If you missed the elephant distribution in the marketplace for selling physical goods—don’t be upset. Because right now, there’s an opportunity to grow your own elephant in the large and actively growing market of service marketplaces 😉 But such a marketplace will take off only if you add this important feature to it—without which nobody will need it!

THE ESSENCE OF THE PROJECT

Lottie is a marketplace where you can find places for elderly living.

Usually, one term “nursing home” is used. However, there are two types of such places – hospital-type institutions with special services for people with age-related problems (care homes) and something like villages for retirees (retirement homes), where healthy elderly people live independently in separate houses. On the Lottie marketplace, you can search for both types of places.

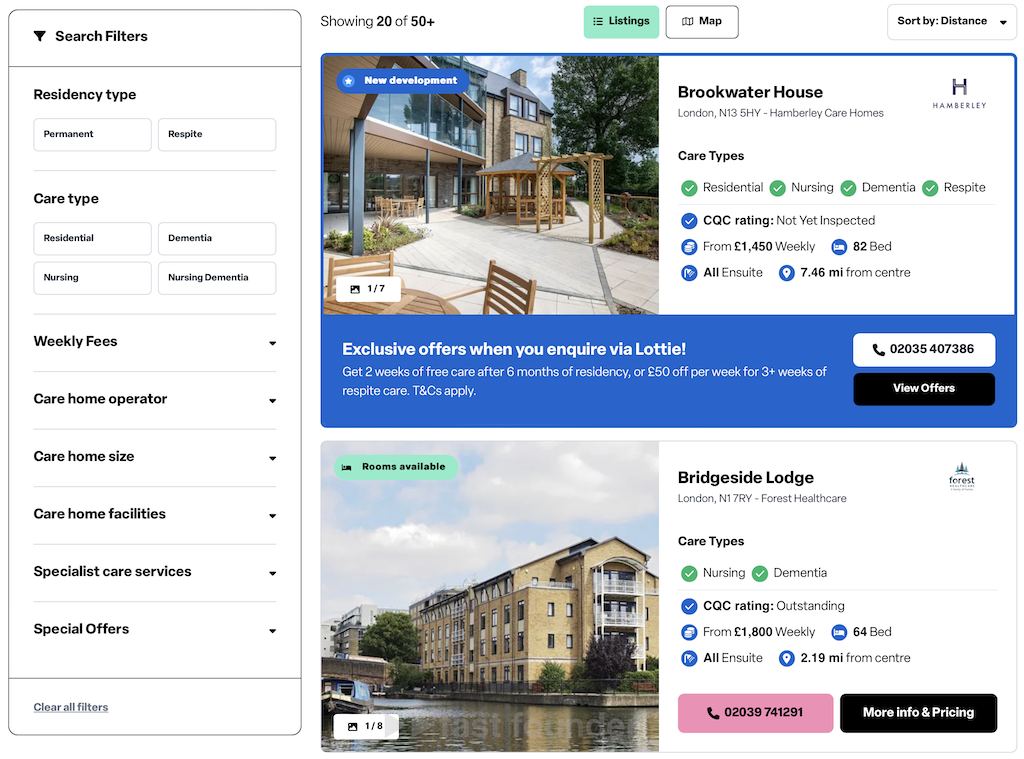

Lottie looks like a typical marketplace, where you can find a suitable place according to various criteria, compare living prices, and arrange a visit to check the place in person.

Lottie is developing quite energetically. In July 2021, they attracted the first 500 thousand pounds of investments, in January 2022 – 2.5 million pounds, in July of the same year – another 6.1 million pounds, and now – a new 16.4 million pounds.

And all this is not in vain. Lottie claims that the number of visitors to their marketplace is now 500,000 people a month – which is a fourfold increase compared to 12 months ago.

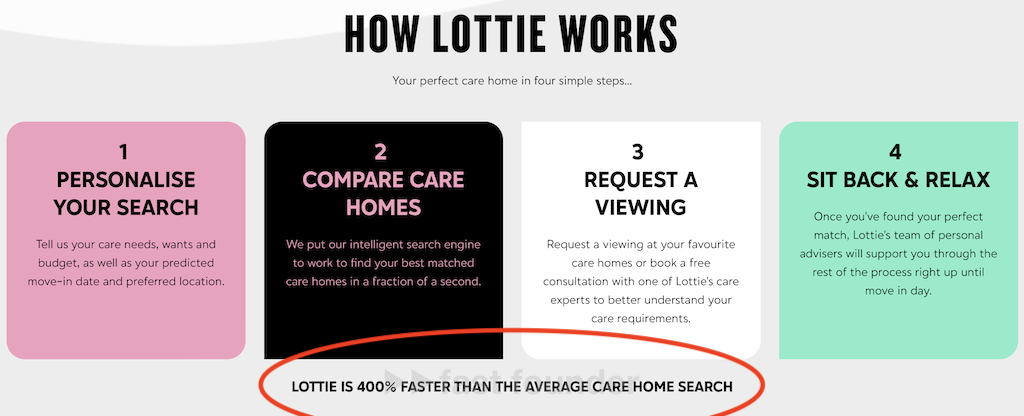

Lottie’s main advantage is that on their marketplace, you can find a suitable place for elderly living 5 times faster than in a “regular directory”. But how?

What’s interesting?

A year ago, Lottie acquired a company named Found, which created a specialized CRM for elderly homes. By that time, according to Found, “hundreds” of hospital-type institutions and retirement villages in the UK were already using this CRM.

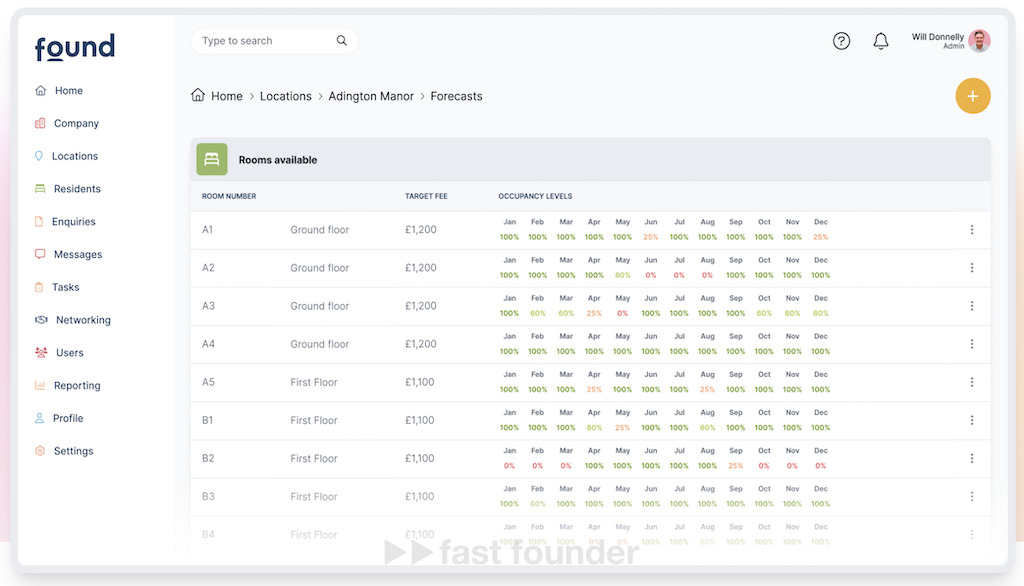

The first critical part of Found’s CRM is the accounting of current and forecasted occupancy in the elderly homes.

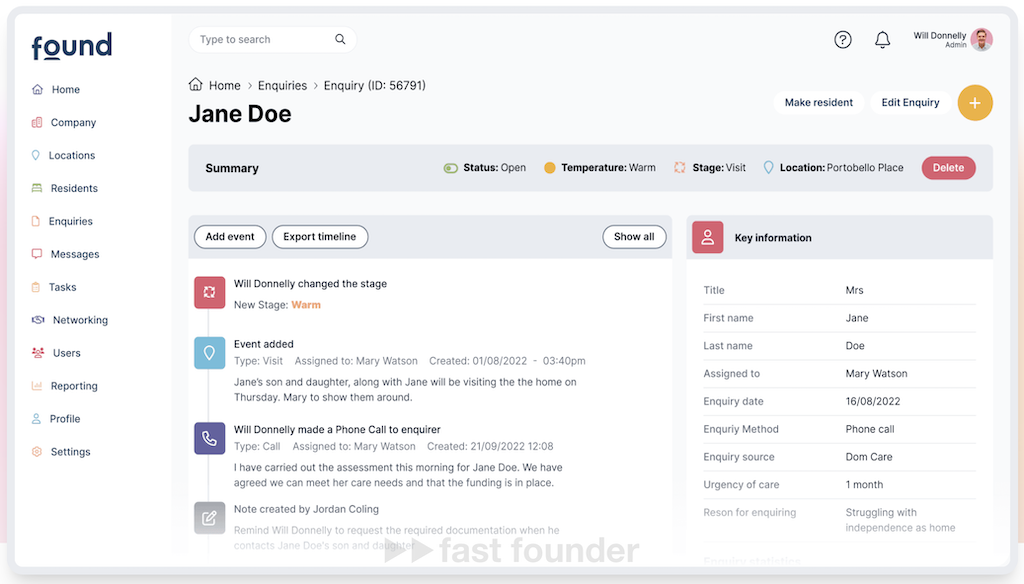

The second is managing incoming inquiries from potential clients about the details of accommodation, terms, and timelines for possible move-ins.

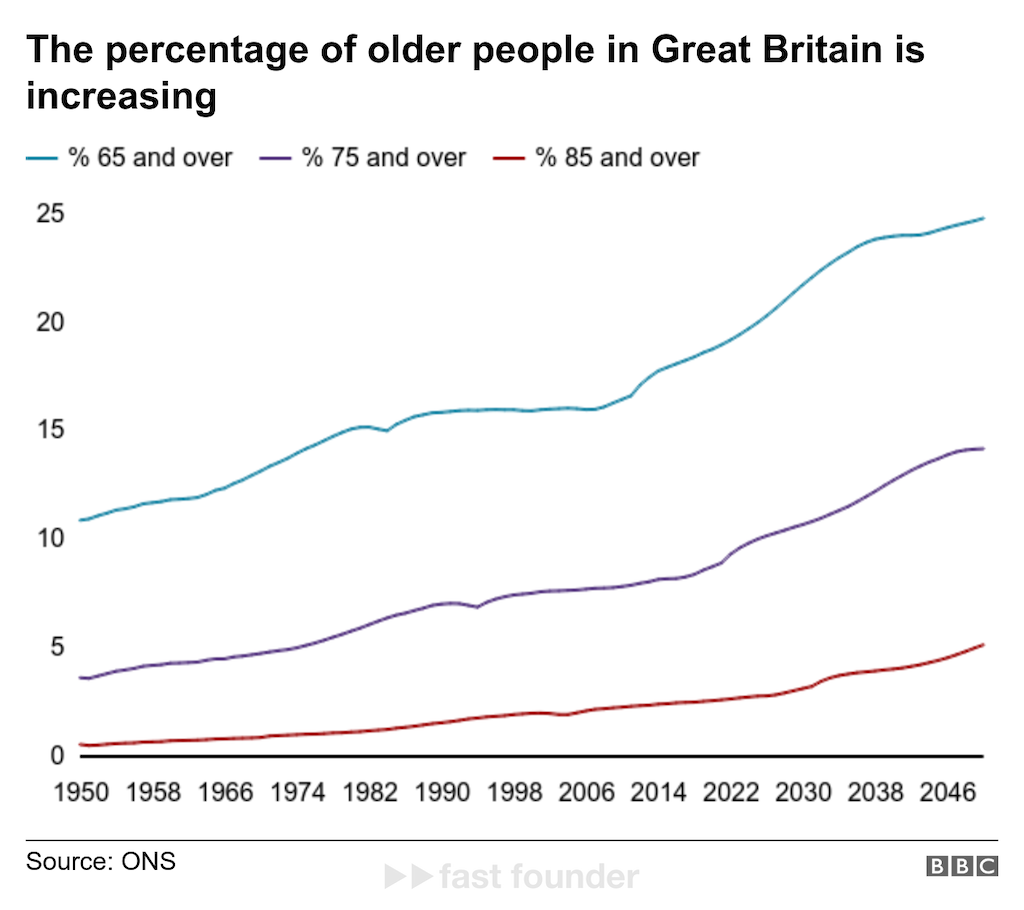

The problem is that the number of elderly people in the UK is growing. They constitute an increasing percentage of the total population because the life expectancy is increasing. In 1950, the percentage of Britons over 65 was slightly over 10%, and by 2046, it will rise to 25%.

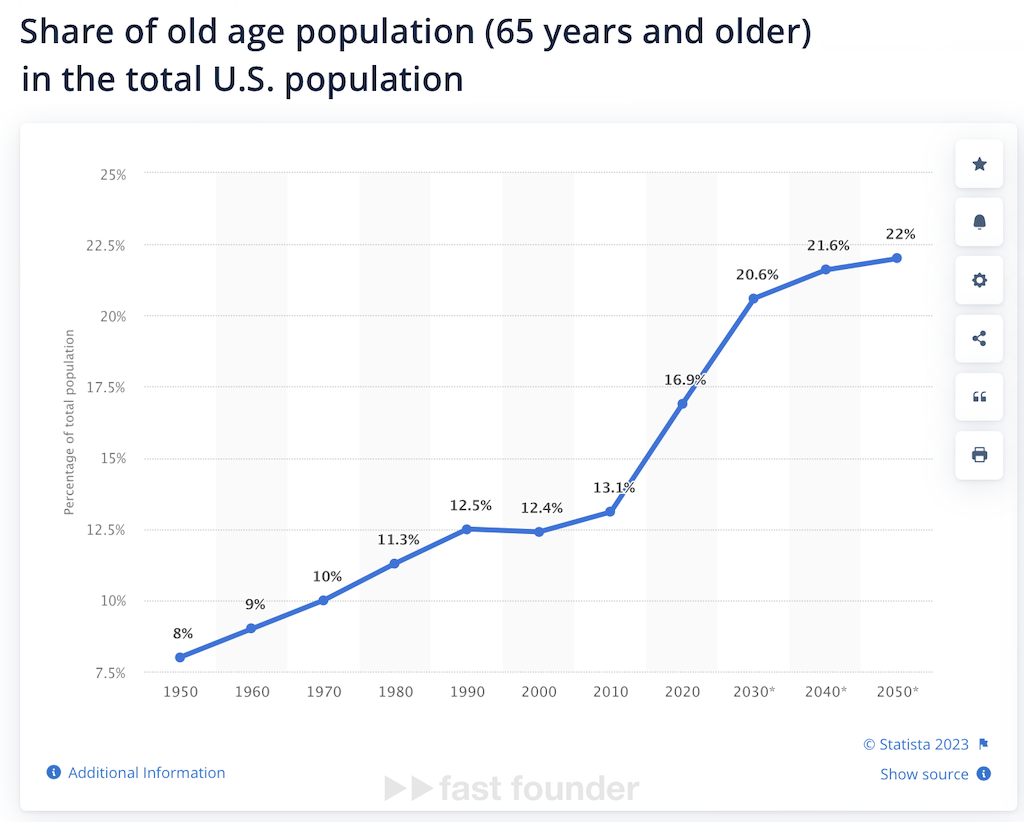

This is a global issue as life expectancy is increasing not in a particular country but worldwide. For reference, the image above shows the dynamics of the percentage change of the population over 65 in the USA.

The number of elderly people who may need a special place to live is growing, the number of inquiries on the marketplaces of elderly homes is increasing — but many homes are already full. A recent analysis of the situation in the UK shows that people are forced to contact an average of 6 places to find a free spot for living in an elderly home with suitable conditions.

The integration of the acquired CRM Found with the marketplace allowed Lottie visitors to find suitable places not only by “external parameters” such as price, appearance, and living conditions — but also by current and expected occupancy at the time of possible move-ins. As a result, visitors to the Lottie marketplace can find a place to move in literally with one search — instead of 6 searches and inquiries, as on other marketplaces.

The typical way such marketplaces make money is through lead generation, that is, some money for the inquiry sent by the client to the elderly home. By reducing the number of inquiries from 6 to 1, Lottie seems to lose money earned on the number of inquiries. But they got the opportunity to earn on something else.

Firstly, it’s a subscription fee for using the CRM, which they implement to all sellers (elderly homes) on their marketplace. The cost of a CRM subscription starts at 150 pounds per month.

Secondly, through CRM, Lottie began to receive information about how long a specific person, who moved in through the marketplace, lives in the elderly home. In connection with this, Lottie plans to change its business model. They will now take from the elderly homes not a one-time payment for the inquiry they received from the client — but a percentage of the cost of living during the entire time of his residence.

And this money can add up to a much higher amount than a one-time payment for the lead. Meanwhile, the interests of the marketplace and the elderly home become aligned — both become interested in ensuring that a person finds the most comfortable place to live, from where he would not want to move out quickly.

Where to Run

Creating marketplaces for eldercare homes is also a promising topic that has become particularly relevant due to the increase in life expectancy and the growing number of elderly people.

But one can look at the situation even broader! Ordering and booking services are actively transitioning online. The market size of online service orders in 2021 was already 62 billion euros, and it continues to grow at 24% per year.

As a result, marketplaces are emerging where one can find and order services all in one place. European startup Scnd, which created a service marketplace – raising 4 million euros in the very first investment round. It even began to claim the title of being the “Shopify for services,” since the original Shopify is more tailored for selling physical goods.

The catch is that a service marketplace should be a real marketplace – not a directory of service providers that one has to call separately to inquire about the availability of the service at the desired time.

For marketplaces selling physical goods, this problem is more or less solved, as one can see the real availability of the product from the seller. Although about 10-15 years ago in the market of selling physical goods, there were “price catalogs,” not “marketplaces” – and one had to call the sellers separately to clarify the price and availability of the product in stock.

Now the same path should be traversed by service marketplaces. But for this, service providers need to have order management systems (CRM) implemented, where current orders are accounted for, and occupancy forecasts are calculated. And these CRMs need to be integrated with the marketplaces – so that customers can find not only a provider of the desired service but a provider capable of providing the desired service at the desired time.

A separate segment of such service marketplaces – are those where one needs to find availability and prices for services in real-time. For instance, online stores might use such marketplaces to choose the most optimal delivery service at the moment when sending each order to a customer. A real-time service marketplace for delivery services was created by the startup Nash. It raised 27.9 million dollars in investments.

Thus, a more general direction of movement – is the creation of service marketplaces. And only those where one can find not just providers of the needed services – but providers capable of providing the needed service at the needed time. Because service marketplaces without such a feature will soon be completely uncompetitive!

For this, either the integration of the marketplace with CRMs, already popular in the chosen service segment, is required. Or the creation and implementation of its CRM in this segment.

Then not only the user of the marketplace will be comfortable, but the marketplace itself can earn more money, getting percentages from the cost of provided services (or even from all orders of the same client), aligning its interests with the interests of service providers.

The potential market is very large, it’s growing at a good pace now, and what to do is also already clear. All that remains is to find a suitable service segment – and do it 😉

About the Company

Lottie Website: lottie.org

Latest Round: £16.4M, 09.10.2023

Total Investments: £25.5M, rounds: 2