In the realm of niche cloud services and marketplaces, the consensus among investors is clear: adding financial services to your customer offerings is the key to unlocking exponential growth. However, why take the roundabout route when the ultimate destination is the financial services market itself?

Envision a more direct, streamlined, and efficient approach. Begin by building an audience around a simple yet valuable tool related to shopping and finance. Then, seamlessly introduce financial products that generate revenue through transactions and credits.

But what could this ingenious tool be? Consider this: a solution that caters to every individual with multiple bank cards in their wallet. In other words, virtually everyone

Project Summary

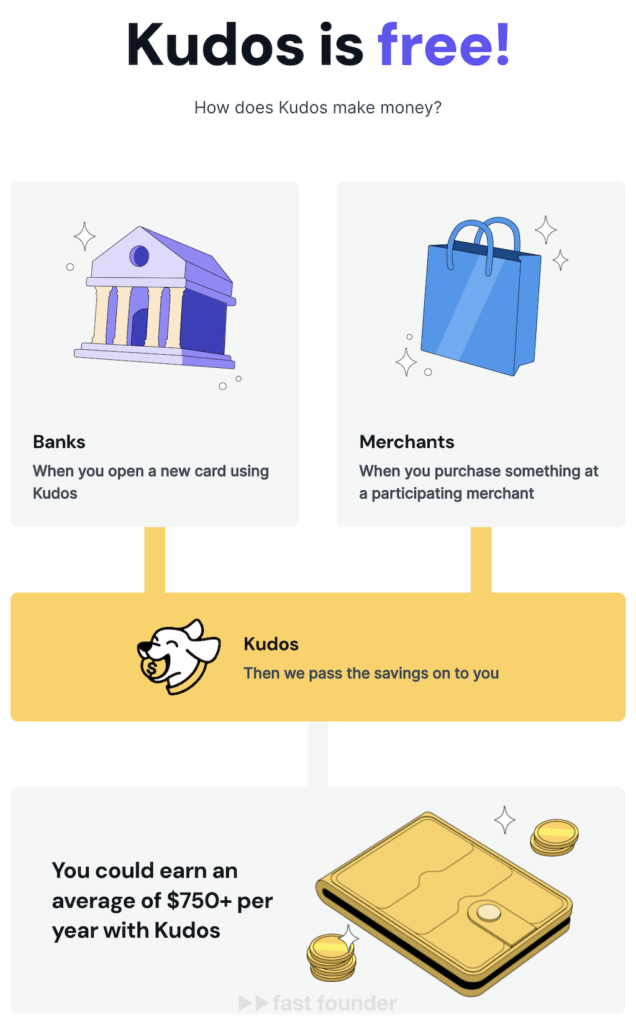

Kudos offers people the opportunity to earn more rewards for the purchases they would make anyway.

To do this, you can continue shopping anywhere online. First, add all your cards to the Kudos app (wallet), and then install the Kudos browser extension.

When filling out a payment form, Kudos will automatically input the details of a bank card. But which card? Most people have several or even many cards in their wallet.

This is the main feature of the startup—it automatically inputs the details of the card that will earn the maximum reward, such as cashback, for that specific store. You can change the default selection by opening the menu within the form and choosing any of the cards added to the Kudos wallet.

The problem is that different banks have various promotions with different retailers, offering increased rewards. Keeping track of all these promotions is tedious, so Kudos handles this task for you.

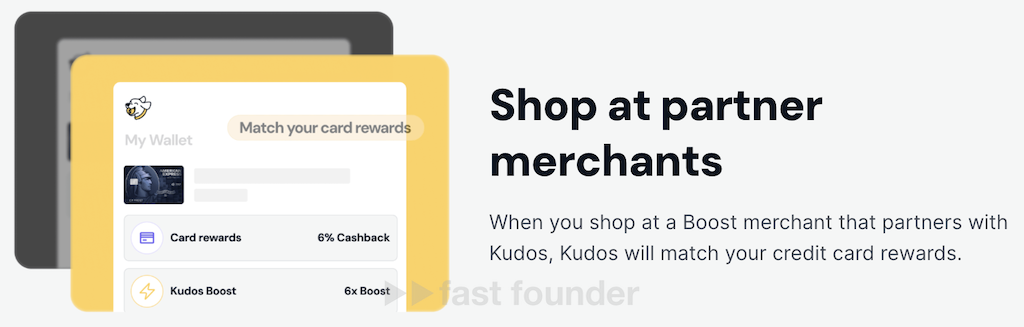

Moreover, Kudos also has its own promotions with retailers 😉 If a person buys from a retailer with whom Kudos has a promotion, it offers an additional reward equal to the one provided by the bank for that purchase.

Naturally, Kudos does this without incurring a loss, as it receives a commission from the retailer for promoting them among its users.

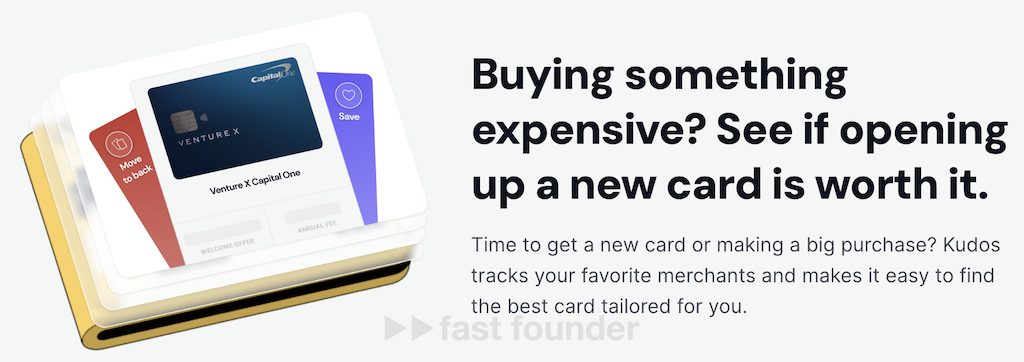

If someone plans to make an expensive purchase where every reward point matters, they can consult the app, which will recommend the best bank and card to use for the highest possible reward.

Additionally, Kudos monitors all purchases and can proactively suggest opening a new card to earn more rewards while continuing to shop at the same places.

These recommendations are handled by MariaGPT, an AI assistant developed by the startup specifically for this purpose. MariaGPT is always up to date on the current reward conditions for 3,000 types of cards issued by American banks.

I first noticed this startup in the fall of 2022, when they launched their app and raised their initial investment. Now they have 200,000 registered users making purchases worth $200 million a year through Kudos.

Recently, Kudos raised an additional $10.2 million in investments, bringing the total investment in the project to $17.2 million.

What’s Interesting

Kudos genuinely benefits owners of multiple cards. But can a billion-dollar company be built on just this feature? 😉

It seems unlikely. Therefore, Kudos continues to develop:

- They plan to transform their AI assistant, MariaGPT, into a full-fledged AI assistant for all personal finance matters.

- Additionally, they intend to launch a marketplace for booking airline tickets, where earned Kudos rewards can be used for payment. I believe they won’t stop at just airline tickets.

Many fintech services evolve gradually. Initially, they create a simple useful feature to attract users, such as shoppers, payers, or cardholders. This way, they build an audience to whom they can later offer more complex and beneficial products.

For example, the Indian startup FPL Technologies, which I wrote about in 2020, initially launched a free app for checking credit scores called OneScore.

A year and a half later, they began issuing co-branded OneCard credit cards with several Indian banks for the audience they had gathered.

They do this under the name OneConsumer, claiming to be “serial” brand creators in the financial market. So, I assume their product line won’t stop at OneScore and OneCard. Altogether, the startup has raised about $240 million in investments for these two products.

Another Indian startup, Flash, which I wrote about last fall, is at a similar stage as Kudos is today, and has also raised $12.5 million in development investments.

They offer users a special email address in the flash.co domain for registration in online stores, so all notifications and newsletters go there instead of the regular email. This provides two advantages:

- All purchase notifications are separated from spam and conveniently organized, allowing users to see a simple list of what was ordered, when it will arrive, and view the entire purchase history.

- The service analyzes what a person buys and separately shows them interesting and relevant offers from received newsletters, as well as from other online stores that don’t send them anything.

Another example, surprisingly also from India, is the startup Khyaal, which I wrote about last fall. They have created what they claim is the “number one app for seniors,” where users can find educational courses, consult with advisors for typical problems, buy items on the in-app marketplace, and even find part-time jobs with companies willing to hire experienced older adults.

Having gathered an audience this way, the startup began offering them a credit card issued by a partner bank under the Khyaal brand. For this, the startup attracted $10.6 million in investments, $4.2 million of which they raised this February after my review.

Where to Go

In several of my previous reviews, I mentioned that financial services are a good way to scale vertical cloud services and marketplaces. But why take such a roundabout route if we ultimately end up in the financial services market anyway? 😉

The path to the financial services market can be made more direct, simple, and short. It can start with much simpler things that are immediately related to spending and finance but provide additional benefits and convenience, thereby attracting an audience. After that, you can begin offering financial products to this already gathered audience, allowing you to earn from transactions and credits.

Therefore, a possible general direction is to invent or find small, useful things related to purchases, spending, and credits. These can then be naturally extended to include issuing cards and/or providing loans directly from yourself or your partners.

Today’s Kudos is interesting because it is only useful to people who already have many bank cards and/or are willing to open them regularly. Typically, these are two categories of people:

- Those who have enough money to spread across many banks,

- Those who don’t have enough money and are constantly refinancing with new banks to cover debts to the old ones.

From the perspective of financial services, both these audiences are interesting. One needs help with spending, while the other needs help obtaining loans 😉 So, this approach is quite viable.

Or you could come up with another simple but useful thing related to purchases, spending, or credits. What comes to your mind? What would personally be convenient for you?

About the Company

Kudos

Website: joinkudos.com

Latest round: $10.2M, 05/17/2024

Total investments: $17.2M, rounds: 3