- Any cloud service is global by default. In the sense that it can become global 😉 And if this doesn’t happen, then only for two reasons.

- The first reason is that the product is globally uncompetitive, which will eventually show up even in the domestic market. The second reason is that the founders lack the courage and ambition for this, which again will eventually make them give way on the domestic market to a global startup.

- There are only two ways out of this situation. Either make your startup global. Or create a platform that allows other startups to become global 😉 And here are examples of platforms that you can copy for this:

Project Essence

Anrok is a platform that enables cloud services to calculate and collect taxes arising from selling access to their digital products in different countries worldwide.

The two main taxes are sales taxes (value-added tax or VAT) and payroll taxes that companies pay to local employees, if any.

Software companies have fewer employees in other countries. However, an increasing number of countries and even states within a country are starting to levy sales taxes on digital products sold to their residents. The composition and size of these taxes vary everywhere, and they also change from time to time.

Non-compliance with local tax laws when selling digital products costs cloud services an average of 4.3% of their revenue.

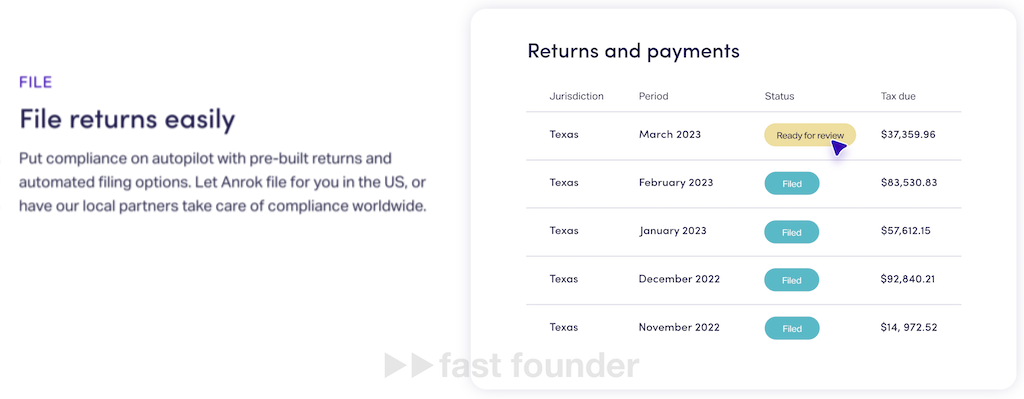

Anrok allows cloud services to automate tax management.

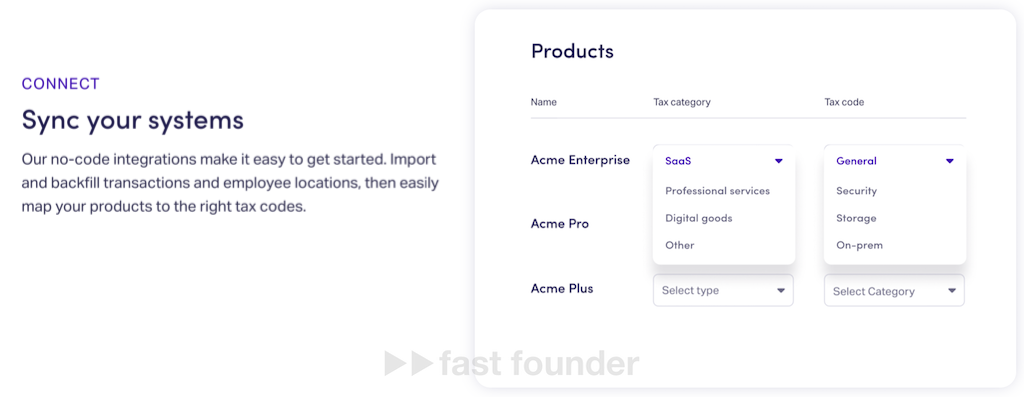

First, you need to upload information about the services sold, a list of past transactions, and a list of employees in other countries to the platform. Then add tax codes (product and employee categories) to this information by simply selecting the required values from the menu.

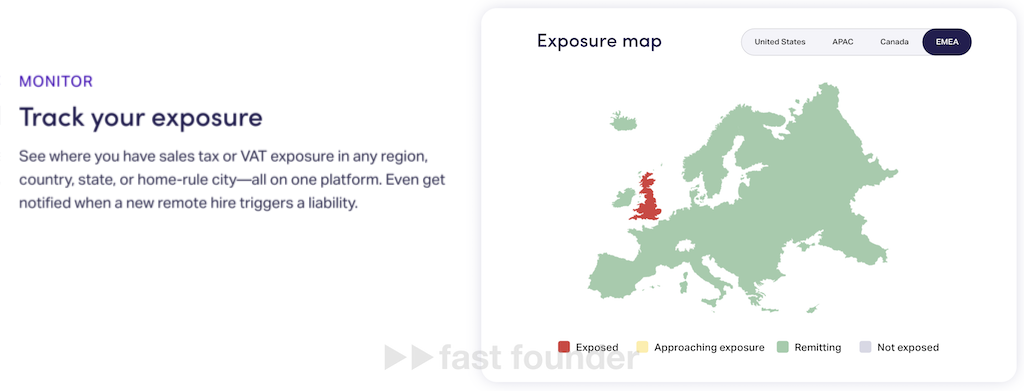

Based on information about sales locations, employee presence, sales volumes, and salary sizes, the platform will show on the map the areas where companies need to take action to start complying with local tax laws.

If the legislation in any of the areas changes, the platform will notify companies where they suddenly need to start paying taxes.

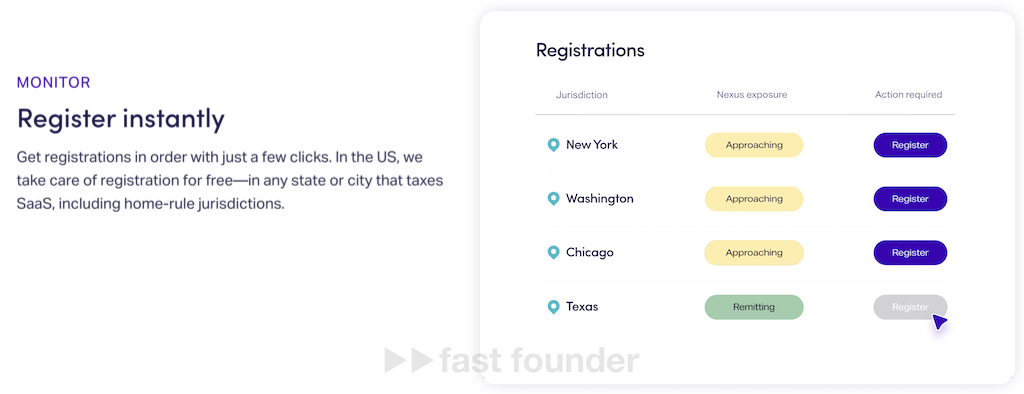

With one click on the platform, a company can apply for tax registration in the required area. Registration in US states is free, while other territories will incur a separate fee for registration.

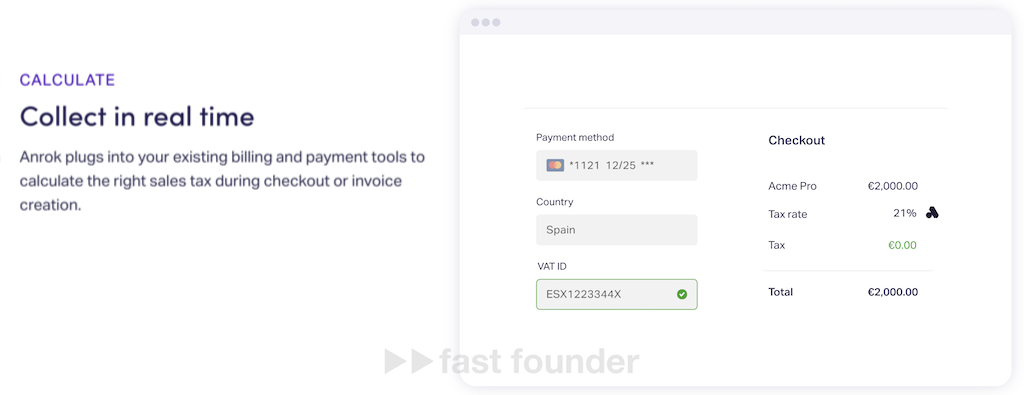

After that, tax status fields for buyers will be automatically added to the service’s payment forms displayed to customers in each area, and corresponding taxes will be calculated and added automatically.

Information about taxes collected in this way will be automatically collected and submitted to the tax authorities of the territory as reports, VAT refund applications, or other documents required by the legislation of that territory.

In the US, the startup itself handles registration applications and tax reports, while in other countries, its local partners do.

Anrok was founded in 2020 and has been growing steadily since then. Last year, it processed $7 billion in revenue generated by platform clients.

It also attracts investments steadily. In the summer of 2021, it attracted the first $4.3 million in investments, in the spring of 2022, another $20 million, and now another $30 million, valuing it at $250 million.

Here’s what’s interesting

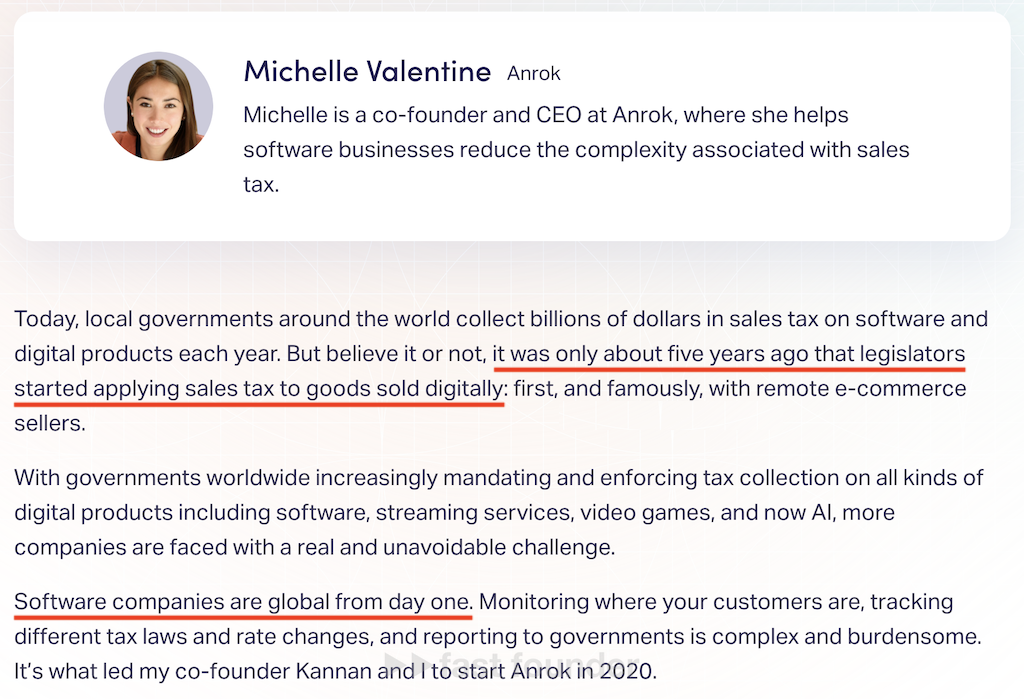

The first important point is that the tightening of local tax legislation regarding sales taxes in its territory began only 5 years ago. It was precisely this change that led to the emergence of today’s startup.

This once again reminds us that successful startups emerge on the wave of ongoing changes – in the market, in regulations, in technologies, or in human behavior.

Because everything old has already been invented before us 😉 And if something is missing, it means someone has already tried it and found that it doesn’t work. Moreover, it is worth noting that as a result of the ongoing changes, something old that couldn’t take off before these changes may suddenly become in demand.

The second important point is that software companies are essentially global from day one.

In the sense that they can become global. And if this does not happen, there are only two reasons for it:

The startup created a “subpar” product that either won’t take off or will eventually stop selling – because a more worthy global product will be bought instead. The founders of the startup lack the courage and ambition to start selling their product globally. Which ultimately will lead to a similar global product eventually displacing the local product from the local market – because the global startup will accumulate more strength and resources to make its global product better than the local one.

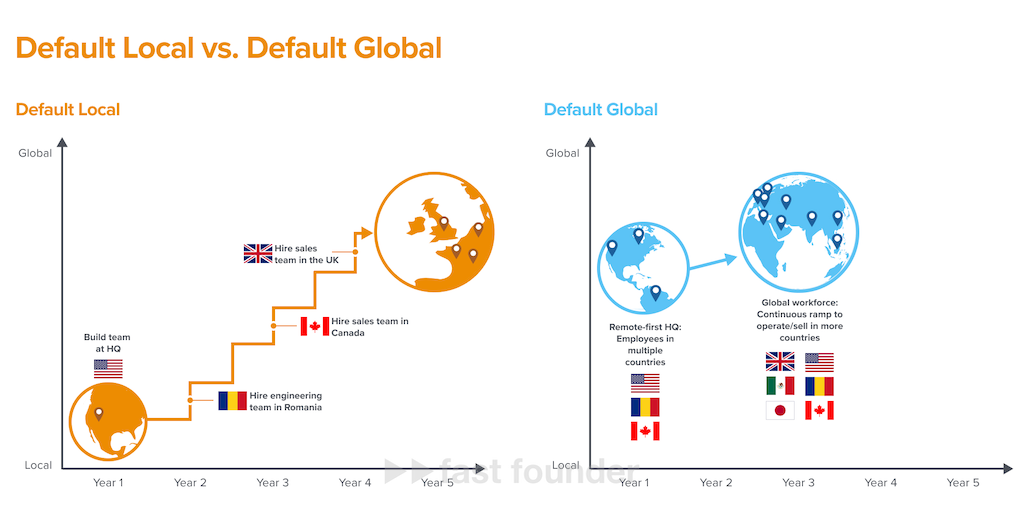

Business globalization is a powerful trend that also started to become mainstream not so long ago. The venture fund a16z claims in an article published in 2022 that the companies of the future should become global “by default”.

Previously, startups developed very slowly and gradually – first, they tried to conquer their domestic market, then, in case of success, every couple of years, they added one new country. Now, conceptually, nothing really prevents them from entering several countries at once.

In addition to a number of technical problems – including, in particular, problems with compliance with local tax legislation. But today’s Anrok will help solve them 😉

Such a sharp turn towards globalization is largely a consequence of the pandemic. During the quarantine, people, on the one hand, settled down at home. But on the other hand, they suddenly realized that online they could freely communicate with the whole world – including conducting negotiations, concluding deals, and working with remote employees located in any country in the world.

Technologies have allowed this for a long time, but there was always a lack of some “last drop” for everyone to decide on it at the same time 😉

Thus, the rise of today’s startup is due to the fact that it was able to capture and harness two key changes – changes in the taxation of digital products and the sudden desire of software startups and companies to start building global businesses.

Where to Run

The first conclusion from today’s overview is that every startup needs to consider becoming “global by default”:

Firstly, immediately aim to create products that can be competitive on a global scale. Secondly, stop considering the domestic market as your target market. Thirdly, be bolder and quicker in trying to enter foreign markets, not postponing it for “someday”.

The second conclusion is that you can create products that help other startups and companies become “global by default”.

Today’s Anrok is just one option. Here are several other examples.

OpenBorder offers local brand manufacturers of physical goods to take over their international sales “turnkey”. Such sales with OpenBorder can be started within a few days and increase their total revenue by 30–40% within six months. This startup has raised $10 million in investments.

Worldover has made a platform that allows manufacturers of cosmetic products to comply with the medical regulations of the countries they intend to supply their products to. Under the hood of the platform sits an AI engine that scours websites of relevant organizations in different countries, compiles and updates a common knowledge base, and helps companies fill out applications and obtain compliance certificates. This startup has raised £3 million in investments.

Onex helps manufacturers of medical products find distributors to sell their products in different countries around the world. This startup has raised $1.2 million in investments.

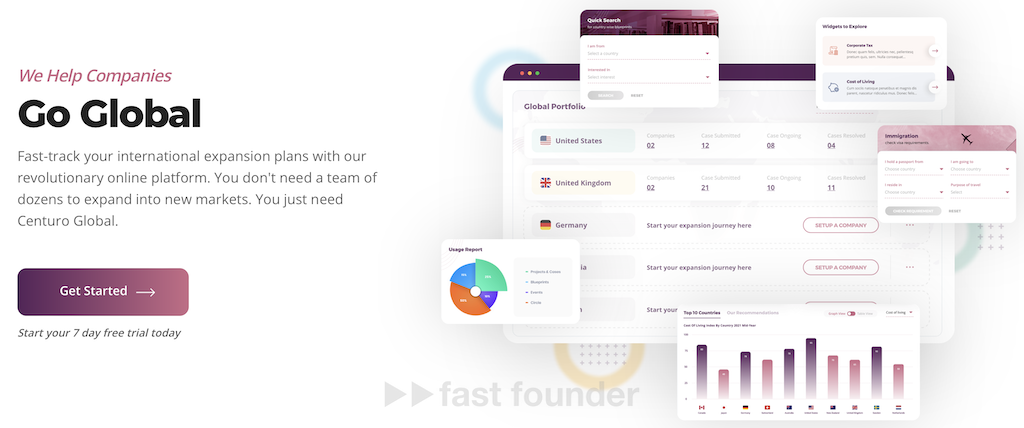

Centuro Global helps companies open local offices and conduct business in 170 countries worldwide. This startup has raised £3.3 million in investments.

So, which path will you take? Will you make your startup global on your own, or will you help other startups become global?

About the Company

Anrok Website: anrok.com

Latest round: $30M, 11.04.2024

Total investments: $54.3M, rounds: 3