To earn really big money by creating a community, it’s best to turn the community into a “bank,” starting to earn on financial services for its members. You just need to choose the target audience correctly. This startup chose a not quite usual audience — whose volumes of already existing, and even more so future expenses, can only be compared with the level of its undervaluation 😉

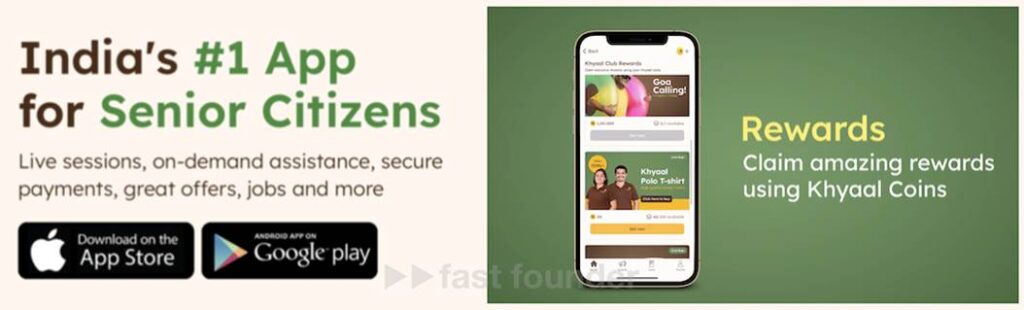

Khyaal calls itself the “number one app for elderly people in India.”

Khyaal is an online club, exclusive to members aged 55 and above.

The startup claims that “half a million people love using the Khyaal app.” However, if you look at the statistics, it’s actually about the number of app downloads. Probably, fewer people actually use the app.

Interestingly, one of the main promotion strategies for the app is gifting – where adult children gift their older parents a membership to the club. Perhaps so the parents spend time there and require less constant attention from their children 😉

Another promotional strategy is advertising online events that one can attend only after registering in the club. According to the schedule, these events are held daily, four times a day, and cover various topics – yoga lessons, singing and cooking classes, computer literacy enhancement, lottery draws, self-improvement sessions, building self-confidence, and finding a new purpose in life after retirement.

For club members, there’s a support hotline, where operators can assist elderly individuals in paying bills, scheduling medical tests or doctor’s appointments, and booking train, airplane, or bus tickets

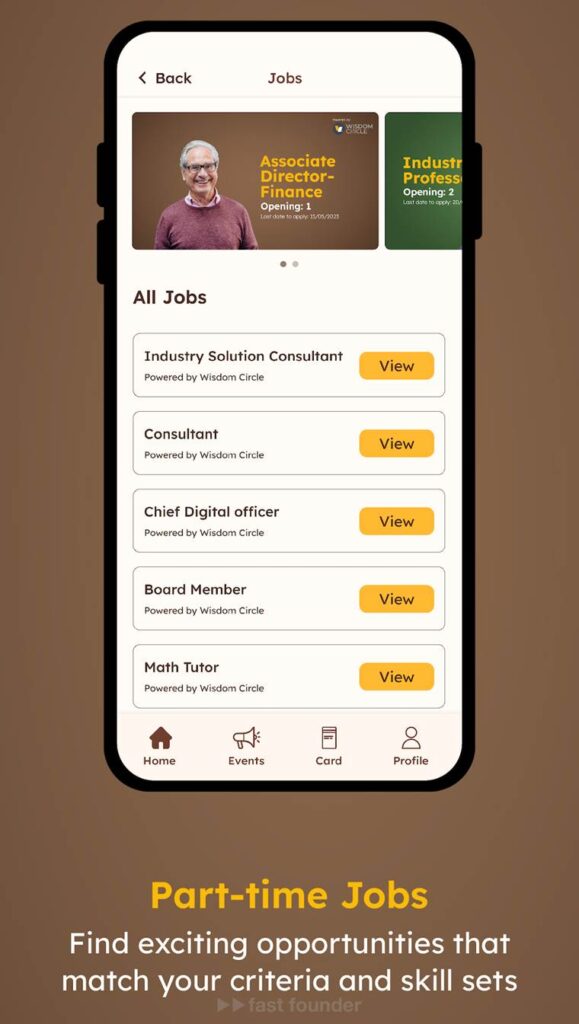

Club members can search for part-time job listings on a dedicated bulletin board. The jobs are varied, ranging from math tutoring, consulting, to even being a chief digital technology specialist.

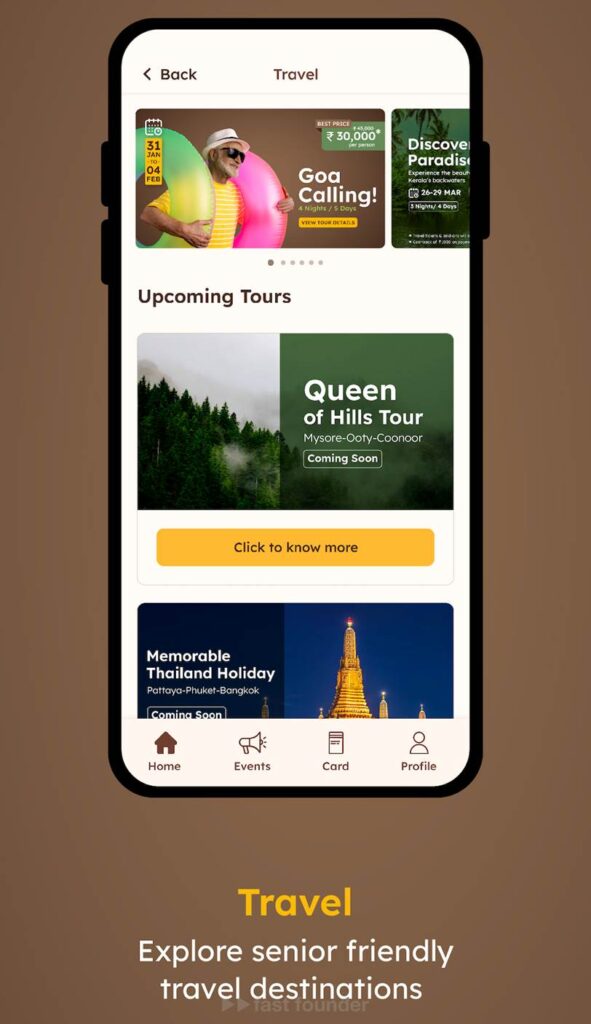

There’s a special section of the club dedicated to travel, where one can not only read about interesting places but also directly book tickets and hotels.

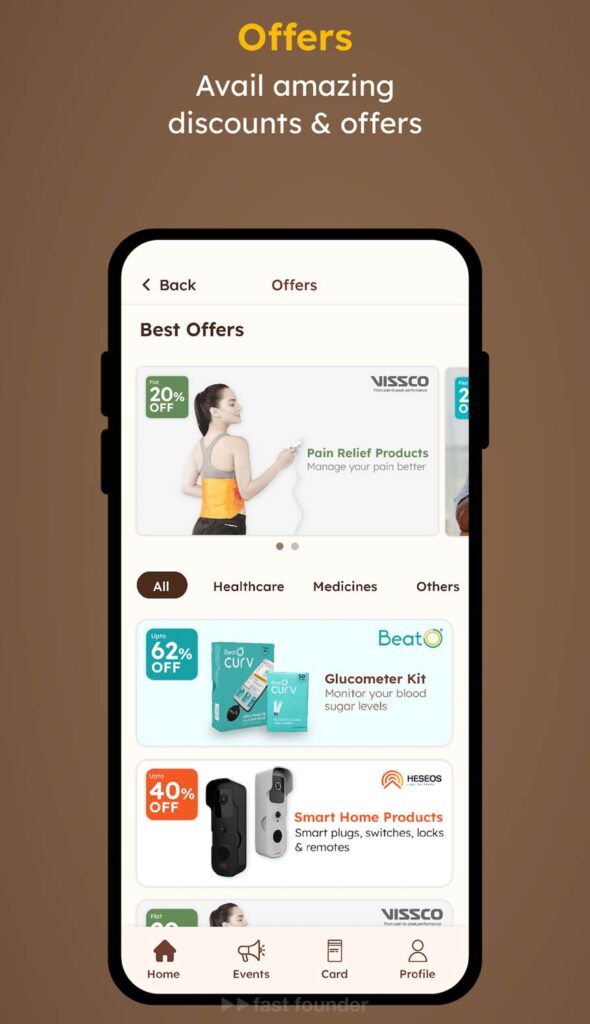

The platform even has its own marketplace for selling various products, but it’s not marketed as a regular shop. Instead, it’s a place where club members can get special offers and significant discounts.

Khyaal has even released its own bank card, which, when used, offers members not just special cashbacks but also unique Khyaal points that they can spend on purchases within the club’s app.

Membership in the club is free; one just needs to verify their age. The startup earns from commissions on product and travel sales within the app, as well as from commissions on all other transactions made by club members using the startup-issued cards.

In the current round, Khyaal raised a significant investment of 5.4 million dollars for themselves. In the two previous rounds, they raised a total of 1 million dollars.

What’s Interesting:

Essentially, the startup is creating what’s called a “super-app” where there’s so much variety that many of a user’s interests and needs can be addressed within this single application.

Creating super-apps has become a trendy direction recently, but most often, banks create them for their customers. Today’s startup, however, has chosen to design a super-app for elderly Indians.

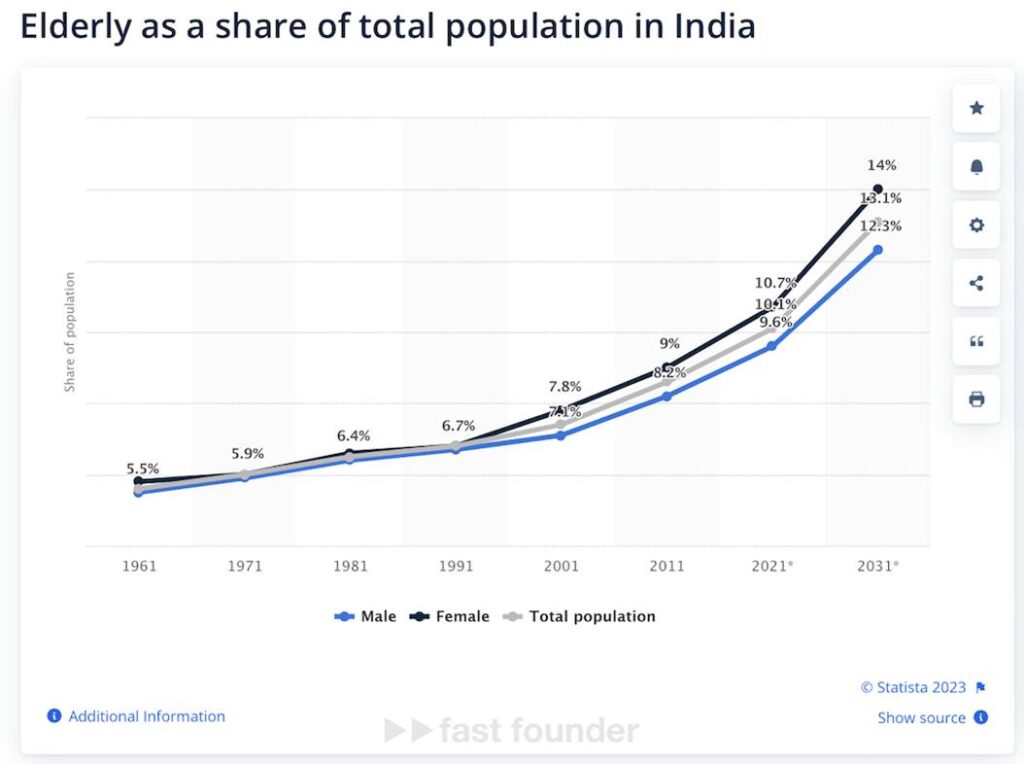

And this seems like a very sensible positioning. In 2022, India had about 149 million people aged 60 and above, and by 2050, this number is expected to double to 347 million.

Such a sharp increase is due to the growing proportion of elderly people in India. This is consistent with the global trend of increasing life expectancy.

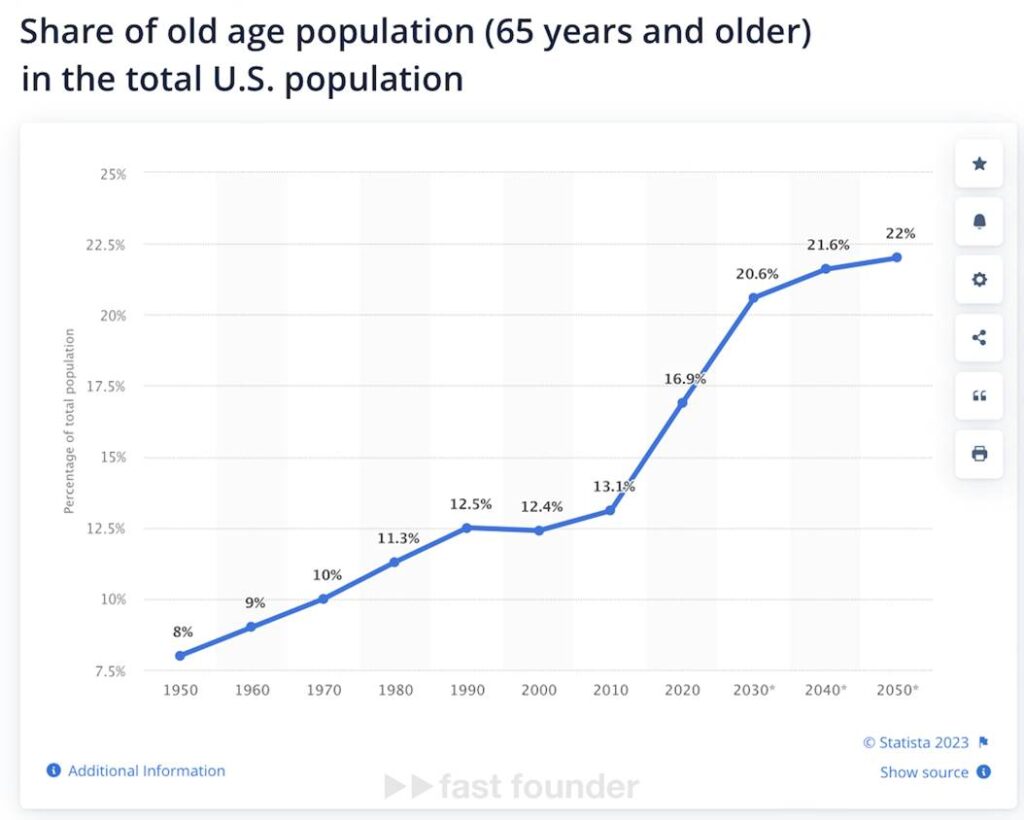

For comparison, one can look at the growth chart of the elderly population percentage in the USA, where an even more pronounced jump is observed.

Therefore, elderly individuals have become not just a large market but a growing one – attracting the attention of a significant number of startups deciding to focus on this market. Within this area, two major trends can be identified.

The first is the creation of communities “for those over 50-55 years old” for joint online or even offline activities and learning new things:

GetSetUp – raised $21 million in investments.

Rest Less – raised £15.1 million.

Hank – raised $8.3 million.

Peppermint – raised $8 million.

The second is services and apps for a healthy lifestyle “for those over…”:

Bold– raised $27 million in investments.

InsideTracker – raised $18.2 million.

Mighty Health– raised $10.4 million.

It seems that most startups want to create something like an online sandbox for the elderly – where they are supposed to play in the sand under the supervision of doctors 😉

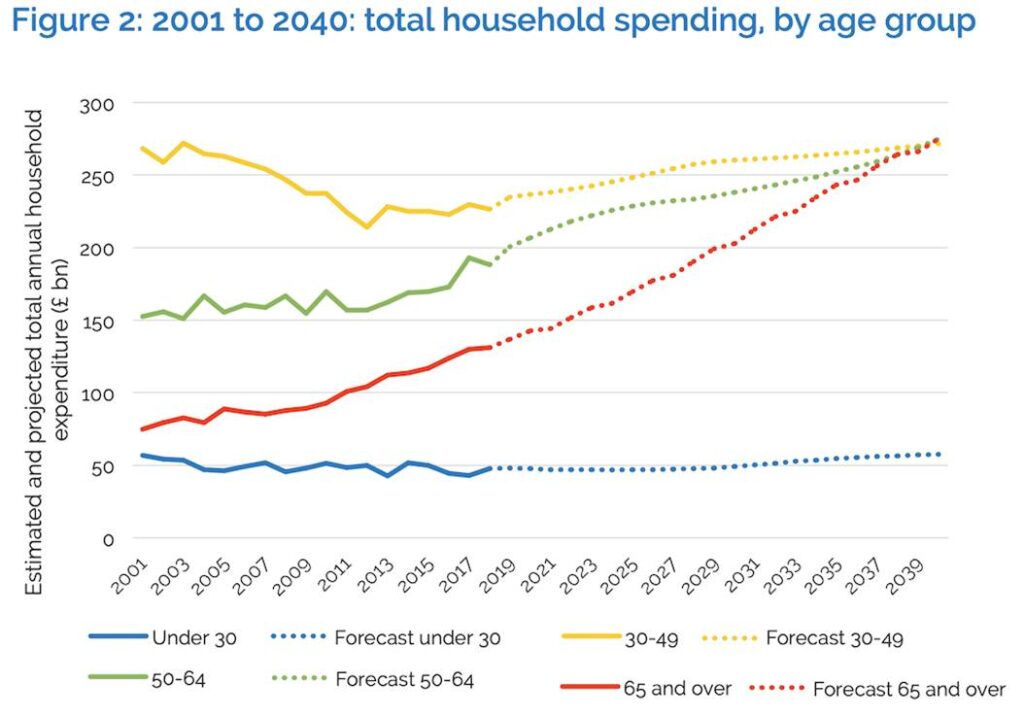

However, as we can see from this chart, the total spending of people over 65 has started to increase rapidly. Simply because there are more of them, and 60 is the “new 40” 😉

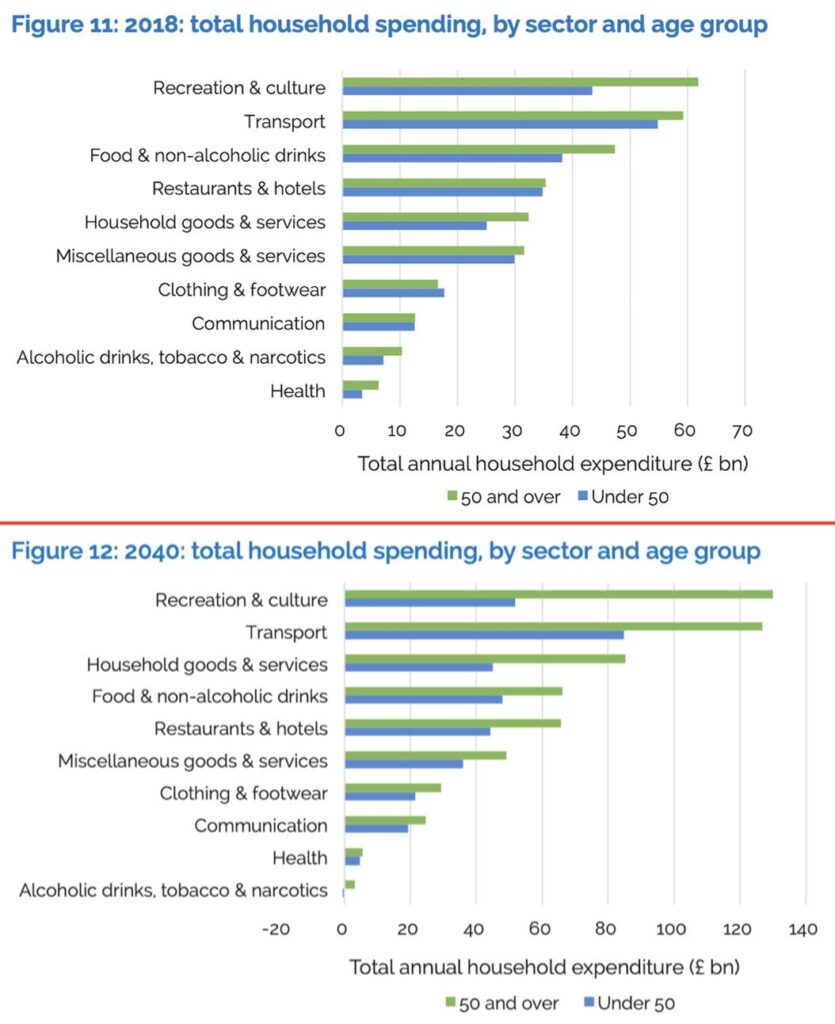

Some might think that older people only spend money on medicine and healthcare. But that’s not true! Here’s a comparative table of expenses for people younger and older than 50 in the UK – data from 2018 and a forecast for 2040.

From this, we can see that people over 50 spend money on entertainment, home goods, restaurants, and travel, and other leisure activities in much larger volumes than on health – which was last on the list of expenses in 2018 and will move to the second to last place in 2040, surpassing only alcohol, tobacco, and other drugs. Even clothing and footwear expenses for people over 50 will soon exceed the similar expenses of the younger generation.

In other words, older people need help spending money! And although not all startups realize this, some do. The American startup Charlie has begun offering banking services for individuals aged 62 and over, which is the official retirement age in the US. They have raised 7.5 million dollars in investments.

Today’s Khyaal is also moving in this direction, having launched a bank card for people over 55 and opened a marketplace for selling goods and travel.

To make selling easier than just another bank, they wrapped their financial services in the guise of a club, providing their clients with a range of entertainment and useful services tailored to the interests and needs of older people.

Where to go:

The first interesting conclusion is that banks wanting to attract new clients should stop being banks – dry and formal institutions providing only financial services.

They should become “clubs”, providing their clients with a plethora of entertainment and services within their super-app. Financial services will remain as infrastructure, supporting the lifestyle of the super-app’s users.

That’s why many banks are now creating their super-apps. However, the example of today’s Khyaal shows that you can move from the other side – create a super-app for a specific audience, and then become a bank. Even if they don’t formally get a banking license, they can start offering financial services and earn money from them.

The key phrase is “super-app for a specific audience”. And the audience of older people is a very interesting option. Because a) there are already many of these people, b) their number will soon double, and c) most young startup founders do not understand the interests and underestimate the financial capabilities of this audience.

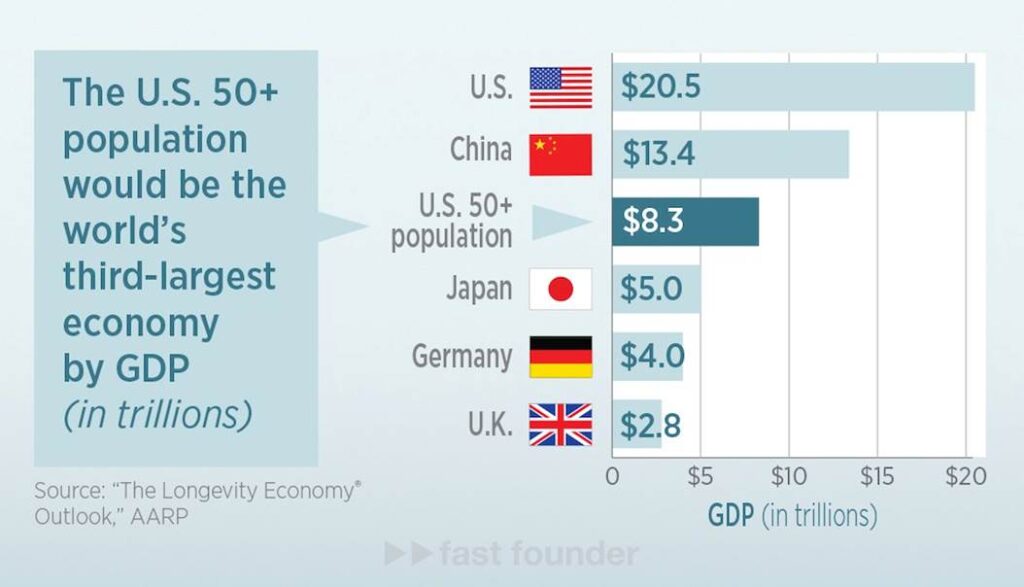

Although, if you think of them as a separate country, like Americans over 50, for example, the economy of this imaginary country would be the third largest in the world, after only the US and China!

So the first general direction is to create lifestyle and shopper clubs for specific audience segments, simultaneously turning them into “banks.”

A more specific model, which can be copied from today’s Khyaal, is the application of this model for the older generation segment. The volumes of their current, let alone future, expenses can only be compared to the level of their undervaluation 😉

About the company:

Khyaal Website: khyaal.com

Latest funding round: $5.4M, 11.10.2023

Total investments: $6.4M, 3 rounds.