- It turns out that online stores and marketplaces are making very good money from advertising—rather than from selling goods. Here are just a couple of convincing examples.

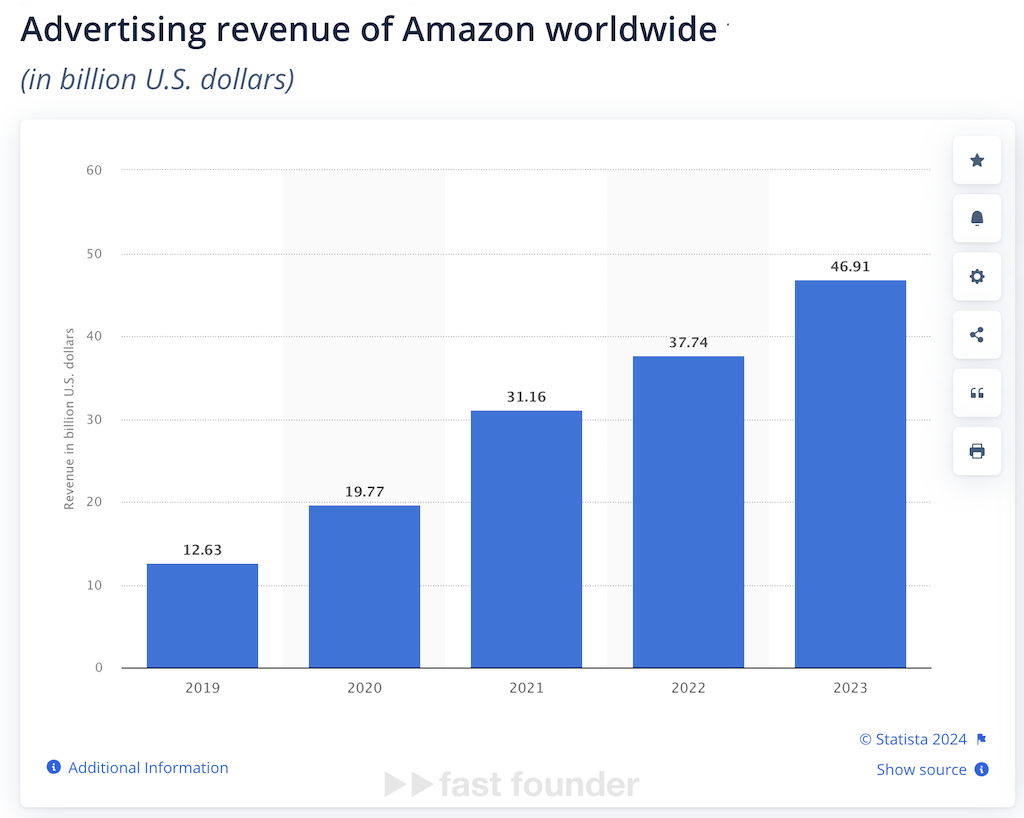

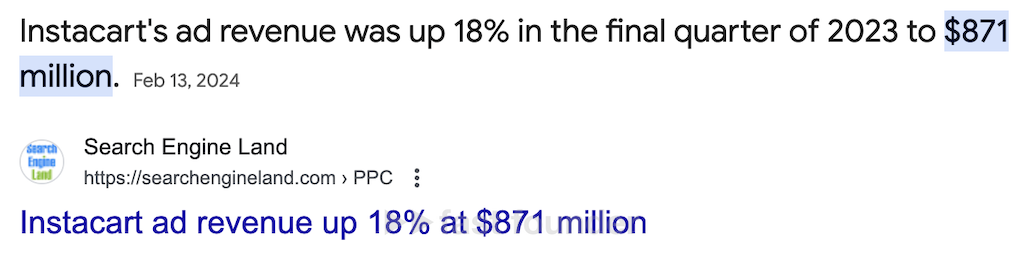

- In 2023, Amazon made $47 billion from advertising by sellers on its marketplace. And at Instacart, 30% of total revenue comes from advertising revenue from stores they deliver goods from.

- The size of the market for such “retail advertising” will soon grow to $130 billion! And you can grab your piece of it if you create your platform following this model:

Project Essence

Kevel is a platform where you can launch your own advertising network.

In principle, anyone can launch an advertising network on their platform. However, the startup focuses on what is called “Retail Media” or “retail advertising,” and their product is called the “Retail Media Cloud.”

“Retail Media” is when online retailers, marketplaces, and other e-commerce players decide to earn extra money on content and advertising by offering paid ways of promoting brands and sellers featured on their platforms.

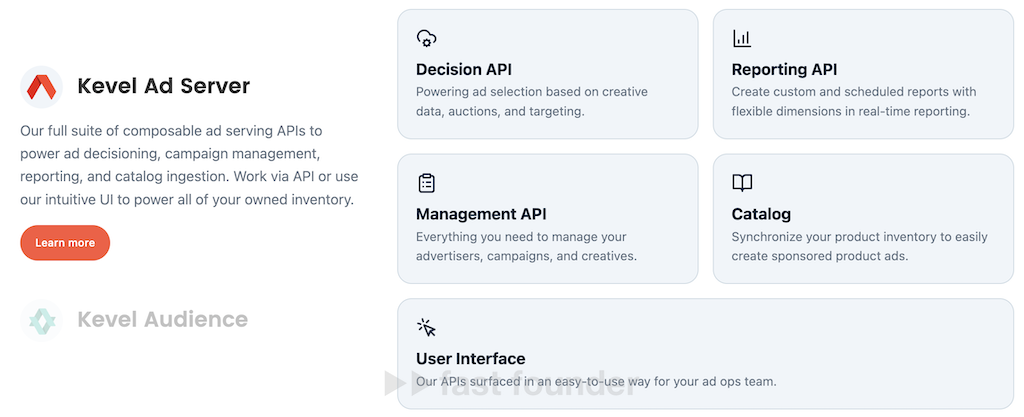

The Kevel platform consists of two main blocks.

The first block is the ad-serving server. There are various pricing systems, including fixed prices and auctions, a self-service ad placement interface, a statistics module, and even the ability to integrate the advertiser’s product catalog so they can quickly and easily select products to advertise.

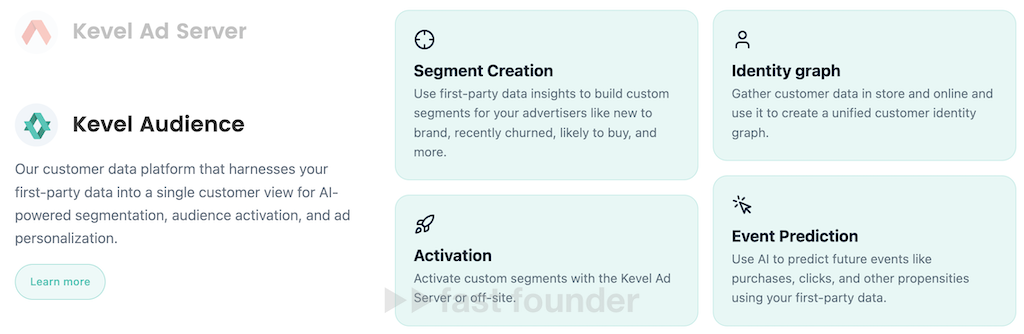

The second block handles targeting the displayed ads. It can automatically segment the audience and automatically adjust ad serving to optimize the cost per impression, click, or purchase, depending on what the advertiser has chosen as the goal of their ad campaign.

The platform can display not only regular banners but also e-commerce-specific formats—featured product listings, videos with their descriptions, blocks with promotions and sales descriptions.

The startup does not take a share of its clients’ advertising revenue generated using the platform. Clients pay “only for the technology”—roughly speaking, for the number of ad slots and the number of ad impressions.

At the same time, the platform’s client can embed ads into their platform in any clever and necessary way—using the platform’s API.

The startup already has enough clients, including small, medium, and even large companies like Delivery Hero.

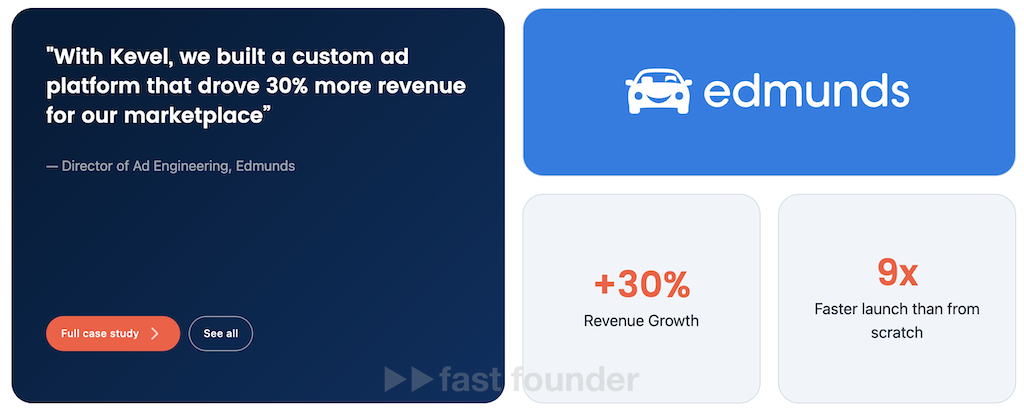

For example, one not very large automotive marketplace added the ability to display ads from its featured sellers—and got a 30% increase in its revenue. At the same time, integrating the Kevel platform took 9 times less time than if the marketplace developers had created a similar platform from scratch on their own.

Currently, Kevel has raised $23 million in investments, thereby increasing the total investment in the project to $45.2 million.

What’s Interesting

Why bother with advertising for online stores and marketplaces when they make money from selling products?

Because they can also make very good money from advertising 😉 And the margin on advertising will be very fat—since from the revenue earned, only the expenses for maintaining their own ad server or paying a third-party platform like Kevel need to be deducted.

For example, Amazon earned nearly $47 billion from advertising placed by sellers on its marketplace in 2023—and as seen from the picture, this revenue volume is steadily growing.

Comparatively smaller than Amazon, Instacart earned $871 million in advertising revenue from stores it delivers goods from in just the last quarter of 2023. Moreover, their ad revenue increased by 18% compared to the previous quarter.

To grasp the scale of such figures, one needs to understand that Instacart’s advertising revenues make up almost 30% of their total revenue. And their advertising revenue is growing, while delivery volumes are not 😉

Against the backdrop of such numbers, it can even be argued that online stores (and marketplaces) are gradually turning into specific media—that profit from selling advertising, not goods.

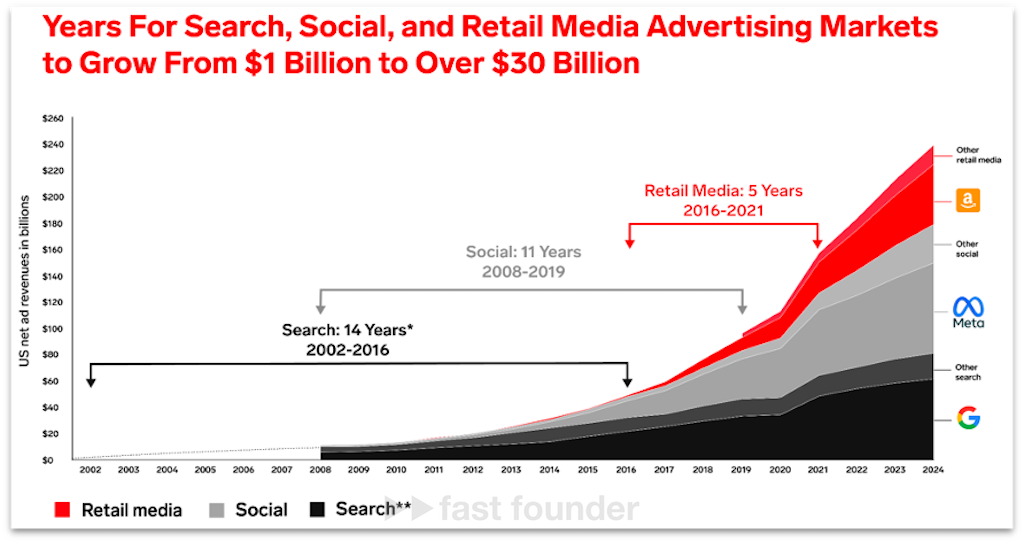

Moreover, the retail advertising market is growing much faster than any other advertising markets. It took search advertising 14 years to grow from $1 billion to $30 billion. Social media advertising took 11 years to grow from $1 billion to $30 billion. And retail advertising—only 5 years.

And this leap happened not so long ago—from 2016 to 2021. Thus, when talking about retail advertising, we are dealing with a recently occurred key change and a market growing as a result of this change.

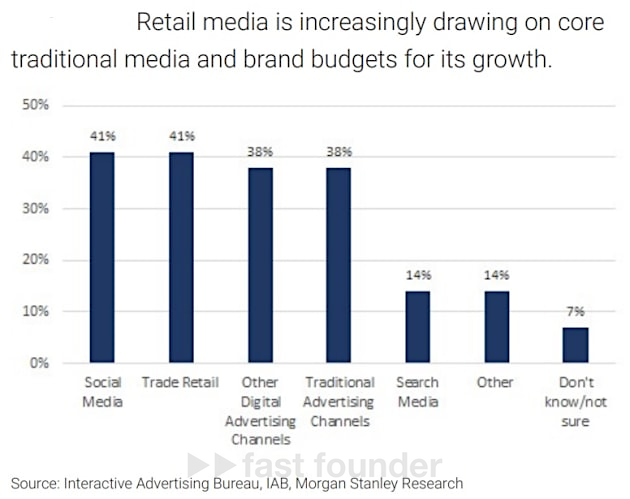

If we look at the advertising market as a whole, we will see that advertisers are already spending the same amount of money on retail advertising as they do on social media advertising. For comparison— they spend three times less on search advertising.

In a recent Morgan Stanley report, it is suggested that the volume of retail advertising will soon grow to $130 billion.

The leader here for now is Amazon, which holds 47% of this market. Two other major players are Criteo, to which Morgan Stanley predicts 15% of the market, and Trade Desk, which Morgan Stanley assigns 5% of the market.

The rest will fall to the share of other players, and one of them is today’s Kevel. However, by raising new investments, it surely wants to compete with Criteo and Trade Desk. Although even the fourth place in this market can turn into a very lucrative cash cow 😉

Where to Run

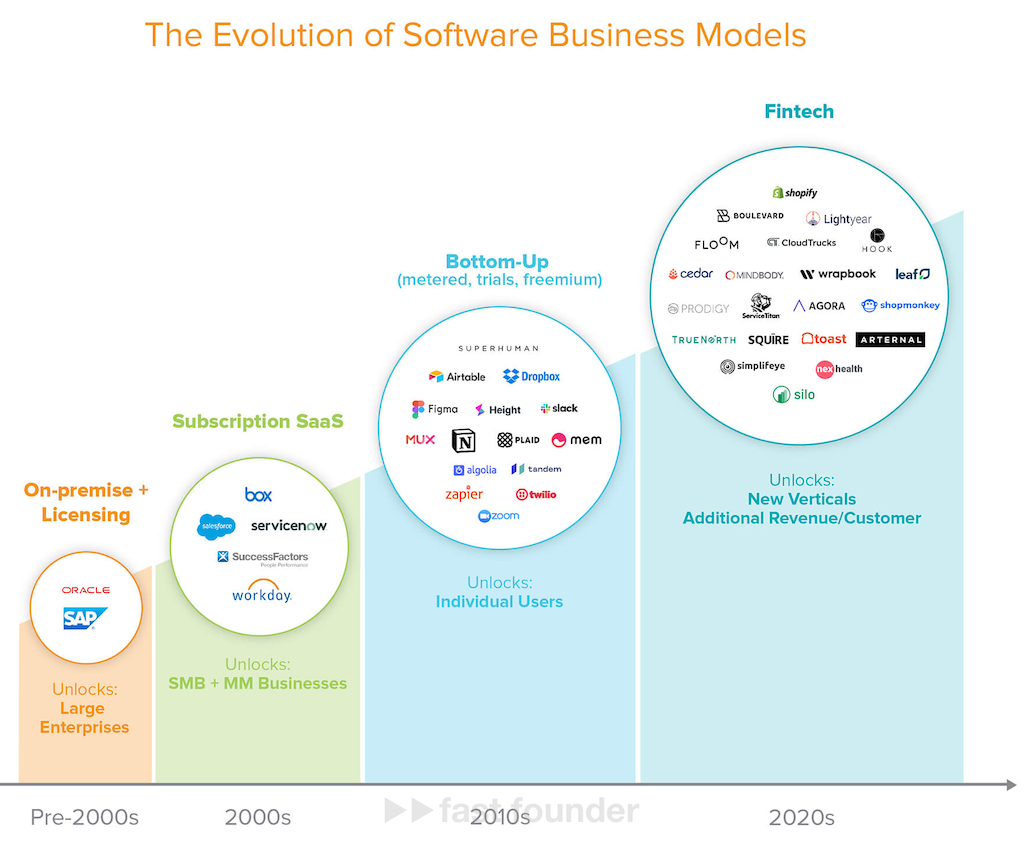

In 2020, the well-known venture capital fund Andreessen Horowitz published an article depicting the evolution of software businesses. Initially, it was about licensing for use on clients’ local servers, then subscription to cloud services, then “pay as you go” (usage-based pricing), trial versions, and freemium models.

And in the 2020s, the fintech revolution began—when developers of cloud services in any field started adding financial services to them to scale their business through new sources of revenue. Thus, cloud services began to transform into fintech businesses.

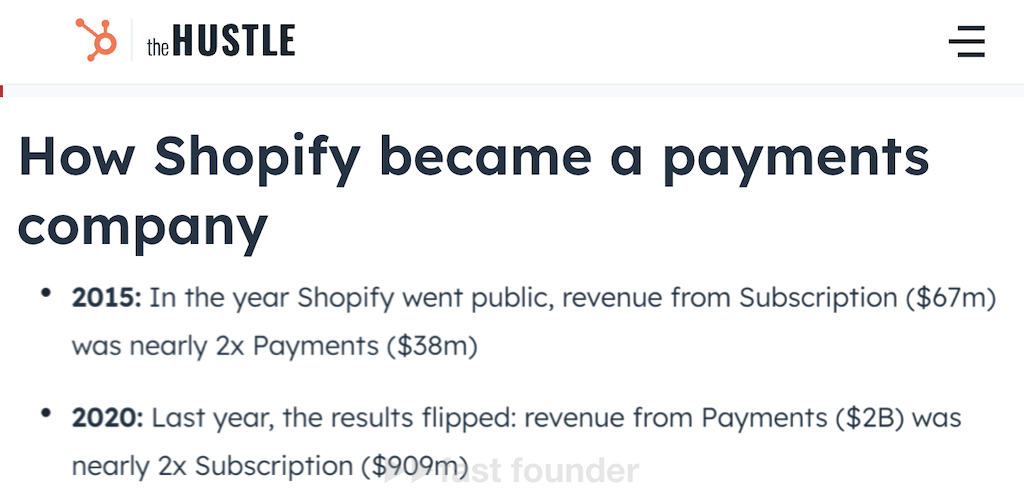

And this seems to be true. For example, the e-commerce website builder Shopify’s revenue from commissions for payments in stores created on the platform was already twice the revenue from platform subscriptions in 2020. In total, financial services (including loans to sellers and other “trifles”) currently account for 76% of Shopify’s revenue!

A similar story, apparently, is happening in the e-commerce market. Players in this market have also started earning additional revenue from financial services—such as financing (installments, leasing, factoring) for their customers, and even sellers in the case of marketplaces.

Now, the most advanced of these players are targeting a new source of additional revenue—retail advertising. But for this, they need reliable and functional advertising platforms. Amazon is developing its own advertising platform. However, not all players in the e-commerce market have the necessary resources and desire. Therefore, platforms similar to today’s Kevel will become even more in demand.

It turns out that the possible direction of movement is the creation of platforms that allow players in the e-commerce market to earn revenue from retail advertising.

This market is still growing, and not all players in the market are already tied to one of these platforms. And the size of the market is large enough to support not just one, not two, and not even three such platforms. So right now, you can enter this market and rise well.

In general, there is an interesting trend. It lies in the fact that as the market matures, its players begin to earn from “extraneous” things. Cloud services on financial services, online stores and marketplaces on advertising.

And it’s even explainable. Because there is an old economic law—on any competitive market, business margins tend towards zero. And this means that as competition grows, it becomes increasingly difficult to make significant profits from the main business—and new, more marginable sources of income need to be found, transferring them, for example, from other markets.

From this arises another interesting direction of thought. Which market has already become so competitive that its players are ready to seek and try new ways to generate income?

Take, for example, educational services selling long expensive courses. Most students buy them in installments or on credit—which is currently where banks make their money. Why shouldn’t educational services themselves turn into banks or become “branches” of banks—to receive their share of interest on loans and installment plans? Rather than losing money, which banks currently take in the form of fees for instant payment processing for education.

So, on which market is it time to introduce new revenue sources, for which you could create your own platform that players in this market would use? It seems that a good answer to this question can be measured in nothing less than billions, and in which currency—it depends on the target market 😉

About the Company

Kevel

Website: kevel.com

Latest Round: $23M, 07.03.2024

Total Investments: $45.2M, Rounds: 2