As they say, ‘don’t teach me how to live, better help me materially’ 😉 Therefore, it’s foolish to teach financial literacy without providing financial services at the same time, and vice versa. This startup managed to combine both — and raised 75 million dollars in investments. Its example can help you attract more clients for any educational program if you take this approach.

THE ESSENCE OF THE PROJECT

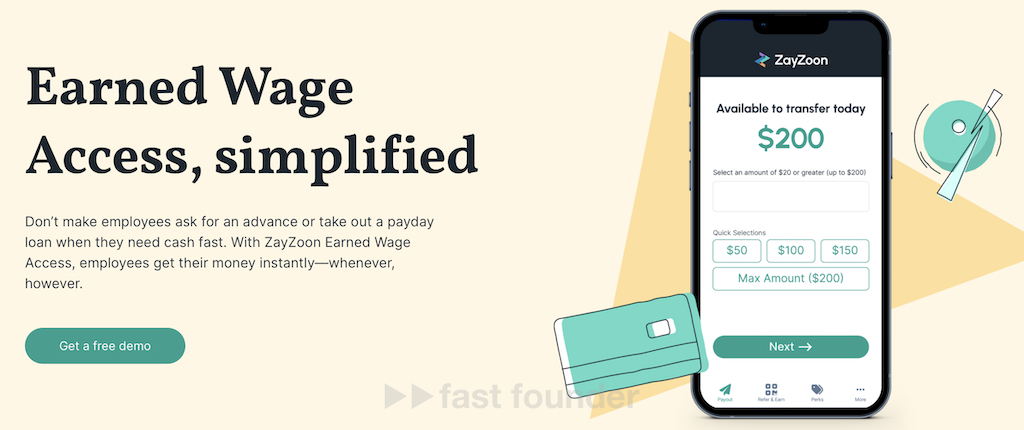

ZayZoon describes itself as a “platform expanding the financial possibilities for small and medium business employees.”

Their primary service is issuing money to employees before payday. They issue a small amount—ranging from $20 to $200 at a time. You can borrow again only after repaying the previous loan. The loan is interest-free.

Repaying the loan can be done in installments. The employee doesn’t have to do anything as the necessary amount will automatically be deducted from the upcoming salary directly in the company’s accounting department and sent to ZayZoon. For this, the startup has integrated its platform with 200 platforms through which American companies calculate and pay salaries to their employees.

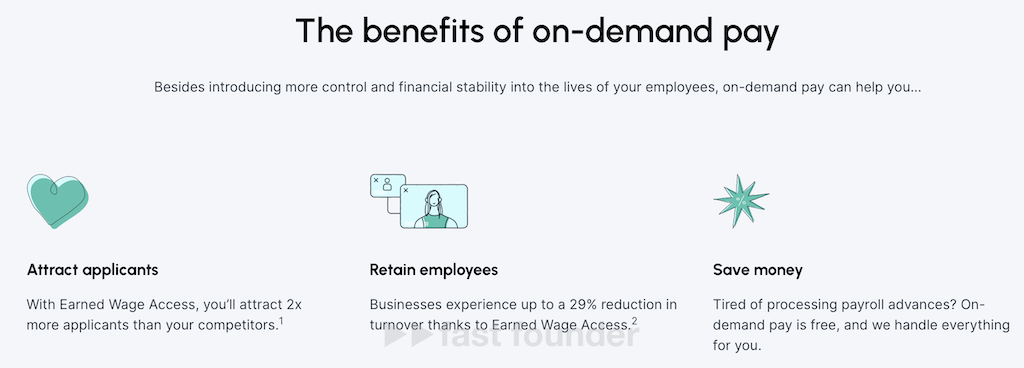

The startup claims that the ability to get money when needed, not just on payday, is an attractive offer for employees—who are keen to work for companies offering such an opportunity and are reluctant to quit.

This is also beneficial for companies as otherwise, owners and managers would have to issue money from their pockets or the company budget, and deal with the hassle of keeping track of loans issued and repaid.

ZayZoon considers itself one of the leaders in this direction in the American market, having 10,000 companies issuing loans to their employees with their help.

In the current round, ZayZoon raised $34.5 million, thus increasing the total amount of investments attracted to $75 million.

What’s interesting

Most people live paycheck to paycheck, without having significant savings. So, when they need to make a large purchase relative to their salary (an iPhone, for example) or cover unexpected expenses (such as a medical bill), they have to borrow money somewhere.

If this can be done right at work, without dealing with banks—great! This is why paycheck advance services integrated with employer companies have become quite popular. This category of services even got its name—”Earned Wage Access” (EWA), because employees get already earned money or money they are about to earn, without waiting for payday. ZayZoon is one of the representatives of this category.

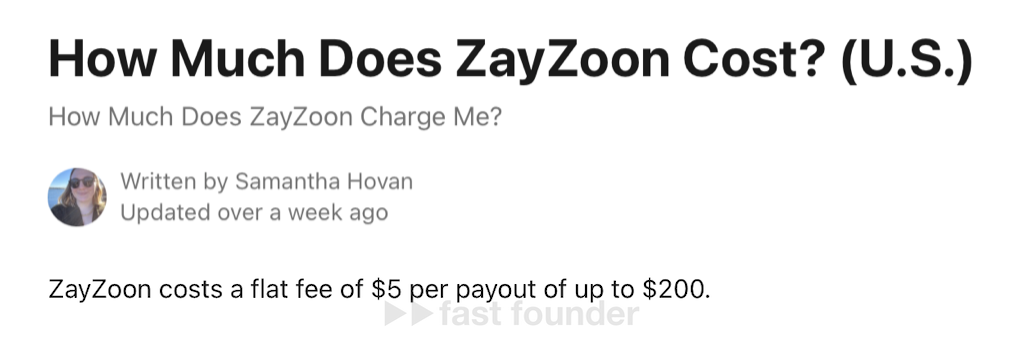

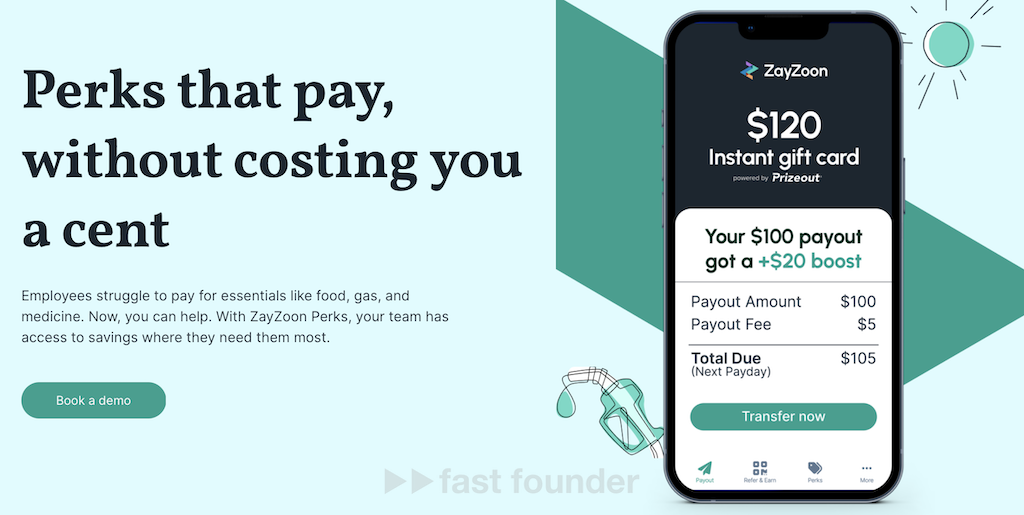

An interesting psychological trick used by ZaZoon is that although its loan is interest-free—it charges $5 for each money issuance, regardless of the amount. This consciously or subconsciously encourages people to take more, as $5 needs to be paid whether for $20 received or for $200. By the way, these $5 do not need to be paid explicitly; they just get added to the amount the employee has to repay.

Replacing loan interest with a fixed fee is an interesting economic focus. Because for the consumer, psychologically, it seems more profitable than percentages—but in reality, it usually turns out to be more profitable for the creditor.

The most interesting variant of such a focus I saw in the startup SteadyPay. They issue interest-free loans, do not charge for their issuance, and the issued loans can be repaid indefinitely!

The trick is that for this, you need to be a subscriber of their service, paying £7 per week. The longer a person does not return the money, the more money for the subscription they will have to pay in total. And canceling the subscription, while you have not repaid the loans received from the service—is technically and legally impossible 😉

ZayZoon’s second trick is to add a bonus in the form of gift cards with each money issuance. By requesting $100 against their salary from the service, an employee can essentially receive $120 in monetary value, considering the bonus value.

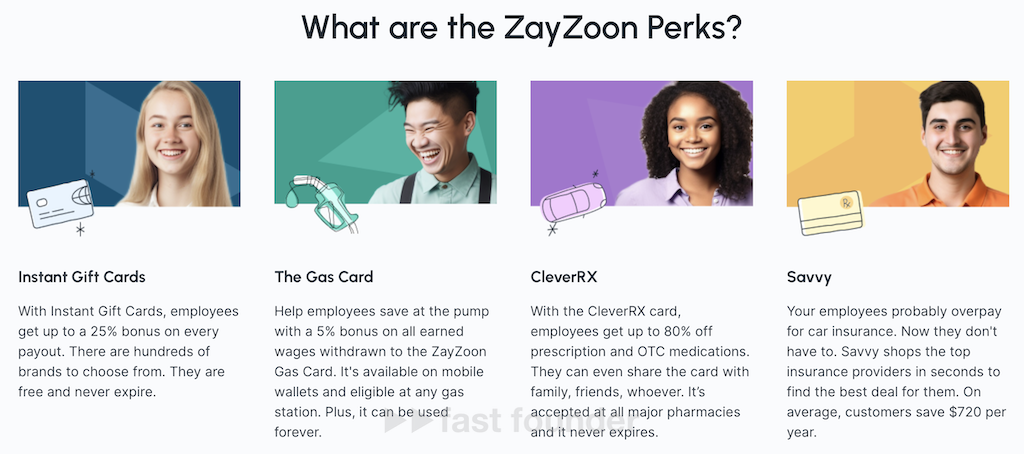

Employees can even choose to receive the entire payout amount in gift cards—in this case, the service will not charge the $5 cash issuance fee. There are many gift card options, including cards for refueling vehicles, purchasing medications, and insurance services.

By distributing gift cards, ZayZoon acts as an additional marketing channel for the sellers issuing these cards—for which the sellers pay ZayZoon commissions. These commissions become another source of income for ZayZoon, allowing them to add cards on top of the cash amount issued or remove the $5 fee when issuing the loan entirely in the form of gift cards.

Quite often, the need to borrow money before payday is explained not only by the need to make a large purchase or cover unexpected large expenses—but by the fact that people cannot properly plan their personal budgets.

Therefore, an important part of ZayZoon’s service has become a free program to improve the financial literacy of company employees. It includes:

- An online course to improve financial literacy.

- An automatic income and expense analyzer that a person can connect to their bank accounts. This machine will monitor income and expenses, forecast the future situation, and issue timely warnings and advice when it sees that the person is confidently moving towards a financial abyss.

Having such a component allows ZayZoon to claim that they are not ordinary creditors, but a service “expanding the financial possibilities of ordinary people” 😉

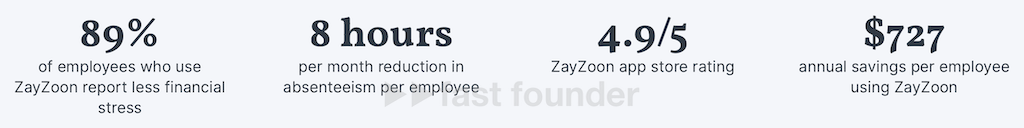

As a result, 89% of company employees who began collaborating with ZayZoon report a decrease in stress levels associated with financial problems, saving $727 a year in the process.

Companies say their employees began to miss work less, dealing with their financial problems or sorting out their consequences—by a whole 8 hours a month.

Where to run

Financial problems are arguably the most common source of regular stress. Not only people suffer from it, but also their employer companies—because employees with financial problems work worse and look around more in search of other employment options.

Therefore, recently, startups have emerged that sell platforms for improving financial literacy not to individuals, but to companies—so that they provide an opportunity for their employees to improve their financial literacy, get their finances in order, and be less distracted by financial problems. A couple of examples of such startups:

- Origin —raised $72 million in investments.

- LearnLux —raised $17.1 million.

However, as the saying goes, “don’t teach me to live, better help materially” 😉 Therefore, just teaching financial literacy, without providing financial support in time, seems insufficiently convincing. Against this background, today’s ZayZoon offer, combining financial literacy improvement with the opportunity to catch money before payday, looks more attractive than just educational courses or just loans.

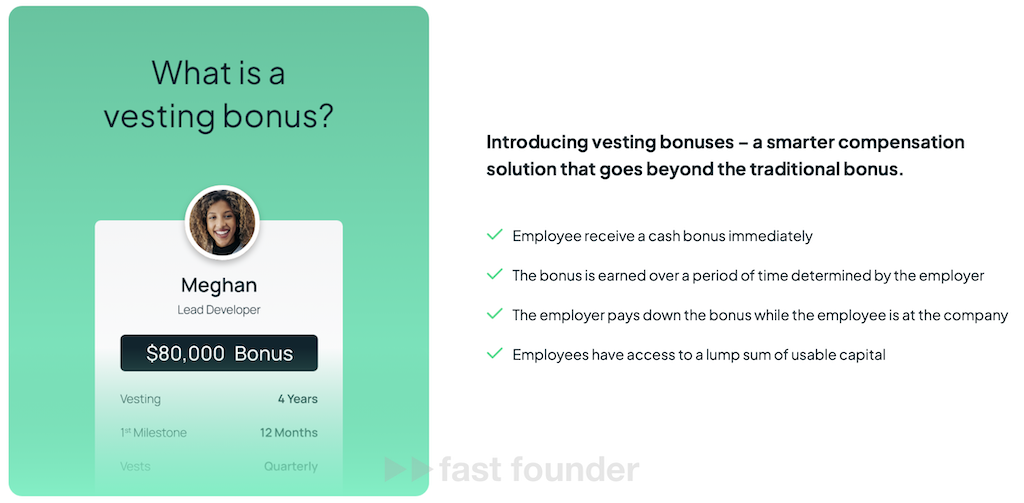

In the “financial assistance” field, there’s an intriguing startup called Keep Financial that I wrote about last spring. It helps companies to provide substantial bonuses to their employees for work achievements or expectations (which are essentially loans), to be repaid by the company (either in full or partially) over several years, provided the employee continues to work for the company. If they decide to leave, they will have to cover the remaining loan balance themselves. This mechanism has proven to be a good way for companies to retain good employees from resigning.

A possible direction indicated by today’s analysis is towards the creation of B2B services, combining corporate employee financial literacy training with the provision of financial services.

A larger number of people regularly or occasionally face financial problems, affecting both themselves and their employers. Hence, the market potential here is enormous. The key is to formulate the right offer, an example of which we see in today’s ZayZoon.

Looking at the broader picture, it’s advisable for any educational service to add a suite of accompanying services, transitioning from merely “teaching to live” to also “helping”. This way, a much larger audience can be attracted.

It’s quite shortsighted if, for example, you decided to teach someone design – provide your students with free licenses for design software for the duration of the course. The cost of these licenses can be embedded in the course price, and additionally, commissions from developers for attracting new users can be earned, as they may continue to use and pay for this software after completing the course.

The above example is more illustrative, but it leads to an interesting thought – what other areas could convincingly combine education with accompanying services (or services with accompanying education)?

What could be taught in this case? What services could be offered? How could the costs for these services fit into the unit economics? How could additional revenue be generated from them?

About the company

ZayZoon

Website: zayzoon.com

Latest round: $34.5M, 09/19/2023

Total investments: $75M, rounds: 6