What if we start distributing a portion of the company’s profits among employees — will they work more efficiently? And if we aim to share some of the profits with users — won’t they start actively attracting others? This is an incredibly big idea! But it won’t work without platforms that allow all of this to be automated. And here’s what and how things have already started here.

The essence of the project

A company may wish to ensure that its employees receive not only salaries and bonuses but also a share of the profit earned by the company. This mechanism is called profit sharing.

Introducing plans for distributing a company’s profit among employees motivates them to focus not only on personal efficiency but also to make efforts to ensure that the company as a whole achieves its profit goals.

This aligns the interests of employees and company shareholders. After all, shareholders receive dividends from the company’s profit at a minimum. Additionally, shareholders are concerned about the company’s stock value, which typically increases as the company’s financial performance improves.

In many countries, this method of distributing part of the company’s profit among employees is officially recognized. As a result, standards regulating this process have been introduced.

For example, in the US:

Even with such restrictions, profit-sharing plans remain a good motivational tool, and

therefore more than 100,000 companies in the US use them.

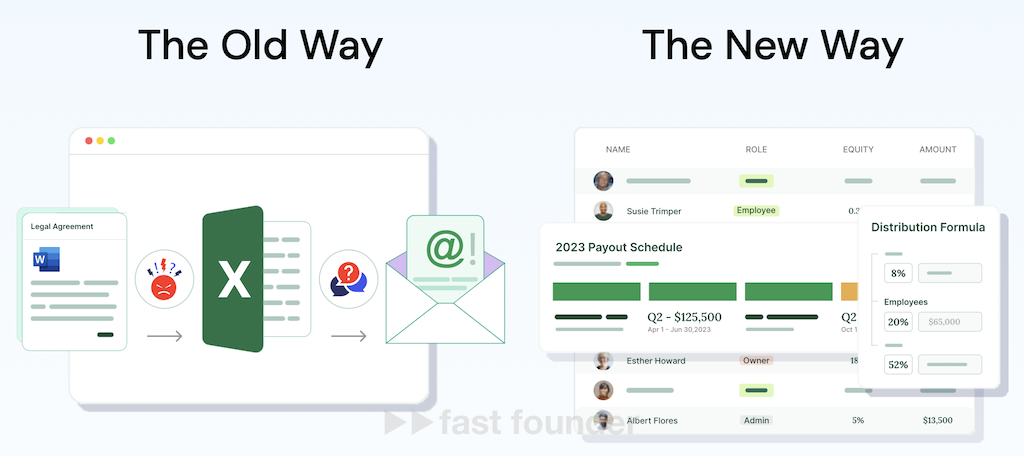

ShareWillow is a platform for automating the calculation and distribution of profit shared among employees within such plans.

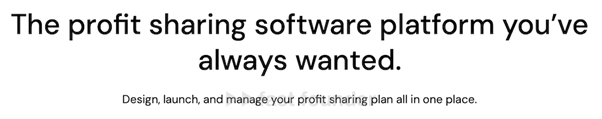

The problem is that introducing profit-sharing plans for employees puts a strain on the finance department, accounting, and HR departments. All these funds need to be regularly (quarterly or annually) counted, distributed, transferred, and constantly answering employees’ questions like “why this much?”. ShareWillow allows this to be done quickly, simply, and transparently.

On the platform, even complex profit distribution plans can be constructed and immediately tested on real company profit data and employee information. This allows companies to select the most suitable scheme and then launch it with the press of a button.

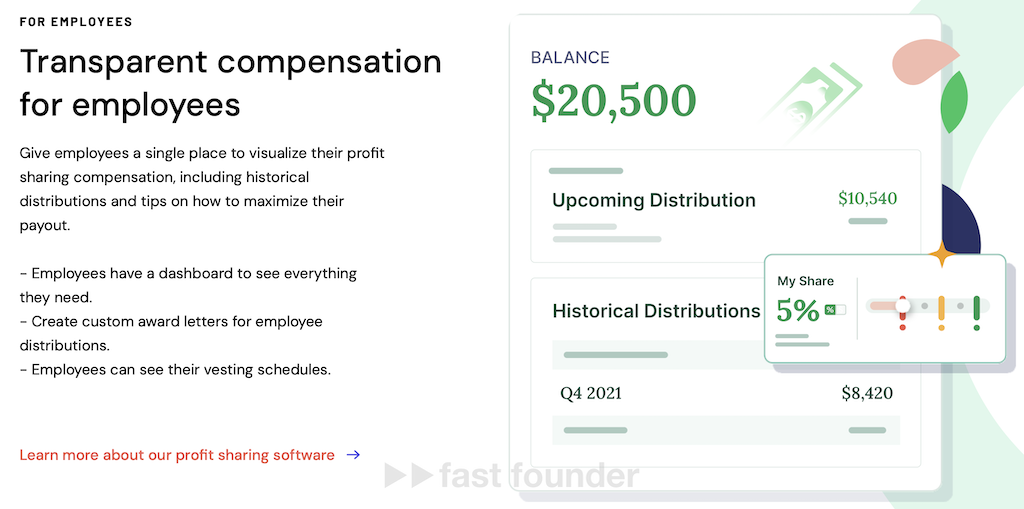

When accessing the platform, each employee can see the money they’ve already received or can expect to receive for the current period under this plan, which practically eliminates all questions they might otherwise pose to the individuals responsible for this.

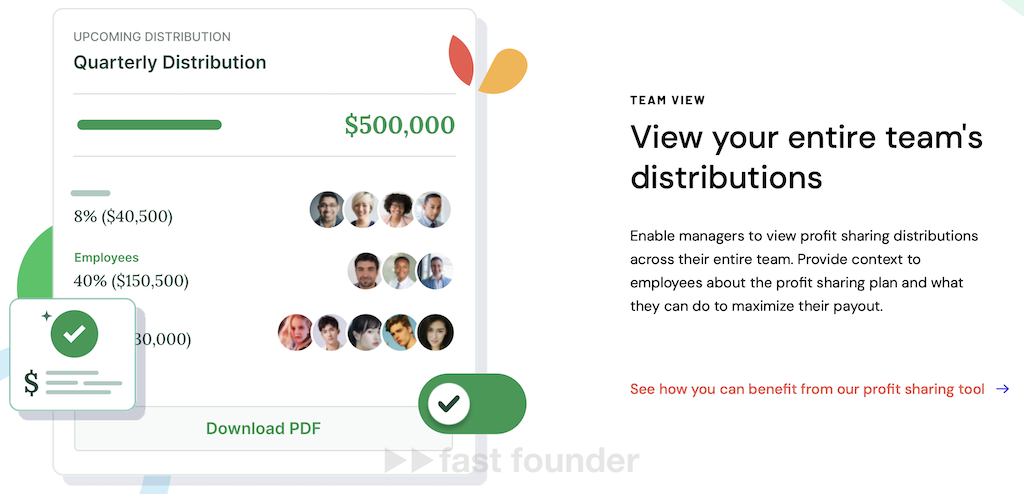

Those responsible, as well as company leaders, can see the money that all employees receive under this plan. This insight allows them to draw their own conclusions, including making modifications to the profit distribution scheme being used.

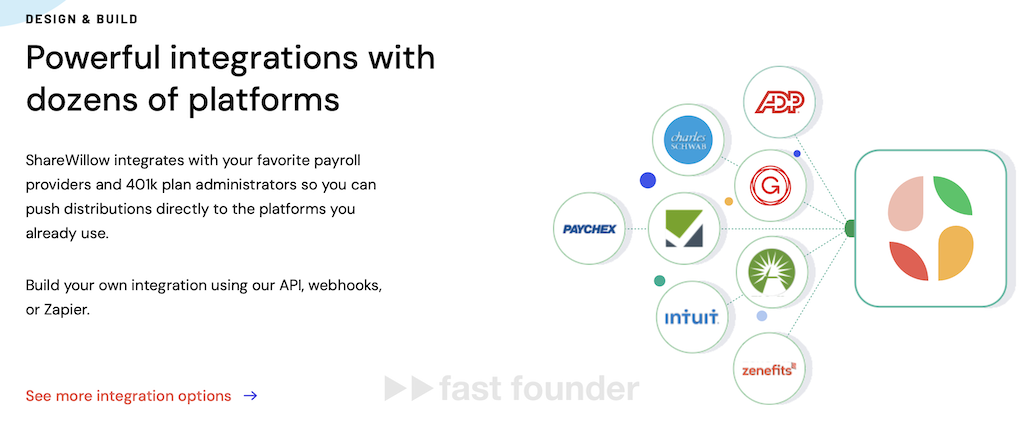

Funds accrued under the plans are automatically included in payment statements and/or transferred to retirement accounts via the platform, as it has integration modules with popular accounting systems and pension plan management systems.

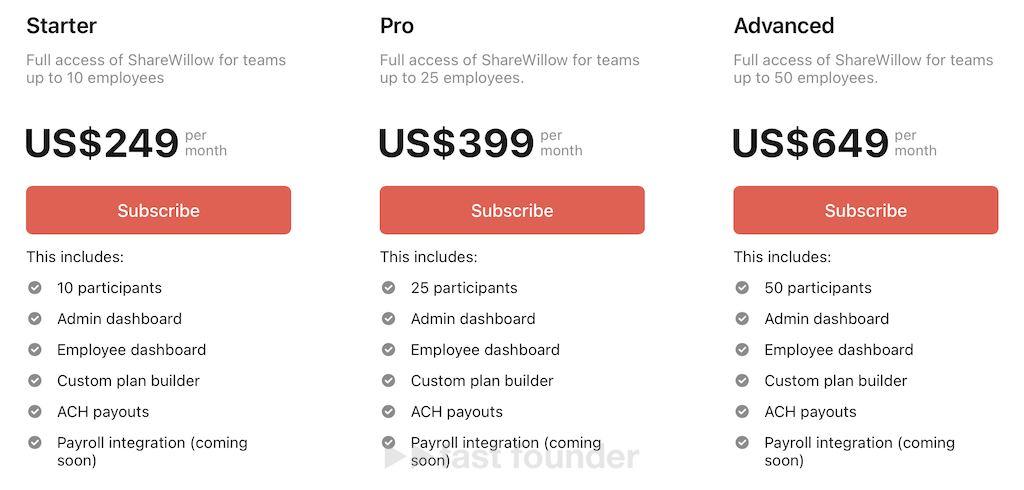

ShareWillow’s primary target audience is small and medium-sized businesses, evident from their pricing tiers. The three basic pricing tiers are designed for companies with up to 10, 25, or 50 employees participating in profit distribution plans.

The startup was only founded this year, but it has already raised its first investment of $3.8 million.

What’s Interesting

On one hand, ShareWillow seems to have identified a niche area with insufficient automation and has decided to address that. From this perspective, the startup might not seem very intriguing.

On the other hand, there’s a sense that companies are more actively searching for ways to motivate their employees and even users. Through these methods, companies aim to achieve their own goals faster and with more confidence.

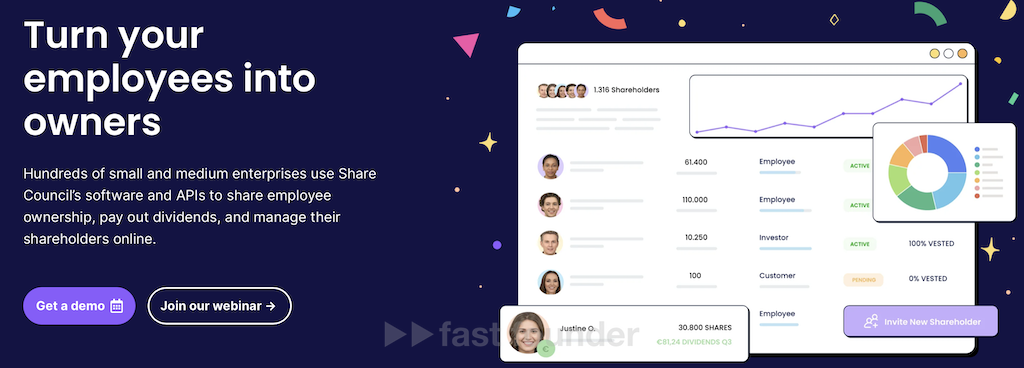

The startup Share Council, which created a platform, “helping companies turn their employees into co-owners”. Essentially, it’s a platform for automating the implementation of an even broader range of motivational plans for employees, tied to company profits or equity, than what ShareWillow offers. Share Council raised 1.5 million euros in investment.

Another startup, KOOS created a platform “for a new form of co-ownership.” Essentially, it’s also about distributing a portion of a company’s profits, but among potentially thousands of users, customers, and partners who take actions that help the company grow. KOOS raised 4.6 million dollars in investments.

All of this is starting to shape into a trend. Companies are looking for ways to succeed by engaging more people, be it their employees or their users.

But they began to need platforms that help organize, automate, and simplify this process.

Drawing a broader analogy, one could speak of a trend towards “open-source” companies. This is akin to open-source software when a developer uploads the code of their program to GitHub (or a similar service) to involve more people in its development and evolution. The software can then become even better and, as a result, even more popular.

Roughly speaking, just as GitHub became a platform without which collaborative open-source software development would be challenging, so ShareWillow, Share Council, or KOOS could become an equally essential “GitHub for open-source companies.”

By the way, some developers manage to make money even on their open-source programs by offering premium technical support, additional paid modules, or paid services.

So, an intriguing thought arises. Why not integrate a profit distribution mechanism into GitHub itself, based on contributors’ input to the programs posted there? After all, if such a mechanism were implemented, many more people would want to participate in the development of these programs, beyond purely altruistic motives 😉

Where to run

The general direction is the creation of mechanisms and platforms that allow companies and entrepreneurs to engage broader masses of people in their own success.

The key point of these mechanisms is not just monetary stimulation of certain types of actions by people but aligning common interests. So that it’s not about “just randomly hitting” – but distributing a certain portion of the profit earned by the company or entrepreneur among people. For this, it’s crucial to take into account, calculate carefully, and distribute the earnings in a straightforward way – otherwise, it will turn into a financial and operational nightmare.

Spotify does something similar, distributing a portion of its profits among the authors of songs posted on the platform proportionally to the number of listens. But this is similar to the mechanism of profit sharing among employees. But if they also distributed another part of the profit among those who listen to these songs, and/or post links to songs on their social networks and blogs – that could be even cooler.

Or take the usual referral program, where a person who shares a link to a product earns some money for clicks or for purchases through this link. But what if this reward could be tied to the company’s real profit in the form of real money or its shares – wouldn’t people post these links more wisely and diligently?

How could a similar platform look for bloggers? Or for freelancers? Or for online store couriers, for instance?

Our world is becoming increasingly transparent. If previously the financial indicators of non-public companies were a top-secret, now in some countries, financial data even for private companies can be found on tax inspection websites. So why shouldn’t companies take the next step – and implement a transparent mechanism for sharing this no longer so secret profit among everyone who can contribute to its further growth?

About the Company:

ShareWillow

WEBSITE: sharewillow.com

Latest Funding Round: $3.8M on October 3, 2023

Total Investments: $3.8M across 1 round.