But no, they don’t help B2B sellers find new customers. Their goal is to increase NRR (Net Revenue Retention), sometimes referred to as NDR (Net Dollar Retention), meaning to retain and grow the profit generated by existing company clients.

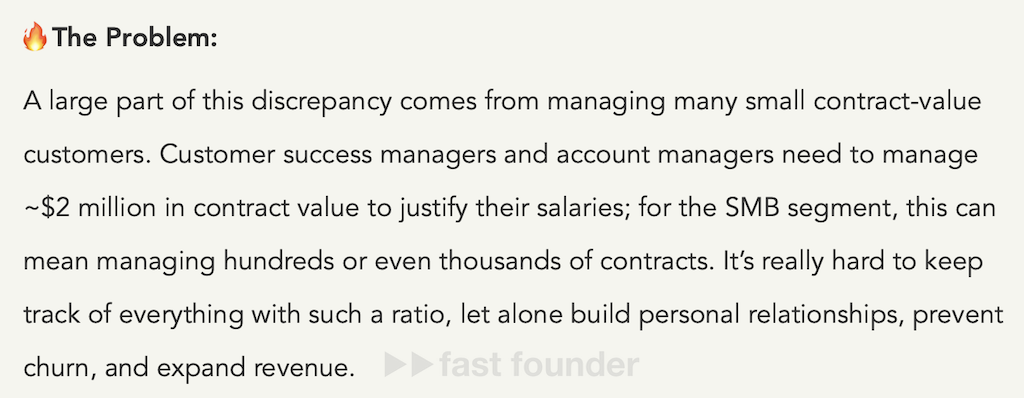

The problem is that B2B companies selling to small and medium businesses face a challenge. For a live salesperson to be profitable, they need to make sales worth $2 million. However, small and medium-sized businesses can only place orders of a small or medium volume ☹️ As a result, salespeople are forced to “go by quantity” — handling hundreds or thousands of clients.

However, a salesperson cannot efficiently handle such a large number of clients, extracting the reasons and opportunities for new orders or increasing the size of current orders from each of them — there’s simply not enough time.

Moreover, salespeople end up spending most of their time on clients who are “bothering” them — rather than on those who could bring in more money.

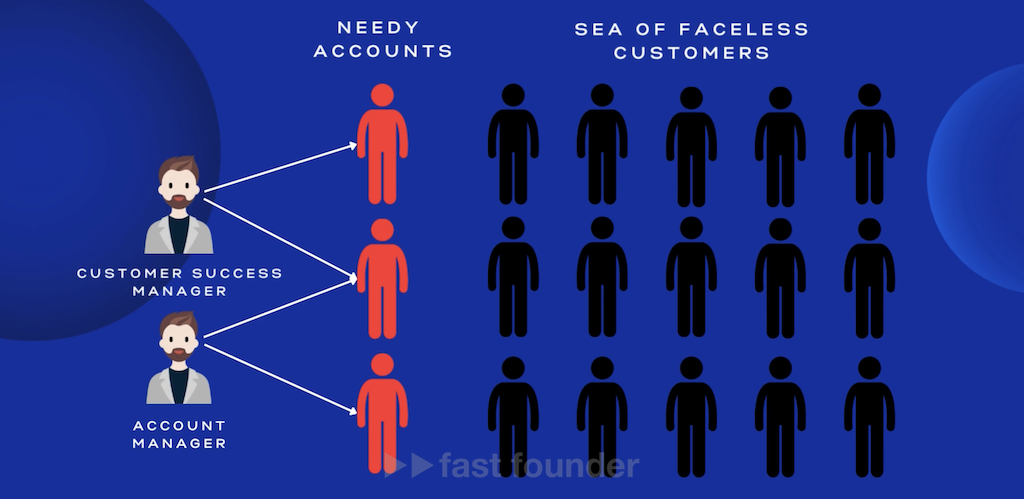

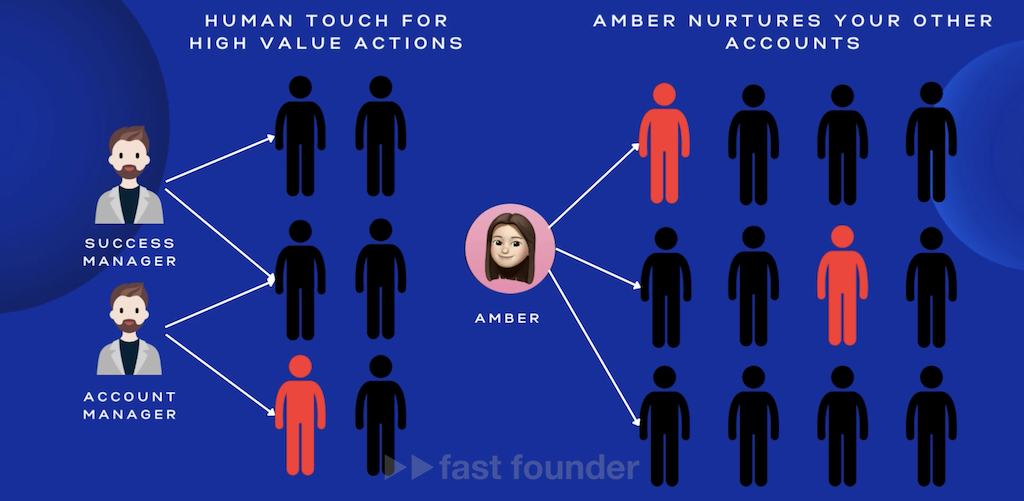

Amber AI helps salespeople divide all their clients into two groups:

The first group consists of clients who are capable of ordering more. Therefore, they should be handled by a live person to turn this “capability” into reality. The second group includes all others, who can be managed not by a live person, but by the AI assistant, Amber AI.

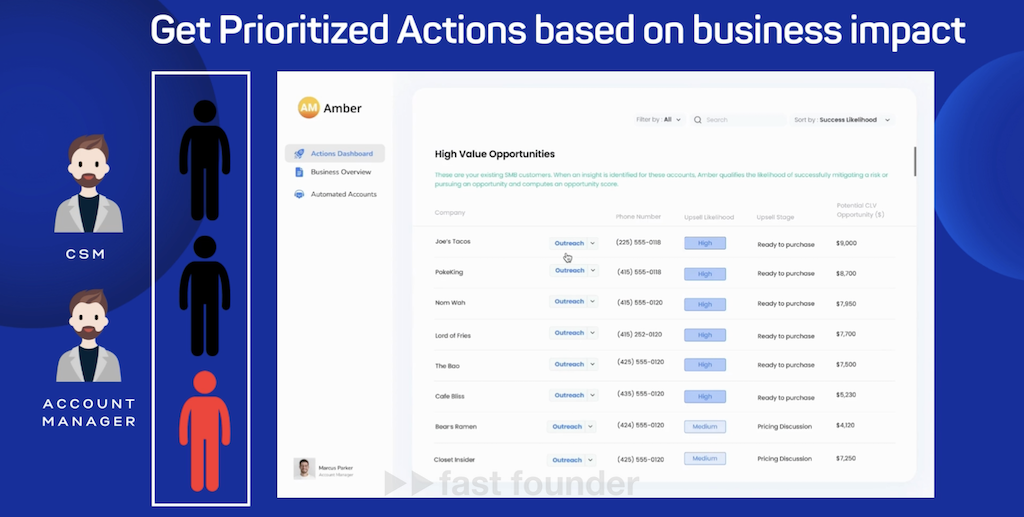

The AI assistant maintains a list of all the company’s clients on the platform, considering all their orders, actions, and results of previous contacts with them. Here, the AI assistant automatically updates the list of the most profitable clients, with whom the salesperson needs to work personally and in-depth.

The information for the AI assistant’s client prioritization algorithm is drawn from all connected sources to Amber AI — CRM (Salesforce, HubSpot), customer communication platforms (Zendesk), data aggregators (Snowflake), and others.

Dividing clients into “profitable” and “others” does not mean that the seller simply ignores the latter — it’s just that the AI assistant, Amber AI, handles them instead of a live salesperson.

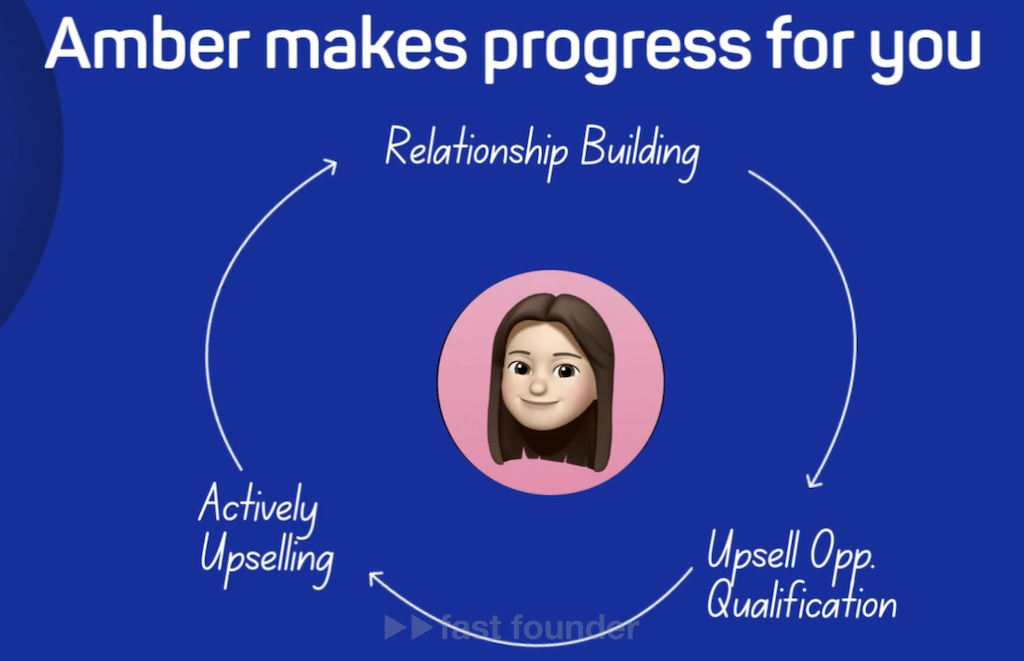

The trick is that the AI assistant’s task is the same — to increase the revenue from the client. To achieve this, the AI assistant tries to build “personal” relationships with clients, regularly nudging them regarding their interest in new products or promotions, and also attempts to upsell them something at the moment they place a new order.

If the AI assistant suddenly discovers significant interest from a client, it automatically reprioritizes this client, passing them on for further processing by a live salesperson.

If the AI assistant sees no opportunities to extract more money from a client, it continues to work with them on its own.

Amber AI is currently going through Y Combinator, from which it received the standard $500,000 investment. Interestingly, the Y Combinator website states that the startup was founded in 2024, which means it was formed as a company after being accepted into Y Combinator. The startup announced the launch of its first platform version a week ago.

What’s Interesting

NRR (Net Revenue Retention), increasing profit from a single client, is the most important growth driver for any business.

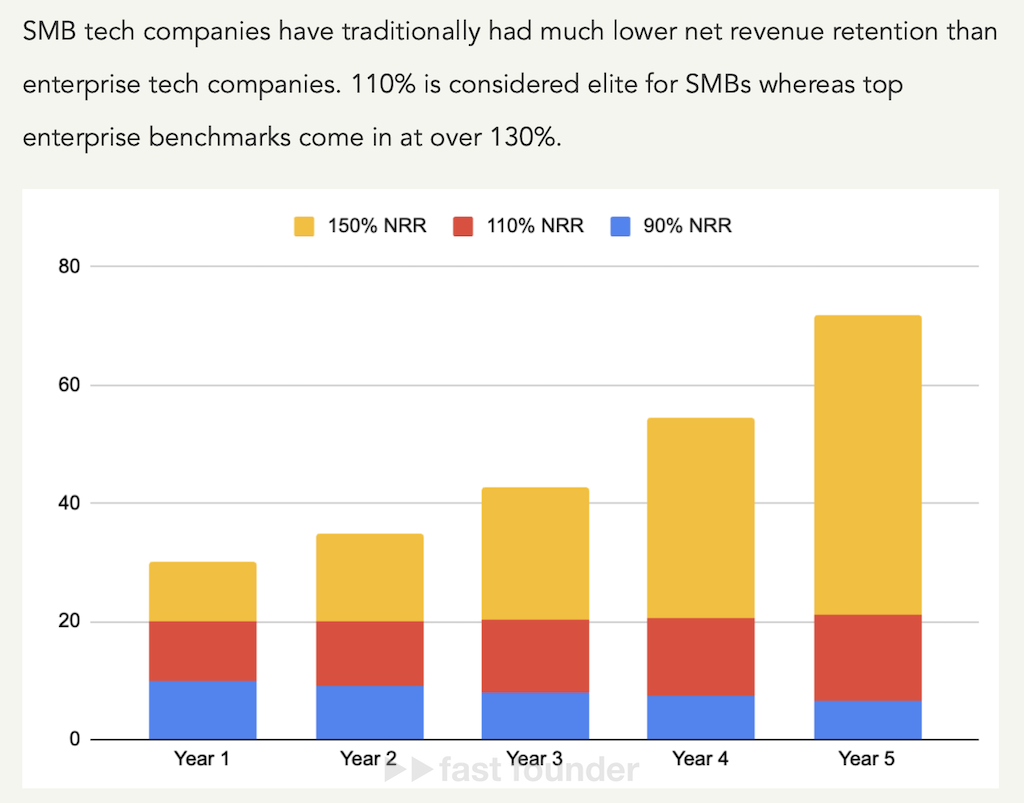

The problem is that increasing NRR is easier to achieve when a business deals with large clients. In this case, each salesperson has only a few such clients — with each of whom they can work individually, utilizing any opportunity to get more money from them.

When dealing with a large number of small clients, unfortunately, there are no such opportunities for individual work. Therefore, an NRR at the level of 110% is considered very good for companies working with small and medium-sized businesses. At the same time, for companies dealing with large clients, a good NRR is around 150%. You can see the NRR calculation methodology in yesterday’s review.

But what about individually squeezing additional money from clients when companies dealing with small and medium-sized businesses lack the energy and time to handle incoming requests and orders in a human way ☹️

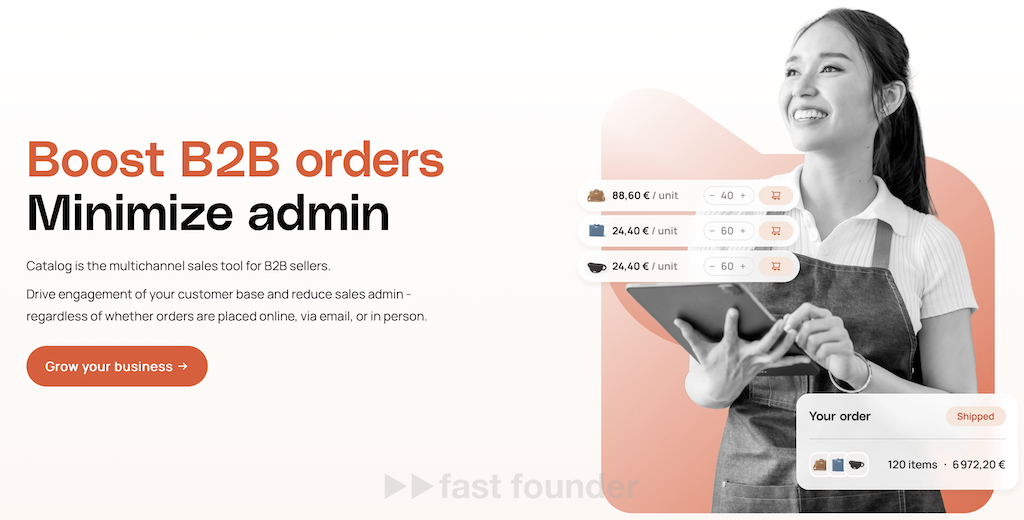

A week ago, I wrote about the startup Catalog, which addresses the issue of processing incoming orders for such companies. With the help of their platform, one of the first clients was able to reduce the average processing time for one order from 10 to 2 minutes. This French startup raised its first investment of 3 million euros.

Thus, startups focused on increasing the efficiency of B2B companies selling their products and services to small and medium-sized businesses seem to be attracting interest from investors.

Interestingly, just yesterday, I wrote about the startup Resonance from the same current Y Combinator batch, which also created a platform to increase NRR (Net Revenue Retention). However, their target audience is cloud service developers.

The platform’s task is to effectively inform users about new and existing features of these services, which they are not yet using. The catch is that users may want to use them — and start paying additional money for them or upgrade to the next tariff, which includes these features, thereby bringing more money to the developer.

At least the second service focused on increasing NRR in the same Y Combinator batch confirms the interest and potential of this topic.

Where to Head

Today’s review immediately suggests two possible directions for movement.

The first direction is the creation of platforms to enhance the efficiency of B2B companies selling to small and medium-sized businesses.

Efficiency enhancement can be achieved through a) saving time on client interaction (like Catalog) or b) increasing profit from existing clients (like Amber AI).

It’s clear that other opportunities for time savings and other methods of increasing client profit can be found. So, there’s still plenty of room for exploration and imagination here.

The second direction is the creation of platforms that help increase NRR (Net Revenue Retention) for sellers from various sectors and developers of various products.

The beauty of this direction is that it doesn’t require dealing with the thankless task of finding new buyers and users. If a company can’t find new clients on its own, there’s a good chance it will soon die—either because they have a crappy product or a crappy sales system. So, why waste time on them?

But a company with a good product and/or good sales, which has acquired a bunch of clients but can’t handle them properly, that’s a normal situation 😉 What kind of companies might these be? What exactly can’t they handle? How can we help them with this?

So, which way will we go—will we enhance the efficiency of B2B sellers, or help someone increase NRR? Or will we decide to combine these tasks by creating an analogue of today’s Amber AI? 😉

About the Company

Amber AI

Website: helloamber.ai

Latest Round: $500K, 01.02.2024

Total Investments: $500K, Rounds: 1