- If you want the key employees of your startup to work with full dedication, you need to motivate them correctly. However, handing out company shares right off the bat is also not the right approach. This needs to be done carefully, but effectively 😉

- Moreover, the commonly known “options” turn out to be not the best option. There are other incentive models that are more beneficial for both employees and the company itself. Here are examples of platforms supporting such models

- Another point is that the shortage of qualified talent in the labor market will only intensify. Therefore, the demand for such platforms will only grow. So, not only can they be used oneself, but they can also be developed for others 😉

Project essence

“We are what we have,” claims Upstock.

With this, it leads us to a simple idea—if we want our employees to give their all, they need to feel like they are a part of our company. And for them to feel like a part of the company—they need to own a part of the company 😉

In other words, key employees need to be given a stake in the company. Naturally, after they prove themselves worthy of it.

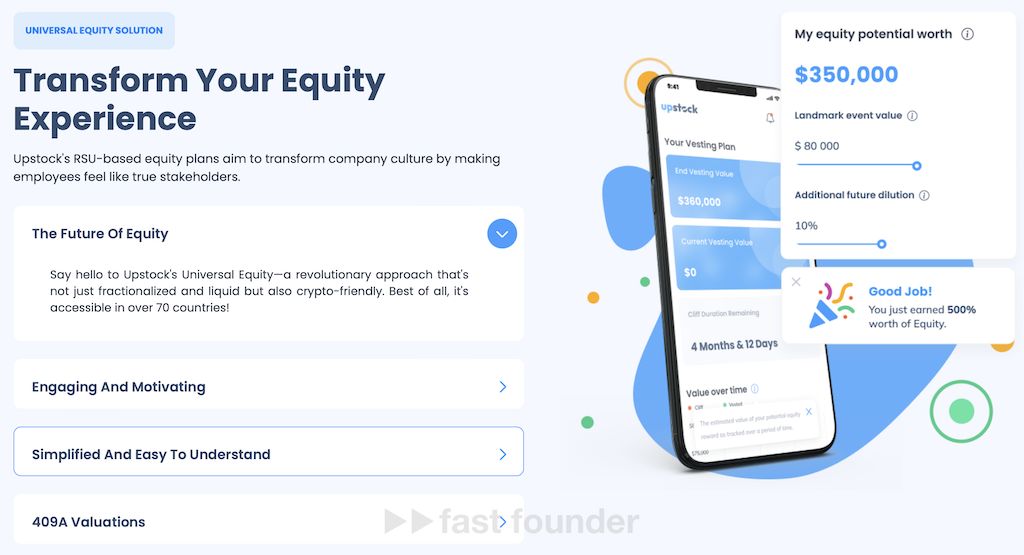

Upstock has created a platform that allows company stakeholders to manage the process of distributing shares to their employees. The key features of the platform are simplicity, transparency, real-time updates, and the ability to use it to motivate employees, who can see how their work impacts the company’s success and how the company’s success affects their well-being.

Upstock’s target audience is startup founders because they don’t have enough money to motivate employees with high salaries right away. However, they need skilled and motivated employees—who they have to incentivize with a share in the company’s future success.

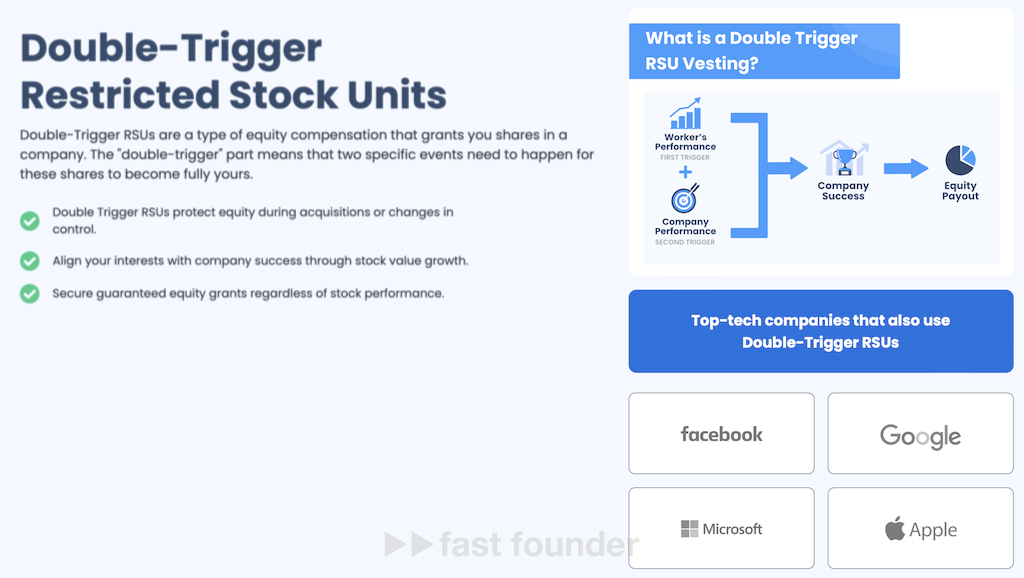

The basic model of allocating shares to employees is Restricted Stock Units (RSUs). This is a standard model successfully used by many successful technology companies—from Google to SpaceX.

RSUs grant the right to receive a certain number of company shares over a specified period of time upon meeting certain conditions.

The simplest condition is if the employee continues to work at the company, but these conditions can also depend on the employee’s performance. The promised number of shares may be allocated in parts—for example, 100 shares after a year, another 100 shares after another year, and so on, so the employee has to demonstrate the required results during this time 😉

Upstock also supports a variant of RSUs with a double dependency on conditions (Double-Trigger RSUs). This is when the allocation of shares depends on two conditions—a) the employee’s performance and b) the company’s overall performance.

If an employee resigns or is terminated, their rights to receive shares are nullified. Sometimes, in this case, there is even a provision for the mandatory sale of shares already received in exchange for RSUs.

From the employee’s point of view, RSUs are beneficial compared to options because shares in exchange for RSUs are granted for free. An option, on the other hand, is the right to purchase company shares at a fixed price agreed upon at the time of the agreement. Thus, the employee must pay for them, and if the stock price falls below the purchase price, they will incur a loss.

Upstock has expanded the RSU model—turning it into what they call “Universal Equity.” These universal shares have become compatible with cryptocurrency, and working with them has become possible in more than 70 countries worldwide. At the same time, these universal shares remain compliant with the legislation regulating RSUs in countries where this mechanism is provided.

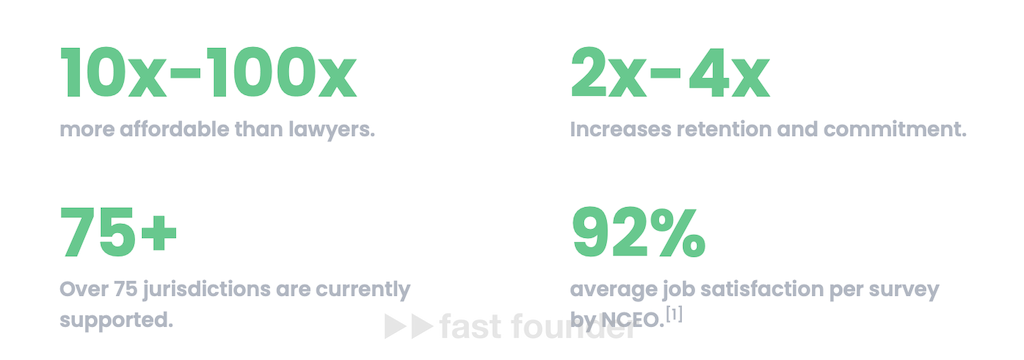

Upstock claims that using their platform to distribute shares to employees is 10–100 times cheaper than hiring lawyers to prepare all the necessary documents for this purpose.

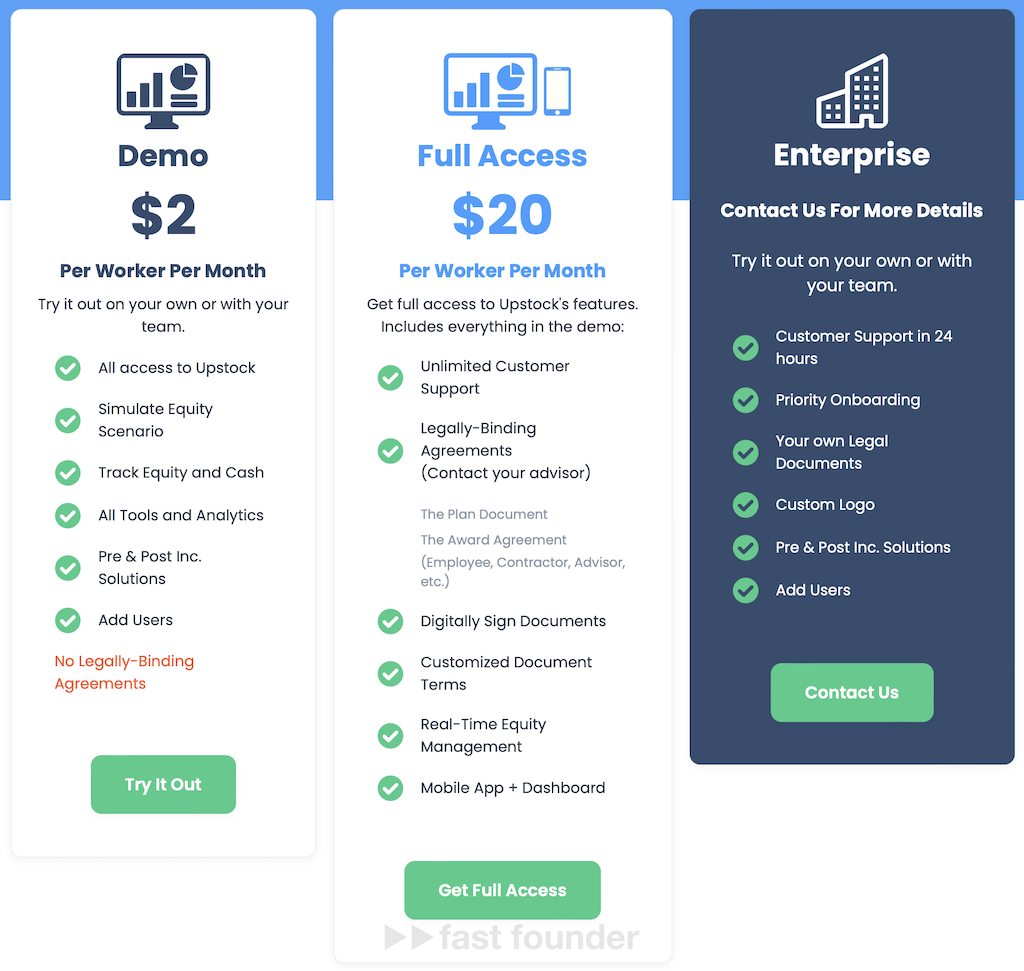

A subscription to the Upstock platform will cost a company $20 per month per employee. Surprisingly, they even have a paid demo version, which costs $2 per month per employee 😉

Companies whose employees work in 75 countries around the world use the Upstock platform, and they have previously attracted investments of undisclosed amounts. And now they have raised new investments of $13 million.

Here’s something interesting:

Over the past couple of years, the RSU (Restricted Stock Units) model has gained popularity in the USA. In 2022, 86% of public companies were using it, compared to just 3% in 2000. At the same time, the percentage of public companies using options dropped from 100% to 47%.

The reason for this is clear—a sharp decline in the stock prices of technology companies, which occurred around the same time on the American stock exchange. As a result, previously fixed option exercise prices became disadvantageous for employees, and those who managed to exercise them before that ended up at a loss.

Generally speaking, there’s a trend towards the growing popularity of platforms for motivating employees through various forms of company ownership or “co-ownership.”

The reason for this is also clear—a growing shortage of qualified employees in the labor market. Therefore, companies have to go to extreme measures to attract and retain such employees.

“Co-ownership” can be in quotes because there’s also a profit-sharing model among employees without receiving a real share in the company. In such a scheme, an employee receives a portion of the company’s profits based on a certain conditional share—but this happens as long as the employee works for the company.

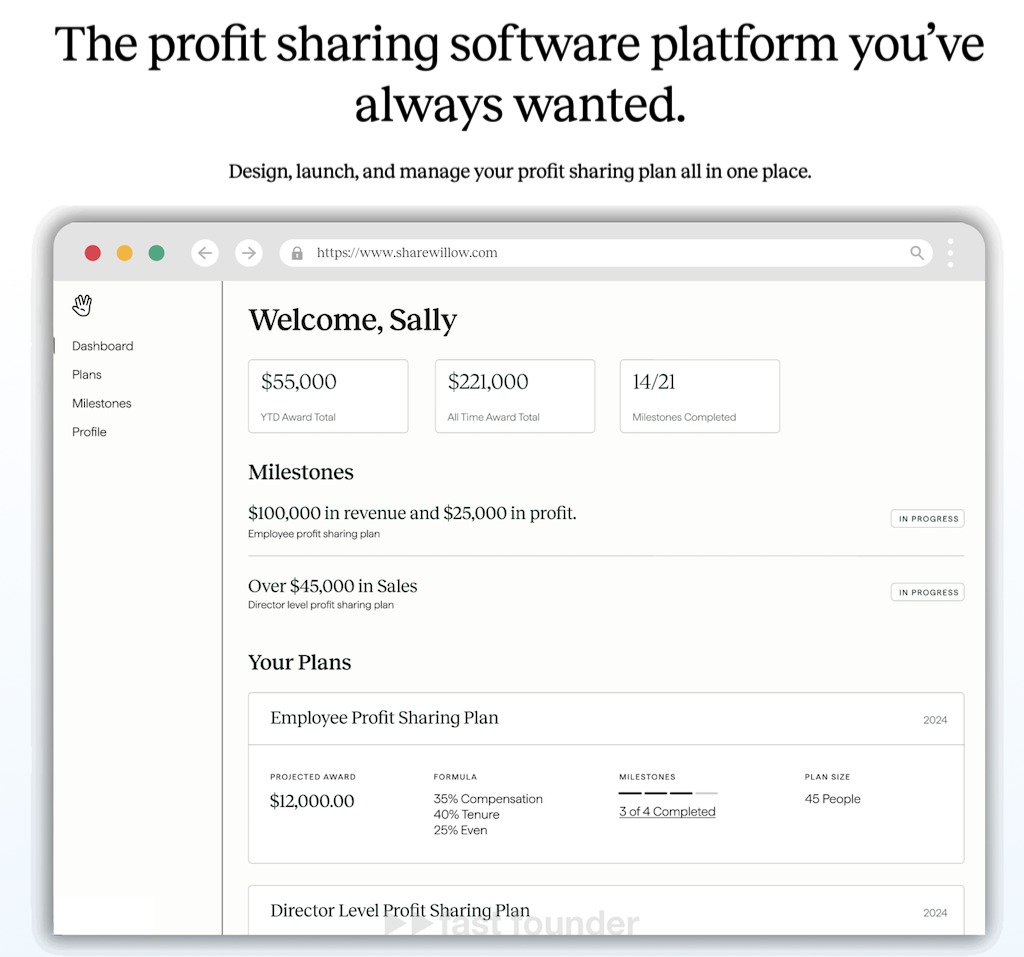

A platform like ShareWillow, founded in 2023 and receiving initial investments of $3.8 million, supports a model compatible with American legislation.

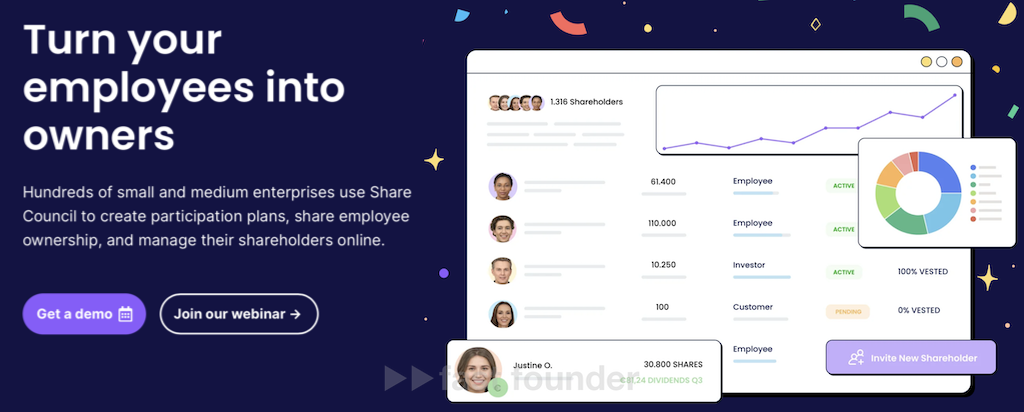

A similar model, but compatible with European legislation, is supported by Share Council, a platform I wrote about in winter 2022, which raised €1.5 million in investments.

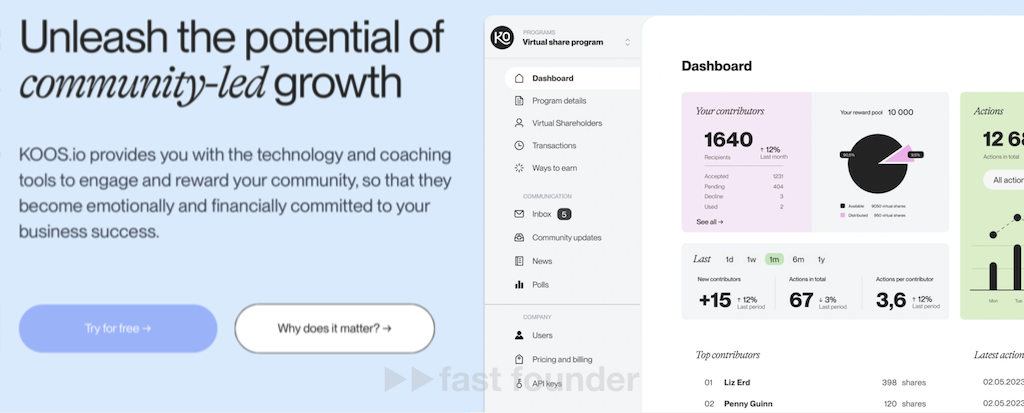

Previous platforms use profit-sharing models to reward company employees. However, the same model can be used to reward product company users if they do something that contributes to the company’s success—bringing in new users, recommending employees, introducing new clients, and so on.

KOOS, a startup started doing just that—creating a platform for profit-sharing among active members of the company’s product user community. They raised $4.6 million in investments.

Where to go

The first direction to move in is to stop being stingy 😉 And to think about how to set up an employee reward program in your startup and, perhaps, even users of your product depending on the company’s success and the contribution made by employees and users.

The second direction is to create a platform that allows other companies to do this.

You don’t need to come up with anything new, just take models that are already established in advanced jurisdictions—like RSUs or profit-sharing. However, you’ll need to figure out how this can work in jurisdictions where such regulations don’t exist. But, as today’s Upstock experience shows, this problem is solvable.

The shortage of qualified employees in the labor market is unlikely to suddenly disappear. More likely, it will only intensify. Therefore, the demand for platforms that allow companies to attract and retain employees through such motivational programs will only grow.

And if we automate this process, make it simple, transparent, convenient, and scalable, then expanding it to the users of the company’s products will be a natural progression 😉

About the Company

Upstock

Website: upstock.io

Latest round: $13M, 07.02.2024

Total investments: $13M+, rounds: 4