On the enormous $2 trillion clothing market, a clear division of labor is emerging. Soon, there will only be “pure brands” focusing on creativity and sales, and “pure manufacturers.” But then, IT platforms will be needed to connect them with each other. Here’s an example of how these platforms should be structured. And here’s another example — showing what they can’t function without.

Project Essence

Inflow is a platform that connects fashion brands with manufacturers capable of producing their clothing and footwear.

Originating from Vietnam, the startup is currently focused on attracting Vietnamese factories, of which they have already engaged more than 150.

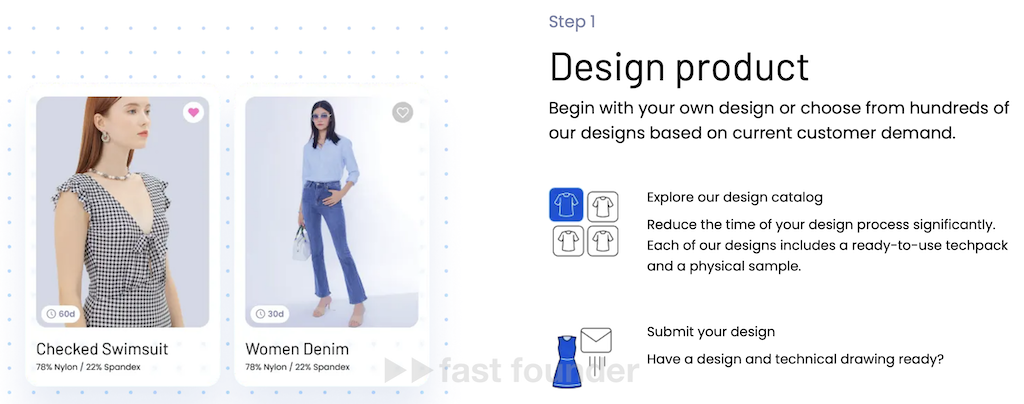

Initially, a brand must upload the design of the item they want to produce onto the platform. They can create a design from scratch or choose one from a fairly large catalog of products ready for production.

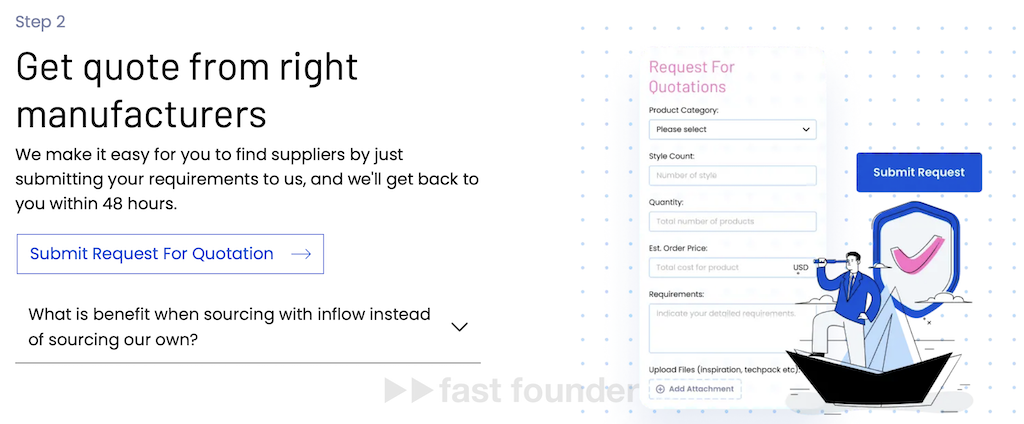

The prepared design then needs to be sent to Inflow specialists, who within 48 hours will find factories capable of producing it, contact them, confirm their readiness, and provide the brand with a list of the most suitable factories, along with prices and production terms.

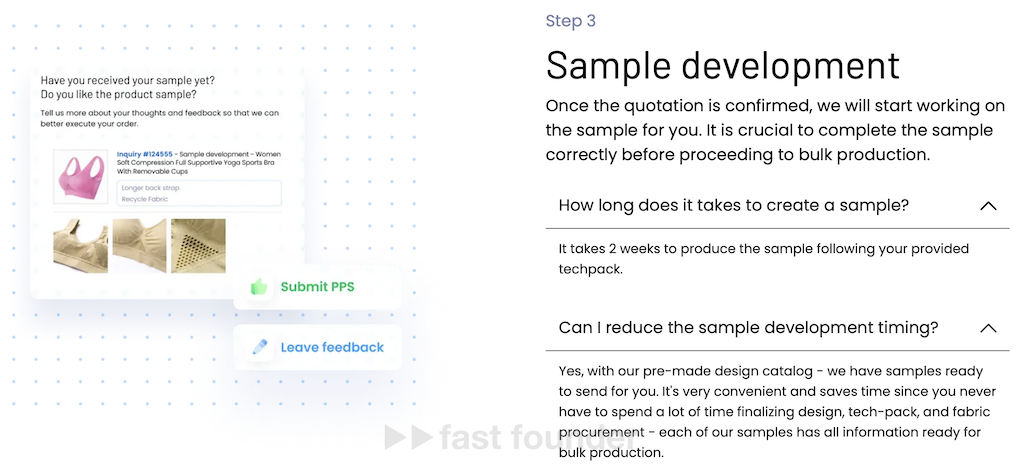

Once the brand selects a factory, Inflow specialists begin working with the factory to produce samples of the final product, including different colors and fabrics. If the design is created by the brand itself, the sample production takes 2 weeks; if it’s selected from the platform’s catalog, it’s faster.

The produced samples are sent to the brand to check the quality and confirm readiness to start actual production.

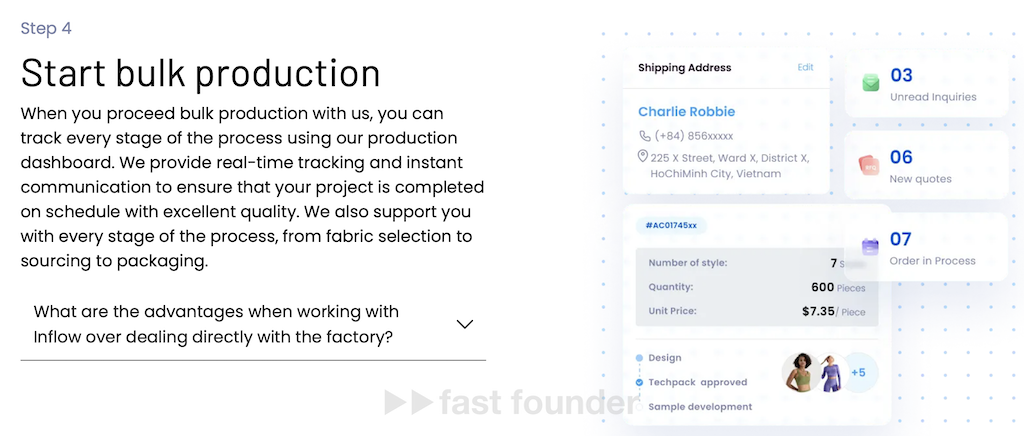

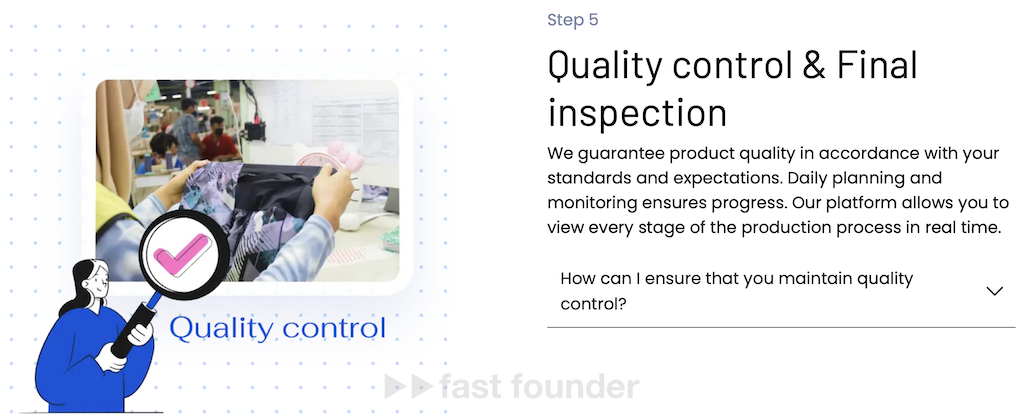

The brand can monitor the current state of production and the number of finished products in real-time on the platform’s special dashboard.

Currently, the minimum production batch size is 100 units, and its production can take up to 45 days. However, the startup promises that they will soon reduce the minimum batch size to 50 units and production time to 30 days.

The factory itself will handle the shipping of the finished products to the end customers. For this, the brand needs to integrate Inflow with its online store or manually upload new order lists to the platform with product codes, sizes, colors, and customer addresses. The brand can also monitor the packaging and shipping of ordered goods through the platform.

Inflow specialists will oversee the quality of the produced products, ensuring they fully match the samples approved by the brand.

In case of any problems with production or shipping to customers, the brand can contact Inflow so that its specialists can directly communicate with the factory and resolve the issue.

The startup, founded just last year, has already started working with around 80 brands. However, most of them are currently from Southeast Asia, although the startup already promises factories access to more than 1,000 brands worldwide on its website. The startup says that even small brands with annual turnovers of just $200,000 can be customers on their platform.

Over the last year, Inflow’s revenue has increased 15-fold, and the startup has now raised its first significant investment of $2 million.

What’s Interesting

A similar platform for manufacturing various categories of products, including home appliances, electronics, cosmetics, and interior items, was created by another startup, Manufactured. It raised $19 million in investments.

A platform quite similar to today’s Inflow was developed by the startup SILQ. However, since then, it has pivoted to focus solely on solving logistics between brands and factories, including controlling the products shipped by factories.

Apparently, SILQ faced a common problem. Factories were eager to take orders from brands… but then failed to meet production deadlines. And in this case, the platform, not the factory, was blamed 😉

Delays in production occurred for an obvious reason – small factories often lack a proper production planning and control system. Everything happens “by eye” – at best in Excel, and at worst on paper.

However, you can’t build a smoothly functioning platform for connecting clients and manufacturers if the manufacturing itself doesn’t operate smoothly. This means that digital platforms for production control and planning need to be implemented in factories first, so they cannot give customers unreasonable promises.

Groyyo decided to enter the same outsourcing production market from this angle. Their basic product became the “digital factory” – a platform for digitizing production.

Based on this, they are creating a B2B platform where brands can order raw materials (fabrics) and finished products (clothing) from factories.

With their platform, they plan to digitize 20 million micro-manufacturers from Southeast Asia, allowing them to access the global market for orders. For this ambitious goal, they raised $40 million in investments last June – just six months after their initial $4.6 million in seed investments.

The lack of planning and missed deadlines are common problems for all small service providers, including manufacturers. Therefore, any marketplace for finding service suppliers will not function effectively if all its suppliers do not start using digital management platforms integrated with the marketplace, to provide customers with realistic timelines for the planned services.

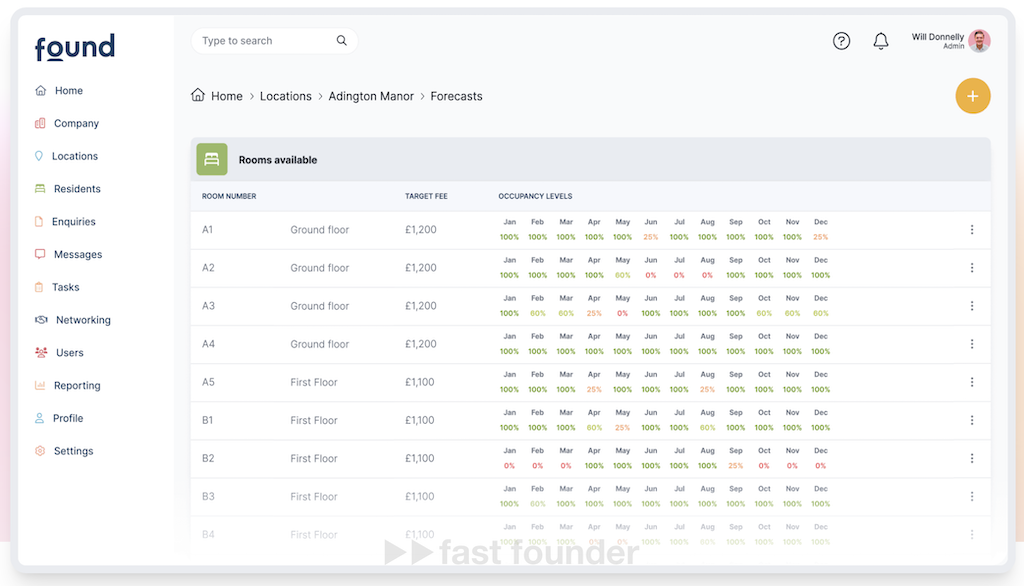

Here’s an example from an unexpected area. Lottie, a startup I wrote about in October, created a website in the UK for finding nursing homes. However, it essentially functioned as a directory rather than a marketplace, as users had to manually call the found options in search of a home with available spots for the required stay duration.

Therefore, a year ago, Lottie acquired another startup, Found, which made a CRM for nursing homes, and integrated this CRM with its website. As a result, the directory finally transformed into a marketplace where users can now find not just suitable places but suitable places where they can settle their elderly parents at the needed time.

This move allowed Lottie to surpass competitors in search convenience and change its business model to a more profitable one – it will soon charge nursing homes not a one-time fee for contact but a percentage of the cost for the entire duration of the client’s stay. This enabled them to attract $20 million in new investment.

Where to Head

The fashion market is entering a period of “unbundling.” I’ve written several times here about the concept of “bundling” and “unbundling.”

The essence is that every market sequentially undergoes a “bundling” stage, where multifunctional companies appear, and an “unbundling” stage – where specialized companies emerge, focusing on just one function but doing it very well. And because of this, they successfully compete with the multifunctional “giants” that appeared in the previous “bundling” stage.

So far, in the fashion market, there are companies that create their own brands, own designs, and have their own factories to produce all this goodness. And it doesn’t matter – whether they started with their brand for which production was created, or with their production, the owners of which decided to sell products under their brand.

Now, however, everything is moving towards a clear division in this market. Some will exclusively come up with brands and designs, never distracting themselves with thoughts of creating their production. Others will build and scale production, not even attempting to create their brands.

Otherwise, it’s easy to “tear oneself apart” – either settling for a lack of production capacity or investing in expanding it, but getting stuck in the need to constantly load these capacities. And investing simultaneously a lot of money in marketing to increase the number of orders and in expanding production – this is not only a lot of money and big risks but also completely different competencies.

And if such a clear division between brands and manufacturers finally occurs – it will be impossible to do without platforms that connect them. Moreover, this trend is already clearly visible – hence such platforms are already emerging, developing, and raising investments.

The clothing market is huge – by 2027, it will grow to almost $2 trillion. Therefore, a promising direction within the trend of labor division in this market is the creation of platforms for connecting “pure brands” with “pure manufacturers” 😉

From the examples of SILQ and Groyyo, it is clear that building such platforms should start with platforms for digitizing production, on the basis of which one can confidently enter this market.

By the way, platforms allowing “pure brands” to develop their assortment without worrying about production capacities – but only about marketing opportunities now opening in the market – will inevitably start to develop. Among them is the platform MakerSights. This startup raised $36.6 million in investments.