- The easiest way to make money is to sell money 😉 That is, to provide various financial services. You just need to understand who exactly to sell to and what exactly to sell. And, as usual, you need to target large markets and in-demand services.

- One of these markets is the market of creatives who shoot videos, write blogs, and record podcasts. In the United States alone, 14% of the population aged 16 to 54 earns money this way! Moreover, 44% of them are employed full-time.

- And what financial services can be sold to them – there are even options to choose from 😉 And each of the options finds clients and attracts investments. Considering that this market is growing, you can still enter it yourself by choosing one of these models:

Project Essence

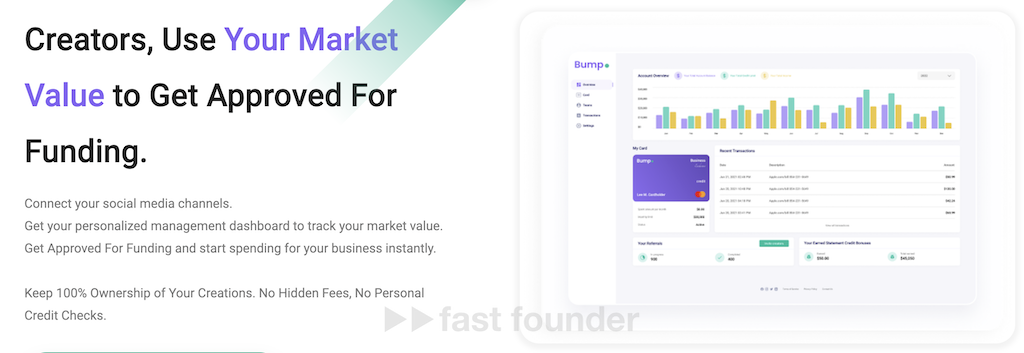

Bump offers financing to individuals engaged in creative business. The catch is that the amount of such financing is determined by the “market value” of the individual.

From Bump’s perspective, “creative business” is when a person runs a channel on YouTube or TikTok, records podcasts, writes texts for blogs or even books, works as an actor or model, or engages in any other form of “creative” freelance work.

The “market value” is essentially the maximum amount of credit that Bump is willing to provide to a specific creative.

The startup calculates the credit limit using its own algorithm, which in no way takes into account traditional banking ratings. Instead, it considers income from clients and advertisers deposited into bank accounts, the number and activity of subscribers on social media, as well as the current value of alternative assets such as cryptocurrency and NFTs (Non-Fungible Tokens).

For the market value (credit limit) of a creative to be calculated, they must connect all their bank accounts, crypto wallets, and social media accounts to the Bump platform. After that, the size of the limits will be regularly recalculated based on current indicators.

Creatives can receive financing through the Bump credit card issued to them. Card servicing is free of charge. There are no restrictions on payment categories with the card. Any negative balance on the card must be repaid within 30 days – then no credit interest will be charged on that amount.

Bump’s clients can be both individual entrepreneurs and companies. If a company becomes a startup client, other employees can also receive a card linked to one corporate account.

Currently, the startup serves more than 5,000 clients, with a total of about $10 million in live funds in their accounts. At the same time, Bump states that it has “discovered” $111 million in their potential income – presumably, this refers to the total market value (total credit limit size) of these clients.

Bump has raised $3 million in investments, increasing the total investment in the project to $4.5 million.

What’s Interesting

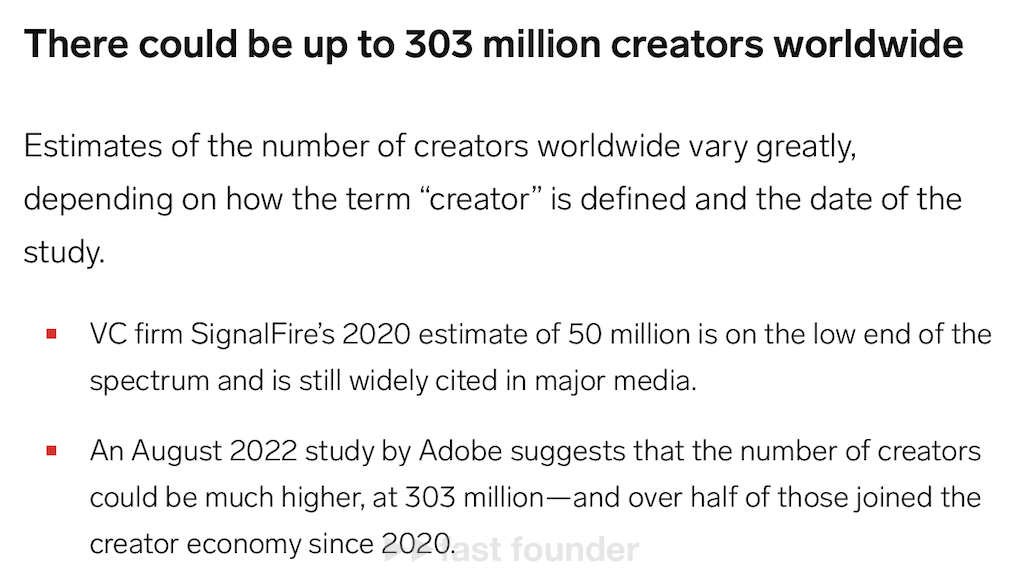

Bump’s goal is to create a “neobank” (digital bank) for “1.2 billion creatives.” On one hand, this is a huge potential market. On the other hand, such a large number raises doubts – who exactly did they count 😉

For example, Adobe in 2022 counted “only” 303 million creatives. It’s less than 1.2 billion, but still a significant number. So, I decided to dig deeper.

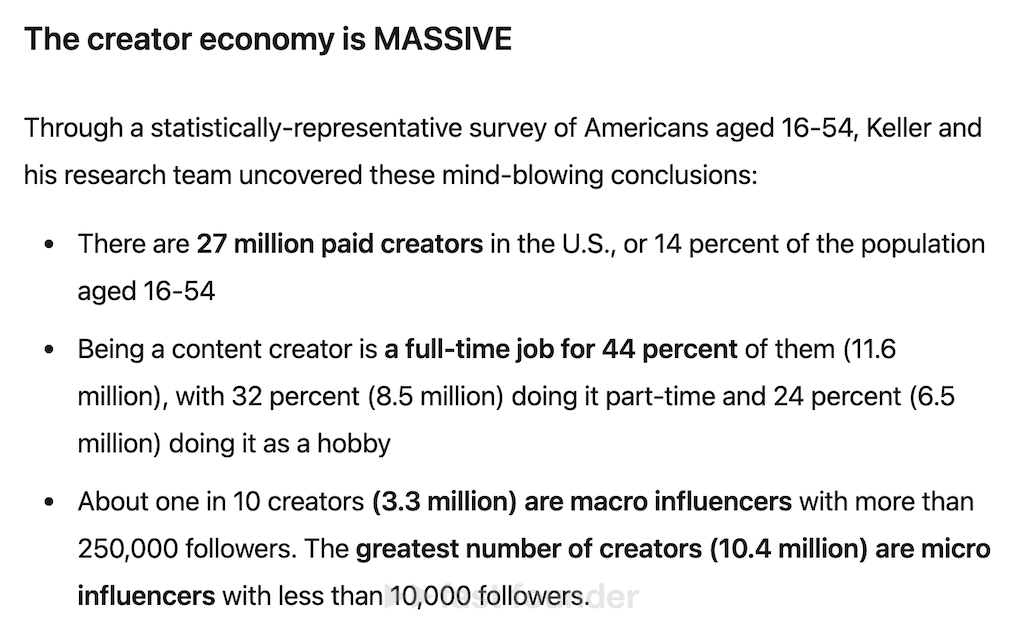

According to an article published in November 2023, there are 27 million creatives in the US who earn money through their creative work – that’s 14% of the entire US population aged 16 to 54.

Of these, 44% are engaged in creative activities full-time, 32% part-time, and the remaining 24% consider it a hobby but still earn from it.

Moreover, 10% of creatives (3.3 million people) are “macro-influencers” with over 250,000 followers. And the largest share of creatives, 10.4 million people, are “micro-influencers” with fewer than 10,000 followers.

Thus, even with conservative estimates for the US alone, the number of creatives earning money from their work globally is estimated to be around 100 million people. And this is a market of considerable size that one can truly aspire to tap into 😉

Since the market does exist and is growing, other startups are also entering with similar offerings.

Among them, for example, is Karat, which I wrote about in the summer of 2023. They went through Y Combinator in 2020 and have been growing steadily since. The total investment in this startup has already reached $115.6 million.

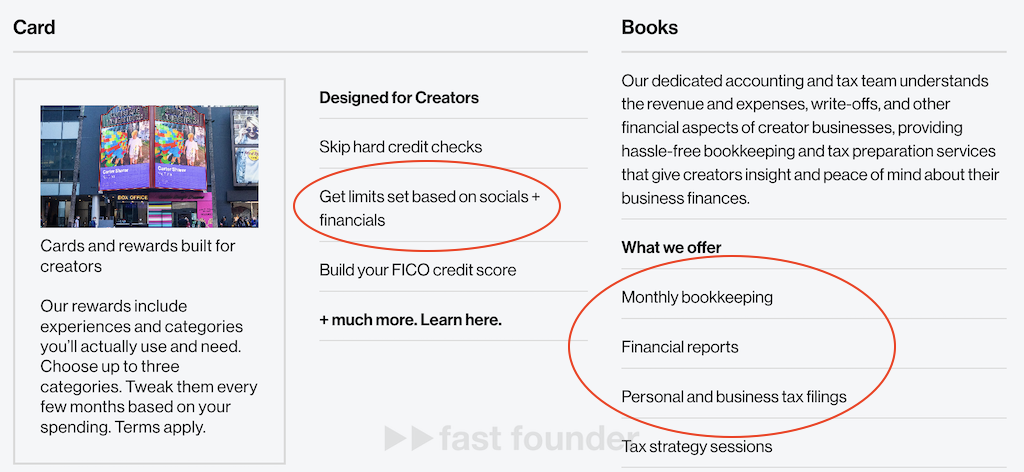

They also offer creatives a credit card, the limits of which are calculated based on the number and activity of their subscribers. In addition, they offer their clients accounting and tax filing services – tasks that creatives usually dislike and are not skilled at 😉

The creative economy is clearly on the rise. After all, each of us reads, listens, and watches something on social media every day at least. And many also write, record, and shoot – and some even earn money from it.

This means that such people may really need their own banks tailored to the specifics of their work and income.

Well, why not? After all, there were special banks for startups and companies at one time. True, the most famous of them, Silicon Valley Bank, faced problems managing financial assets last year and was acquired by First Citizens Bank. But there’s also Mercury, which initially focused on banking for startups – and its last investment round in 2021 valued it at $1.6 billion.

Therefore, the idea of creating banks for creatives is also quite reasonable. Moreover, creatives have their own specifics.

The first point is that the creditworthiness of creatives is largely measured by the number and activity of their subscribers. If they have active subscribers – it means the creative can definitely earn from them somehow. But traditional banks cannot take such assets into account.

The second point is that creatives, by nature, are not good at or do not like to deal with financial intricacies. So, they can be offered to perform all the boring work related to this – as Karat does with accounting and tax filing.

The third point is that collaborations are highly developed among creatives, where they join forces with other creatives for one-off or longer-term joint projects – such as making a film or commercial, performing at a concert together, hosting a podcast together, and so on.

Collaborations are essential because most creatives are individuals who can do only one thing. Therefore, to create more complex projects, they have to team up with other creatives who have different competencies required for it. And then the problem of settlements between them for jointly performed work or advertising placed within the joint project arises.

This problem is solved by the startup Mozaic, which I wrote about in the fall of 2023. They have created a platform that automatically divides and transfers money to all project participants in pre-set proportions. This startup has raised $31.3 million in investments.

The fourth point is that creative work, like any other freelance work, is a very uneven source of income, following the principle of “busy today, empty tomorrow.”

This means that creatives need loans not only for developing their business like buying equipment or hiring staff – which does not happen very often. They need a financial partner who can lend a hand at any moment when the pocket is “empty.” Then the freelancer will have the same feeling of stability for which many people still sit in offices and work for a salary 😉

SteadyPay wants to become such partners for creatives, freelancers, and temporary employees, about which I wrote in the spring of 2023. They have created a platform where clients can instantly receive a small loan, which would complement their earnings for this week or month to the average level of earnings for the last few months. This startup has raised $13.4 million in investments.

All the startups mentioned today offer interest-free loans. However, some of them have a subscription fee for service, but, as today’s Bump claims, this is purely a “nominal” annual fee.

So how do they make money?

They earn when clients delay loan payments beyond the interest-free period – because then they start accruing penalties (interest) for the delay.

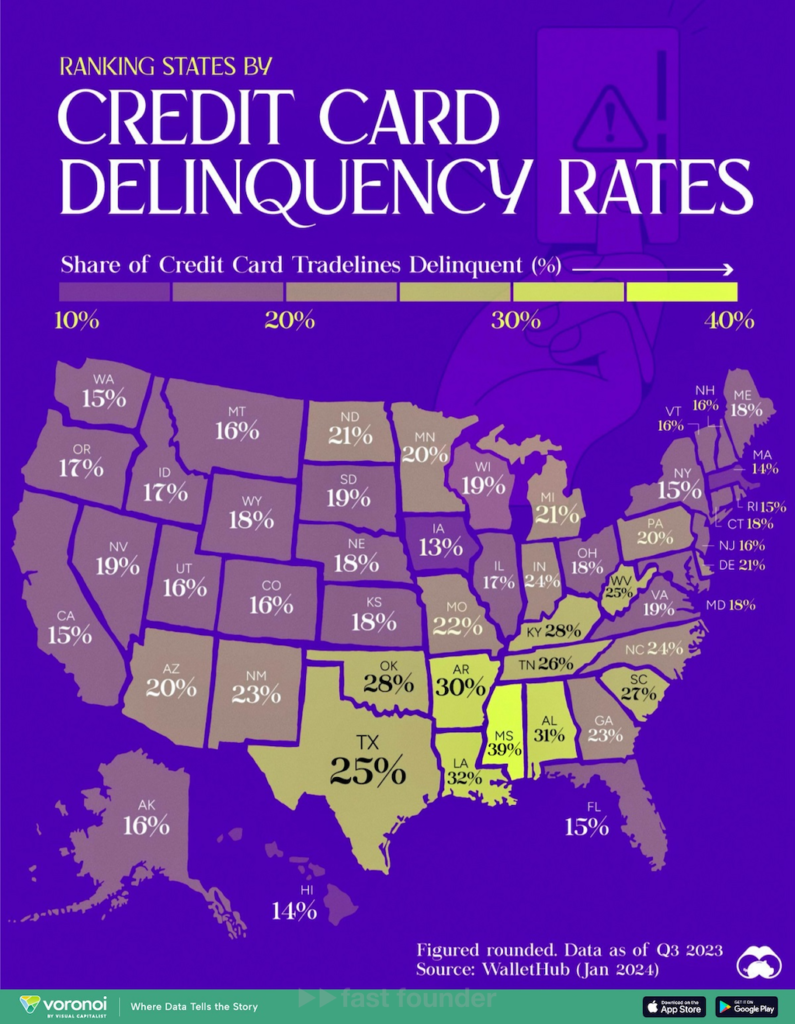

The trick is that the number of delays on credit cards is far from an isolated case. The picture shows the percentage of credit card owners with delays of over 90 days in different states of the USA. It seems at first glance that on average 15–25% of credit card owners are guilty of this.

That’s how startups like these make money. Moreover, enough to cover the cost of servicing all clients and even make a profit 😉

Where to Run

The general direction of possible movement is towards the market for creating financial services for creatives. Moreover, for the small and medium-sized ones. Because there are many more of them, and they often experience money problems much more frequently. And these problems are also small and medium-sized, so the risks will be evenly distributed among all of them.

Moreover, financial services already exist for celebrity influencers, and they are already trying to court this small number of celebrities. Take, for example, Spotter (my review) and Jellysmack, which provide loans to influencers – and in exchange, they get the opportunity to earn from advertising on their videos already posted on YouTube. These startups have already raised $700-900 million in investments, without which such large loans cannot be issued.

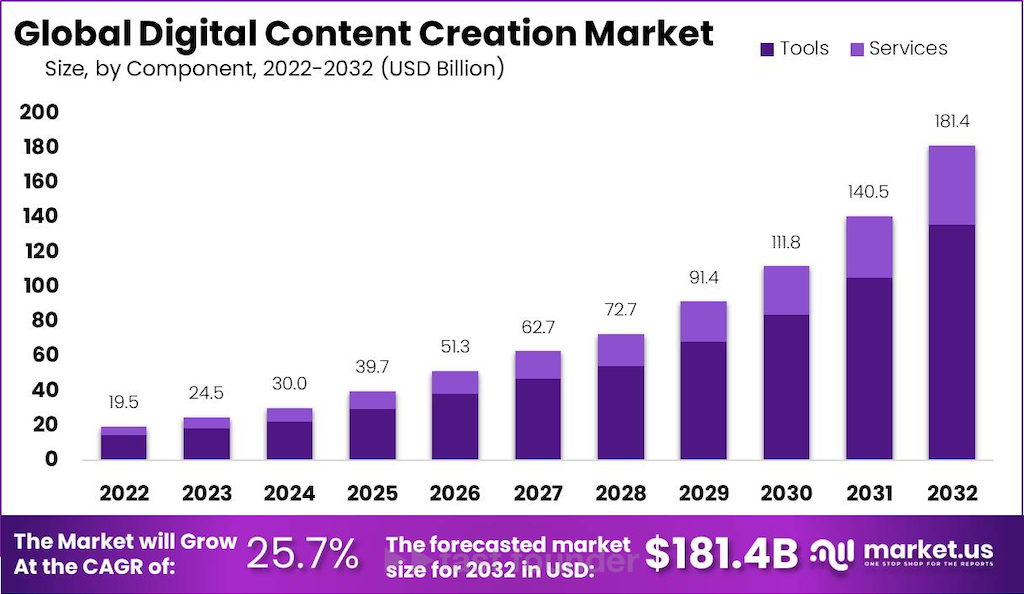

The market for small and medium-sized influencers is already huge, and it continues to grow. And the total size of the digital content creation market is growing by 25% annually, and by 2032 it will surpass the $180 billion mark.

A portion of this huge pie can be carved out by starting to offer financial services to the vast army of small and medium-sized creatives. The main thing is for the offer to be attractive, and the business model to be convergent.

Well, the options for such offers and business models can be borrowed from the startups mentioned today 😉

About the Company

Bump

Website: usebump.com

Latest round: $3M, April 23, 2024

Total investments: $4.5M, rounds: 4