- In a recent Y Combinator release, 3 startups emerged on one topic. These startups utilize AI to search for companies based on informal criteria — whether to sell something specific to them, resell through them, or outright acquire them.

- It seems that this is a new and promising theme — in which one can develop their product right now using the same approach. However, as usual, there are nuances.

- However, these nuances are good 😉 Because this approach can be made even more interesting and promising if delved into a little deeper.

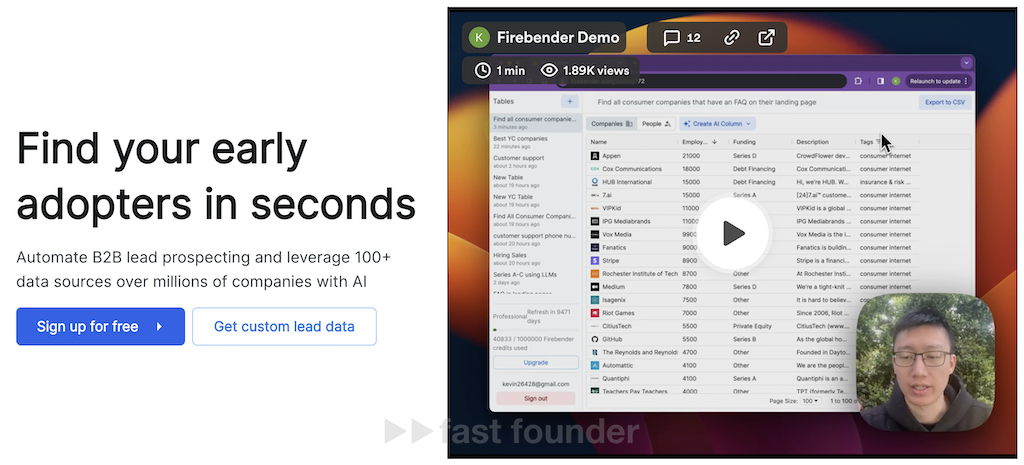

Firebender is a platform that helps B2B product developers find companies that could become their buyers.

Under the hood of the platform sits an AI engine that utilizes over 100 sources of information to compile a list of the most likely buyers for a specific product from among millions of various companies.

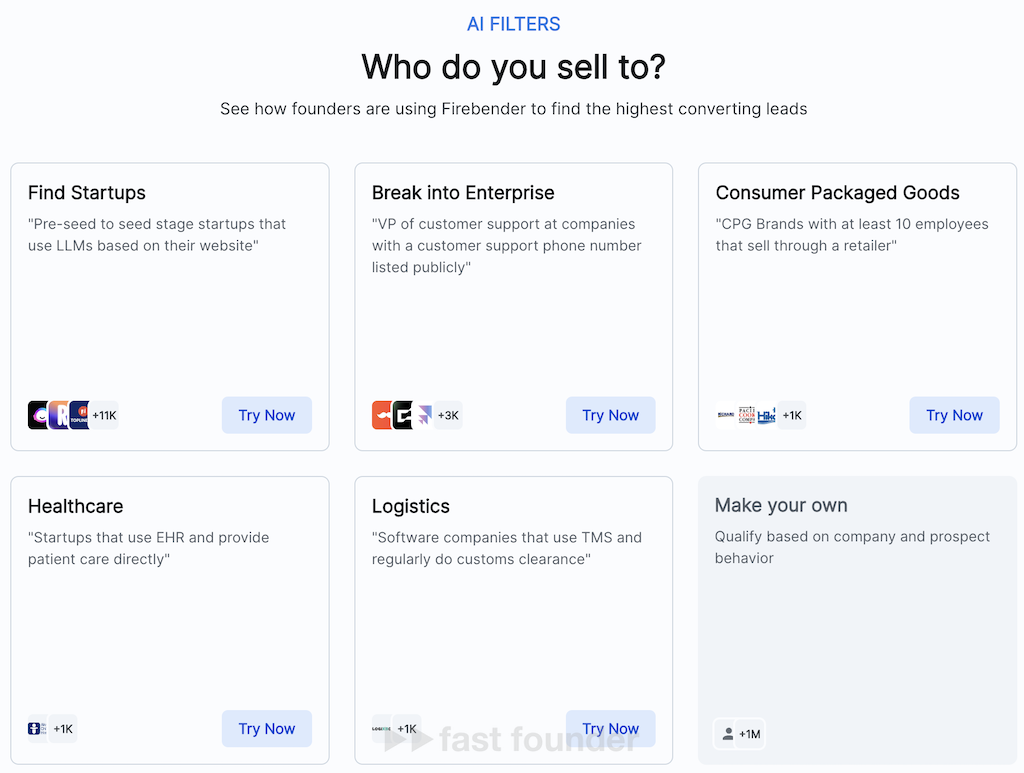

On the platform, companies can be found based on different criteria, such as “startups developing AI products that have received pre-seed or seed investments,” “customer support managers of companies with published support hotline numbers,” “companies with more than 10 employees selling food products under their brand through retail stores,” “startups providing medical services and using electronic medical records,” and “logistics companies with IT systems involved in customs clearance of goods.”

The problem is that most address databases only allow finding companies based on very formal criteria like industry and number of employees. Therefore, B2B sellers have to spend additional time searching for additional information about these companies to identify the most likely buyers of the products they are selling—by studying company websites, their posts on LinkedIn and Facebook, published job listings, and other sources.

Firebender does this long and painstaking work instead of sellers. Their AI engine pre-scans numerous sources in search of any additional information about companies, collects this information into a unified database, regularly updates it—and allows searching for companies in the collected database using queries formulated in natural language, which can then be refined using more formal filters.

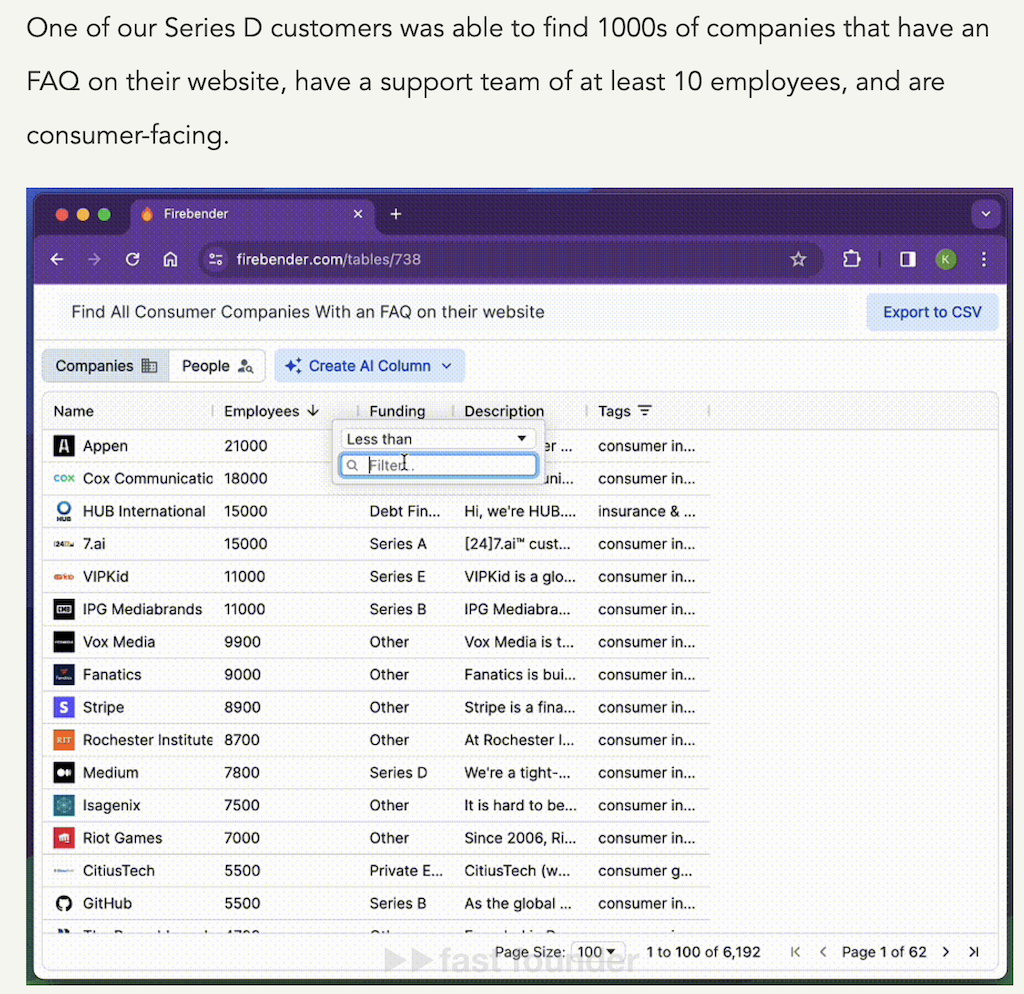

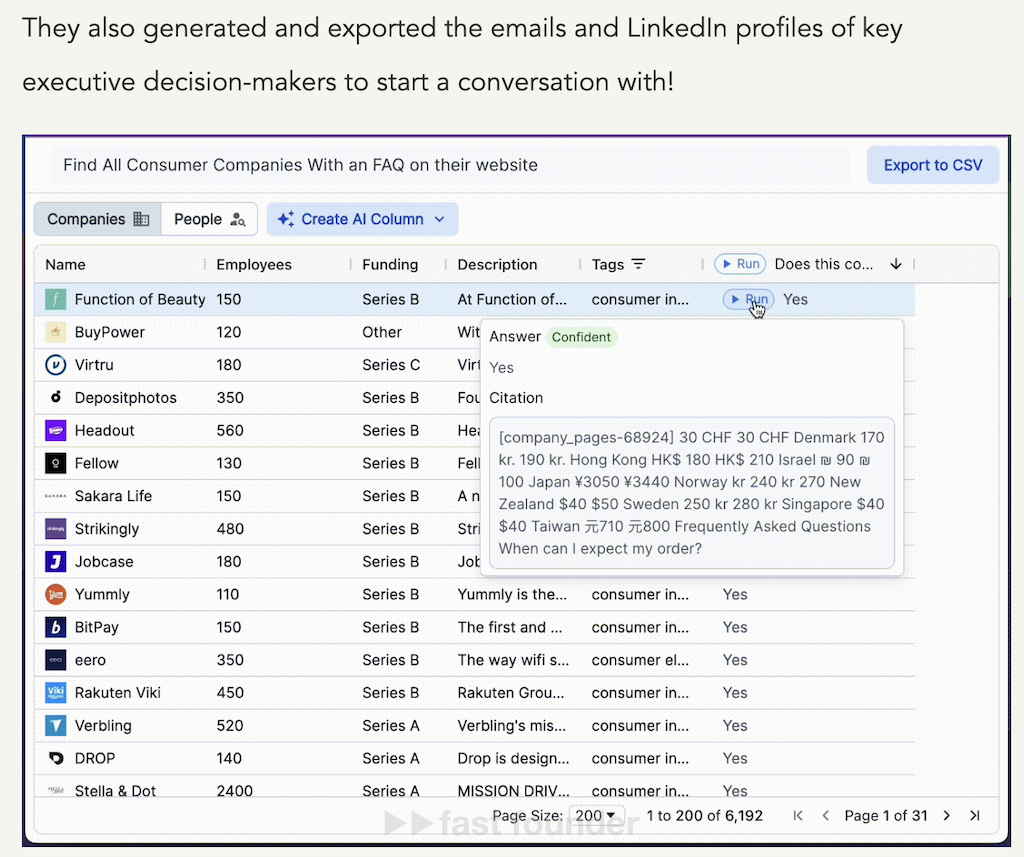

One of the startup’s clients managed to find “thousands” of companies selling their goods and services to individual buyers, who have a list of frequently asked questions (FAQs) published on their website and employ more than 10 support staff.

Furthermore, the client even received a list of decision-makers in these companies on the platform—along with links to their LinkedIn profiles and email addresses.

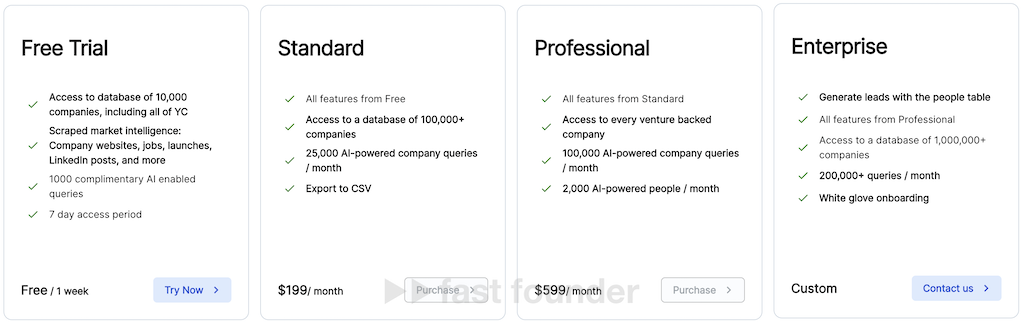

Standard prices for using the platform are $199 or $599 per month depending on the number of queries to the database. However, the size of the initial database in this case is “only” 100 thousand companies. Searching among the promised “millions” of companies is available only on the corporate tariff, the prices for which should be requested directly from the startup.

Firebender was created last year and recently graduated from Y Combinator, from which it received a deserved $500,000 investment.

What’s Interesting

The topic of using AI to compile lists of companies based on various criteria and for different purposes has turned out to be surprisingly relevant and in demand. In this batch of Y Combinator, there were at least 3 such startups.

Here are some of the others besides today’s Firebender.

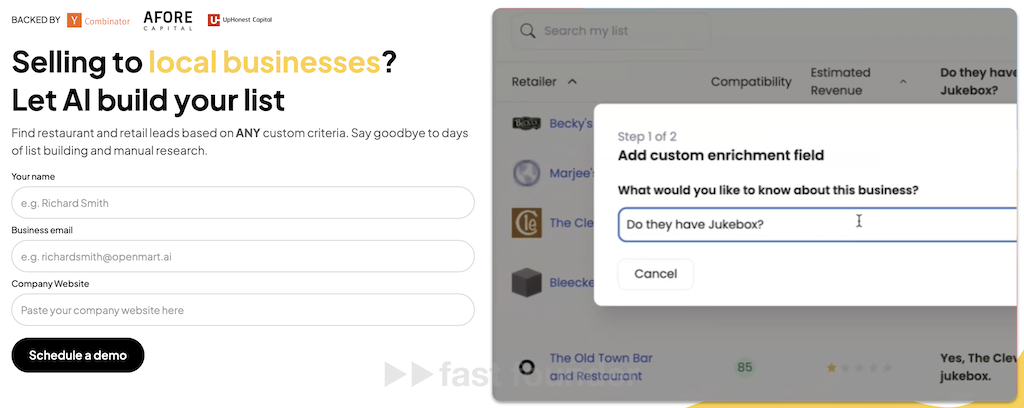

Openmart helps manufacturers and federal distributors find local resellers who may be interested in reselling their products. These resellers can be stores, beauty salons, dentists, hotels, restaurants, cafes, bars, tour agencies, museums, regional distributors, and marketplaces.

OffDeal helps federal companies and direct investment funds compile lists of local companies that may be of interest in terms of a potential purchase.

Thus, the topic of using AI to compile lists of companies based on a large set of “informal” criteria, for which information needs to be searched and combined from multiple sources, is a currently sought-after topic. Otherwise, Y Combinator wouldn’t have chosen such startups in such numbers for its accelerator 😉

The whole point of such startups lies in choosing those very informal criteria for finding companies.

At the same time, it seemed to me that today’s Firebender formulated a very interesting criterion in its main offer on the first screen of the website—but one that, unfortunately, wasn’t further developed in the product description.

They proposed to sellers not just to find potential buyers, but “early adopters” of the products and technologies they are selling.

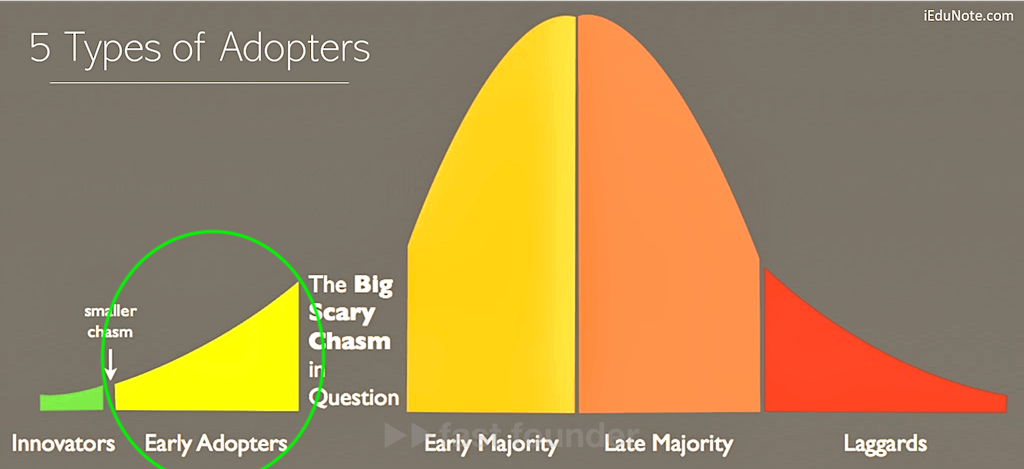

This name comes from the well-known theory of the sequence of new product adoption in the market.

First, a small number of “innovators” start using them, who actively love to try everything that has just appeared. Then, the penetration briefly stalls, after which a larger number of “early adopters” start using the product—those willing to try something new, but already tested by someone in some way. Then comes a fairly long “chasm,” which not all products are capable of crossing. The product either disappears in this chasm, or after some time, the “early majority” starts using it—and the product starts to grow rapidly and significantly. Then the more conservative representatives of the “late majority” start using the product. Followed by the most conservative “laggards.” In other words, the demand for the product depends not only on the problem it solves and its set of properties—but also on the stage at which the product itself is! Because most people, on principle, are not ready to use new products—simply because they are new ☹️

Therefore, the most critical audience for buying new products is the early adopters:

Firstly, they are ready to buy new products. Secondly, there are noticeably more of them than the very risky innovators. Thirdly, whether the product can survive on the accumulated user base until the “chasm” is exhausted depends on the number of early adopters. That is, until the product becomes “old” or “proven” enough to attract the attention of the early majority. The problem is that the behavior of early adopters differs from that of innovators. Innovators are enthusiasts who actively monitor their field of interest and seek out new products themselves. But early adopters are not such “enthusiasts in eternal search” 😉 Early adopters are ready to try something new—but they need to be approached and shown this new thing.

So, early adopters already need to be found. But this turns out to be too difficult and expensive:

Firstly, this is a completely informal criterion that we cannot set in regular advertising targeting. Secondly, there are fewer such adopters—so by advertising based on formal criteria, we will mostly reach those who are not yet ready to buy our product at an early stage. And this will negatively affect conversion rates and the cost of acquiring a customer.

Thus, the task formulated by today’s startup to find people and companies that could become early adopters of the product being sold is very important and interesting. However, at least explicitly, he did not formulate solutions to this problem.

Where to Go

The general trend is to follow the clearly defined interest of Y Combinator 😉 That is, to create platforms that use AI to search for potential buyers (resellers, partners) based on a set of meaningful informal parameters in a specific field. Moreover, it seems that there’s no need to limit oneself to B2B sales, as similar approaches could work just as well in B2C.

In which field do sellers spend a lot of time and effort searching for potential buyers (resellers, partners)? What informal criteria do they use to qualify leads? What additional sources of information do they use for this? What other sources of information could be used to draw similar conclusions and assumptions? How can this be automated?

A more narrow direction is to create platforms and tools not just for finding potential buyers, but for finding early adopters.

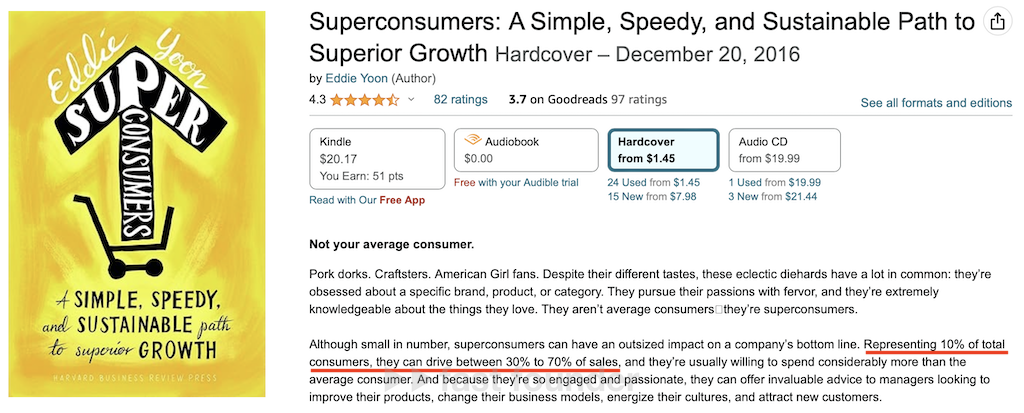

In my opinion, the concept of “early adopters” has a good intersection with the concept of “superconsumers.” An unexpected fact is that in each product category, 10% of buyers generate 30–70% of all revenue in that category because they buy more frequently and in larger amounts than others. These people are called “superconsumers.”

The trick is that superconsumers in one category usually are also superconsumers in 9 other categories! And not necessarily in adjacent categories—but in any. Because what usually makes people superconsumers is not just a passion for something specific—but their overall character traits and corresponding financial capabilities.

This means that we can notice superconsumer behavior in one category… and make a fairly reasonable assumption from this that we can “super-sell” them something from a completely different category—just because they are that kind of person 😉

Similarly, if we find that someone has become an early adopter of a product, then we can reasonably assume, with a sufficient degree of confidence, that they can become an early adopter of a product from another category—because by their nature, they are not afraid to try new things.

Considering that in every company, decisions are initiated and/or made by specific individuals—the same could apply to B2B sales.

In simple terms, if the owner of a small company recently bought a product from a startup, then we can offer them another product from a different sphere of another startup—because the limited spread of the product is not a fundamental obstacle for them to make a purchase. Or, if the director of customer support at a large company regularly buys new and unusual phones and cameras—our startup has a chance to sell them a new and still unknown program for automating customer support 😉

Even if you don’t delve into this specific narrow direction, it’s a cool illustration of how choosing unexpected informal criteria can be the basis for an interesting product in the mentioned topic today.

So, what set of informal criteria and in which areas can you suggest for your own interesting product? 😉

About the Company

Firebender

Website: firebender.com

Last round: $500K, 01.12.2023

Total investments: $500K, rounds: 1