What prices to set in your online store? If you set them low, you won’t earn much. If you set them high, the products will be stuck in the warehouse. Every minute, goods worth 500 billion dollars are lying in sellers’ warehouses! It’s a huge problem. That’s why startups addressing this issue quickly raise millions of dollars in investments even for such simple solutions.

THE ESSENCE OF THE PROJECT

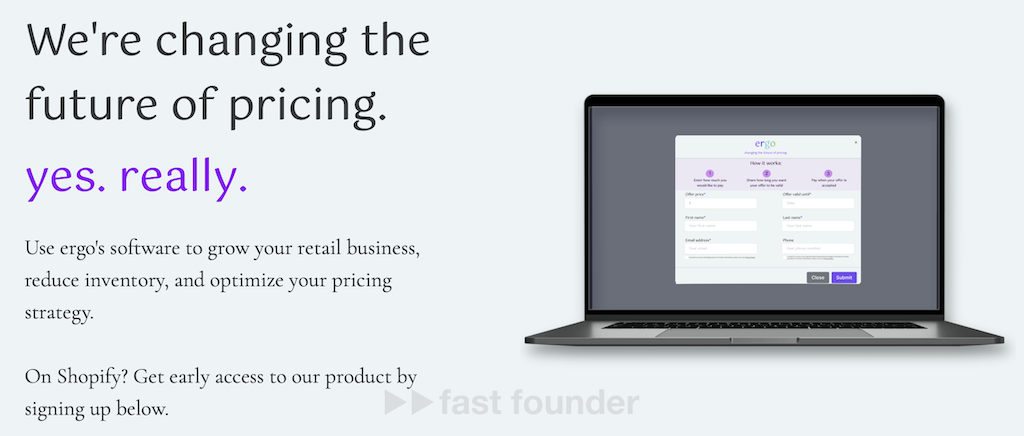

Ergo aims to “change the future of pricing” for online stores.

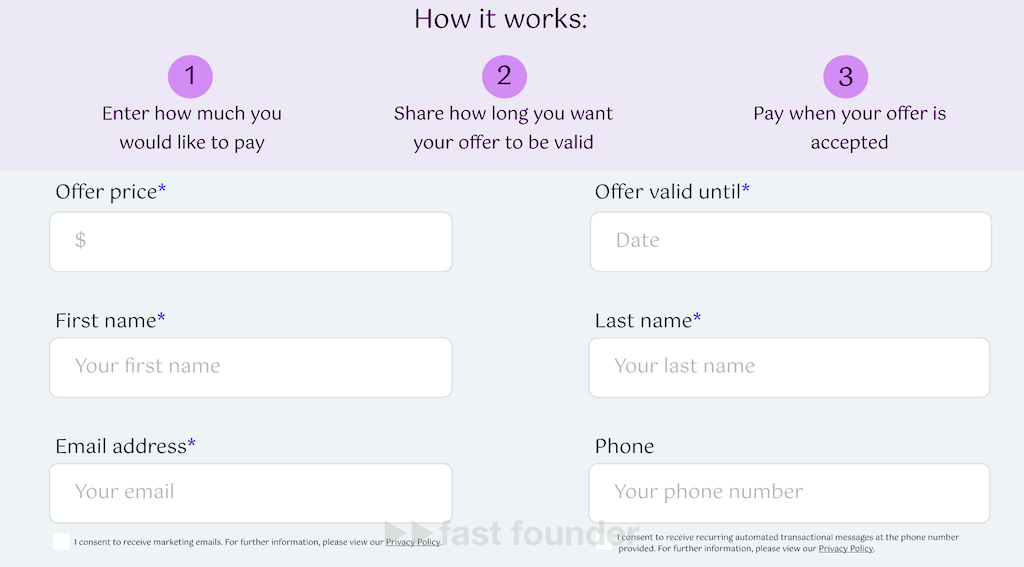

The concept is straightforward. Ergo allows visitors to an online store to offer their own price at which they are willing to buy a specific item from a particular online store. They can specify how long their offer is valid and provide contact information in case the seller accepts the offer.

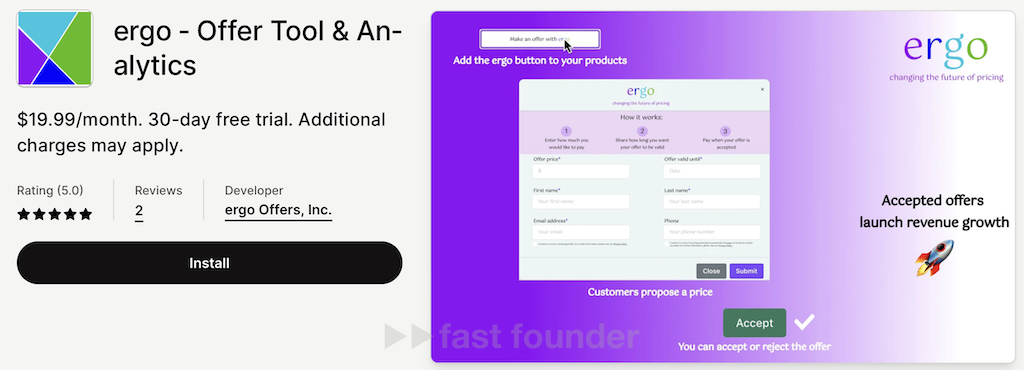

To implement this, the store owner must integrate the Ergo platform with their online store. Currently, Ergo exists as an application for the Shopify platform. Once integrated, products designated by the seller will have a “Make an Offer” button.

All offers submitted through this button go to the seller, who decides whether to accept or reject the offer. If accepted, the platform generates an order in the store at a special price and sends the buyer a link to confirm and pay for the order.

The cost of using the application is $19.99 per month.

The startup was founded just this year, and its application has been released in the very early stages for testing basic functionality.

Despite its early stage, Ergo managed to secure $1.5 million in investments in its very first round of funding.

What’s interesting

And why are investors willing to provide funding for such a simple demonstration of capabilities? Because money is invested not in complex technologies but in solving important problems for the target audience—problems that can sometimes be solved in simple ways.

So, the size of investments is not determined by the complexity of the startup’s chosen method but rather by the significance and scalability of the problem being addressed by the startup.

As for the problem that Ergo aims to solve, it’s the seller’s opportunity to “efficiently sell inventory without announcing sales.” The catch here is that regular sales events diminish customers’ desire to buy at regular prices. Many customers start waiting for sales to purchase items at a discount, which affects the overall profitability of the store.

The basic problem for sellers lies in the fact that they accumulate a large quantity of goods in their inventory, tying up their working capital. Consequently, they need to take out loans to purchase new products, incurring interest charges. Additionally, they must pay for storage space to house these goods.

To grasp the size of this problem, consider that at any given moment, retail sellers collectively hold more than $500 billion worth of goods in their inventories!

Moreover, most of these goods sell very slowly. For instance, within two months of purchase, sellers can only sell 22.8% of perfumes, 24.3% of clothing, and 25.4% of cosmetics. Even within a year of purchase, only 47.8% of cosmetics, 62.8% of perfumes, and 68.7% of clothing are sold.

On average, many sellers freeze at least half of their working capital in their inventory for a minimum of a year, which comes at a significant cost. Sellers are genuinely willing to pay for a solution to this problem in some way.

Various solutions to this problem can be proposed.

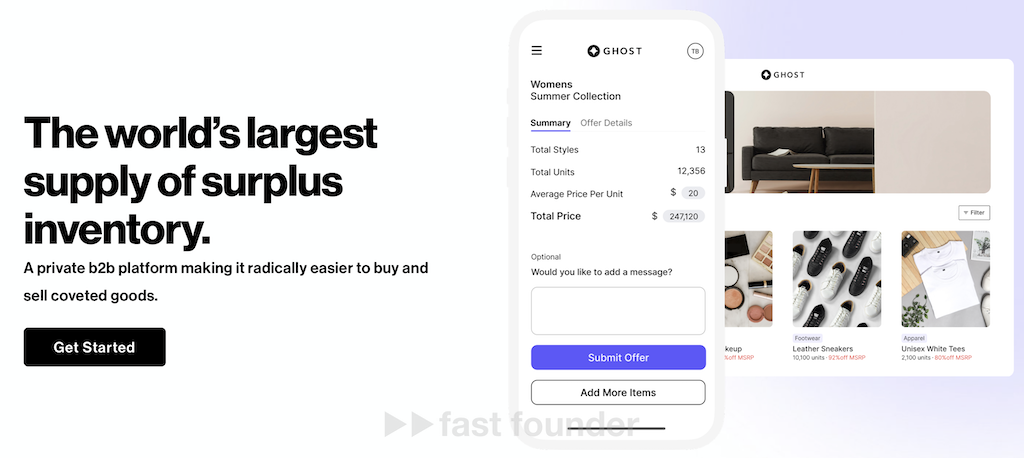

Startup Ghost created a special wholesale marketplace where sellers can sell their excess inventory not only to their own customers but also to “outsiders,” low-cost stores, or distributors in other countries. Ghost raised $68 million in investments. Max Retail operates on a similar model, raising $5.8 million.

Another option is offered by the startup Yaysay. They also sell excess inventory of sellers but directly to end customers, not wholesalers. They created an app where AI generates a new feed of special offers for each user every day. However, users can buy the products they like only within 30 minutes after adding them to their cart. If they don’t purchase within that time frame, they won’t see the product again. Yaysay raised $10.3 million, $8 million of which came just a couple of weeks ago during the beta release of their app.

Ergo’s approach allows stores not to clear out excess inventory at significant discounts that resellers profit from but to try selling them to their own customers at a price determined by the customers. This might be more advantageous for the store.

As a side effect of letting customers name their own prices for products, the store also gains the ability to build analytics and assess the acceptable price range for customers. This information can then be used to adjust the regular prices of products listed in the store.

So, Ergo works not only as a means to organize “slow sales” (essentially sales at discounted prices without announcing a sale) but also as a marketing tool.

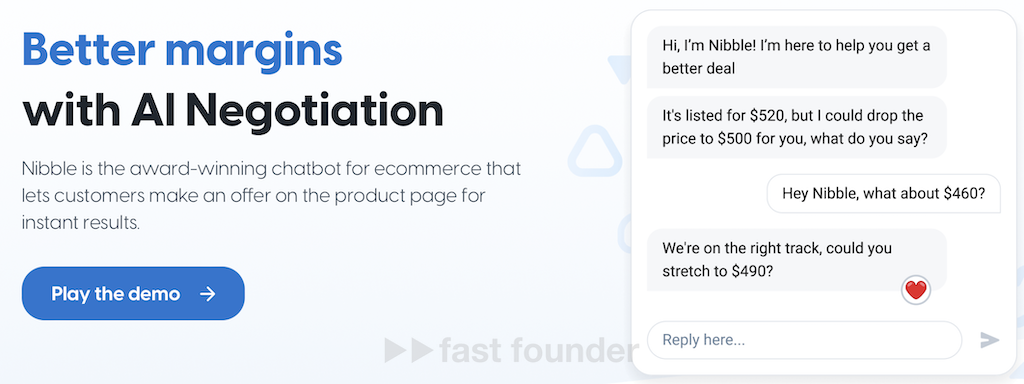

Another startup operates on a similar “name your price” model – Nibble. Their process of obtaining an acceptable price is more complicated – it’s a real negotiation with the AI bot of the platform. You suggest your price, it disagrees, presents arguments, and states its price. Now, you disagree, provide your reasons, and name a new price. This continues until either you get tired or the AI bot reaches a price within the range set by the store owner.

Nibble raised $3.6 million, which is more than 2.5 times that of Ergo. However, it seems to me that this was primarily due to the magical term “AI.” Simply naming your price as a buyer is much faster than spending time bargaining with an AI bot that operates within a seller-set price range. It might be fun once, but doing it every time you shop online is excessive.

Where to go from here: Moreover, adding a “name your price” button for every product and every customer, in my opinion, is overkill. At best, it would result in an even longer bargaining process, with the buyer repeatedly clicking the button and stating another price after each refusal. At worst, having been refused, the customer may never return. Selling products to each visitor at a price they’ve plucked out of thin air might not be profitable, and could even be the opposite.

Especially since the seller, receiving a price proposal from a buyer, must quickly analyze many parameters – how much money they lose by keeping this product in stock, their upcoming payments that require liquid funds, whether the buyer is a regular or a one-time visitor, and so on.

Why make a human quickly analyze all this? Especially when AI can now handle it.

Therefore, a much more general and viable direction is the creation of simple and effective dynamic pricing tools for online stores.

A fundamental component of such a platform should be an AI engine capable of analyzing warehouse status, product sales rate, upcoming payment schedules, seasonal demand, purchase history of a particular buyer, and many other parameters. This would allow it to constantly adjust the prices of products in the store based on the ever-changing situation and customer profiles.

But that’s not all! The AI should also periodically add “name your price” buttons so that it can receive feedback from customers about the prices it sets, which is more detailed than just “bought/didn’t buy”. This way, it can use the information about the prices named by people for even more efficient adjustment of its algorithms.

In other words, all these games with negotiating bots and named prices should not be the only functionality – but just a module for periodic feedback in a genuinely smart, yet still simple, dynamic pricing platform.

Which should solve a significant problem for online stores – faster sales of goods from the warehouse. And as we can see, this is a big issue, even for which startups manage to raise good investments with simple solutions. So, how much can one quickly raise for a smarter platform? 😉

About the company:

Ergo

Website: ergooffers.com

Latest funding round: $1.5M, October 12, 2023

Total investments: $1.5M, funding rounds: 1