Competition has intensified extraordinarily. An unexpected consequence is that fixed prices have begun to fade away in some places. In their stead, bargaining over terms and prices has emerged. What remains is to make this process faster and less painful. For this purpose, special platforms are needed, like the one this startup has developed. In fact, this is a tremendous change, the time for which has arrived in many other areas as well.

The essence of the project

Final Offer wants to make the process of negotiating the purchase of residential real estate listed on their marketplace transparent and less nerve-wracking.

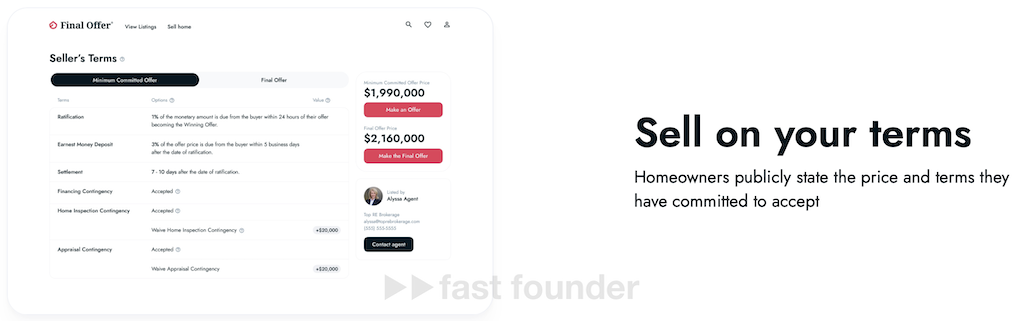

The method is simple — good old-fashioned auction. For this, first of all, the seller must determine the minimum price from which they are ready to consider purchase offers, and the maximum price at which they are willing to sell immediately. Although the seller may not even set a maximum price.

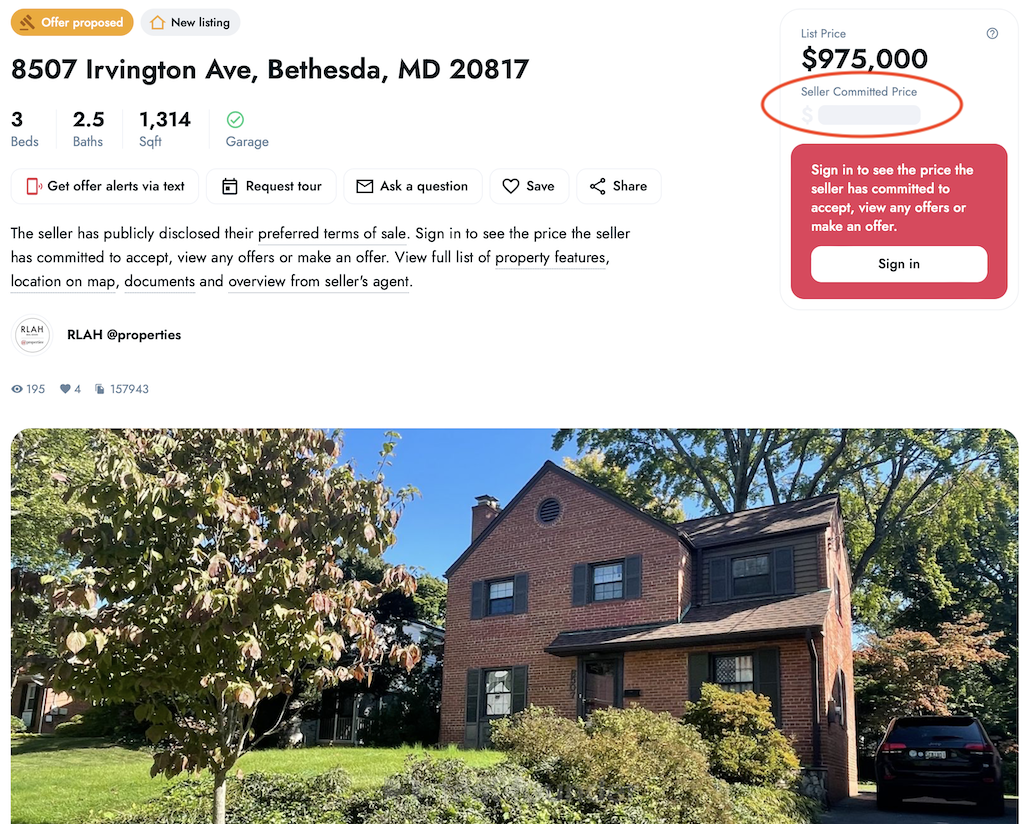

Cool detail. The instant sale price can be seen by the buyer only if they register on the marketplace.

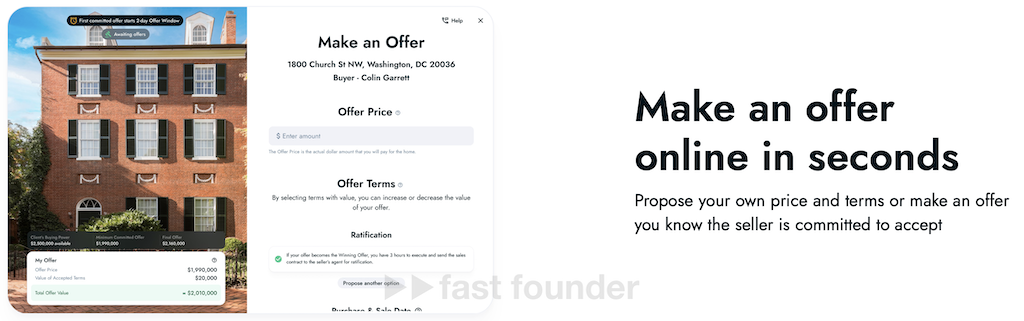

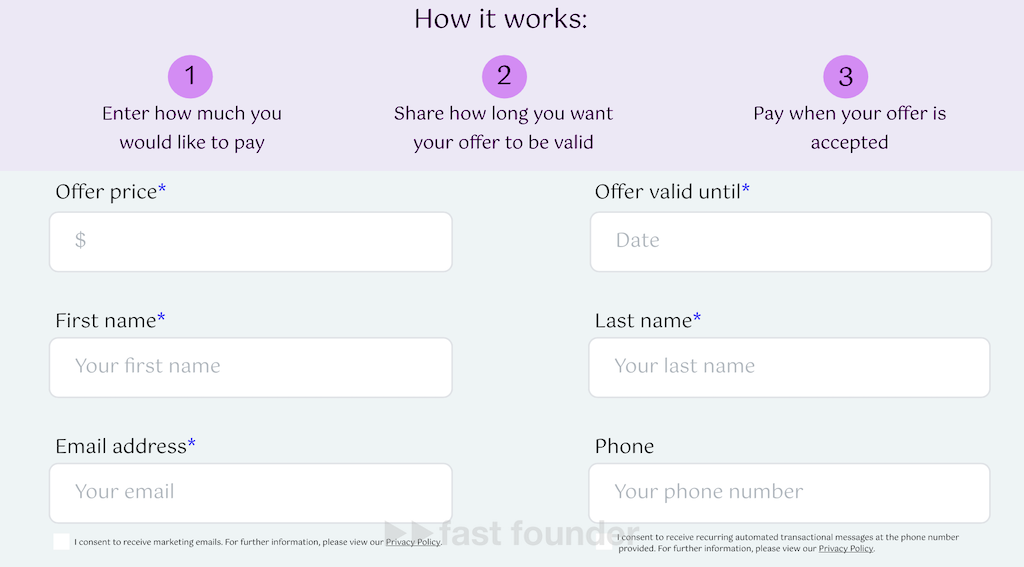

After registering, the buyer can make an offer to the seller at the price they are willing to buy the listed property. At the same time, they must first provide the marketplace with proof of having a certain amount of money in the account or an approved loan, and then they can only bargain within this amount.

The seller has the right to immediately accept the buyer’s offer, even if it does not reach the maximum price, or to make a counter-offer to them personally with a higher price, which is valid for a limited period of time. If the buyer decides and manages to accept the counter-offer, then the deal will be concluded with them.

In all other cases, the deal will be concluded with the buyer who made the offer with the higher price, or with the one who first agreed to buy the property at the maximum price.

After listing the property on the marketplace, the seller has the right to change the values of the minimum and maximum prices – both to decrease and increase them depending on current demand.

Before making an offer, the buyer can directly arrange with the seller’s agent on the marketplace for a time to visit and inspect the property.

The project described, Final Offer, aims to make the negotiation process for purchasing residential real estate listed on their marketplace transparent and less stressful.

The method is simple – a good old-fashioned auction. To this end, the seller must first set a minimum price, starting from which they are willing to consider purchase offers, and a maximum price at which they are ready to sell immediately. Although, the seller may not even set a maximum price.

An interesting detail is that the immediate sale price can only be seen by the buyer if they register on the marketplace.

After registering, the buyer can make an offer to the seller at what price they are willing to buy the listed property. In doing so, they must first present to the marketplace proof of a certain amount of money in the account or an approved loan, and then they can only bargain within that amount.

The seller has the right to immediately accept the buyer’s offer, even if it does not reach the maximum price, or to make a counter-offer to them with a higher price, which is valid for a limited period. If the buyer decides and manages to accept the counter-offer, the deal will be concluded with them.

In all other cases, the deal will be concluded with the buyer who made the offer at the higher price or with the one who first agreed to buy the property at the maximum price.

After listing the property on the marketplace, the seller has the right to change the values of the minimum and maximum price – both decreasing and increasing depending on current demand.

Before making an offer, the buyer can directly arrange with the seller’s agent on the marketplace a time to visit and inspect the property.

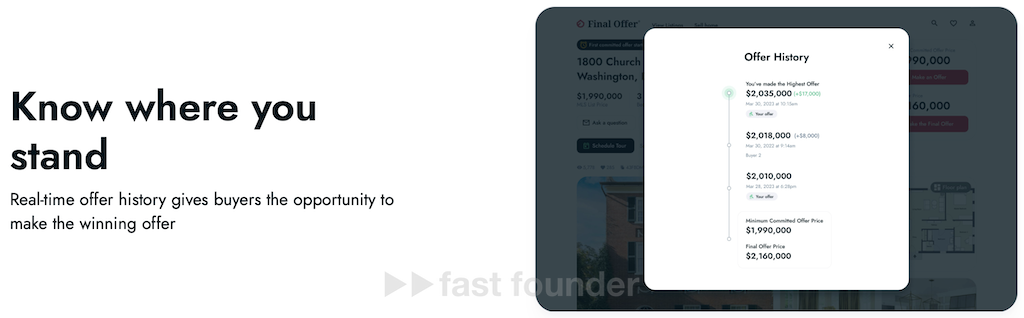

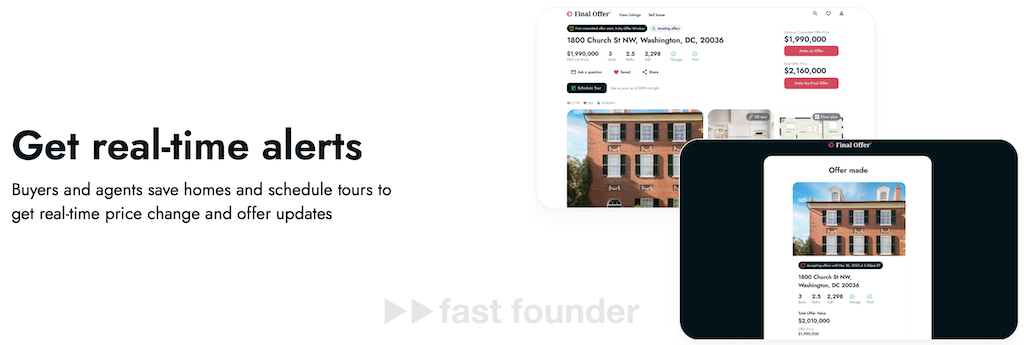

Having made an offer, the buyer will receive real-time notifications about offers made by other buyers and possible changes in the maximum price of the property. This will help them make a higher offer in time or just give up and immediately agree to buy at the maximum price.

Final Offer received its first seed round of $87,500 at the end of last October. And now it has already raised a decent round of $5 million.

What’s interesting

Is that Final Offer has not invented a new way of selling real estate. Anyone who has bought an apartment or house on the secondary market has likely gone through a similar bargaining process.

The price listed on the website is usually just a starting point for negotiations – and then begins a painful and nervous process. The buyer tries to guess what other offers the seller has to pay less but still buy. And the seller tries to guess how much each of the buyers is willing to pay to sell more expensively but still sell.

This process can be called “blind” trading, where all participants try to guess something – as a result, buyers often overpay because they want to buy guaranteed, and sellers under-earn because they want to sell guaranteed.

Today’s Final Offer has proposed a mechanism to turn “blind” trade into “transparent” trade, allowing you to quickly and with less nerve find the optimal price for the object. At the same time, both sides will be slightly dissatisfied with the found price, as with any successful deal: the seller will think that they sold for too cheap, and the buyer – that they overpaid 😉

So the first general conclusion is that startups often do not need to invent something – just digitize what is happening anyway. Whether it’s buying and selling, performing some tasks, or even the established structure of business processes in companies.

By the way, it’s interesting that lately startups with platforms that allow you to trade in various fields have started to appear.

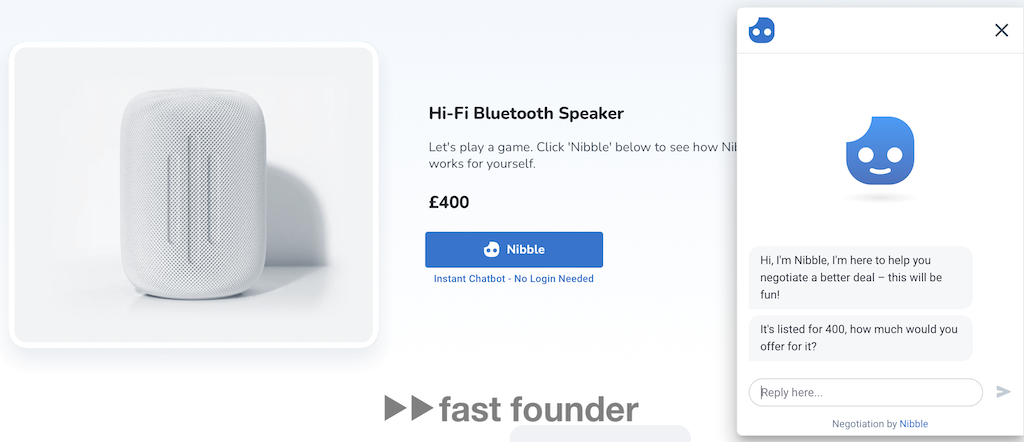

The startup Ergo made the simplest tool that allows buyers of online stores to name their price for the goods displayed in the store – and the seller can reject or agree to them. The startup states that their goal is to allow sellers to sell off stockpiled goods faster without announcing official sales. The Ergo platform is still in beta testing, but the startup has already managed to raise $1.5 million in investments.

The advancements in real-time price negotiation facilitated by AI and machine learning are reshaping various markets, leading to more dynamic and personalized pricing strategies. As competition intensifies, these technologies enable sellers to respond more swiftly to changes in demand and supply, thus optimizing revenue opportunities and potentially enhancing customer satisfaction by offering deals that align more closely with their willingness to pay.

For instance, the startup Nibble integrates an AI chatbot on the seller’s side that negotiates with the buyer in real-time, a method that garnered $3.6 million in investments. This illustrates the potential for AI to streamline negotiations, providing a more efficient and responsive pricing mechanism that can lead to increased sales and customer engagement.

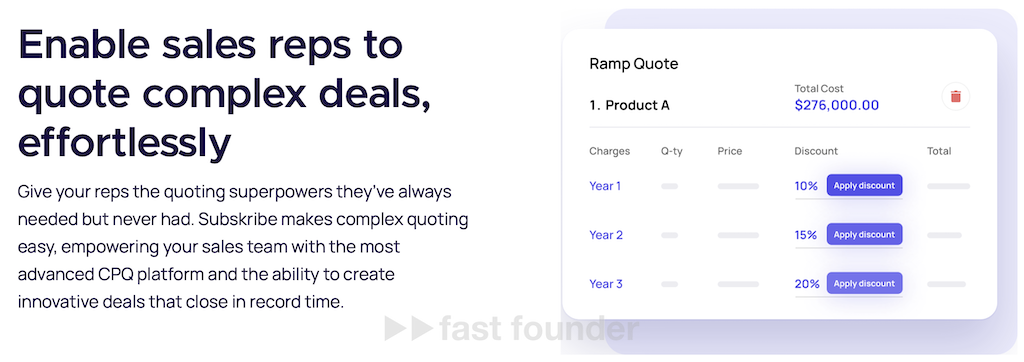

Subskribe’s platform, having raised $18.4 million, reflects the B2B sector’s growing need for flexible pricing solutions in cloud-based services. Their system streamlines the process of creating and approving special prices for prospects and seamlessly integrates these prices into the billing process, reflecting a broader trend towards efficiency and automation in sales and pricing strategies.

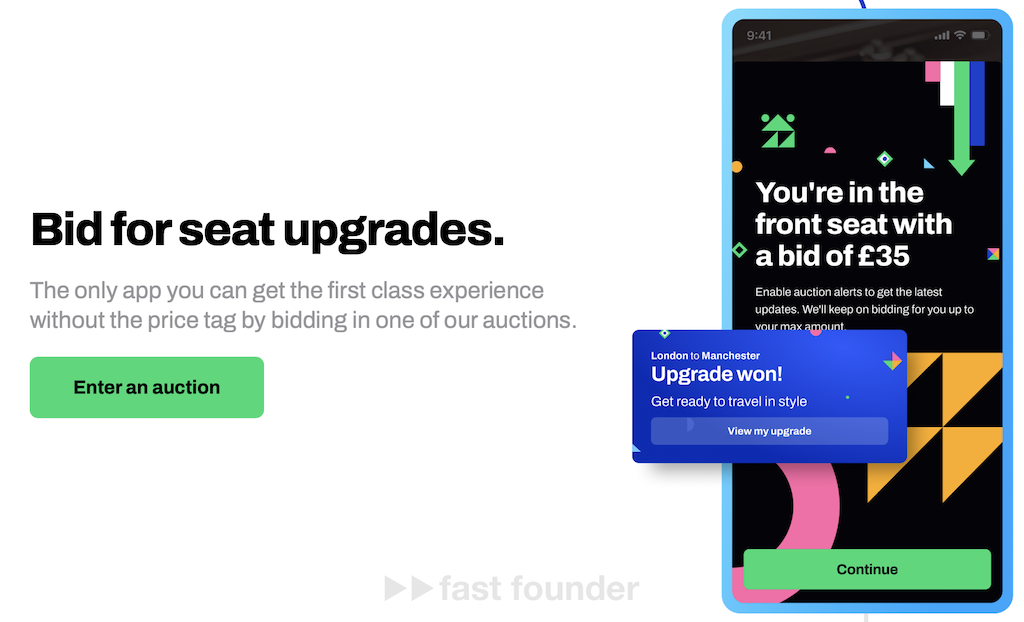

Moreover, Seatfrog’s concept, with $23.2 million in investments, where economy class train passengers bid for upgrades to first class if seats are available, demonstrates an innovative approach to maximizing revenue from existing customers. This real-time bidding system can be an effective strategy for transportation companies to fill up premium seats that would otherwise remain empty, optimizing earnings per passenger.

These cases signify a broader market trend where startups facilitate real-time bargaining platforms as a response to fierce competition. Traditional price research and market analysis may be too slow and cumbersome in today’s fast-paced market. Instead, real-time price adjustments—ranging from seconds in some sectors to days in others—are becoming a viable solution. This is evident in areas like ride-sharing services, where prices fluctuate automatically based on current demand.

In conclusion, the ability to adapt prices in real-time or near-real-time could become a crucial factor for businesses to stay competitive and capitalize on market opportunities as they arise.

Where to run

Currently, we are witnessing an intensification of competition in many areas — somewhere sellers are competing fiercely, and somewhere buyers are too. I have a feeling that startups with platforms that allow for real-time bargaining, or close to it, are an unexpected consequence of this intensification of competition.

Indeed, in a competitive environment, each company periodically conducts price, demand, and supply research to adapt its prices to the market situation. However, firstly, this is too long and inertial a process. And secondly, prices that are optimally average do not always turn out to be optimal in each specific case.

As a result, at any given moment, the seller risks either not selling anything or earning less by selling at a once-fixed price. Of course, after that, they can conduct research again and readjust prices — but there’s a risk of being late again.

A possible solution is real-time price adjustment, which in some areas can take seconds, and in others, days.

There are areas where this has been working relatively long, and we are already accustomed to it — like taxi fares, which automatically change depending on demand.

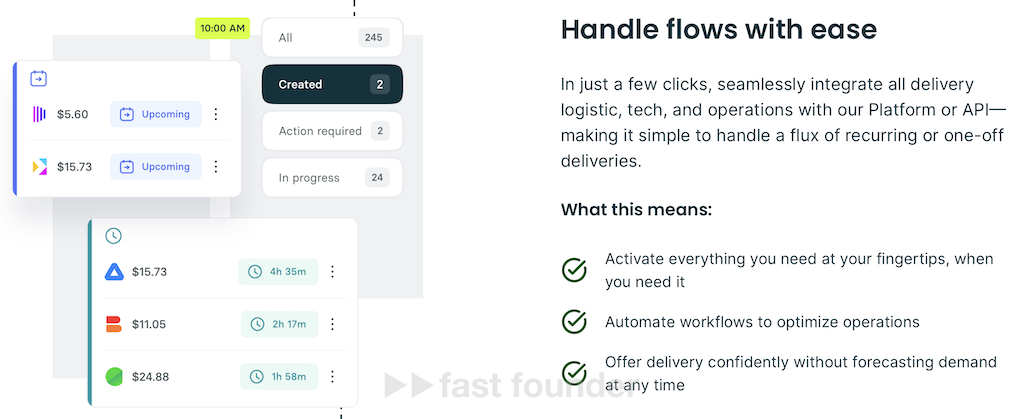

Another example is the Nash platform. It combines many different local delivery services and integrates with online stores, restaurants, and other businesses. The essence of the platform is that it can automatically and in real-time choose the most optimal service for delivering an order at any given moment based on a given combination of price and speed. Meanwhile, delivery services are also free to change their prices depending on workload and demand. This startup raised $27.9 million in investments.

I suppose that the model of dynamic pricing, including manual or automatic bargaining over prices, will now begin to penetrate more actively into all areas where there is competition. That is, almost everywhere 😉

Can you, for example, imagine a mechanism for bargaining future salaries, built right into a job marketplace? Because I can 😉

Thus, the direction of possible movement is the creation of platforms and tools for bargaining over terms and prices in those areas that have so far been dominated by fixed prices, or where bargaining was “bracketed out” of standard business processes (as, for example, when buying residential real estate or hiring for a job).

So, what unexpected or, on the contrary, obvious area and in what form can we start integrating transparent mechanisms for bargaining over prices and conditions right now? It seems that the time for this has already come.