- A “global redistribution of property” has begun worldwide! Aging business owners have started passing on their companies to heirs and selling them off. In the United States alone, assets worth $90 trillion will change hands in this way!

- It’s a unique time when you can buy a good company for reasonable money. After all, they’ll be sold not because they’re failing but because their owners are retiring. This means that the market for business buyers will become significantly more active.

- To profit from this, it’s not necessary to “dig for gold,” meaning to buy companies. You just need to sell “shovels” to these gold-seeking buyers in the form of AI platforms like this:

Project Essence

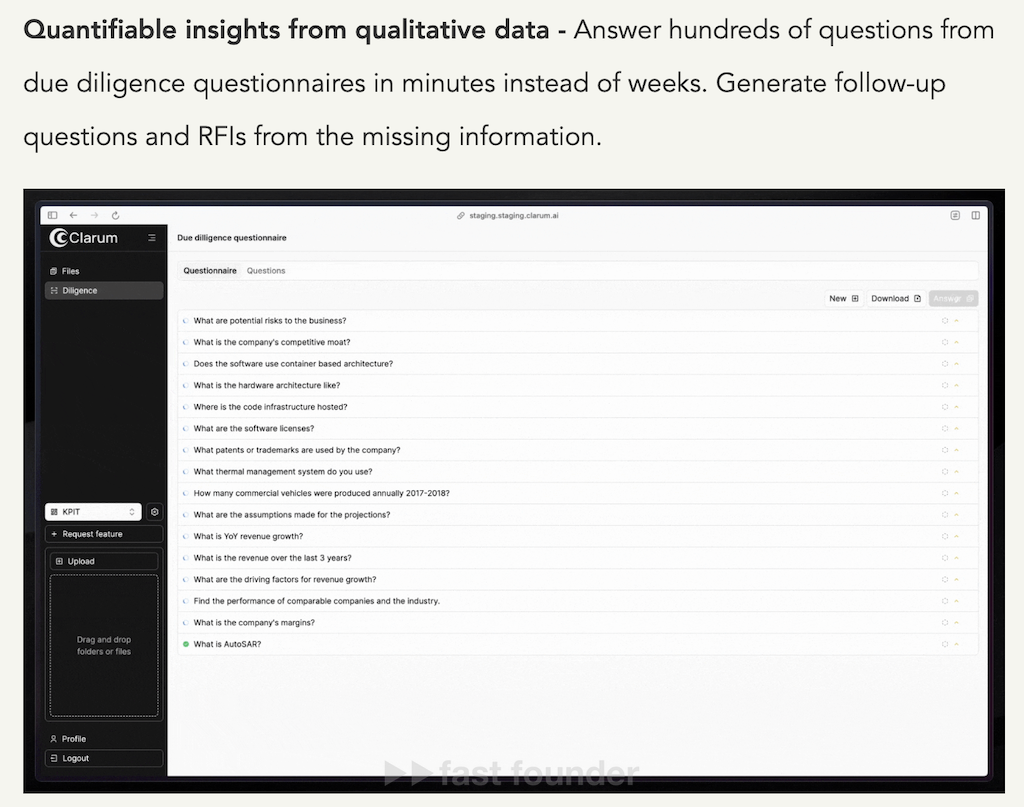

God bless every startup to have the hassle of “due diligence” — with a comprehensive business check before the planned purchase 😉 After all, this means that the buyer’s intentions are serious. Since they conduct this check on their own and at their own expense after signing a preliminary document on the purchase terms (termsheet). This check is usually the final hurdle to overcome before signing the final contract.

However, conducting such a check is really a hassle for both the buyer and the owner of the business being purchased, taking a lot of effort, time, and nerves from both sides.

Clarum decided to make this process much faster and simpler by using AI, which will take the lion’s share of this hassle upon itself.

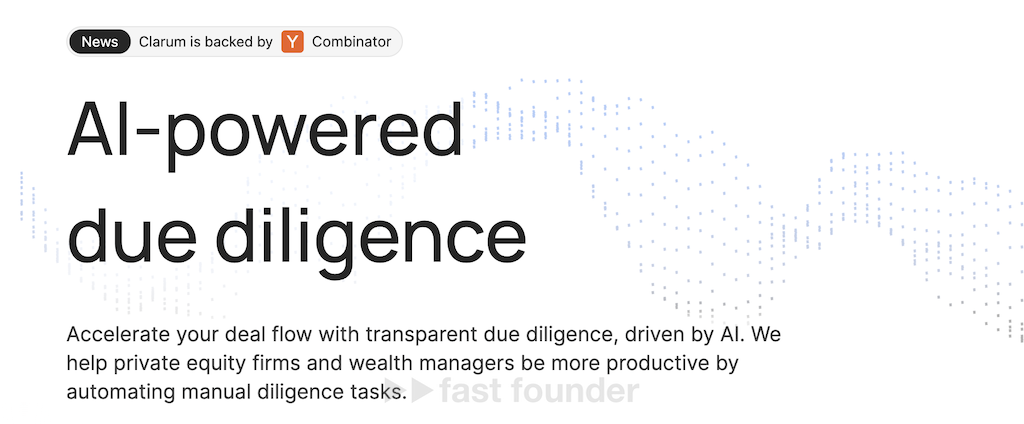

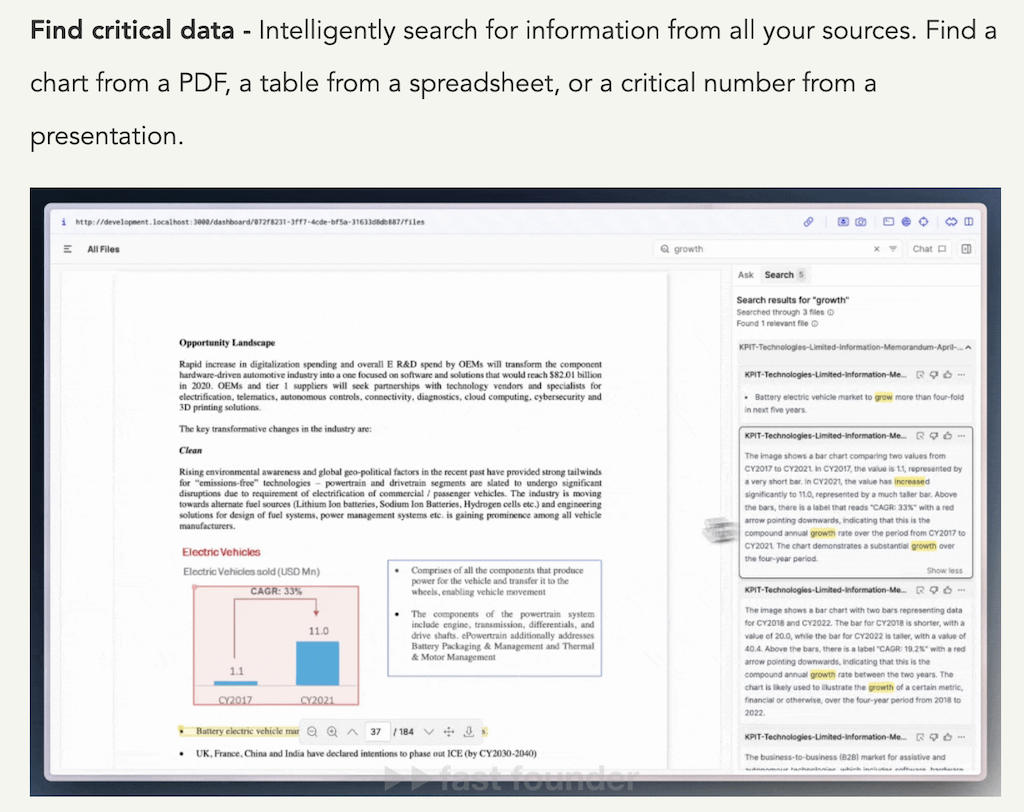

First, the buyer must import documents provided by the owner of the business being purchased onto the Clarum platform — financial reports, presentations, contracts with customers and suppliers, business process regulations, and everything else of that nature.

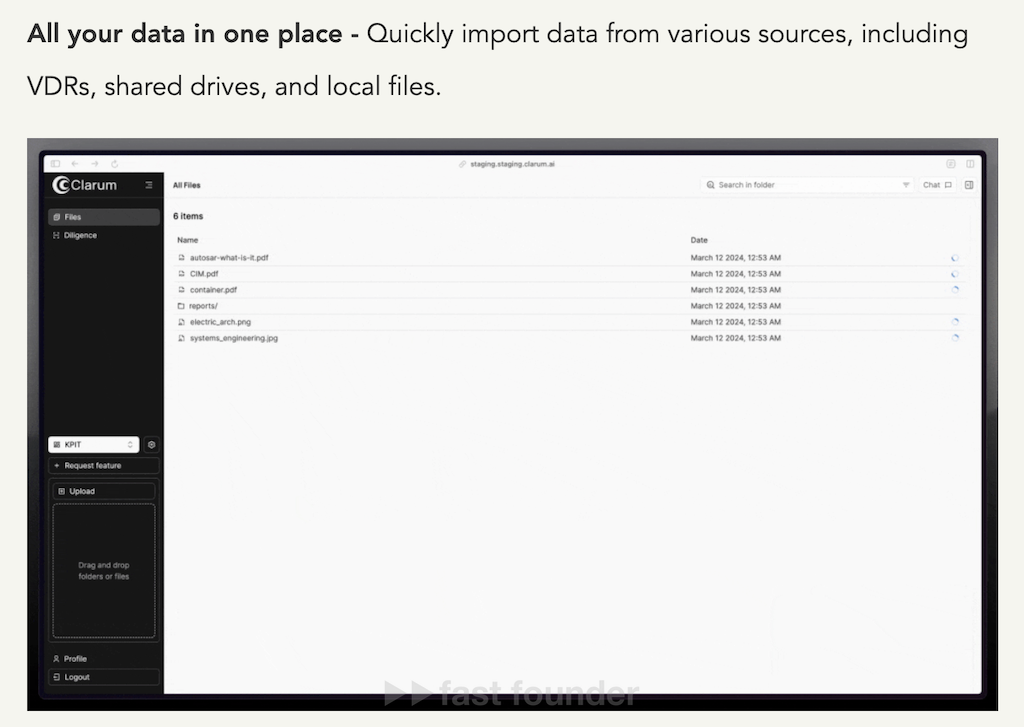

After that, the buyer can ask the AI platform any questions related to the essence of the business being purchased, the answers to which can be formulated based on the information available in the uploaded documents.

At the same time, all the answers from the AI platform will be accompanied by references to sources — whether they are text documents, tables, or graphics from presentations.

If the buyer professionally deals with the purchase of businesses, then they have a list of already prepared questions, but it is usually quite extensive. Nevertheless, the buyer can hand over this list to the AI platform, and it will quickly generate a document with answers to all these questions.

Clarum has just graduated from Y Combinator, from which it received the promised $500,000 investment. The startup itself was created at the end of November last year.

What’s Interesting

Interestingly, in the same Y Combinator batch, there is another startup in the same business acquisition theme.

To use Clarum, you first need to find a suitable acquisition target. And to do this, you need to sift through a bunch of businesses to make a rough and preliminary assessment of at least potential interest for possible purchase.

Currently, this is done manually. Even companies that professionally engage in business acquisitions may not sift through more than 100-150 companies per week. However, to find even one suitable business, you need to sift through about 10 thousand companies.

Considering such a lengthy preparation stage, followed by discussions, and then complex due diligence, the business acquisition process, even for small businesses, can easily take 18-24 months. Thus, the time and monetary costs of the acquisition process turn out to be very high.

Clarum plans to automate the comprehensive due diligence process, while OffDeal has decided to use AI to optimize the process of searching for companies that could be acquisition targets.

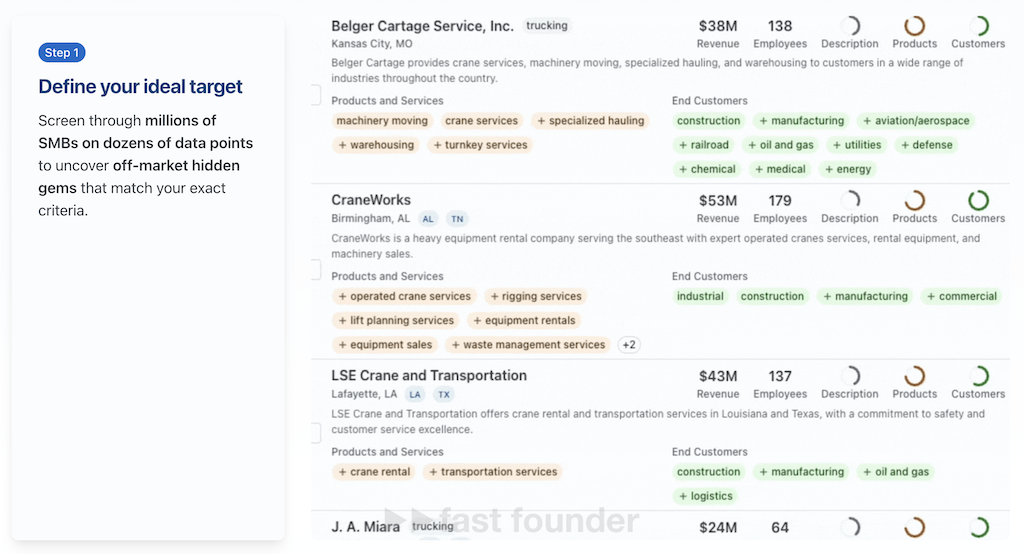

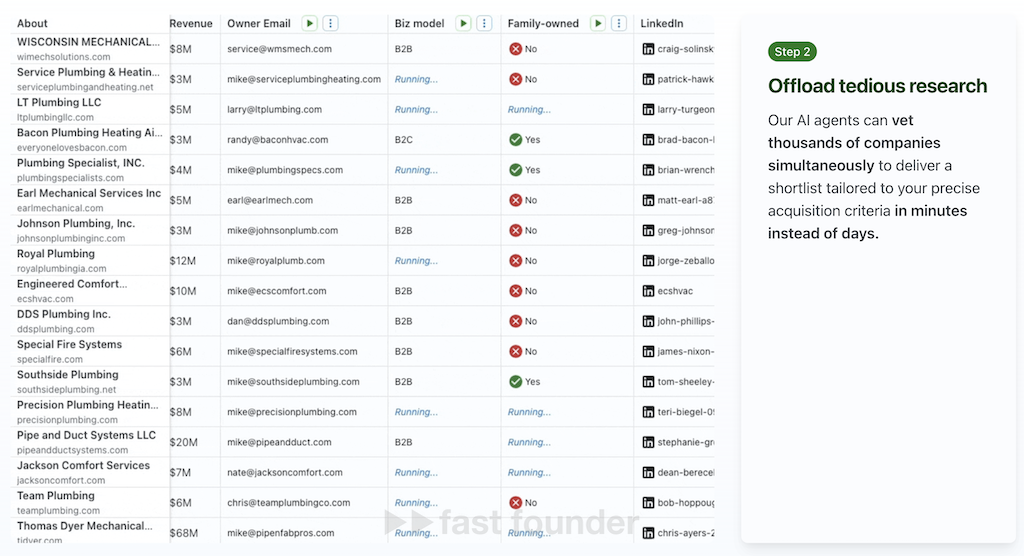

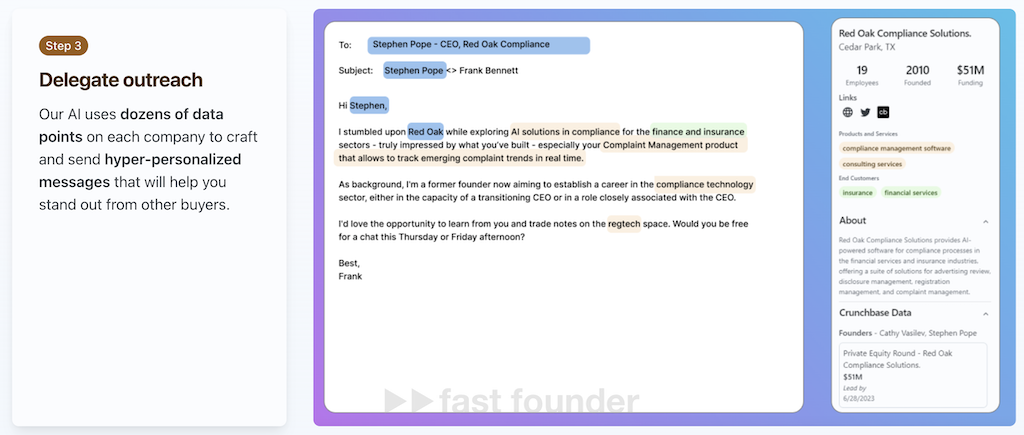

Using the internet and open sources, the OffDeal platform allows the buyer to create a preliminary list of companies based on a set of criteria, including specialization, location, approximate client list, revenue assessment, and the number of employees.

The resulting list can be further filtered and sorted according to additional criteria — accomplishing in minutes what would take days, weeks, or even months manually.

After creating a shortlist, the buyer can even ask the AI platform to send individual emails to all the companies on the list to further engage with companies that have expressed preliminary interest in negotiations for a possible purchase.

Why suddenly two startups in the same business acquisition theme in one Y Combinator batch?

Firstly, business acquisition is such a separate business area that can also be profitable 😉

Secondly, acquiring small regional companies is perhaps the easiest way for companies looking to expand their national presence to grow and develop.

Thirdly, on a global scale, a voluntary property redistribution process has begun and will continue for at least the next 20 years — as aging owners of existing businesses pass them on to heirs or sell them to external buyers.

Some studies on this subject claim that in the coming years alone, assets worth $90 trillion will change hands in the United States!

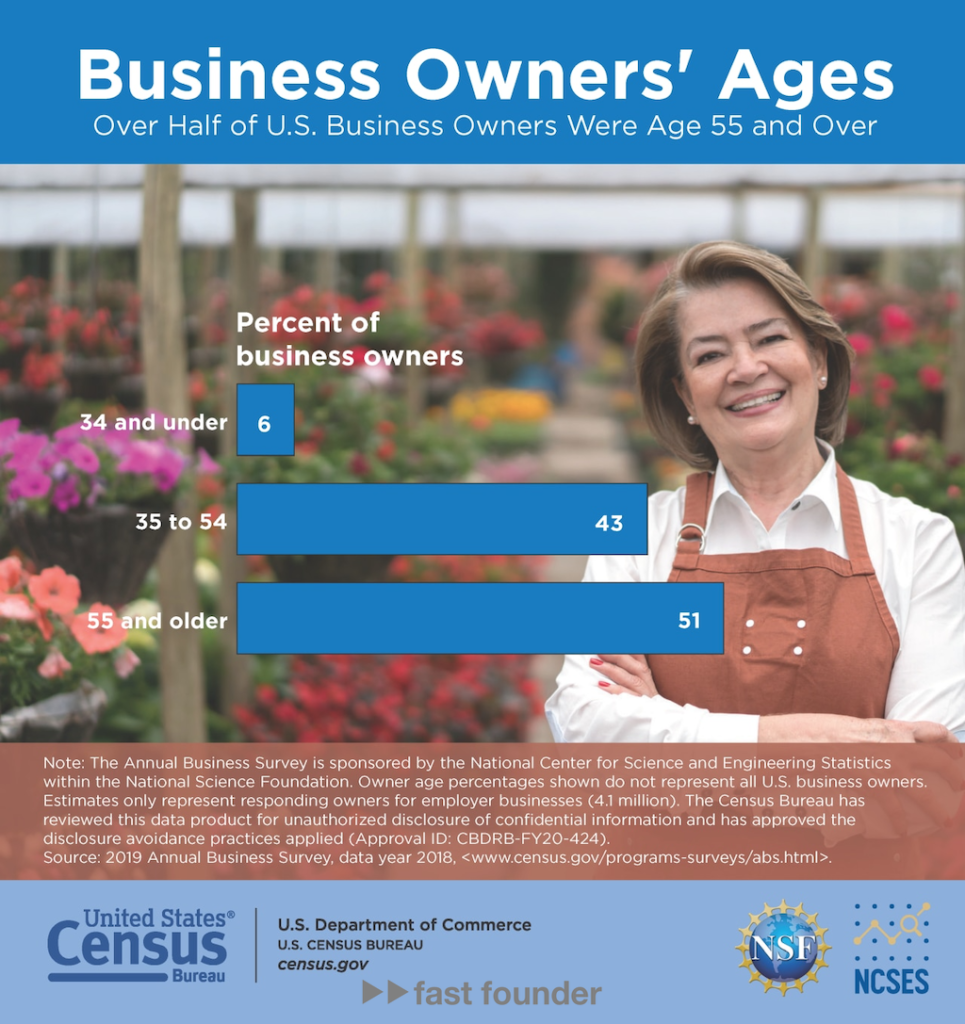

This global change is an excellent opportunity to acquire other companies for earning or developing one’s own business. The owners of 51% of American companies are already over 55 years old. And the owners of another 41% of companies, aged 35 to 54, are being followed closely — the youngest of whom will begin to consider selling their businesses starting “tomorrow,” and over the next 20 years.

Passing on to heirs or selling to external companies and investors is one of the possible ways to exit a business, optimization of which is being undertaken by Clarum and OffDeal mentioned today.

Another way out is to sell the company to its own employees. And startups have also emerged for this method:

Teamshares buys companies entirely and then, over 20 years, transfers an 80% stake to a trust fund, whose participants are company employees. They raised $245 million in investments.

Common Trust doesn’t buy anything itself; instead, they provide assistance and support in the rapid process of transferring the company from the former owner to a trust fund consisting of employees and even the company’s clients. They raised $2.6 million.

In addition, companies have emerged that aim to become leaders in specific business areas by acquiring local companies in that field. Among them are:

Platform Accounting Group first introduces its centralized business optimization platform into small legal companies and then is ready to acquire companies that have successfully integrated this platform. They raised $85 million in investments.

Pipedreams does the opposite — they first acquire local companies engaged in the installation, repair, and maintenance of heating, ventilation, and air conditioning systems, and then implement a centralized business optimization platform in them. They raised $35.7 million.

Where to Run

From a technological standpoint, today’s Clarum and OffDeals are not particularly innovative. Many startups have already begun using AI to create corporate knowledge bases (essentially what Clarum does) and to search for potential B2B clients and partners (the same technology used by OffDeals).

Their novelty lies in the fact that they have chosen a somewhat unconventional theme for applying already common technologies. And this approach could turn out to be promising for creating their own AI startups — not by creating “even better” technology, but by finding such areas of application for existing technologies where a bunch of competitors have not yet rushed in.

So, the first direction of movement is to search for such “unusual” areas of AI application.

Where could you apply AI? What seemingly inconspicuous types of businesses or types of tasks do you know where AI can save time and money?

Now, the second direction of possible movement is to enter the business buying and selling market, which will be actively growing over the next 20 years.

Entering this market can be done from different sides and with different business models. One option is to sell “shovels” to those who are planning to dig for gold in this market 😉 In other words, create an analog of Clarum and OffDeals, possibly even combining them within a single platform.

About the Company

Clarum

Website: clarum.ai

Last round: $500K, 01.12.2023

Total investments: $500K