symptoms. This data not only helps to detect and deal with problems faster but also prevents them—by timely performing preventive work.

The marketing of all acquired companies also starts working on a unified advertising technology—which ensures maximum coverage and high conversion from coverage to new customers.

The HR of all acquired companies is also centralized—which allows using unified effective means of searching, selecting, hiring new, and retaining old employees.

The acquired companies must meet the following criteria:

They must operate in a limited local area where it is easier to establish and maintain connections with potential and existing customers. The company must employ at least 10 repairmen full-time. The company’s revenue must be at least $2.5 million per year.

Pipedreams promises the owners of the acquired companies that they will not kill the brand of the acquired companies, merge them into one large company, or fire unnecessary old qualified employees.

If the owner also served as its managing director, then Pipedreams may allow him to retire peacefully or engage in another business—finding a replacement director for him, the transfer of duties to which will take place in a mode acceptable to the old owner.

Currently, Pipedreams has raised $25.5 million in investments to develop its technological platform, bringing the total investment in the project to $35.7 million.

However, the startup’s founder says that they are unlikely to raise further investments in exchange for a stake—since they use borrowed funds to buy companies, not investments. They already have access to a credit line for these purposes in the amount of $15 million, and as their activity increases, they will negotiate an extension of this line or turn to other sources of debt financing.

What’s interesting

The home appliance repair market is very large.

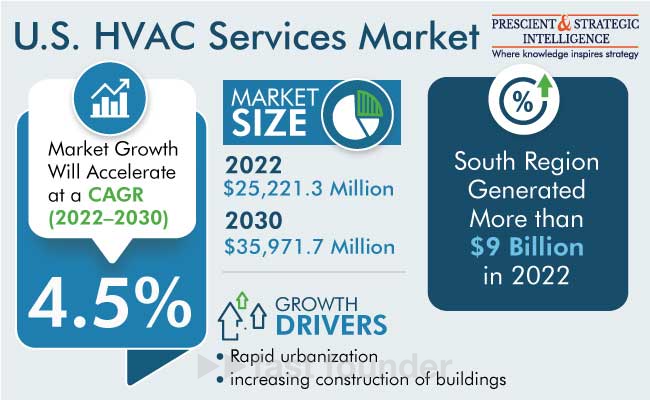

In the USA, the market size for services related solely to the installation, repair, and maintenance of heating, ventilation, and air conditioning (HVAC) systems amounted to $25 billion in 2022, and by 2030, it will grow to almost $36 billion.

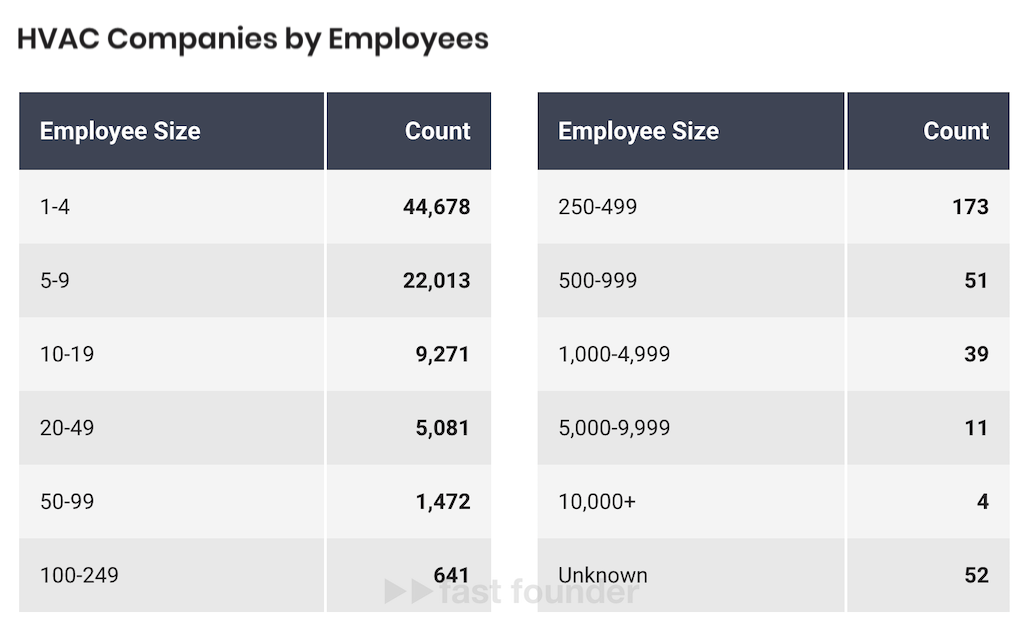

Moreover, there are almost 150,000 companies in the American market dealing with heating, ventilation, and air conditioning! So, there are plenty of potential acquisition targets 😉

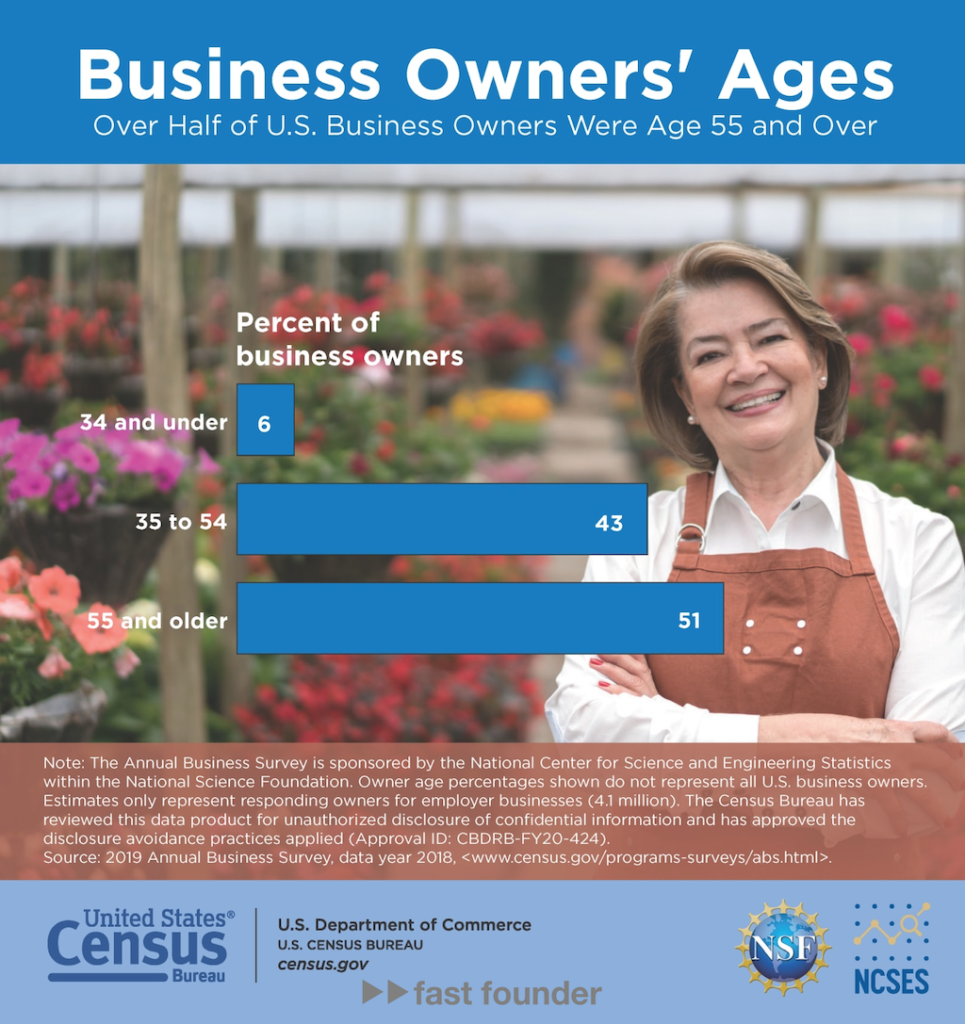

The catch is that over half of the owners of American companies are already over 55 years old—and they are already thinking about retirement. For this, they first need to sell their companies—so they can live on that money. And besides, they don’t want to betray the people they’ve been working with for years. Moreover, they don’t want to kill the business they’ve built so painstakingly—which is why Pipedreams promises not only not to kill the companies they acquire but also not to rename them.

Thus, Pipedreams has a wide choice of companies to buy, the owners of which may want to sell not because they are bad and unprofitable—but because it’s time for their owners to exit the businesses they’ve created.

Moreover, the vast majority of such companies are small. This means that you can buy them for very reasonable money—and you don’t even need to break anything inside the companies much, as in small companies, nothing much is built 😉 This greatly facilitates the integration of Pipedreams’ platform and new business processes into the acquired companies.

Using a very similar model but in a different field is the startup Platform Accounting Group, which I wrote about in February of this year. It offers local accounting companies to switch to its centralized platform, which is very similar in essence to the Pipedreams platform—allowing these companies to greatly optimize their activities.

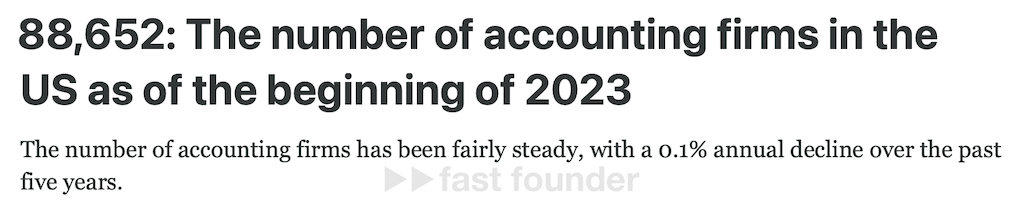

The strategic goal is the same as Pipedreams—further acquisition of these companies while leaving the old brand and old employees. The potential market size for Platform Accounting Group is also similar to Pipedreams—since there are about 90,000 accounting companies in the USA.

Moreover, most of them are small and local—there are 90 times more such companies than large ones.

An important point is that companies operating in the repair market have a huge problem with hiring new employees to replace old ones or to expand their business. This problem is caused by the fact that young people today are not very interested in becoming repairmen, and old qualified personnel are already leaving or are about to retire.

Therefore, Pipedreams is forced to become an educational company—in the sense that they need to be able to quickly train and retrain a large number of new employees. To do this, last fall, they entered into a strategic partnership with Interplay, a company that has developed a platform for rapid training in trades, including in the field of heating, ventilation, and air conditioning.

Another interesting trend is that repair companies are starting to become “data-driven” companies—that is, companies whose work is based on data.

The catch is that repair is the consequence of a problem that was not prevented in time 😉 Moreover, repair is long and expensive. Prevention is cheaper and faster without long equipment downtimes.

But to confidently know when and what needs to be prevented, you need to collect and analyze data on failures and reasons for failures of different types of equipment. Thus, repair companies are beginning to turn into data analysis companies as well 😉

And some startups even build their business models on this. For example, Scription, which I wrote about last fall, began offering repair services on subscription. What it actually means is that they take a subscription not for repairs—but for timely equipment maintenance for customers. For this, they use their own data analysis platform—probably something similar to what Pipedreams uses.

Where to Run

The service market is a mess 😉 There are no McDonald’s here, where you can quickly buy a product of standard quality. What you’ll encounter when ordering another service in a new or even the same place is known only to one god. The only thing that is clear in advance is that it will turn out longer and more expensive than planned ☹️

Thus, optimization and standardization of the service market are exactly what is very much needed! However, it’s too expensive and seemingly unnecessary for every small company to develop technological platforms and quality standards for themselves, thinking “it will do as it is” 😉

Therefore, without centralization, it won’t work here. It’s necessary to centralize both technologies and operational business processes, hiring, training employees, and marketing. And this means that just implementing a platform won’t be enough—we need to centralize management and standardize business processes. But at the same time, each business should remain local—able to quickly and efficiently find, serve, and retain local customers while being at arm’s length from them.

And whether each of these businesses has the same sign hanging on it is not so important. The Pipedreams and Platform Accounting Group models can be called “franchise without a franchise” at all. Because a classic franchise is invariably a single brand and the independence of each franchisee in the unity of business processes. Although it is quite possible to make unity of business processes the only mandatory requirement 😉

The direction of possible movement is the creation of such “franchises without franchises” in the selected service sector.

A mandatory condition is that this sector should be large enough in volume, and there should be many small local offline players in it that can be bought out immediately or over time.

So, what service sector is ripe for implementing such a model?

About the Company

Pipedreams

Website: pipedreams.com

Latest Round: $25.5M, 26.03.2024

Total Investments: $35.7M, Rounds: 4