- The sweetest time to enter the market is when you think everyone already has this technology 😉 Then you don’t need to convince anyone specifically that they need it. There are plenty of successful examples to refer to. And you can even copy them to create your own product.

- The keyword here is “seems”! After all, founders are technologically savvy individuals, usually suffering from the corresponding cognitive distortion. They notice when a certain technology is being used. And they don’t notice the 80% of people or businesses who aren’t using it!

- One of such technologies is branded electronic wallets that retail sellers issue for their customers. Firstly, it’s a good tool for enhancing loyalty. And secondly, as it turns out, it’s an excellent way to reduce fees when paying by bank cards.

- It seems that now those same 80% conservative sellers will want to make such wallets. But for this to happen quickly and inexpensively, they will need a platform to create and manage such wallets. Which can be copied from this successful example:

Project essence

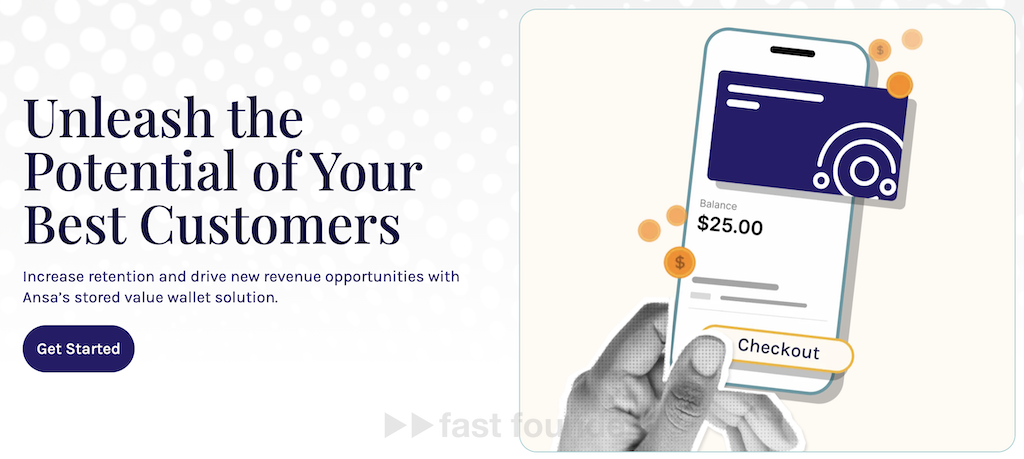

Ansa wants sellers to be able to “unlock the potential of their best customers,” meaning two things at once:

learn to distinguish those customers from the total mass who could become loyal, get a tool to incentivize these customers to continue making purchases. To achieve this, the startup suggests that sellers create and connect a branded electronic wallet to their store on their platform. After this, customers get an additional opportunity to pay the seller with money they transferred to their wallet themselves or that the seller credited to them as a reward.

It’s understandable that only those who plan to continue buying in this store and beyond will open such wallets and transfer money there. This is precisely the selection from the total mass of potentially loyal customers.

And if the customer has money in the wallet linked to the store — they won’t mind spending it. So now the store can send them special offers to buy something in the store with that money. And then reward them for the purchase so that there is always something left in the wallet — enticing them to spend it on something else 😉

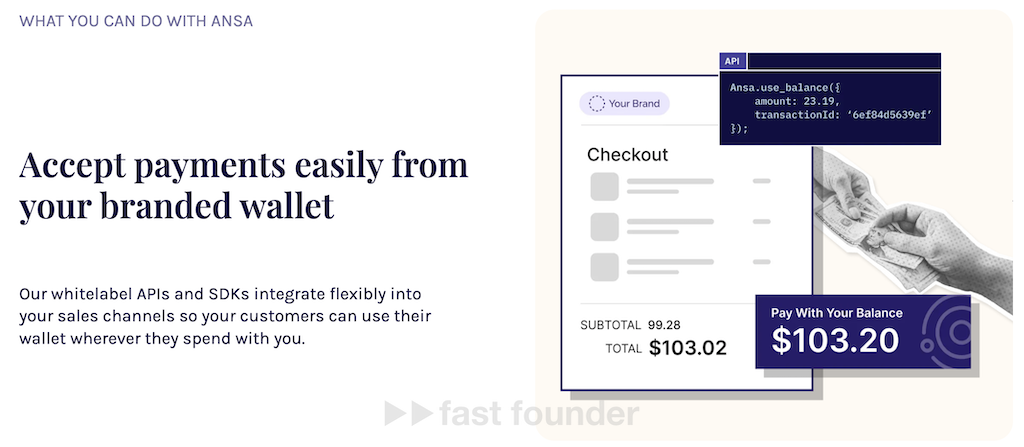

All wallet features are available to the seller via Ansa’s platform API, so the seller can embed buttons for wallet top-ups and payments anywhere — on their website, in the app, and in any other sales channels where the API call can be inserted.

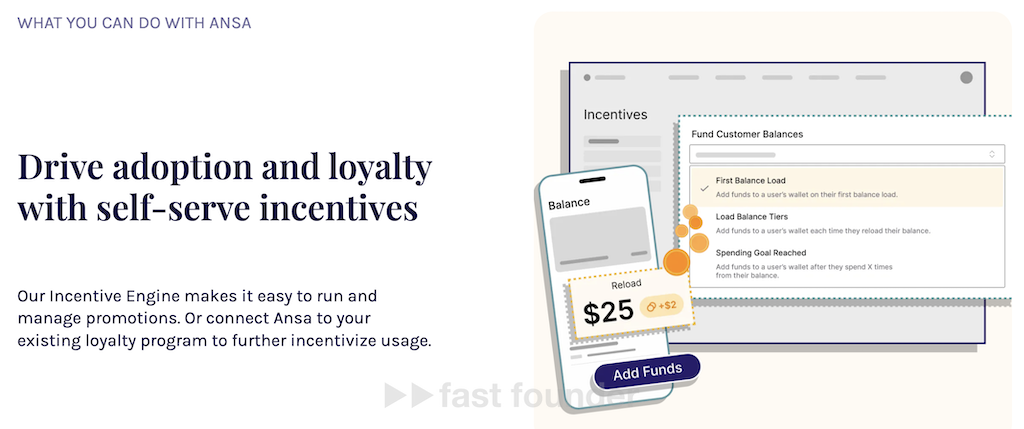

There’s also an API for rewards, so the process of earning and crediting rewards to customer wallets can be automated — either by devising a reward system from scratch or integrating it into the loyalty program already used by the seller. For example, simply doubling all rewards under the existing loyalty program for wallet owners 😉

The platform collects all statistics on wallet usage and presents it in various reports, helping sellers study the connection between marketing campaigns, rewards, and wallet usage — to increase the frequency and amounts of purchases by their owners.

The accruals into customer wallets and spending from them need to be reflected in the accounting reports of sellers. For accountants, this is an additional headache ☹️ Fortunately, the platform has a tool that automates the transfer of financial reports on wallets to standard accounting reports.

The first target market for the startup is coffee shops and fast-food restaurants, where people traditionally drink coffee or have small bills. The introduction of an electronic wallet system allowed one coffee shop client of the platform to increase sales volume by 30% and revenue by 26% on the same customer base. Revenue increased less than sales volume because some of the money went to customer rewards.

Currently, the startup is also targeting marketplaces to encourage them to open wallets for their customers as well — but there are no success stories from this area on the site yet.

Ansa was founded in 2022. It launched in early 2023 and immediately attracted $5.4 million in investments. It’s growing very well now — according to the founders, the number of wallets opened on the platform doubled in the first quarter of 2024. Therefore, now, a year after the previous round, it has raised new investments — but this time in the amount of $14 million.

What’s interesting

The idea with wallets reminded me of the hype that arose after the emergence of mobile apps. Back then, every seller or even website owner felt it was their duty to create their own mobile app to get onto users’ phone screens. After all, if an app catches someone’s eye on the screen — they feel compelled to use it 😉

And this strategy generally worked back then and continues to work now. It’s no wonder that the cost of installation and the number of app downloads are now important marketing metrics for almost all B2C services.

In this sense, wallets are the new apps 😉 Sellers can persuade users to deposit some money into their store-linked wallet — and then this money will “bug” users, prompting them to visit the store and spend it. Well, as I wrote above, it’s important to also deposit more money into their wallet so that the idle money continues to “bug” them.

Some sellers have long been opening their own wallets. However, it’s not excluded that now this could become as massive as it did with apps. And then platforms like Ansa will be in high demand because sellers can set up their branded wallets there without any hassle of programming.

By the way, right now I’m sitting, having coffee and writing a review in a coffee shop near home, where I last did this over a year ago. Back then, they didn’t have these electronic wallets, but now they do, as the girl at the counter asks each customer, “Will you pay with the app?” “redeem or accumulate bonuses?”

The marketing benefit of wallets suddenly became clear to me 😉 But it turns out that many sellers will be interested in creating their own wallets for an even more mercenary reason!

Many retail purchases are now made with bank cards, and in developed countries, it’s already the majority. In the USA, for example, the share of retail purchases made by cards is 60%.

However, sellers are forced to pay fees to card systems and payment aggregators for accepting card payments. Only in the USA, the total amount of these fees is a staggering $138 billion. And it turns out to be the second largest expense item for retail sellers after employee salaries!

Moreover, the fee structure of card systems and payment aggregators is such that on small checks, the percentage of fees becomes significant. For example, when buying a $4 cup of coffee, the seller is forced to pay a 12.5% fee! Which seems disproportionately high ☹️

But the seller can save the majority of this money if they transition their customers to their own electronic wallets. Because people usually top up their wallets with significantly larger amounts than the cost of a cup of coffee — and from this money, even when replenishing from a card, the seller will pay a significantly lower percentage of the fee.

Technically, paying for a purchase through an electronic wallet is simply transferring money from one pocket of the seller to another, so it should be free for the seller. However, Ansa itself takes a cut of these funds, as it’s how they make a living 😉 But for the seller, it ultimately turns out to be significantly more profitable than accepting a nominal $4 via card.

Where to Run

A possible direction to move in is to replicate the Ansa platform in order to catch the beginning of the real boom in electronic wallets.

If you think that everyone is already using such electronic wallets, or that all sellers already have them, it’s a cognitive distortion associated with being a very technologically advanced person, living in a highly advanced metropolis, or frequenting exclusively advanced establishments 😉

After all, 80–90% of any market consists of conservatives who adopt or implement technological innovations with significant delay. Besides, there are individual regions or entire countries that lag behind others in terms of technology.

This reminded me of a review I wrote at the end of last year for Durable, entitled “Think Everyone Already Has This? Think Again!”. The review was about the Canadian startup Durable, which rolled out a website builder platform for micro and small businesses. Within the first year, it created 6 million websites! Even though we might think that everyone already has websites 😉 By the way, this startup raised $20.25 million in investments.

I believe that with electronic wallets, the situation could be even more impressive. So, getting into this topic now could be very timely. Especially since we have a successful example to emulate right in front of us 😉

About the Company

Ansa

Website: ansa.dev

Latest funding round: $14M, April 30, 2024

Total investments: $19.4M, rounds: 2